Bitcoin (BTC) surged past $47,000 and is attempting to reverse a bearish commencement to the year.

The world's largest cryptocurrency by marketplace capitalization is up 15% implicit the past week, compared with a 16% emergence successful ether (ETH) and a 25% emergence successful Solana's SOL token implicit the aforesaid period. The rally successful alternate cryptocurrencies (altcoins) comparative to BTC reflects a greater appetite for hazard among crypto investors.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why. Coming April 4.

Meanwhile, the S&P 500 was astir level Monday, versus a 6% emergence successful BTC implicit the past 24 hours. That suggests the caller rally successful bitcoin tin beryllium explained by caller token accumulation, which is unsocial to the crypto market.

Over the past six days, the Luna Foundation Guard’s (LFG) bitcoin wallet code purchased much than 27,000 BTC worthy astir $1.3 billion. The instauration is delivering connected its month-old promise to adhd BTC arsenic an further furniture of information for UST, which is Terra's decentralized dollar-pegged stablecoin.

Do Kwon, the foundation's director, confirmed the code to Bitcoin Magazine successful an email, which was besides marked by OKLink, a blockchain accusation website.

There appears to beryllium a synergy betwixt bitcoin and the Terra ecosystem, according to Lucas Outumuro, caput of probe astatine IntoTheBlock, a crypto information company. "UST benefits from having further backing and bitcoin benefits not conscionable from the buying pressure, but besides from having a unchangeable mean of speech backed by BTC," Outumuro wrote successful an email to CoinDesk.

●Bitcoin (BTC): $48,010, +6.84%

●Ether (ETH): $3,412, +7.22%

●S&P 500 regular close: $4,576, +0.71%

●Gold: $1,919 per troy ounce, −1.78%

●Ten-year Treasury output regular close: 2.48%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

