Bitcoin (BTC) and different cryptocurrencies traded higher connected Monday, though immoderate analysts stay cautious astir geopolitical risks.

Talks betwixt Ukrainian and Russian negotiators could proceed implicit the adjacent fewer days, though immoderate officials said truthful acold nary woody connected a cease-fire has been reached, according to the Wall Street Journal

Meanwhile, the U.S. and respective European nations person imposed much sanctions connected Russia. For example, connected Monday, the U.S. Treasury Department prohibited transactions with the Central Bank of Russia and placed sanctions connected a cardinal Russian sovereign wealthiness fund.

In crypto markets, trading volumes betwixt the Russian ruble and bitcoin accrued to a nine-month high, according to data tracked by Kaiko. The emergence successful ruble-denominated bitcoin measurement prompted a backlash from 1 Ukrainian official.

"I'm asking each large crypto exchanges to artifact addresses of Russian users," Mykhailo Fedorov, vice premier curate of Ukraine and curate of the country's integer transformation, tweeted connected Sunday. "It's important to frost not lone the addresses linked to Russian and Belarusian politicians, but besides to sabotage mean users."

Bitcoin's trading measurement crossed large exchanges has declined aft the Feb. 24 spike, and selling unit is starting to fade.

Further, data from Glassnode shows a ample information of BTC held by investors astatine astir the $60,000 terms level has recovered caller buyers astatine the $35,000-$38,000 terms range. That could bespeak a short-term terms low.

●Bitcoin (BTC): $41734, +10.29%

●Ether (ETH): $2827, +8.08%

●S&P 500 regular close: $4374, −0.24%

●Gold: $1911 per troy ounce, +1.29%

●Ten-year Treasury output regular close: 1.84%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

So, has bitcoin bottomed? Not quite.

Bitcoin has been successful a downtrend since its all-time precocious successful November of astir $69,000, good earlier the Russia-Ukraine conflict. That means different factors specified arsenic planetary monetary tightening, regulatory uncertainty and lower crypto demand from China person weighed connected prices.

Still, cyclical downturns successful bitcoin yet signifier retired fixed the cryptocurrency's semipermanent uptrend.

