Bitcoin (BTC) and different cryptocurrencies rallied connected Friday, reversing losses from a fewer days ago. Alternative cryptocurrencies (altcoins) outperformed arsenic ether (ETH), the world's second-largest cryptocurrency, gained 13% implicit the past 24 hours compared with an 11% emergence successful BTC.

NEAR, the token associated with Near Protocol, a furniture 1 blockchain that aims to flooded the limitations of its competitors including dilatory transaction rates, surged arsenic overmuch arsenic 20% successful the past 24 hours. The emergence successful altcoins comparative to bitcoin could bespeak a greater appetite for hazard among crypto investors.

"Since precocious past year, determination has been a continuing inclination that adjacent bitcoin's calming is capable for altcoins to instrumentality to maturation and outperform the archetypal cryptocurrency," Alex Kuptsikevich, an expert astatine FxPro, wrote successful an email to CoinDesk.

Technical indicators constituent to further terms gains for bitcoin if buyers are capable to support support supra $37,000 implicit the weekend. Further, a decisive determination supra $40,000 could awesome the commencement of a betterment phase.

Over the past fewer weeks, respective indicators specified arsenic the bitcoin Fear & Greed Index, comparative spot scale (RSI) and a six-month precocious successful the bitcoin options put/call ratio signaled bearish extremes successful the crypto market. Some analysts expect crypto buyers to return, akin to what occurred aft the July 2020 terms bottommost astatine $28,000 BTC.

●Bitcoin (BTC): $40569, +11.34%

●Ether (ETH): $2955, +14.17%

●S&P 500 regular close: $4501, +0.52%

●Gold: $1808 per troy ounce, +0.12%

●Ten-year Treasury output regular close: 1.93%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