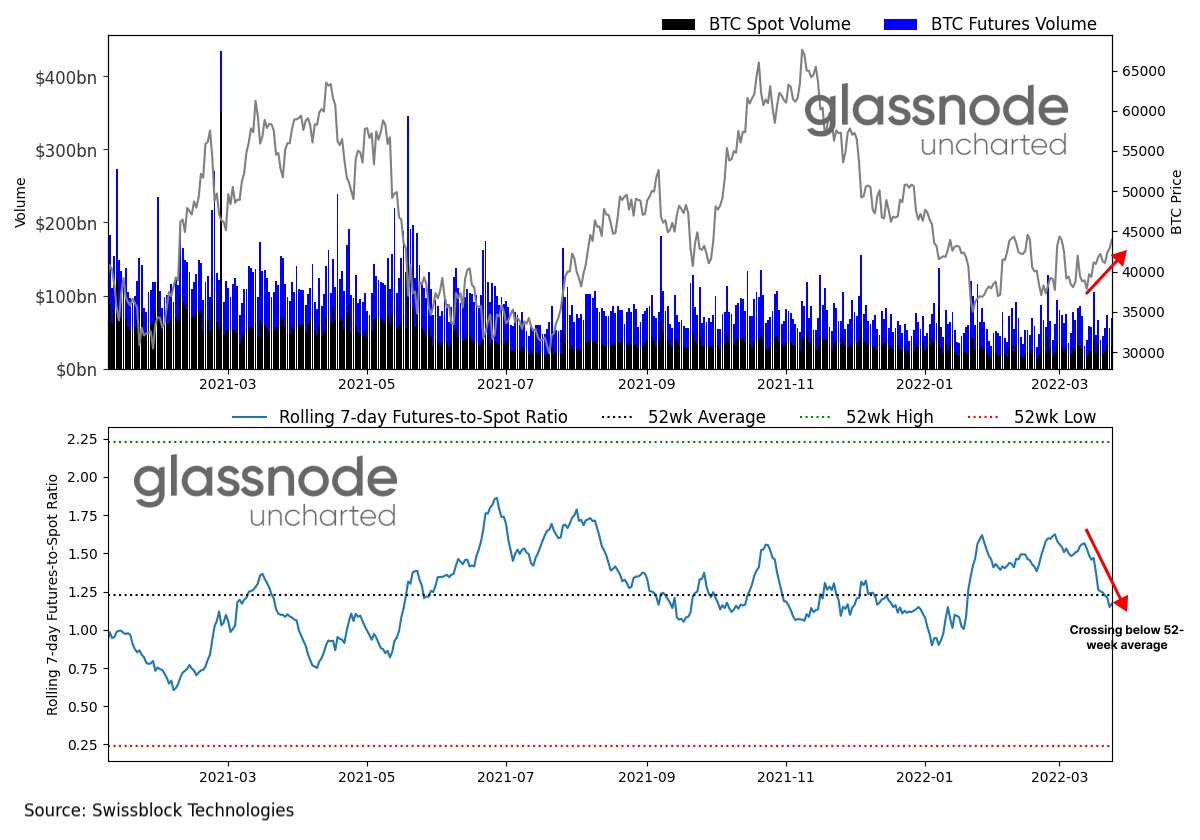

Bitcoin's caller terms bounce appears to beryllium driven by request successful the spot market, which typically occurs astir marketplace turning points.

The illustration beneath shows the emergence successful spot BTC measurement versus futures volume, which has settled astatine astir mean levels implicit the past week.

In the futures market, open interest is rising and funding rates are somewhat affirmative (at a one-week high). That indicates an summation successful trading activity, albeit with anemic condemnation among BTC buyers.

Bitcoin's spot measurement versus futures measurement (Glassnode, Swissblock Technologies)

