Bitcoin (BTC) held dependable astir the $40,000 terms level connected Thursday portion respective alternate cryptocurrencies (altcoins) took the lead.

The emergence successful altcoins implicit the past fewer days suggests a greater appetite for hazard among crypto traders. BTC and ether (ETH) were up 2% implicit the past 24 hours, compared with a 20% rally successful Pancake Swap (CAKE). But determination were immoderate misses, particularly successful ApeCoin, the token linked to the fashionable Bored Ape Yacht Club (BAYC) non-fungible token (NFT) collection, which dropped arsenic overmuch arsenic 80% connected Thursday.

Despite occasional rallies and crashes, it appears that large cryptos (large marketplace capitalization) specified arsenic BTC and ETH are stabilizing aft a volatile past fewer days.

Global equities are besides higher, particularly successful Asia, aft China's authorities pledged support for its banal marketplace connected Wednesday. Some analysts expect China's cardinal slope to support debased involvement rates this year, which could support the system afloat contempt the rise successful COVID-19 cases and geopolitical woes.

And connected the macro front, analysts expect constricted upside for the U.S. dollar, which could beryllium affirmative for bitcoin implicit the abbreviated term.

"The U.S. dollar has appreciated since Russia began its penetration of Ukraine, which is not a astonishment fixed that the greenback has a way grounds of appreciating successful effect to geopolitical events," MRB Partners, a planetary concern probe steadfast wrote successful a report. "However, this spot has mostly been followed by a consolidation phase."

●Bitcoin (BTC): $40,827, +0.15%

●Ether (ETH): $2,824, +2.96%

●S&P 500 regular close: $4,412, +1.23%

●Gold: $1,936 per troy ounce, +1.49%

●Ten-year Treasury output regular close: 2.19%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

