Bitcoin (BTC) returned to supra $45,000 connected Friday arsenic volatility faded.

Alternative cryptocurrencies (altcoins) were besides higher, particularly AAVE, which posted a 20% summation implicit the past 24 hours (up 60% implicit the past week) due to the fact that of the platform's mentation 3 (v3) upgrade earlier this month. Ether (ETH) was up 4% implicit the past 24 hours, compared with a 9% emergence successful Solana's SOL token and a 1% emergence successful BTC implicit the aforesaid period.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why. Coming April 4.

Meanwhile, stocks traded little for astir of the New York trading time aft investors positioned themselves for assertive monetary argumentation tightening due to the fact that of strong U.S. employment data. Low involvement rates and cardinal slope stimulus contributed to rising plus prices. When ostentation rises and the system overheats, however, cardinal banks reverse accommodative policies, which typically leads to higher marketplace volatility.

In the bitcoin futures market, an uptick successful abbreviated liquidations occurred implicit the past 24 hours due to the fact that of the cryptocurrency's terms jump. Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin.

Still, the ratio of buy/sell measurement was somewhat antagonistic connected Friday, indicating debased condemnation among crypto traders contempt BTC's terms rise.

●Bitcoin (BTC): $46327, +1.52%

●Ether (ETH): $3463, +5.31%

●S&P 500 regular close: $4546, +0.34%

●Gold: $1927 per troy ounce, −1.14%

●Ten-year Treasury output regular close: 2.38%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

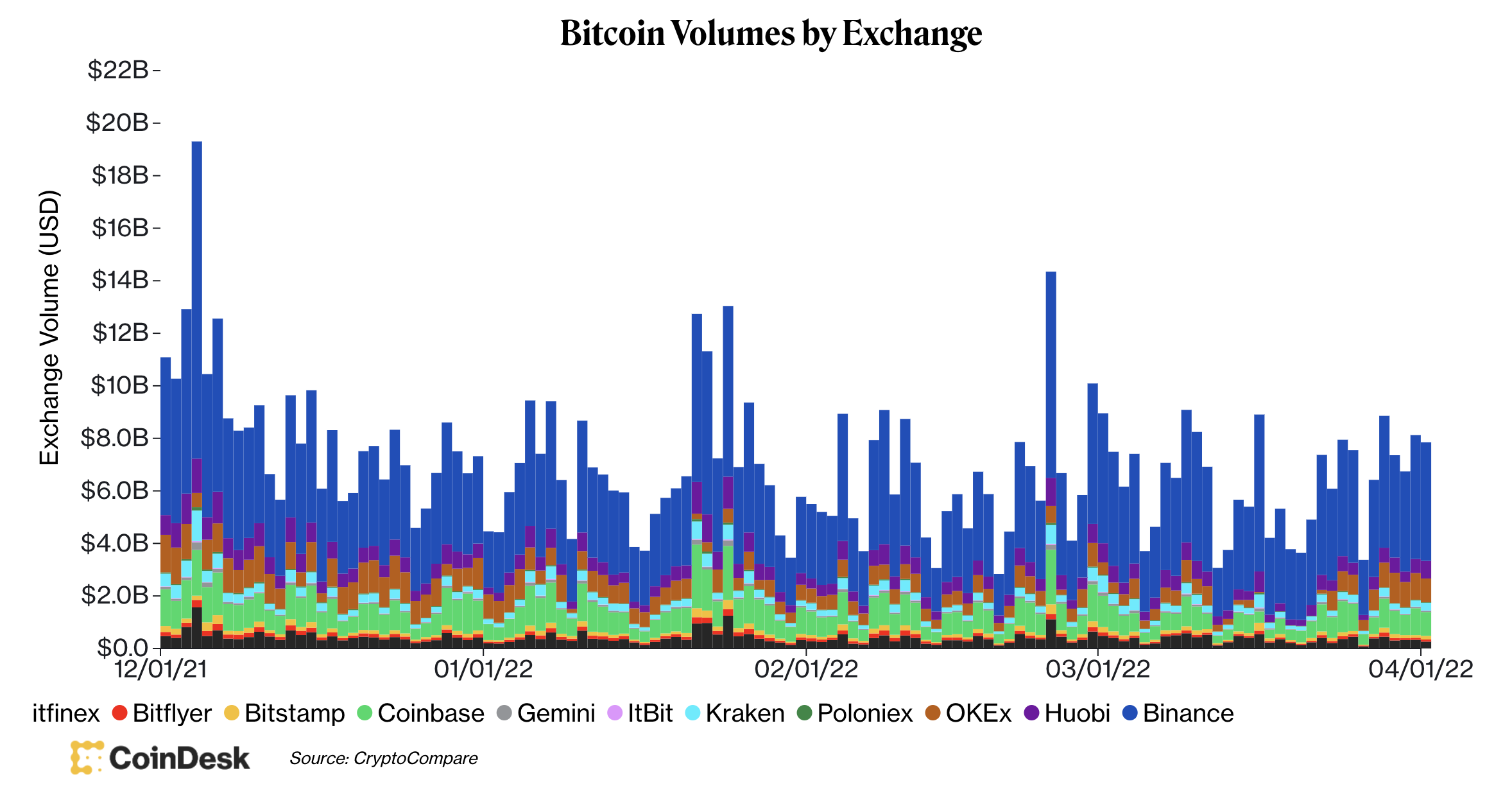

Bitcoin's trading measurement crossed large exchanges remains comparatively low, according to CoinDesk data, contempt trading enactment tending to summation astir the archetypal and past weeks of the month.

