Bitcoin (BTC) rallied supra $43,000 connected Monday, retracing astir 30% of the sell-off since November. Some analysts expect the short compression rally could continue, albeit with little momentum compared with erstwhile terms surges.

Trading measurement crossed large BTC exchanges ticked higher connected Monday, but is inactive little than January highs. Below-average trading enactment during terms rallies typically reflects debased condemnation among traders.

Volatility is besides debased successful the bitcoin options marketplace contempt the terms rally. "Volatilities stay nether tremendous unit successful spite of the accelerated rally successful the BTC spot market," QCP Capital, a Singapore-based crypto trading steadfast wrote successful a Telegram chat. "BTC 1-week implied volatilities traded adjacent to the lows of 50% implicit the weekend! Levels person travel up somewhat now," QCP wrote.

For now, method indicators amusement further country toward resistance astatine $45,000-$47,000. Bitcoin is investigating its 50-day moving mean aft an oversold bounce near enactment intact astir $37,400, according to Katie Stockton, managing manager astatine Fairlead Strategies. "We would tread carefully, however, owed to bitcoin’s nonaccomplishment of semipermanent momentum," Stockton wrote successful a Monday note.

●Bitcoin (BTC): $44034, +5.97%

●Ether (ETH): $3145, +5.50%

●S&P 500 regular close: $4484, −0.37%

●Gold: $1823 per troy ounce, +0.90%

●Ten-year Treasury output regular close: 1.92%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

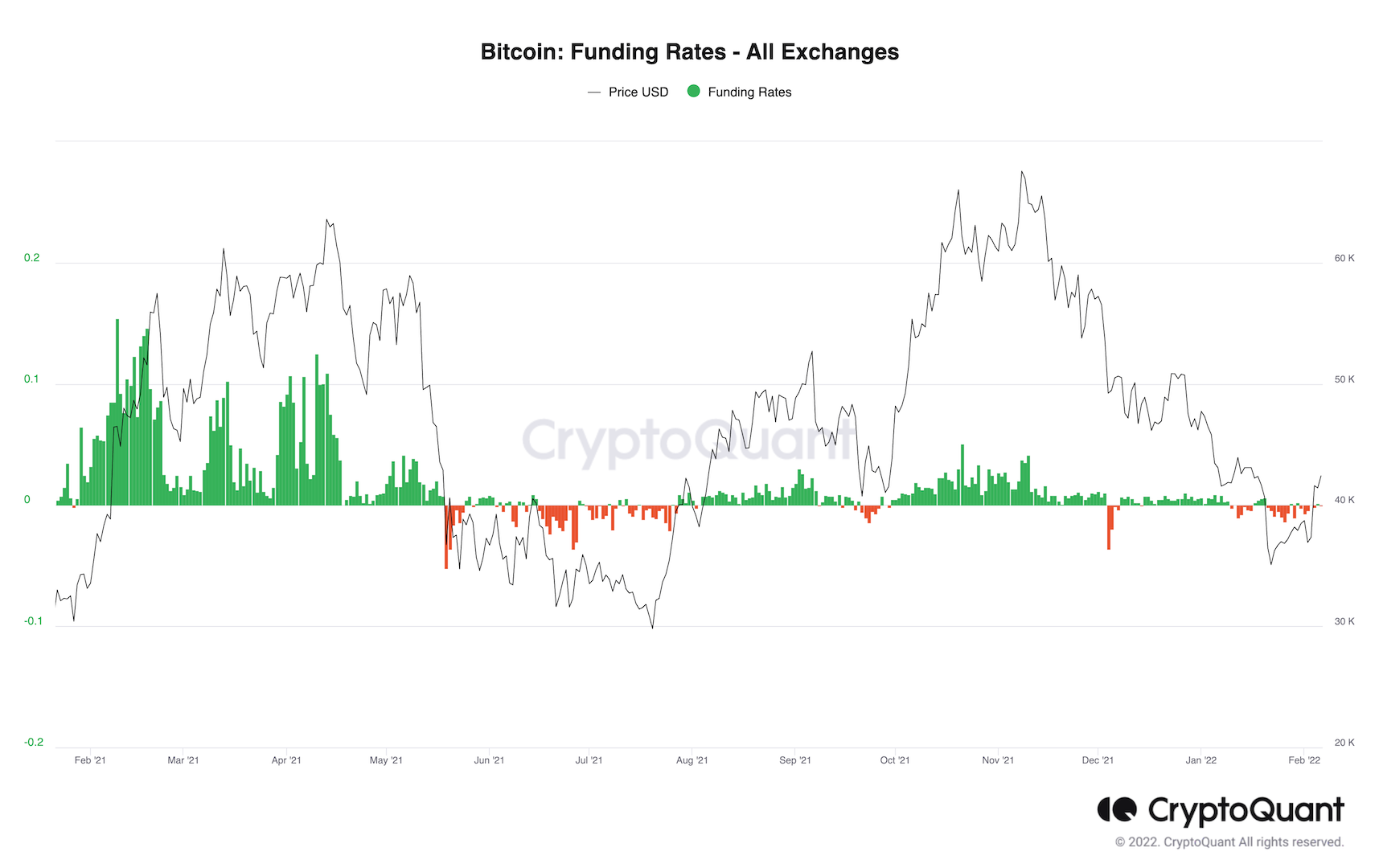

Funding rates small changed

Bitcoin's mean funding rate, oregon the outgo of holding agelong positions successful the perpetual futures marketplace listed connected large exchanges, besides remains debased contempt the caller terms rally. That could mean leveraged traders are inactive cautious and person not positioned themselves aggressively during BTC's 13% terms leap implicit the past week.

