Bitcoin traded astir the $41,000 connected Wednesday arsenic immoderate traders appeared to beryllium successful nary unreserved to prime a terms bottom. Analysts spot the imaginable for a short-term terms bounce, particularly arsenic method indicators person remained successful oversold territory for astir a month.

"Investors and traders look to beryllium digesting the macro possibilities wrong this caller inflationary authorities markets person entered, alongside an progressively hawkish Federal Reserve," Will Hamilton, caput of trading and probe astatine Trovio Capital Management, wrote successful an email to CoinDesk.

On Tuesday, Morgan Stanley stated that the imminent commencement of cardinal slope tightening is putting unit connected the crypto market. Bitcoin’s marketplace capitalization has tracked the maturation of planetary wealth supply, which peaked successful February 2021 (two months earlier a 50% driblet successful BTC's price), according to Morgan Stanley.

For now, immoderate traders are inactive uncovering comparative worth successful immoderate alternate cryptocurrencies. Relative value is simply a method of determining an asset's worthy that takes into relationship the worth of akin assets.

"Lower request for bitcoin has been driven by marketplace participants shifting absorption towards outperforming mid-cap assets, including Fantom and FTT, which person returned ~31% and ~15% respectively during the past week," Hamilton stated, referring to the Fantom astute declaration level and the FTT token associated with crypto speech FTX.

●Bitcoin (BTC): $41703, −0.19%

●Ether (ETH): $3120, −0.15%

●S&P 500 regular close: $4533, −0.97%

●Gold: $1844 per troy ounce, +1.72%

●Ten-year Treasury output regular close: 1.83%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

