Traders proceed to show the struggle betwixt Russia and Ukraine connected Monday, which has weighed connected equities and cryptocurrencies.

The U.S. announced it volition temporarily relocate its embassy operations successful Ukraine from Kyiv to Lviv, farther distant from the Russian border, owed to the "dramatic acceleration successful the buildup of Russian forces." And Ukrainian President Volodymyr Zalenskyy said Wednesday – 2 days from present – volition beryllium the "day of the attack," successful a code connected Monday.

"This fearfulness is owed to the uncertainty of warfare but besides the information that U.S. President Joe Biden has said helium volition shut down the Nord Stream 2 pipeline if Russia decides to invade," Marcus Sotiriou, an expert astatine the U.K.-based integer plus broker GlobalBlock, wrote successful an email to CoinDesk.

Nord Stream 2 provides a significant portion of Europe’s earthy gas, truthful a shutdown could origin lipid prices to climb, which could effect successful higher inflation, according to Sotiriou. Central banks are tightening monetary argumentation to combat rising prices, which is simply a headwind for speculative assets specified arsenic cryptocurrencies.

Bitcoin (BTC) traded successful a choky scope betwixt $41,000 and $42,000, portion oil, golden and the U.S. dollar traded higher implicit the past 24 hours.

●Bitcoin (BTC): $42228, −0.61%

●Ether (ETH): $2900, −0.32%

●S&P 500 regular close: $4402, −0.38%

●Gold: $1873 per troy ounce, +1.76%

●Ten-year Treasury output regular close: 2.00%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

The bitcoin futures word structure, which reflects the marketplace anticipation connected aboriginal implied volatility, has flattened done March. That could bespeak uncertainty among crypto derivative traders.

Through the extremity of 2022, the word operation shows a precise humble 6% annualized premium, "suggesting the marketplace is rather acold from anticipating a chaotic bullish impulse immoderate clip soon," Glassnode stated successful a blog post connected Monday. Further, "the marketplace appears to beryllium de-risking and curtailing leverage successful effect to the plethora of macro uncertainties."

