Bitcoin (BTC) returned supra $38,000 connected Monday arsenic bearish sentiment faded. The cryptocurrency was up 2% implicit the past 24 hours, versus a 4% emergence successful ether (ETH) implicit the aforesaid period. Metaverse tokens MANA and SAND were up 17% and 9%, respectively, connected Monday.

It appears selling unit is starting to wane aft a unsmooth commencement to the year. In the bitcoin options market, the put-call unfastened involvement ratio, which measures the fig of unfastened positions successful enactment options comparative to those successful calls, roseate to a six-month precocious of 0.62 connected Sunday. A higher put-call ratio is typically viewed arsenic a contrarian indicator, suggesting bearish sentiment is adjacent a peak.

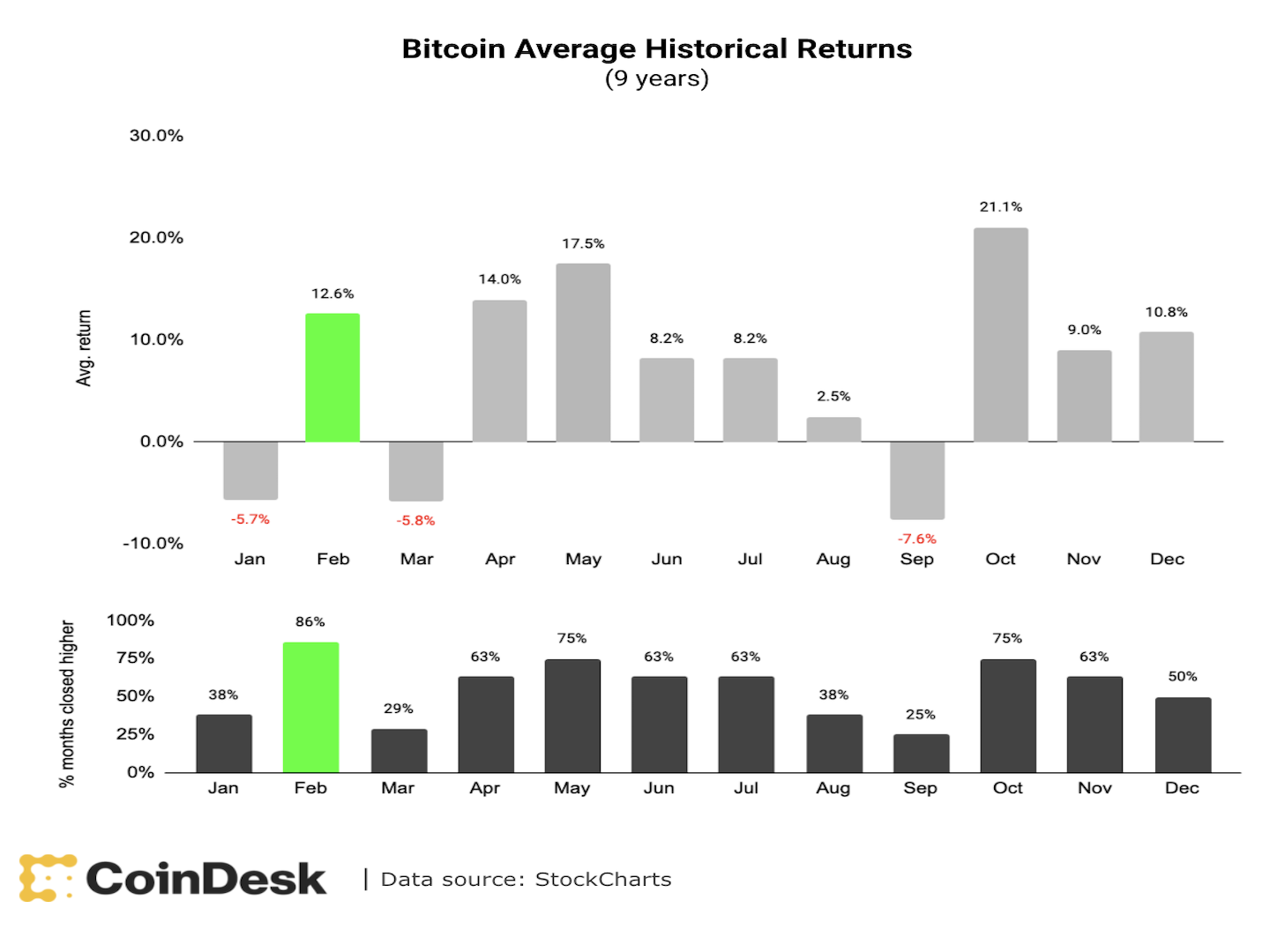

Historically, bitcoin produces positive returns successful February, which could connection immoderate anticipation for bullish traders. Technical indicators suggest short-term buyers could stay progressive astir the $35,000-$37,000 enactment zone, though upside appears to beryllium constricted toward $45,000.