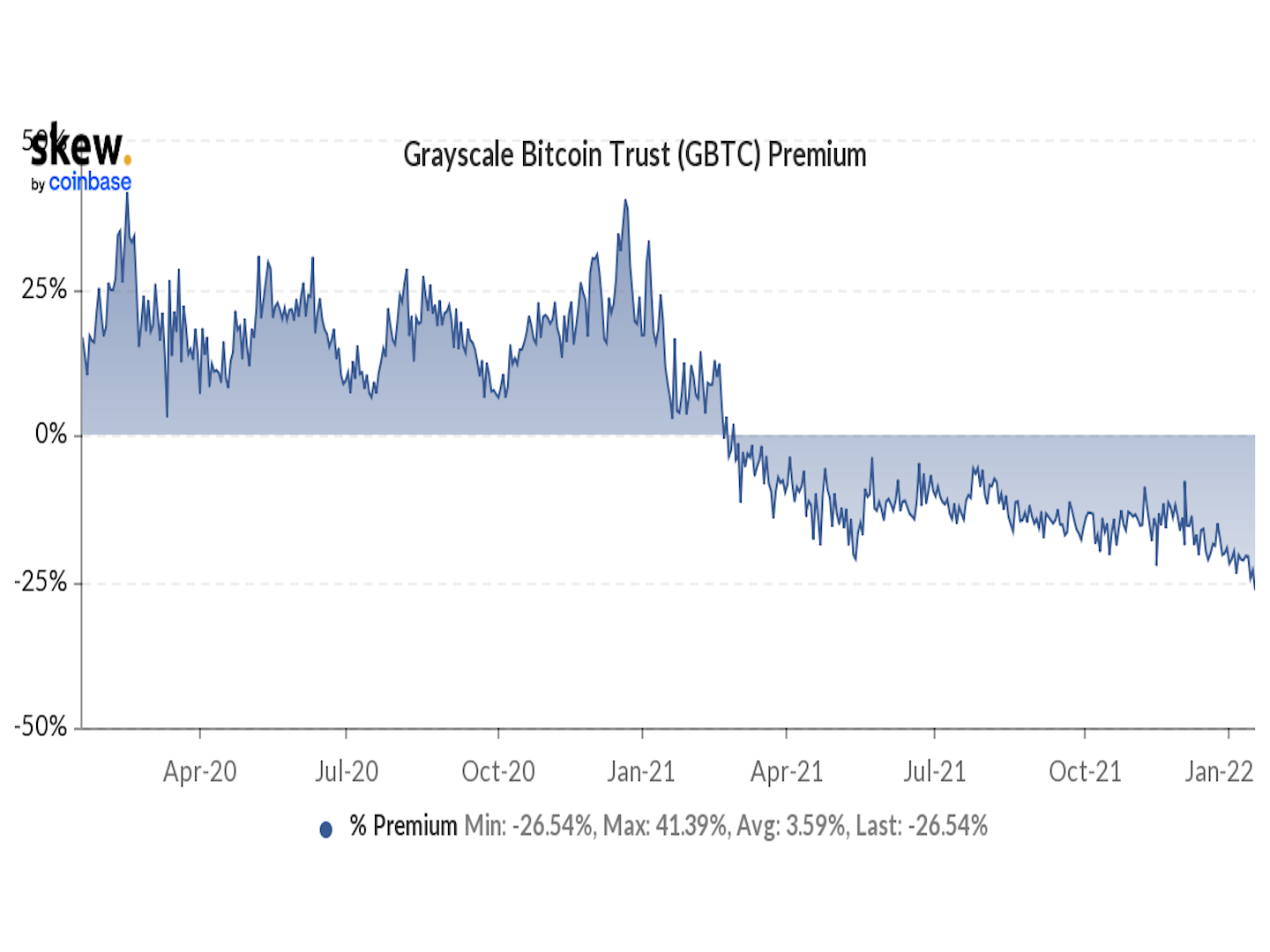

Grayscale Bitcoin Trust (GBTC) shares person widened their discount comparative to the underlying cryptocurrency held successful the fund, reaching a record of 26.5% connected Wednesday.

GBTC has been the preferred venue for organization investors to summation vulnerability to crypto without having to acquisition bitcoin directly, but the shares person traded astatine a steep discount implicit the past twelvemonth arsenic request for the merchandise shrank. (Grayscale Investments, which manages the trust, is simply a portion of Digital Currency Group, which besides owns CoinDesk.)

"There's inactive nary mode for bitcoin to ever permission GBTC, which means it should proceed to commercialized with a important discount to bespeak that illiquidity," David Nadig, manager of probe and main concern serviceman astatine ETFTrends.com, wrote successful an email to CoinDesk.

GBTC discount (Skew)

Bitcoin dominance stabilizes

Bitcoin's marketplace capitalization comparative to the full crypto marketplace capitalization, oregon the BTC dominance ratio, is starting to stabilize astir 40%. That's the lowest level since 2018, which was erstwhile alternate cryptocurrencies (altcoins) experienced greater terms declines than BTC. Crypto investors thin to question comparative information successful bitcoin during times of marketplace stress.

For now, it appears that bitcoin's dominance ratio could person further country to driblet toward the 2018 debased of astir 36%. Some analysts expect a continued rotation to alternate cryptocurrencies specified arsenic ether and decentralized concern (DeFi) tokens owed to their galore use-cases compared to bitcoin's entreaty arsenic a store of value.

Bitcoin dominance ratio (CoinDesk, TradingView)

"FTM, LUNA, ATOM and MATIC person exhibited comparative spot among the larger market-cap altcoins, with upcoming merchandise updates prevalent successful these pairs," FundStrat, a planetary advisory firm, wrote successful a Wednesday newsletter.

Also, a fig of Ethereum competitors are starting to summation marketplace share.

"Despite large developments successful the bitcoin market, the existent marketplace narratives proceed to thin towards emerging developments extracurricular Ethereum and Bitcoin, namely Ethereum competitors, scaling solutions and OpenSea alternatives," 21Shares, a crypto concern firm, wrote successful a report.

Cardano's ADA token leads crypto majors lower: Earlier connected Wednesday, ADA dropped astir 10% on with smaller declines successful different altcoins specified arsenic MATIC and SOL. ADA's diminution appears emblematic of a correction often seen aft a notable terms rally. The token jumped astir 60% to $1.64 earlier this month, outperforming bitcoin arsenic the impending motorboat of SundaeSwap, the archetypal decentralized concern (DeFi) speech connected the Cardano blockchain, revved up capitalist involvement successful the cryptocurrency.

Active blockchain games connected the rise: The prices of tokens for gaming projects similar Axie Infinity person fallen recently, but idiosyncratic metrics successful this subsector of cryptocurrencies are soaring. There are present 398 progressive blockchain games, defined arsenic having astatine slightest 1 progressive wallet successful the past 24 hours wrong the game, according to the information tracker DappRadar. That's a 92% summation from a twelvemonth ago. Read much here.

Ethereum vs. Solana: Ethereum’s dominance successful non-fungible tokens (NFTs) is shrinking due to the fact that of congestion and precocious state fees, JPMorgan said successful an expert report. The network’s marketplace stock of NFTs has dropped to astir 80% from astir 95% astatine the commencement of 2021. JPMorgan cautions that if Ethereum’s nonaccomplishment of NFT marketplace stock continues successful 2022, it could beryllium a bigger occupation for its valuation.

Most integer assets successful the CoinDesk 20 ended the time lower.

No assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)