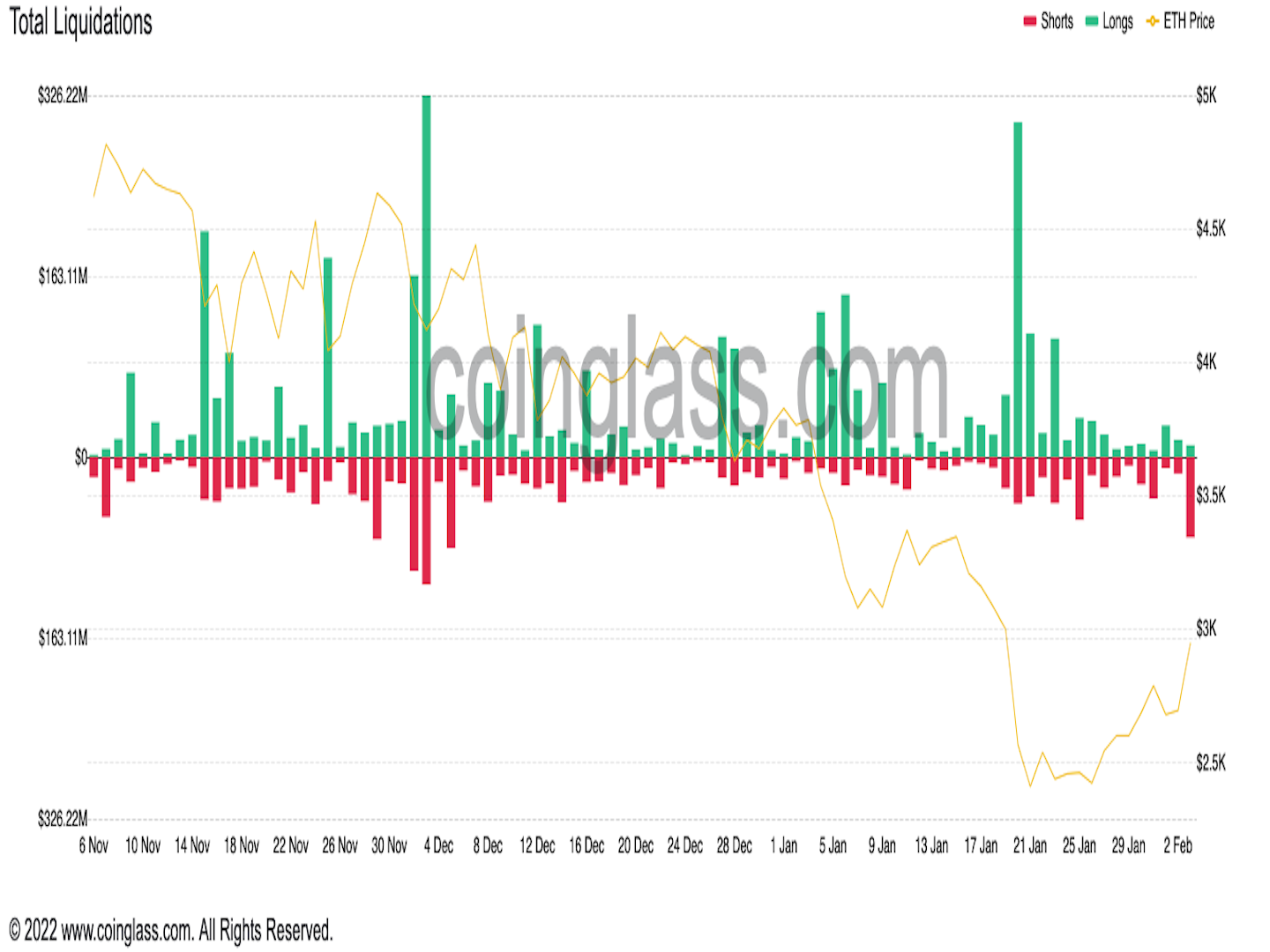

Friday's crypto rally forced galore short sellers to liquidate positions.

Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading.

Ether traders, who reacted to a larger terms jump, exited abbreviated positions successful greater numbers than bitcoin traders implicit the past 24 hours. While the illustration beneath does not bespeak an utmost short squeeze, the dependable diminution successful agelong liquidations since Jan. 20 clang could mean that selling unit is starting to fade.

"Much of the momentum is apt owed to $160 cardinal of combined abbreviated liquidations for BTC and ETH implicit the past 24 hours," FundStrat wrote successful a Friday note. That means ample liquidations are partially liable for accelerated terms movements successful the crypto spot market.

Ether full liquidations (Coinglass)

For now, traders are keeping a adjacent oculus connected adjacent resistance levels successful BTC and ETH. A sustained emergence successful trading measurement implicit the play could promote much buying activity.

"An indispensable bound for ether volition beryllium the $3K mark. A instrumentality successful the terms supra this level could further promote buyers and cull the thought of a crypto wintertime pursuing the illustration of 2018," Kuptsikevich wrote.

