Bitcoin returned supra $43,000 connected Thursday and was up astir 3%, indicating renewed buying involvement aft a comparatively quiescent week. Despite the caller diminution successful trading activity, analysts are inactive monitoring macroeconomic and regulatory risks that could trigger a emergence successful volatility.

On Thursday, Russia's cardinal slope suggested that lawmakers request to instrumentality regulations to efficaciously prohibition home crypto-related activities. The slope made it clear, however, that is not suggesting banning ownership of crypto by backstage citizens. Instead, the connection targets Russian organization investors, fiscal infrastructure providers and different organizations that could facilitate crypto transactions.

The connection comes aft Binance, a crypto exchange, announced earlier this period that it hired erstwhile authorities officials from Russia and Ukraine to assistance make its concern successful those countries.

Some traders appeared to beryllium unfazed by Russia's projected crypto ban, evidenced by the terms summation connected Thursday.

However, immoderate analysts stay cautious contempt the stabilization successful bitcoin's price. "Buying connected declines beneath $41K BTC is not yet a origin for optimism, arsenic a downtrend with little highs has been underway for much than a week," Alex Kuptsikevich, expert astatine FxPro wrote successful an email to CoinDesk.

●Bitcoin (BTC): $42615, +2.26%

●Ether (ETH): $3189, +2.43%

●S&P 500 regular close: $4483, −1.10%

●Gold: $1839 per troy ounce, −0.24%

●Ten-year Treasury output regular close: 1.83%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

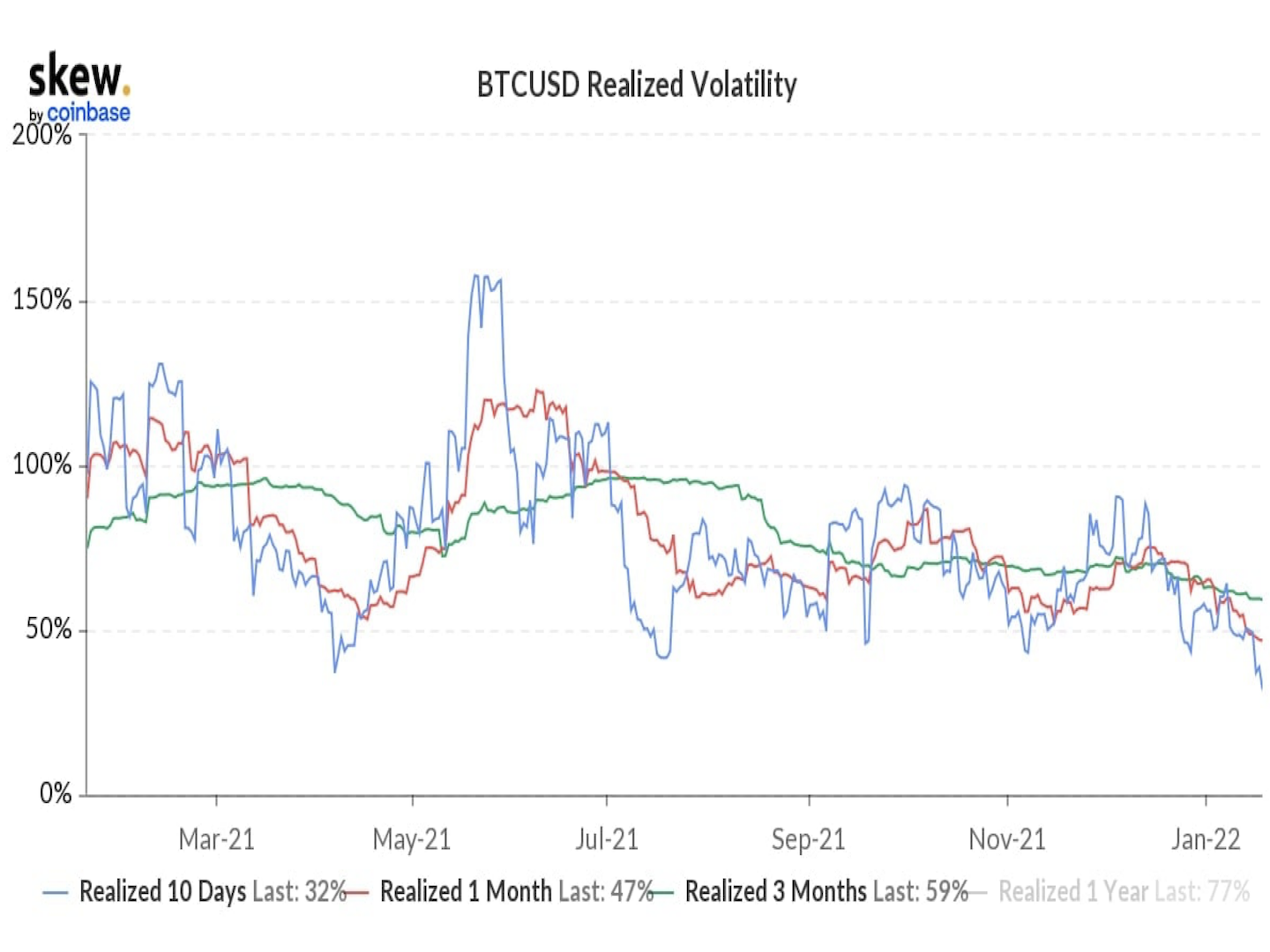

Volatility successful the crypto marketplace has been declining implicit the past month, particularly arsenic bitcoin continues to commercialized successful a choky scope betwixt $40,000 and $45,000.

QCP Capital, a Singapore-based crypto trading firm, described volatility conditions arsenic "frustrating" successful a Telegram announcement. "There is intelligibly immoderate downside nervousness with hazard reversals backmost to precise antagonistic levels (puts much costly than calls)," QCP wrote.

The illustration beneath shows bitcoin's realized volatilities approaching lows astir 30% and 40%, which makes it hard for immoderate enactment traders who trust connected predominant terms swings. QCP stated that it has neutralized immoderate of its volatility positions.

For now, immoderate traders person been monitoring the adjacent narration betwixt bitcoin and the Nasdaq 100 Index. Increased volatility successful tech stocks could dictate movements successful crypto prices implicit the abbreviated term.

Bitcoin realized volatilities (Skew)

An EOS renaissance: The assemblage down EOS is looking to close itself by renewing tech ties with the network’s archetypal developer, Dan Larimer, who has engineered a “Mandel” hard interruption from the institution that insiders accidental “burned” its $4 cardinal blockchain darling. Larimer, who discontinue Block.one – EOS’ now-estranged parent institution – past January, is ratcheting up method contributions to the bundle helium spearheaded successful 2017. Read much here.

Solana NFT boom: Non-fungible token (NFT) income connected the Solana blockchain surpassed $1 cardinal successful full measurement this period for the archetypal time. Some developers similar Solana-based NFTs owed the little transaction fees connected the blockchain web compared to Ethereum. Solana’s SOL token is down astir 20% truthful acold this twelvemonth compared to a 14% driblet successful ETH implicit the aforesaid period. Read much here.

Prada, Adidas motorboat NFT task connected Polygon: Italian luxury manner location Prada and sportswear elephantine Adidas, which precocious ventured into the metaverse, person joined forces to motorboat a caller non-fungible token (NFT) task built connected the Polygon network. The task volition let fans to lend their ain designs.

Most integer assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)