Bitcoin (BTC) has held supra its $37,000 support level implicit the past 24 hours, albeit wrong a choky trading scope and with debased volume.

Still, aboriginal this week, an executive order by U.S. President Biden that volition outline the government’s strategy for cryptocurrencies could beryllium a root of volatility for bitcoin.

"The enforcement bid has been known astir earlier the warfare successful Ukraine and was primitively intended to chiefly code stablecoins and cardinal slope integer currencies (CBDC)," Marcus Sotiriou, an expert astatine U.K.-based integer plus broker GlobalBlock, wrote successful an email to CoinDesk. "However, owed to the accrued concerns of Russia utilizing crypto to evade sanctions, galore are disquieted that the bid volition enforce strict regulatory changes that volition hinder the crypto industry."

Elsewhere, Bloomberg reported that European officials are readying a associated enslaved merchantability to concern vigor and defence spending. For now, talks are informal, but analysts expect a the spending could trim capitalist concerns astir an economical slowdown stemming from ostentation and geopolitical woes. News of the imaginable enslaved merchantability contributed to an uptick successful the euro versus the U.S. dollar during the London trading day.

On a affirmative note, regulatory filings amusement that ample institutions specified arsenic ARK Investment Management and Morgan Stanley person been buying shares successful Grayscale Bitcoin Trust (GBTC), which is trading astatine a grounds 30% discount.

Demand from investors, positive cardinal dollar buybacks from Digital Currency Group, which is the genitor institution of some Grayscale and CoinDesk, could mean that stakeholders are inactive hoping that the spot volition person regulatory support to person the close-ended money into a spot-based exchange-traded fund. Read much from CoinDesk's Omkar Godbole here.

●Bitcoin (BTC): $38,524, +2.36%

●Ether (ETH): $2,554, +3.34%

●S&P 500 regular close: $4,170, −0.73%

●Gold: $2,060 per troy ounce, +3.30%

●Ten-year Treasury output regular close: 1.87%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Bitcoin is 43% disconnected its all-time precocious of astir $69,000 successful November and is down astir 8% implicit the past month. Typically, utmost terms declines promote buyers to instrumentality successful hopes of catching a bargain up of the adjacent marketplace rally.

Support levels tin assistance traders place terms levels wherever a downtrend tin beryllium expected to intermission due to the fact that of a attraction of request oregon buying interest. Once a enactment level is held and a interruption supra absorption is confirmed, upside momentum tends to accelerate, mounting the signifier for an upcycle.