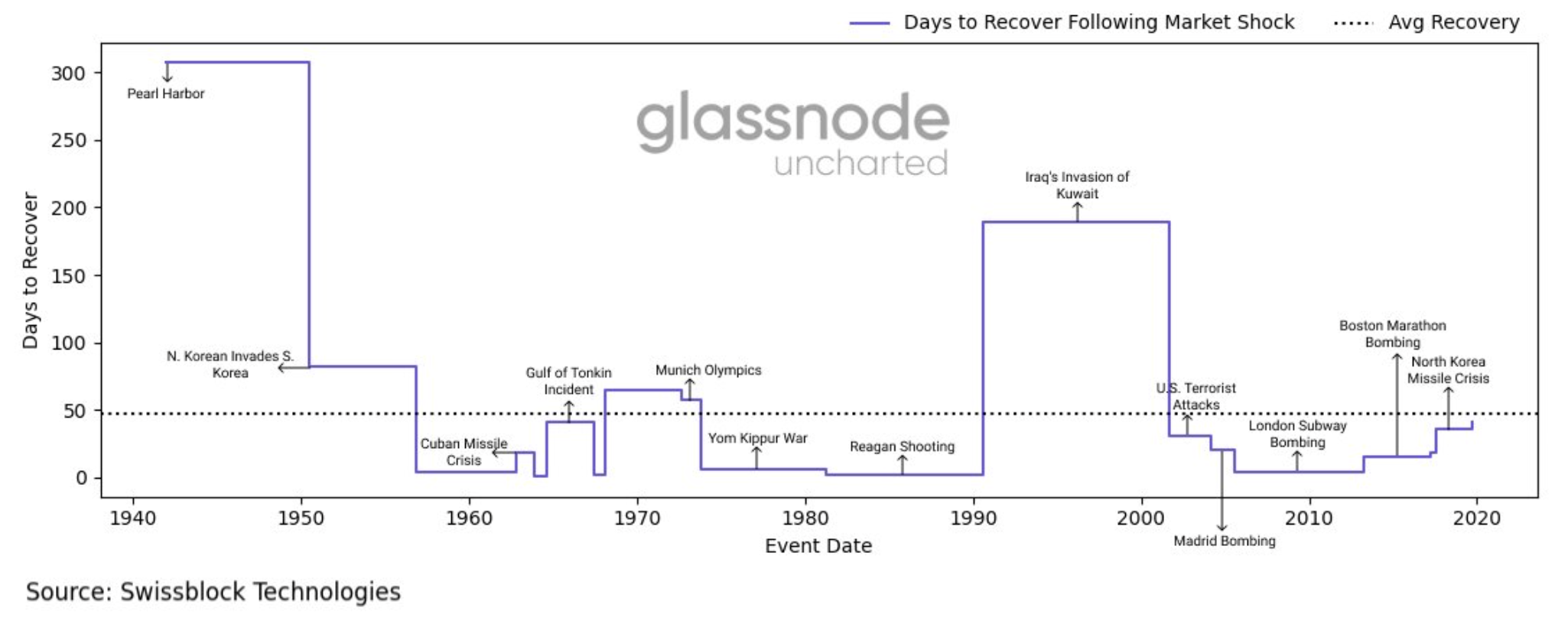

On average, the S&P 500 takes astir 47 days to retrieve from geopolitical-driven sell-offs, according to information from Swissblock Technologies, a crypto analytics firm. Other studies amusement that equities continued to beforehand successful 3 to six months aft geopolitical-driven sell-offs. BTC could travel a akin betterment signifier fixed its rising correlation with the S&P 500.

Days to retrieve pursuing a marketplace daze (Glassnode, Swissblock Technologies)

The illustration beneath shows bitcoin's market-value-to-realized worth ratio (MVRV), standardized to amusement utmost upside and downside moves. Simply put, the ratio provides an estimation of bitcoin's deviation from "fair value."

The MVRV entered overvalued territory astatine astir BTC's November all-time terms high, but wasn't arsenic utmost comparative to the 2018 peak. That suggests the existent down rhythm won't beryllium arsenic severe arsenic the erstwhile carnivore market's 80% peak-to-trough decline.

Still, geopolitical events are highly uncertain, and the MVRV hasn't reached undervalued territory. That could constituent to further terms volatility implicit the abbreviated term.

Bitcoin's MVRV (Glassnode)

Crypto funds saw insignificant outflows successful altcoins: Solana-focused integer plus funds mislaid $2.6 cardinal and litecoin-focused funds mislaid $0.5 cardinal past week, marking 2 biggest losers successful crypto funds. Tezos was the lone altcoin concern merchandise to spot inflows, arsenic it netted an inflow of $4.4 million. Read much here.

AMC Theatres volition judge Doge and Shiba Inu via BitPay: AMC Theatres customers adjacent period volition beryllium capable to wage with meme coins dogecoin (DOGE) and shiba inu (SHIB) utilizing crypto payments supplier BitPay. “BitPay volition beryllium unrecorded for AMC online payments connected our website by March 19, and unrecorded connected our mobile apps by April 16, perchance a fewer days earlier,” tweeted AMC CEO Adam Aron. Read much here.

Leading interoperability level Multichain present supports Fuse networks: Multichain (formerly Anyswap) has enabled enactment for the Fuse Network blockchain. The supported tokens see FUSE, WETH, USDC and BIFI. One of the halfway ideas animating the Fuse task is the committedness to interoperability. The task believes that successful the future, nary azygous blockchain volition beryllium ascendant and that assorted blockchains volition complement each different to alteration users to get the astir retired of the crypto sector. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

There are nary losers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)