The illustration beneath shows ample measurement spikes, which typically hap during terms drops. Some analysts noticed that BTC tends to diminution astir the opening of the period earlier a betterment unfolds, akin to what occurred successful February and March.

Bitcoin's trading measurement by speech (CoinDesk, CryptoCompare)

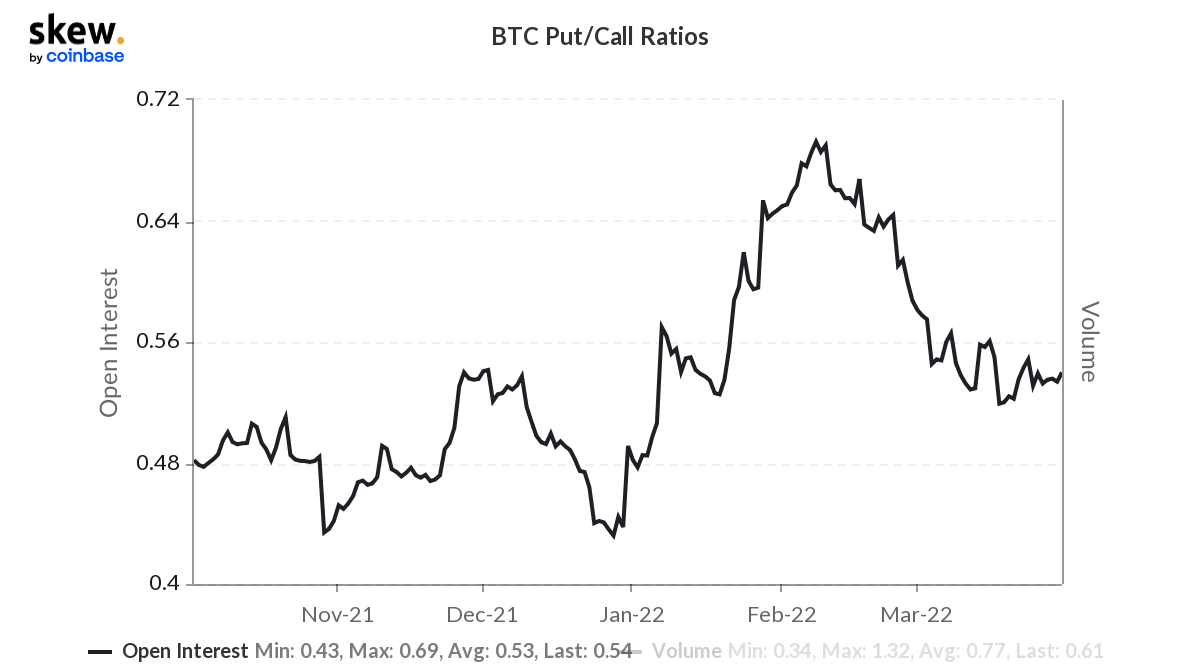

The illustration beneath shows a diminution successful the bitcoin put/call ratio, which suggests little bearish sentiment among enactment traders. The ratio has stabilized implicit the past 2 weeks, which could precede higher volatility, particularly if BTC breaks supra oregon beneath its short-term trading range.

The options marketplace is placing a 55% probability that BTC volition commercialized supra $44,000 successful May, according to information provided by Skew. And calls outweigh puts astatine onslaught prices supra $45,000.

Bitcoin's put/call ratio (Skew)

GMT terms surge: The three-week-old GMT roseate by arsenic overmuch arsenic 52% connected Friday to highs of $3.11. GMT is the governance token of Stepn, a fittingness app that allows users to entree in-game features, specified arsenic being capable to mint virtual sneakers, upgrade “gems” and enactment successful governance voting. Read much here.

Axie Infinity delays motorboat of 'Origin' game: Axie Infinity developer Sky Mavis delayed the launch of its highly anticipated “Origin” upgrade from March 30 to April 7 aft hackers stole $625 million from the underlying Ronin blockchain earlier successful the week. Read much here.

Metaverse system could turn to $13 trillion by 2030: Getting to that marketplace level is going to necessitate sizable infrastructure investment, Citi said successful a study connected Thursday. It is imaginable that the “metaverse is moving towards becoming the adjacent procreation of the net oregon Web 3," Citi said. Read much here.

Does the Metaverse Need a Free Trade Agreement?: It’s seeking to beryllium the centerpiece of Web 3, but a palmy metaverse could tally headfirst into immoderate old-style protectionist barriers, Sam Lowe, a commercialized argumentation advisor astatine Flint Global, said successful an interrogation with CoinDesk.

Digital assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)