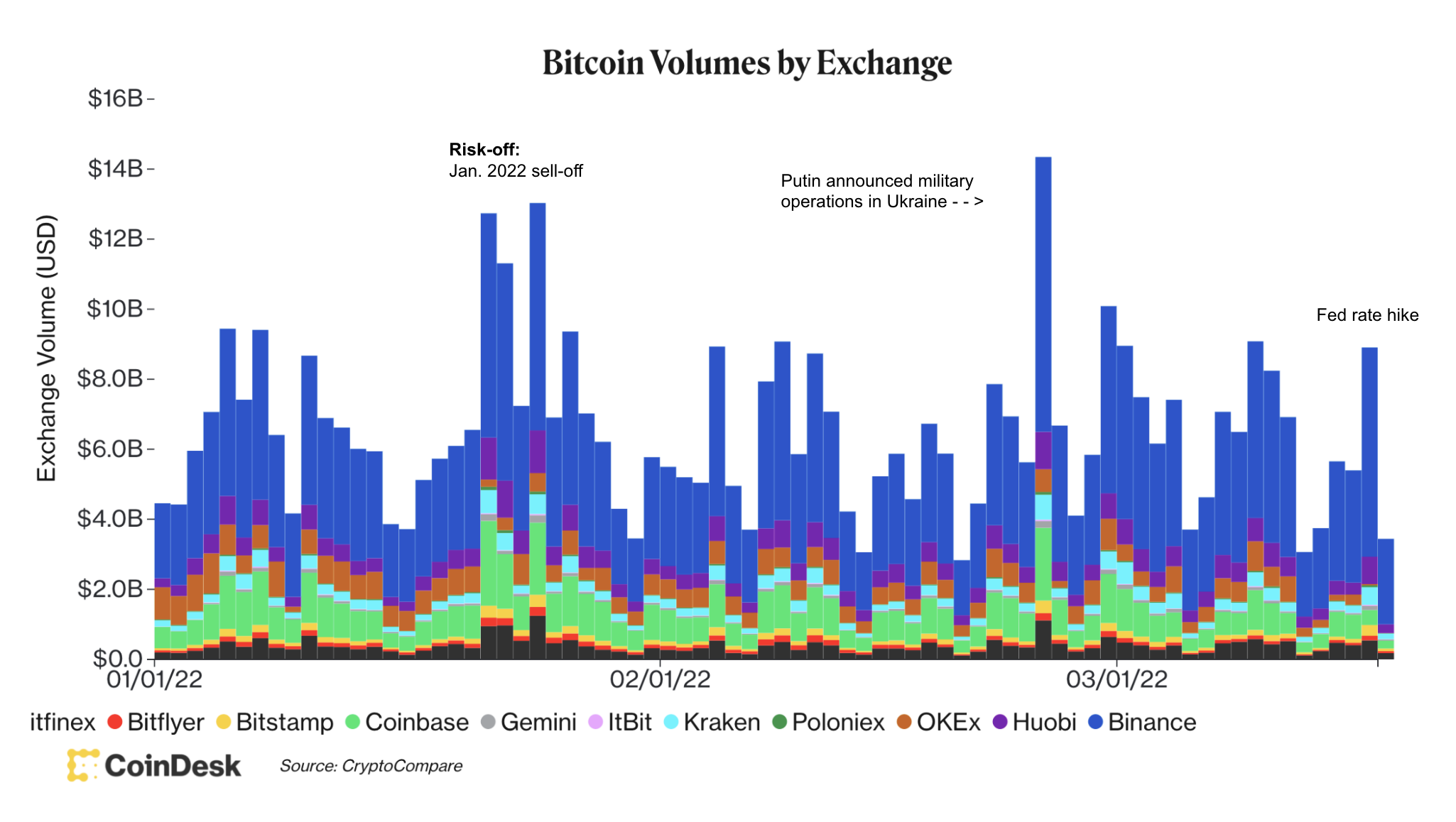

Bitcoin's trading enactment remains comparatively debased crossed large exchanges, according to CoinDesk data.

The caller highest successful BTC measurement was seen connected Wednesday erstwhile the U.S. Federal Reserve's complaint hike triggered 5% terms swings. Still, trading enactment has been debased comparative to anterior measurement spikes specified arsenic the terms sell-off successful precocious January and the opening of the Russia-Ukraine warfare successful precocious February.

Bitcoin trading measurement by speech (CoinDesk, CryptoCompare)

Some analysts person accrued their terms targets for bitcoin, portion others stay cautious due to the fact that of ongoing macroeconomic and geopolitical risks.

"The Fed complaint hike was not damning capable to interest crypto investors, hence solidifying renewed buying spirit," Alexander Mamasidikov, co-founder of mobile integer bank MinePlex, wrote successful an email to CoinDesk. Mamasidikov expects selling unit to subside toward the extremity of the 2nd quarter, and has a terms people astatine $50,000 for BTC.

Still, bitcoin volition request to marque a decisive interruption supra the $40,000 intelligence obstruction to trigger an summation successful buying activity. So far, volatility hasn’t been peculiarly precocious "taking into relationship a barrage of mostly antagonistic quality implicit the past fewer days with COVID-19 cases rising and China’s Shenzhen state going into lockdown," Mikkel Mørch, enforcement manager of ARK36, a crypto concern fund, wrote successful an email.

Generally, the communicative of bitcoin arsenic a safe haven and store of value has been accordant crossed immoderate expert commentary contempt the caller diminution successful a risk-off environment, akin to what occurred successful 2018 and 2020.

Despite short-term stabilization, bitcoin's marketplace capitalization comparative to the full crypto marketplace headdress remains elevated this year. Typically, BTC outperforms (declines less) successful a down marketplace due to the fact that of its little hazard illustration comparative to altcoins.

Bitcoin dominance ratio (TradingView)

HSBC enters the Metaverse done concern with the Sandbox: HSBC (HSBC), with astir $3 trillion successful assets, is the archetypal planetary slope to participate The Sandbox metaverse. The slope volition bargain a crippled of onshore astatine The Sandbox metaverse, which it volition make to prosecute with sports, e-sports and gaming fans, the connection said. Details of HSBC's improvement successful the virtual crippled of onshore weren't announced. A promotional GIF that was posted on with the connection showed an HSBC stadium adjacent to a virtual assemblage of water, according to CoinDesk’s Eliza Gkritsi. Read much here.

APE token tied to Bored Ape Yacht Club NFTs sinks 80%: ApeCoin, the token linked to the fashionable Bored Ape Yacht Club (BAYC) non-fungible token (NFT) postulation was airdropped to Bored Ape NFT owners connected Thursday aft being announced yesterday arsenic a portion of a larger ApeDAO campaign, but holders rapidly selling the coin person sent its terms plummeting. The token has fallen from its highest terms of $39.40 to a present unchangeable $8.90, trading for arsenic debased arsenic $6.48, per CoinMarketCap, according to CoinDesk’s Eli Tan. Read much here.

Andrew Yang launches caller DAO for AAPI advancement: Former U.S. statesmanlike campaigner Andrew Yang has launched GoldenDAO, a decentralized autonomous enactment (DAO) dedicated to Asian American and Pacific Islander (AAPI) issues. The effort comes close aft Yang’s first foray into DAOs. Last month, helium announced Lobby3, a caller enactment advocating for Web 3 policies successful Washington, D.C. In caller months, the proliferation of DAOs has seen the adoption of usage cases ranging from social clubs to investment syndicates to crowdfunding vehicles, according to CoinDesk’s Tracy Wang. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

There are nary losers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)