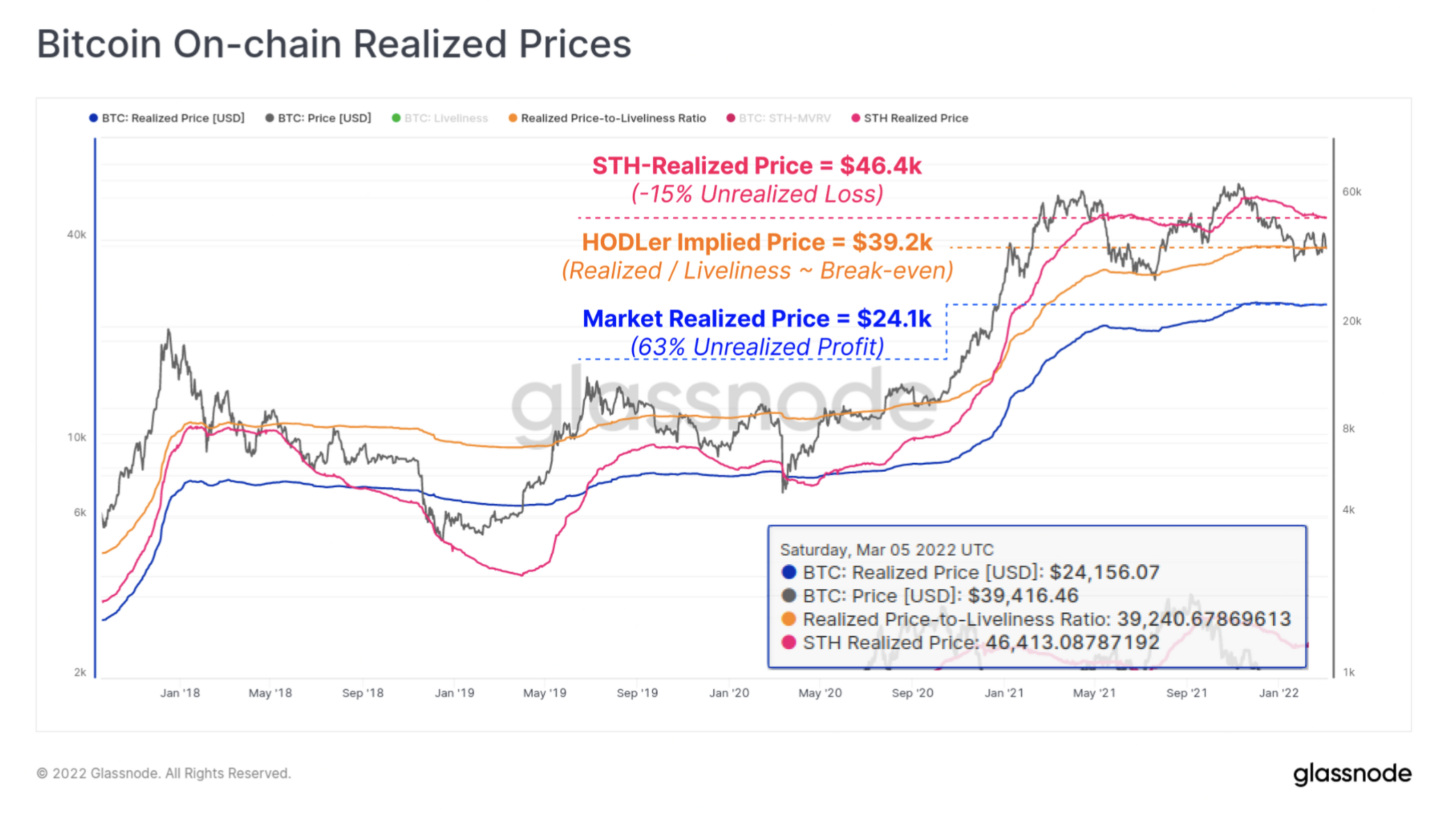

The illustration beneath estimates the mean outgo ground (realized prices) among bitcoin investors, which aligns with cardinal method enactment levels.

Most short-term bitcoin holders are astatine a loss, having a outgo ground of astir $46,400, according to information compiled by Glassnode. Long-term holders, however, person an estimated break-even constituent of astir $39,200, which, if broken, could output further downside toward $24,000.

Sell-offs are typically driven by short-term holders, whereas semipermanent holders are apt to accumulate on large enactment levels, akin to what occurred during the 2019 and 2020 terms bottoms. So far, it appears that BTC is astir halfway done a carnivore marketplace phase.

Estimates of bitcoin investors' outgo ground levels (Glassnode)

Avalanche commits $290M successful AVAX to pull gaming, DeFi and NFT ‘subnets”: The Avalanche Foundation announced Tuesday a large propulsion to woo apical projects with a cache of 4 cardinal AVAX tokens (worth $290 cardinal astatine today’s prices). Specifically, the effort looks to foster smart contract blockchain Avalanche’s “subnet” functionality, wherever application-specific blockchains – beryllium they for Web 3 gaming oregon decentralized concern (DeFi) – tin beryllium spun up astatine scale, according to CoinDesk’s Zack Seward and Eli Tan. Read much here.

Papa John's NFT drop: Pizza takeout concatenation Papa John's (PZZA) is readying to springiness distant astir 20,000 non-fungible tokens (NFTs) to customers successful the U.K., shrugging disconnected a erstwhile informing from the country's advertizing regulator astir its dalliances successful the crypto world. The postulation of 19,840 NFTs has been minted connected the Tezos blockchain and takes the signifier of 9 antithetic pizza transportation blistery container designs. The NFTs volition beryllium dropped connected respective dates successful aboriginal March, according to CoinDesk’s Jamie Crawley. Read much here.

Minorities are utilizing the NFTs to beforehand their culture: Last July, Amar Bedi, a turbaned Sikh, an individuality associated with Sikhism, the fifth-largest religion successful the world, visualized an NFT level that would seizure the assorted identities of his people. The level that would supply practice to an under-represented assemblage successful the metaverse would beryllium called MetaSikhs. More of these stories are covered by Amitoj Singh here.

Digital assets successful the CoinDesk 20 ended the time higher.

There are nary losers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)