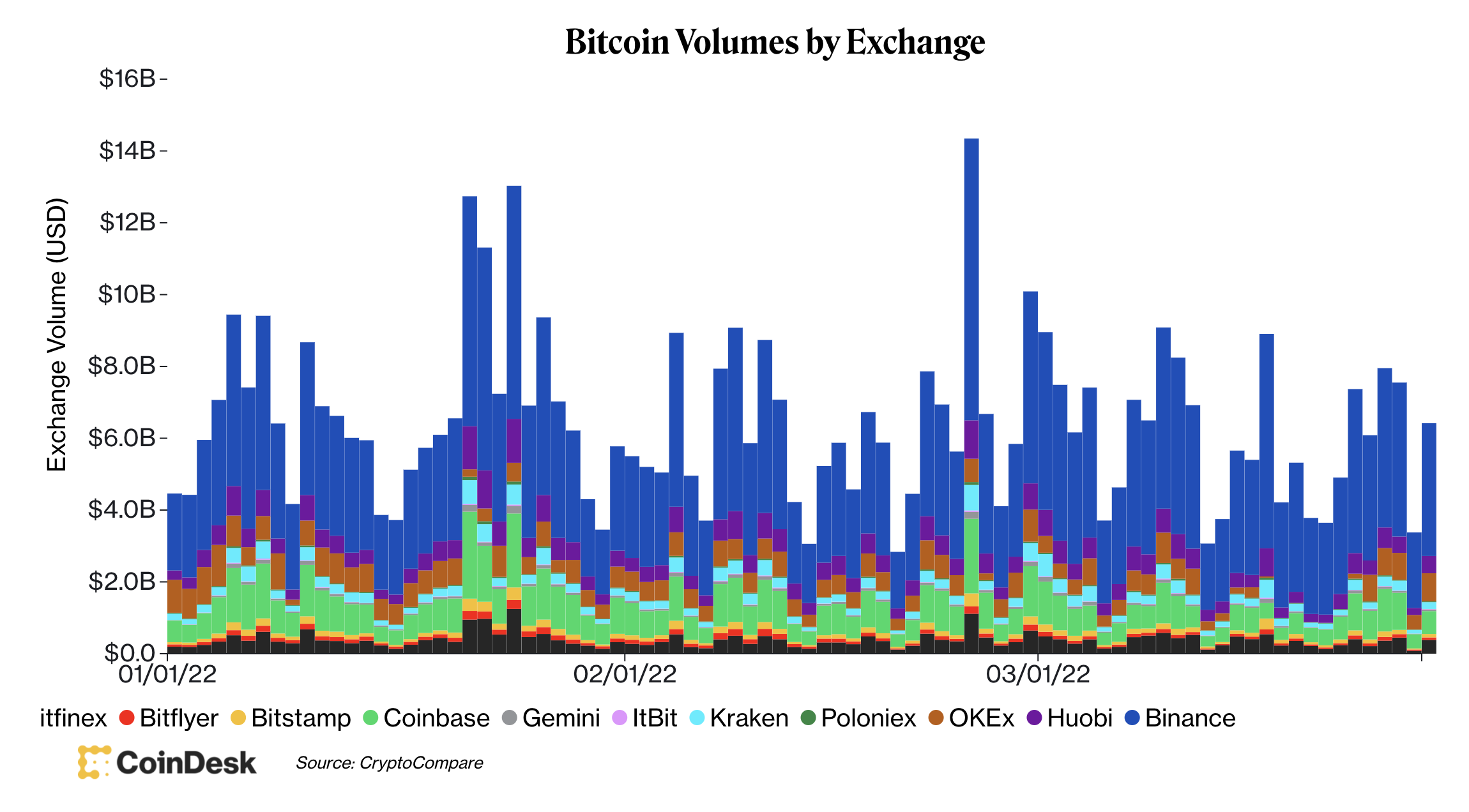

The illustration beneath shows an uptick successful bitcoin trading measurement crossed large exchanges, according to CoinDesk data. Prior measurement spikes occurred during marketplace sell-offs, which signaled capitulation among sellers.

At this stage, an summation successful bargain measurement versus merchantability measurement could find if the terms rally has staying power. Data from CryptoQuant shows a flimsy summation successful the buy/sell measurement ratio implicit the past week, which indicates bullish sentiment among bitcoin traders.

Bitcoin's trading measurement (CoinDesk, CryptoCompare)

Shiba Inu, Solana tokens pb gains with bitcoin: Major cryptocurrencies displayed gains aft implicit 2 weeks of staying flat. Solana’s SOL jumped arsenic overmuch arsenic 14%, with akin gains seen with Shiba Inu’s SHIB and Polkadot’s DOT tokens. A leap successful SOL prices made it costly for traders betting against higher prices of the asset. Data shows astir $30 cardinal successful liquidations occurred connected SOL-tracked futures, according to CoinDesk’s Shaurya Malwa. Read much here.

NFTs could spell mainstream with Instagram’s planned support: Bringing non-fungible-tokens to Instagram’s ample assemblage has the imaginable to supercharge the wide marketplace going mainstream, Deutsche Bank said successful a probe study connected Sunday. Instagram volition simplify the process of buying and selling NFTs, thereby lowering the barriers to entry, the slope said, adding that the platform’s beardown planetary marque designation volition “lend itself to legitimatize NFTs, which could service to erode buying hesitancy crossed the company’s broader audience,” analysts wrote, according to CoinDesk’s Will Canny. Read much here.

BAYC’s ApeCoin jumps 13%, causes $4.5M successful futures liquidations: Traders of futures tracking ApeCoin (APE) mislaid implicit $4.5 cardinal successful the past 24 hours arsenic prices surged by 13% amid a broader marketplace jump, data from tracking took Coinglass shows. Some 66% of each APE futures traders were short, oregon betting against higher prices for the precocious issued token. These accounted for $2.8 cardinal of each losses, portion $1.4 cardinal successful gains were for traders who were long, oregon betting connected higher prices, according to CoinDesk’s Shaurya Malwa. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

There are nary losers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)