Bitcoin (BTC) and different cryptocurrencies struggled to support earlier gains connected Wednesday, though alternate cryptocurrencies specified arsenic Cosmos' ATOM, Shiba Inu's SHIB and Polygon's MATIC roseate arsenic overmuch arsenic 9% implicit the past 24 hours, compared with BTC's level show implicit the aforesaid period.

Meanwhile, the emergence successful stablecoins could bespeak a formation to information among traders who are seeking extortion from marketplace volatility.

Equities besides declined connected Wednesday, portion accepted harmless haven assets specified arsenic golden and the U.S. dollar rose. That could mean investors are inactive acrophobic astir macroeconomic and geopolitical risks. On Wednesday, Ukraine declared a state of emergency and urged its citizens to permission Russia instantly arsenic tensions betwixt the 2 nations escalated.

●Bitcoin (BTC): $37683, −0.67%

●Ether (ETH): $2624, +0.80%

●S&P 500 regular close: $4226, −1.84%

●Gold: $1910 per troy ounce, +0.22%

●Ten-year Treasury output regular close: 1.98%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Monitoring selling pressure

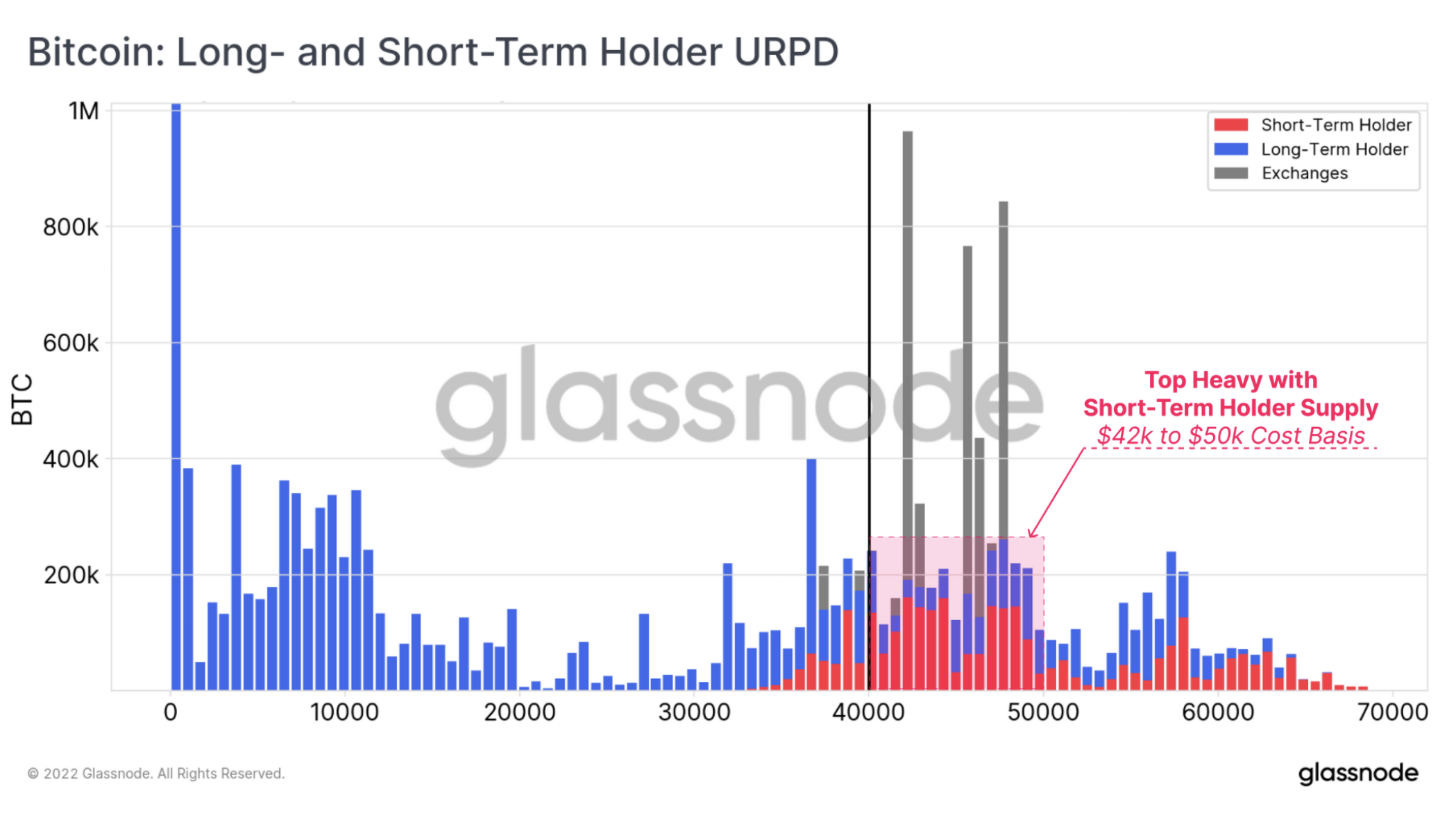

Blockchain information shows a bulk of short-term bitcoin holders person a outgo ground of betwixt $42,000 and $50,000. Therefore, caller fluctuations successful prices beneath $50,000 could origin immoderate anxiousness among traders arsenic losses adhd up.

Glassnode, a crypto information firm, estimates that much than a 4th of each Bitcoin web entities are present underwater connected their position.

"If the marketplace fails to found a sustainable uptrend, these users are statistically the astir apt to go yet different root of sell-side pressure, specially if terms trades beneath their outgo basis." Glassnode wrote successful a blog post.

The steadfast besides noticed short-term holders purchasing bitcoin successful caller weeks, with an mean outgo ground of $33,500 to $44,600. Still, for now, buying measurement remains low, which means caller bids from short-term holders aren't capable to trigger a sustained upswing successful price.

Long/short-term bitcoin holder supply

Stablecoin’s bull marketplace continues: The proviso of stablecoins continues to turn adjacent arsenic the broader crypto marketplace remains depressed. CoinGecko information shows the marketplace capitalization of stablecoins has risen supra $180 billion, marking a 32% leap from the tally of $141 cardinal observed earlier the crypto marketplace peaked successful mid-November. Read much here.

Terra’s LUNA jumps: Buoyed by affirmative news, LUNA, the autochthonal token of the smart contract blockchain Terra, has jumped 13% successful the past 24 hours. Other notable gainers connected the database of coins with astatine slightest $1 cardinal marketplace worth are Cosmos’ ATOM, up 7.2%, and Avalanche's AVAX, up 5.6%. LUNA's enactment possibly stems from a determination by Singapore-based nonprofit enactment Luna Foundation Guard's (LFG) to make a bitcoin-denominated reserve arsenic an further furniture of information for UST – Terra's decentralized stablecoin, whose worth is pegged 1:1 to the U.S. dollar, according to CoinDesk’s Omkar Godbole. Read much here.

StarkWare launches Layer 2 merchandise StarkNet connected Ethereum: StarkWare's furniture 2 merchandise for the Ethereum blockchain – StarkNet – is acceptable for the deployment of decentralized apps (dapps), the institution said. StarkNet uses zero-knowledge (ZK) rollup technology to lick Ethereum’s scaling problem, according to CoinDesk’s Sam Reynolds. Read much here.

Digital assets successful the CoinDesk 20 ended the time somewhat higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)