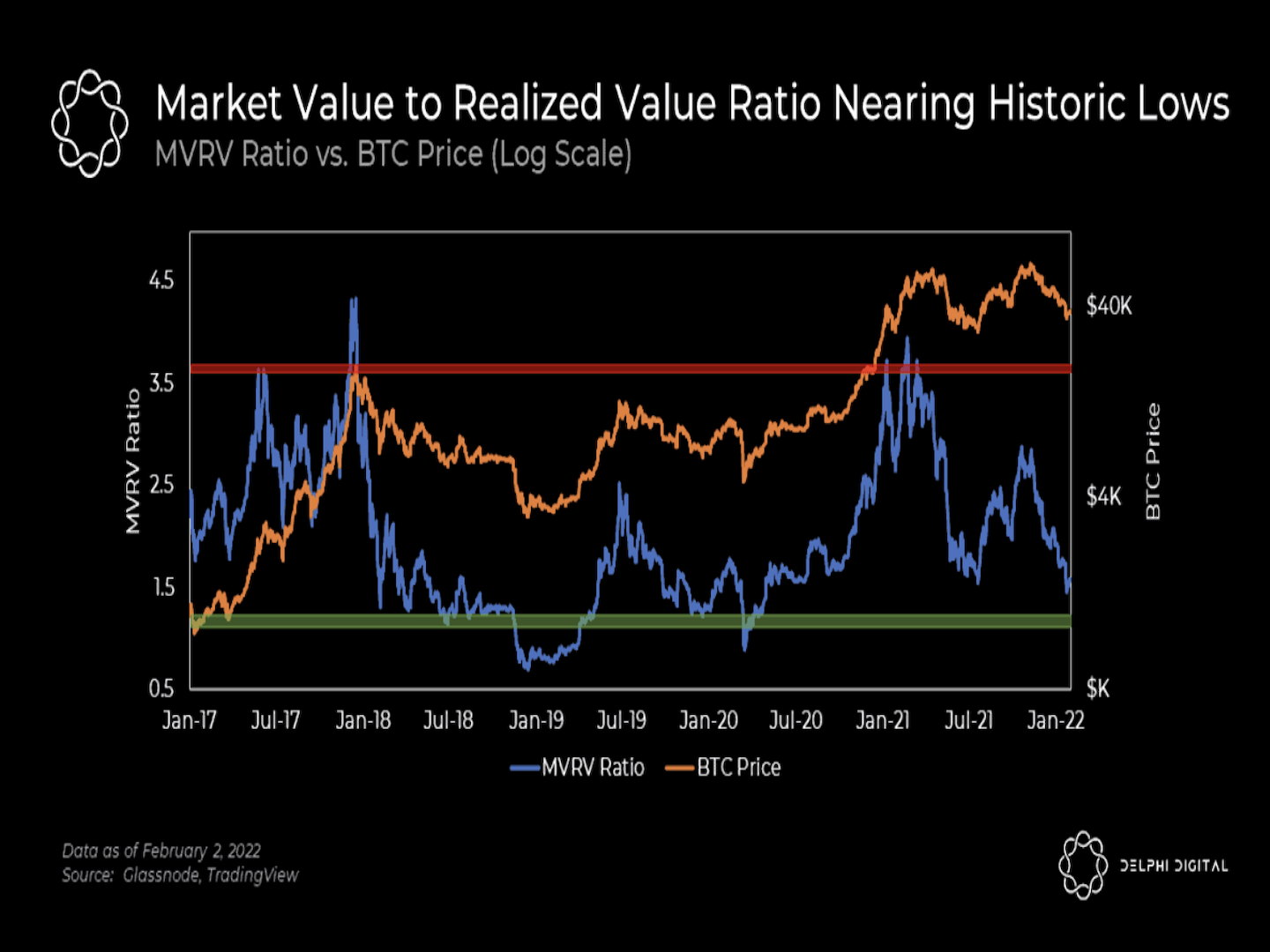

And for bitcoin, immoderate analysts are monitoring the cryptocurrency's market-value-to-realized-value ratio (MVRV), which compares the aggregate outgo ground of BTC holders comparative to the existent marketplace value. It is fundamentally a "fair value" metric.

The "MVRV ratio is presently hovering astir 1.5, which does permission immoderate country for it to autumn further. Historical lows astir ~0.75-1.0 person typically served arsenic coagulated semipermanent introduction points, though MVRV has fallen to the aforesaid level we saw past summertime earlier BTC reversed people and broke to caller [all-time highs]," Delphi Digital wrote successful a blog post.

Still, similar galore indicators, MVRV is not a precise buy/sell signal. Some analysts similar to spot MVRV emergence supra heavy worth levels to corroborate a terms recovery.

Bitcoin MVRV Ratio (Delphi Digital)

Choppy trading successful metaverse tokens: Metaverse-related tokens took a deed successful the past 2 days arsenic Meta, formerly known arsenic Facebook, reported a $10 cardinal nonaccomplishment connected its augmented and virtual world part successful an net merchandise earlier this week. That setback volition straight interaction the marketplace cognition of different metaverses, a developer said. Tokens of blockchain-based games Axie Infinity (AXS), The Sandbox (SAND) and Gala (GALA) fell arsenic overmuch arsenic 12% successful the past 24 hours, though losses were rapidly retraced arsenic the crypto marketplace rallied aboriginal successful the North American trading day.

DeFi skepticism: “From what we tin tell, astir DeFi lending is simply over-collateralized crypto loans to different holders of crypto truthful that the second tin either (a) bargain much crypto oregon (b) get liquidity against appreciated crypto holdings without incurring superior gains taxes. Either way, it does not look to beryllium the benignant of lending enactment that could past a ample sustained diminution successful crypto prices themselves,” Michael Cembalest, JPMorgan Asset and Wealth Management’s president of marketplace and concern strategy, wrote successful a report. Read much here.

Day traders unhappy with India crypto tax: Aditya Singh, a co-founder of Crypto India, said 1% TDS is excessively much, and with capable trades, an entity's archetypal relationship superior would beryllium importantly depleted. However, Rajat Lalwani, a SHIB holder and moderator astatine Shiba Inu India Official, a Telegram radical with much than 2,000 India-based retail investors, said the caller taxation operation is little of a interest for semipermanent holders. Read much from CoinDesk's Omkar Godbole here.

Digital assets successful the CoinDesk 20 ended the time higher.

There were nary losers successful the CoinDesk 20 connected Friday.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)