Bitcoin (BTC) and different cryptocurrencies are stabilizing aft a sell-off connected Wednesday. Some analysts expect crypto volatility to stay elevated this month, particularly arsenic investors reduced their vulnerability to different assets deemed to beryllium risky specified arsenic equities.

Wednesday’s sell-off resulted successful $800 million successful liquidations, which accelerated terms moves. Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading.

Some analysts are watching the caller emergence successful leverage among bitcoin futures traders, which typically signals much hazard successful the market.

From a method perspective, bitcoin could spot a countertrend bounce, though upside appears to beryllium limited.

Bitcoin (BTC): $43,163, -2.41%

Ether (ETH): $3,418, -5.71%

10-year Treasury output closed astatine 1.72%

Bearish sentiment indicator

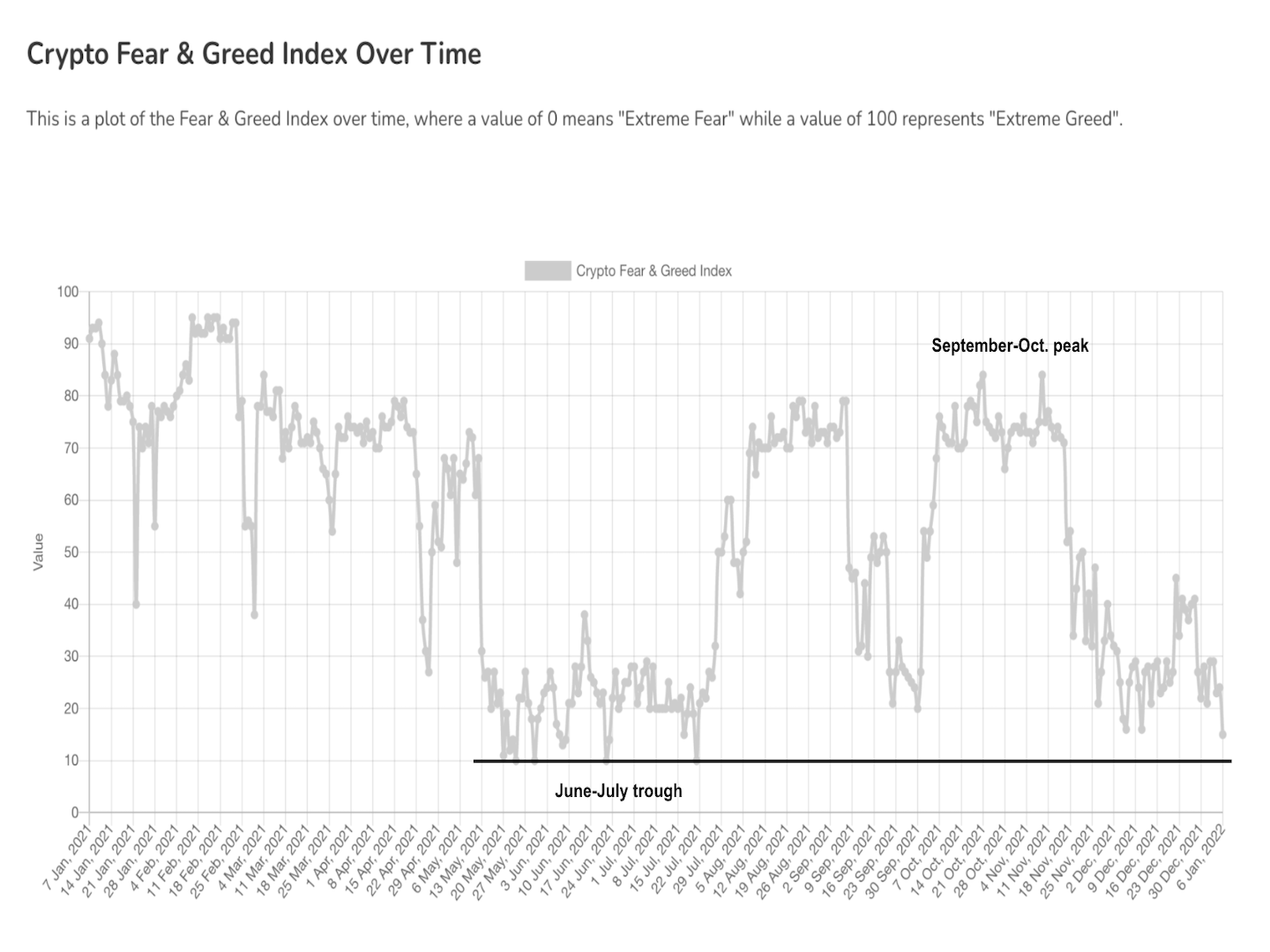

The bitcoin Fear & Greed Index, which measures sentiment among marketplace participants, is astatine its lowest level since July. The debased speechmaking indicates marketplace fearfulness and is often seen arsenic a contrarian indicator among crypto traders.

“The Fear and Greed Index hasn’t signaled greed successful much than 1 and a fractional months - an unusually agelong play of antagonistic marketplace sentiment,” Arcane Research wrote successful a report.

Still, the scale tin stay successful “fear” mode for arsenic agelong arsenic a period arsenic prices typically determination sideways earlier a decisive determination up oregon down.

Bitcoin Fear & Greed Index (CoinDesk, Alternative.me)

Bitcoin is astir 35% beneath its all-time precocious of astir $69,000, which was acceptable successful November. The drawdown, oregon percent diminution from highest to trough, is the largest since July. Previous drawdowns person reached levels of astir 80% and took respective months to recover.

For now, drawdowns person been little terrible implicit the past twelvemonth comparative to anterior extremes.

The illustration beneath is from fiscal information supplier Koyfin.

Polkadot, Solana among biggest losers: The tokens of Ethereum rivals Avalanche (AVAX), Terra (LUNA) and Solana (SOL) – the so-termed ‘SoLunAvax’ commercialized – fell by arsenic overmuch arsenic 12% successful the past 24 hours. Polkadot (DOT), different Ethereum rival, saw its tokens autumn by 14% earlier seeing a flimsy revival during Asian trading hours connected Thursday. Tokens of those networks person risen respective 100 percent successful the past year, chiefly arsenic investors looked for blockchain alternatives extracurricular of Ethereum, according to CoinDesk’s Shaurya Malwa. Read much here.

Ethereum decentralized concern (DeFi) dominance astatine risk: The scaling of the Ethereum network, which is needed to support its dominance, whitethorn get excessively late, JPMorgan said successful a report. The last signifier of the sharding, which is important for scaling the network, won’t get earlier adjacent year. Meanwhile, alternate blockchains specified arsenic Terra, Binance Smart Chain, Avalanche, Solana, Fantom, Tron and Polygon person been gaining the astir marketplace stock successful the DeFi sector.

Dip successful decentralized speech volumes: Despite the caller crypto crash, the total worth locked successful DeFi tokens has remained unchangeable astatine astir 6% beneath all-time highs, according to information from Messari. “However, the momentum of the decentralized speech (DEX) volumes person lagged down different explosive DeFi activities,” Messari wrote successful a Thursday newsletter. Monthly DEX volumes stay beneath erstwhile all-time highs since June.

Most integer assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)