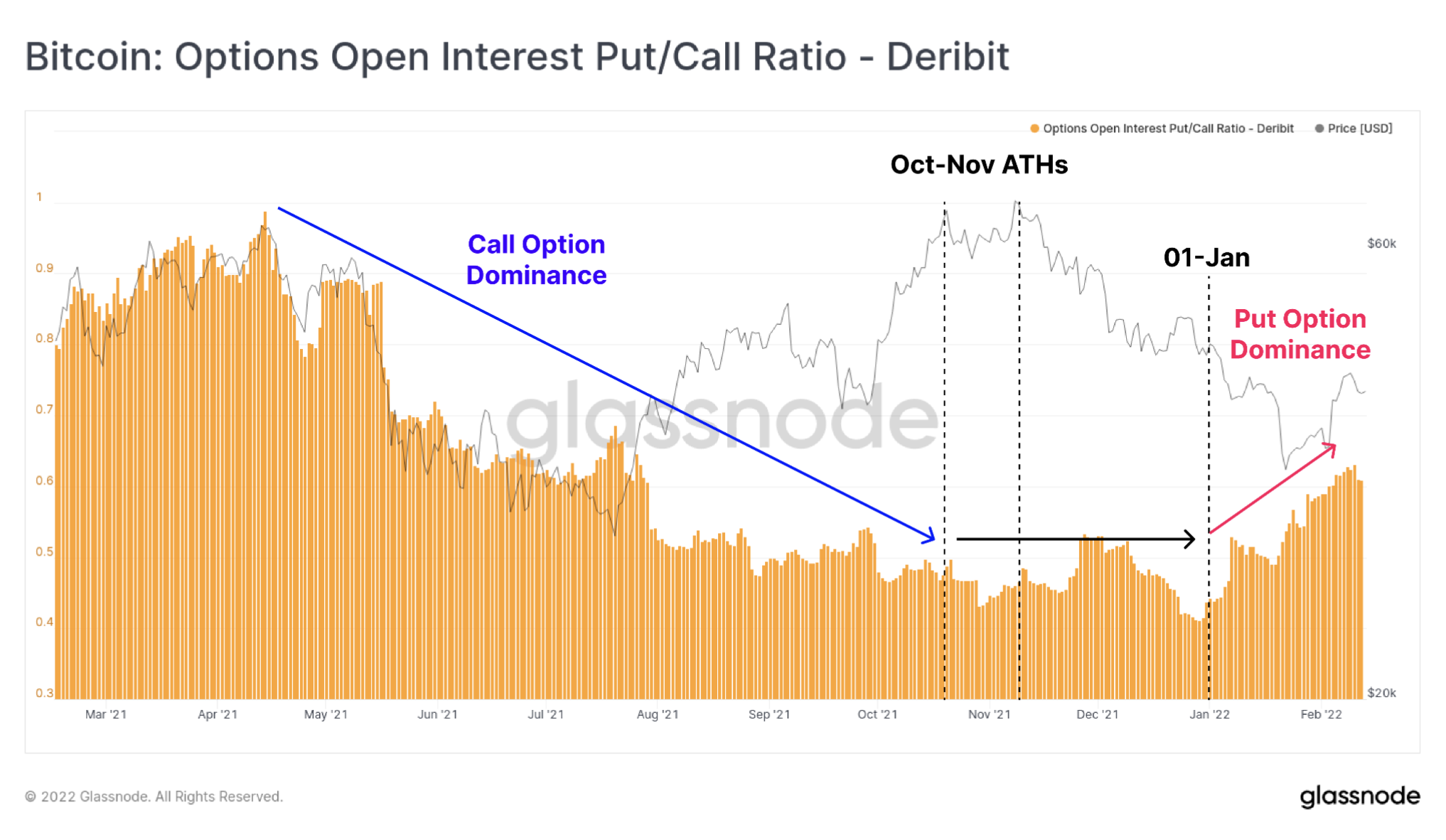

The illustration beneath shows the caller summation successful put options comparative to call options, indicating greater request for downside extortion among bitcoin traders.

Bitcoin enactment enactment dominance (Glassnode)

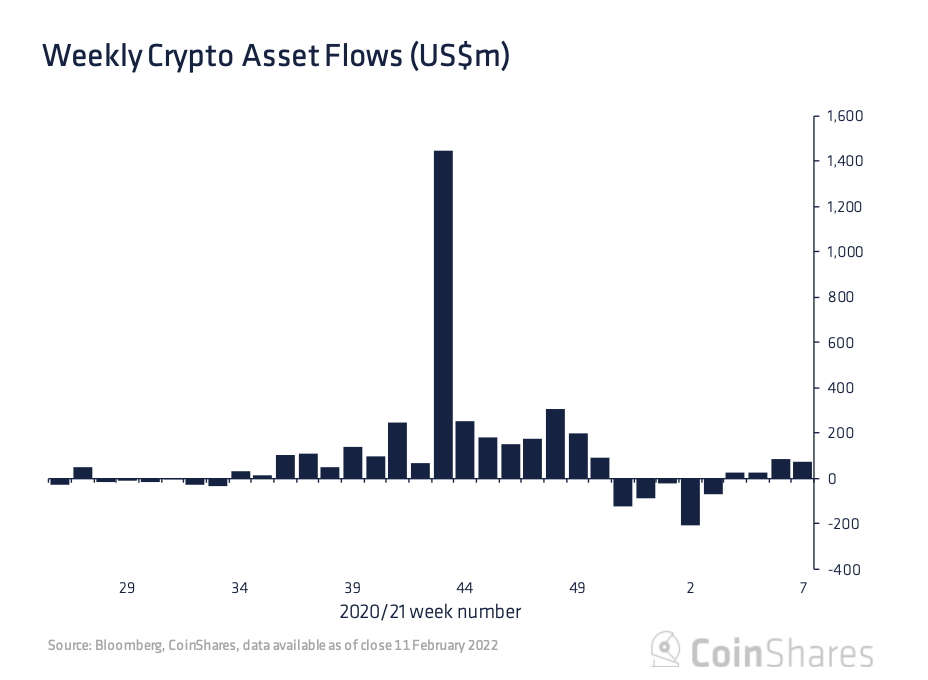

Ethereum funds saw their archetypal inflows successful 10 weeks, astatine $21 million. Meanwhile, bitcoin funds saw inflows of $25 cardinal past week, a slower gait of maturation compared with the $71 cardinal of inflows the week before.

The inflows stay comparatively insignificant successful examination to the inflows during the 4th fourth of 2021, according to CoinShares.

The steadfast noted that determination were determination differences successful the week's data, with $5.5 cardinal of outflows successful the Americas and $80.7 cardinal of inflows into European concern products.

US$75 cardinal flew into digital-asset funds past week arsenic ether funds saw archetypal inflows successful 10 weeks. (CoinShares)

DARMA Capital unveils CFTC-regulated filecoin swap product: Crypto concern steadfast DARMA Capital has created the archetypal fiscal derivative based connected a decentralized retention protocol: the Filecoin Asset Use Swap, oregon FAUS. DARMA (Digital Asset Risk Management Advisors) is making $100 cardinal worthy of its filecoin (FIL) holdings disposable to beryllium loaned out, removing the request for users to bargain the token to enactment successful the network, and allowing much retention providers to gain returns done the system’s proof-of-stake mechanism, according to CoinDesk’s Ian Allison. Read much here.

Animoca brands and Brinc motorboat $30M guild programme for play-to-earn ecosystems: Animoca Brands, an capitalist successful non-fungible token (NFT) and metaverse projects, is partnering with planetary task accelerator Brinc to motorboat the Guild Accelerator Program. Under the enactment of Animoca’s Richard Robinson, the programme volition money up to $500,000 per guild. Among priorities for acceptance volition beryllium projects with a absorption connected sustainability and those that enactment and springiness backmost to player/scholar communities, according to CoinDesk’s Lyllah Ledesma. Read much here.

Tollan Worlds to physique the archetypal play-to-earn metaverse connected Fuse: Multichain metaverse task Tollan Worlds received a assistance from FuseDAO to instrumentality its level connected the Fuse Network blockchain. Fuse volition besides person a dedicated hub successful the Tollan multi-chain metaverse. Read more here.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)