Bitcoin experienced crisp terms swings connected Wednesday on with astir accepted assets. The spotlight was connected the U.S. Federal Reserve, which stated astatine the decision of its two-day gathering that it volition "soon beryllium due to rise the people scope for the national funds rate."

The latest Fed determination comes arsenic the cardinal slope has been winding down its asset-purchasing program. Monetary stimulus has been an important root of marketplace support, which underpinned the emergence successful some equities and cryptocurrencies implicit the past year.

BTC reversed earlier gains soon aft the Fed announcement connected Wednesday. Analysts stay skeptical, noting the caller bounce occurred connected debased condemnation among buyers.

"Short-positioned traders are dominating the derivative market. This indicates that bitcoin's bounce was driven by [the spot market] alternatively than derivatives, which is confluent with the important bidding seen connected Coinbase," Marcus Sotiriou, expert astatine the UK-based integer plus broker GlobalBlock, wrote successful an email to CoinDesk.

●Bitcoin (BTC): $37154, +0.90%

●Ether (ETH): $2530, +3.76%

●S&P 500 regular close: $4350, −0.15%

●Gold: $1818 per troy ounce, −1.88%

●Ten-year Treasury output regular close: 1.85%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

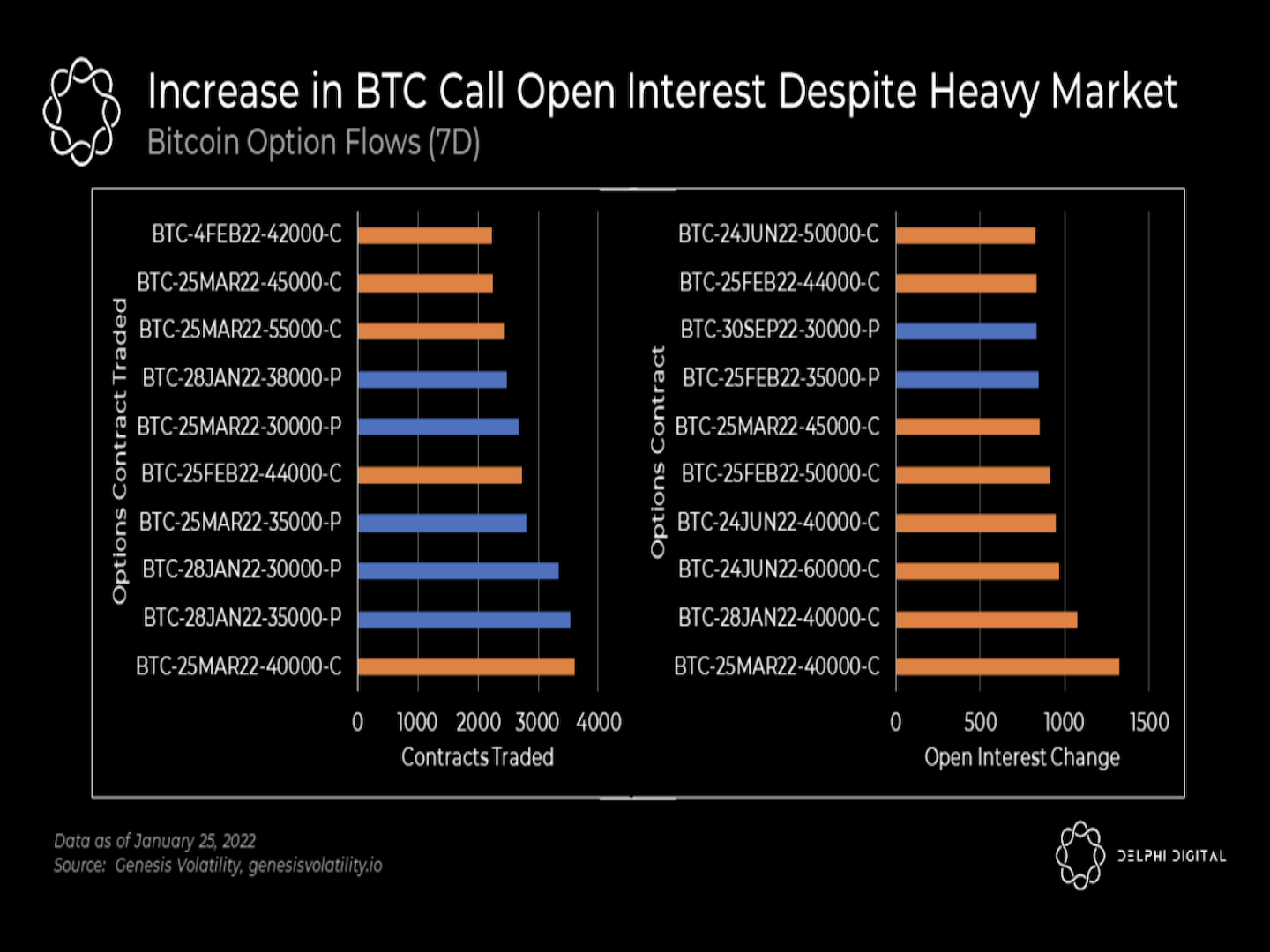

Analysts person noticed bearish positioning among bitcoin enactment traders, which indicates a precocious level of uncertainty astir existent terms levels. For example, information from Genesis Volatility shows that retail enactment traders person been net-short March $40,000 BTC calls and net-long March $35K puts – a bearish trade.

On a much affirmative note, BTC besides saw a ample summation successful telephone unfastened involvement and measurement led by the March $40,000 onslaught price, which is bullish. Further, ample organization traders person been taking the other broadside of bearish enactment trades, according to a blog station by Delphi Digital.

Overall, mixed views among enactment traders could constituent to higher volatility, particularly implicit the adjacent 2 months.

Bitcoin telephone unfastened involvement (Delphi Digital)

Dogecoin leads gains among large cryptos: Prices of BTC, ETH and different large cryptocurrencies roseate arsenic overmuch arsenic 7% soon earlier New York trading hours, with meme coin dogecoin (DOGE) starring gains among the biggest assets by marketplace capitalization. DOGE yet pulled backmost toward $0.14 and is down 9% implicit the past week.

Fake Grimacecoin jumped 285,000% aft McDonald’s’ Tesla joke: “Only if Tesla accepts grimacecoin,” McDonald’s said connected Wednesday morning, referencing its purple mascot fashioned aft a sensation bud. That tweet was successful effect to Tesla CEO Elon Musk’s tweet connected Tuesday, “I volition devour a blessed repast connected TV if McDonald’s accepts Dogecoin.” The tweet triggered the instauration of astir 10 grimacecoins connected the Binance Smart Chain (BSC) web alone. Read much here.

Wonderland’s TIME sets debased of $420 aft liquidation cascade: TIME has lost 95% of its worth from its November highest of $10,000, becoming 1 of the worst-performing cryptocurrencies successful the past fewer months. Theories successful crypto circles down the sell-off included Wonderland developers selling portion of their holdings, and the unwinding of positions of overleveraged traders, according to CoinDesk's Shaurya Malwa. Read much here.

Most integer assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)