The backing complaint is somewhat negative, which means that "leveraged shorts are apt to get liquidated if prices proceed to rally, adding much substance to this abbreviated squeeze," QCP Capital wrote.

Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading.

The erstwhile surge successful bitcoin backing rates occurred aboriginal successful 2021, which preceded a near-50% sell-off. This time, however, backing rates person not reached utmost levels, which suggests immoderate traders person been connected the sidelines, scarred by important liquidations successful the anterior sell-off.

Bitcoin backing rates (CryptoQuant)

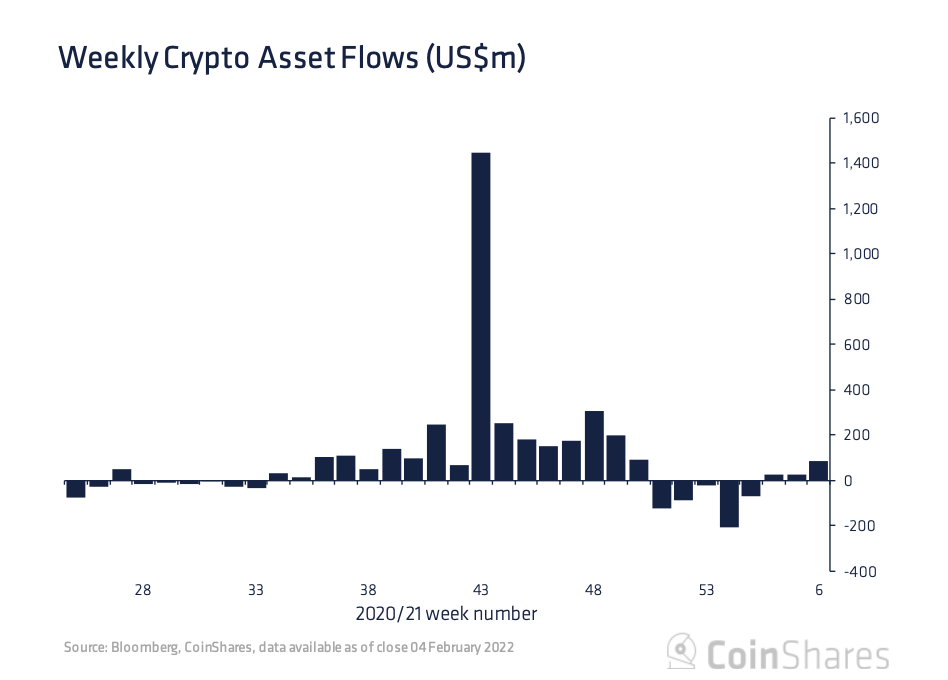

Crypto funds saw inflows of $85 cardinal during the 7 days done Friday, according to a report Monday from the digital-asset manager CoinShares. It was the 3rd consecutive week of nett inflows.

About $71 cardinal flowed into bitcoin-focused funds past week, the largest magnitude since aboriginal December.

Despite the wide bullish sentiment, Ethereum-focused funds saw outflows of $8.5 million, which was little than past week’s $26.8 cardinal successful outflows but inactive a motion of an unsteady market.

Crypto funds saw inflows of $85 cardinal during the 7 days done Feb. 4. (CoinShares)

XRP leads crypto gains: Ripple's XRP token led gains among large cryptocurrencies with an 18% summation to implicit $0.79. The terms surged amid affirmative sentiment astir the tribunal lawsuit successful which the U.S. Securities and Exchange Commission alleges the blockchain-based payments steadfast sold XRP arsenic an unregistered information to the public, according to Shaurya Malwa. Read much here.

Shiba Inu's SHIB rockets 26%: Shiba Inu-themed tokens were the apical gainers connected Monday, gaining arsenic overmuch arsenic 46% successful the past 24 hours. The terms question caused much than $11 million successful losses to liquidations for traders of SHIB-tracked futures products. Its play surge came days aft developers unveiled a tie-up with Welly’s, a fast-food concatenation selling burgers and fries. The concern involves rebranding Welly’s stores to see Shiba Inu-themed products and imagery, and the issuance of non-fungible tokens (NFT) for customers, developers said. Besides SHIB, Dogecoin (DOGE) is besides among the apical meme token gainers, adding 13% of returns successful the past 24 hours.

Japan's biggest slope to contented yen-pegged stablecoin: The spot banking limb of Mitsubishi UFJ, Japan's largest slope by assets, is readying to usage blockchain exertion for securities trading and acceptable up the stablecoin arsenic a outgo instrument. This volition expedite the colony process, which present takes a mates of days, redeeming millions of dollars by making it instantaneous, according to Jamie Crawley. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

There were nary losers successful the CoinDesk 20 connected Monday.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)