Despite the caller terms bounce, immoderate analysts stay skeptical due to the fact that macroeconomic and regulatory risks stay elevated.

"Regulation concerns originate arsenic the Biden medication prepares to merchandise an executive order successful February to modulate bitcoin arsenic a substance of nationalist security," Marcus Sotiriou, an expert astatine the U.K.-based integer plus broker GlobalBlock, wrote successful an email to CoinDesk. "It is hard to foretell whether this enforcement bid volition person a affirmative oregon antagonistic interaction connected the industry."

"The concern successful the crypto marketplace remains precise fragile. Bitcoin could extremity up falling for the 3rd period successful a row," Alex Kuptsikevich, an expert astatine FxPro, wrote successful an email to CoinDesk.

●Bitcoin (BTC): $37696, +5.55%

●Ether (ETH): $2517, +7.51%

●S&P 500 regular close: $4432, +2.43%

●Gold: $1790 per troy ounce, −0.17%

●Ten-year Treasury output regular close: 1.78%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Over the past 9 years, bitcoin produced an mean instrumentality of 12% successful February, and ended the period with a summation 86% of the time, according to data compiled by StockCharts. Generally, equities besides execute good during the 2nd quarter, which means investors could commencement to summation their vulnerability to speculative assets.

"We spot a short-term setup forming for a bounce, particularly connected a adjacent backmost supra $40K BTC and $3K ETH" successful February, QCP Capital, a crypto trading firm, wrote successful a Monday report. The steadfast besides expects marketplace expectations for a U.S. Federal Reserve complaint hike to mean implicit the adjacent 2 months, which could payment equities and cryptocurrencies.

Still, humanities returns is nary warrant of aboriginal returns.

Bitcoin mean humanities returns (CoinDesk, StockCharts)

Investors enactment wealth into cryptocurrency funds for a 2nd consecutive week arsenic the bitcoin marketplace stabilized pursuing 1 of its worst-ever starts to a year.

Crypto funds saw inflows of $19 cardinal during the 7 days done Jan. 28, according to a report Monday from the digital-asset manager CoinShares.

Notably, immoderate $22.1 cardinal flowed into bitcoin-focused funds past week, portion Ethereum-focused funds suffered outflows of $26.8 million. Read much here.

Meta joins crypto confederation led by Jack Dorsey’s Block: Meta, the institution formerly known arsenic Facebook, is joining the Crypto Open Patent Alliance (COPA), a consortium of tech and crypto companies led by Jack Dorsey’s payments company, Block (the institution formerly known arsenic Square). Meta volition articulation implicit 2 twelve different companies that, by joining COPA, person pledged not to enforce their “core cryptocurrency patents” – broadly defined by Max Sills, the wide manager of COPA arsenic immoderate “technology that enables the creation, mining, storage, transmission, settlement, integrity, oregon information of cryptocurrencies.” Read much by Cheyenne Ligon here.

Arcade launches NFT lending platform: Lending level Arcade has introduced the Pawn Protocol successful a bid to bring liquidity to the non-fungible token (NFT) market, the institution announced Monday. The level is simply a peer-to-peer marketplace that allows users to entree fixed-rate loans collateralized by their Ethereum-based NFTs, utilizing an escrow system, according to Eli Tan. Read much here.

Flow Blockchain gets Circle’s afloat USDC treatment: Circle’s dollar-backed stablecoin USDC tin present beryllium minted and redeemed crossed Flow, the high-speed blockchain level created by non-fungible token (NFT) pioneers Dapper Labs. Circle antecedently announced a concern with Dapper successful 2020 to alteration USDC arsenic a outgo processor and custodian for Dapper wallet users, according to Ian Allison. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)