Cryptocurrencies are starting to stabilize aft declining sharply implicit the past week. Some indicators amusement capitalist sentiment astatine highly bearish levels, which typically precede periods of buying activity. Other technical measures, however, suggest choppy terms enactment could persist implicit the abbreviated term.

Bitcoin returned to supra $35,000 and was up 3% implicit the past 24 hours, versus a 5% diminution successful SOL and astir level show successful ETH implicit the aforesaid period.

Still, it mightiness beryllium excessively soon to telephone a terms bottom. "I deliberation the determination of a bull/bear marketplace is not arsenic wide arsenic erstwhile cycles, owed to the operation of the marketplace changing drastically with institutions entering the space," Marcus Sotiriou, an expert astatine the U.K.-based integer plus broker GlobalBlock, wrote successful an email to CoinDesk.

"Now, it is evident that bitcoin is successful a ranging situation (between $29,000 to $69,000 approximately) alternatively than a trending environment," Sotiriou wrote.

"Bitcoin’s betterment is simply a agelong changeable arsenic investors are much keen connected the terms being stabilized for now," Alex Axelrod, laminitis and CEO of Aximetria, a crypto fiscal services firm, wrote successful an email to CoinDesk. Axelrod is monitoring BTC terms levels of betwixt $32,000 and $40,000 for confirmation of a breakdown oregon breakout.

●Bitcoin (BTC): $36925, +4.41%

●Ether (ETH): $2448, +0.88%

●S&P 500 regular close: $4410, +0.28%

●Gold: $1842 per troy ounce, +0.56%

●Ten-year Treasury output regular close: 1.74%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

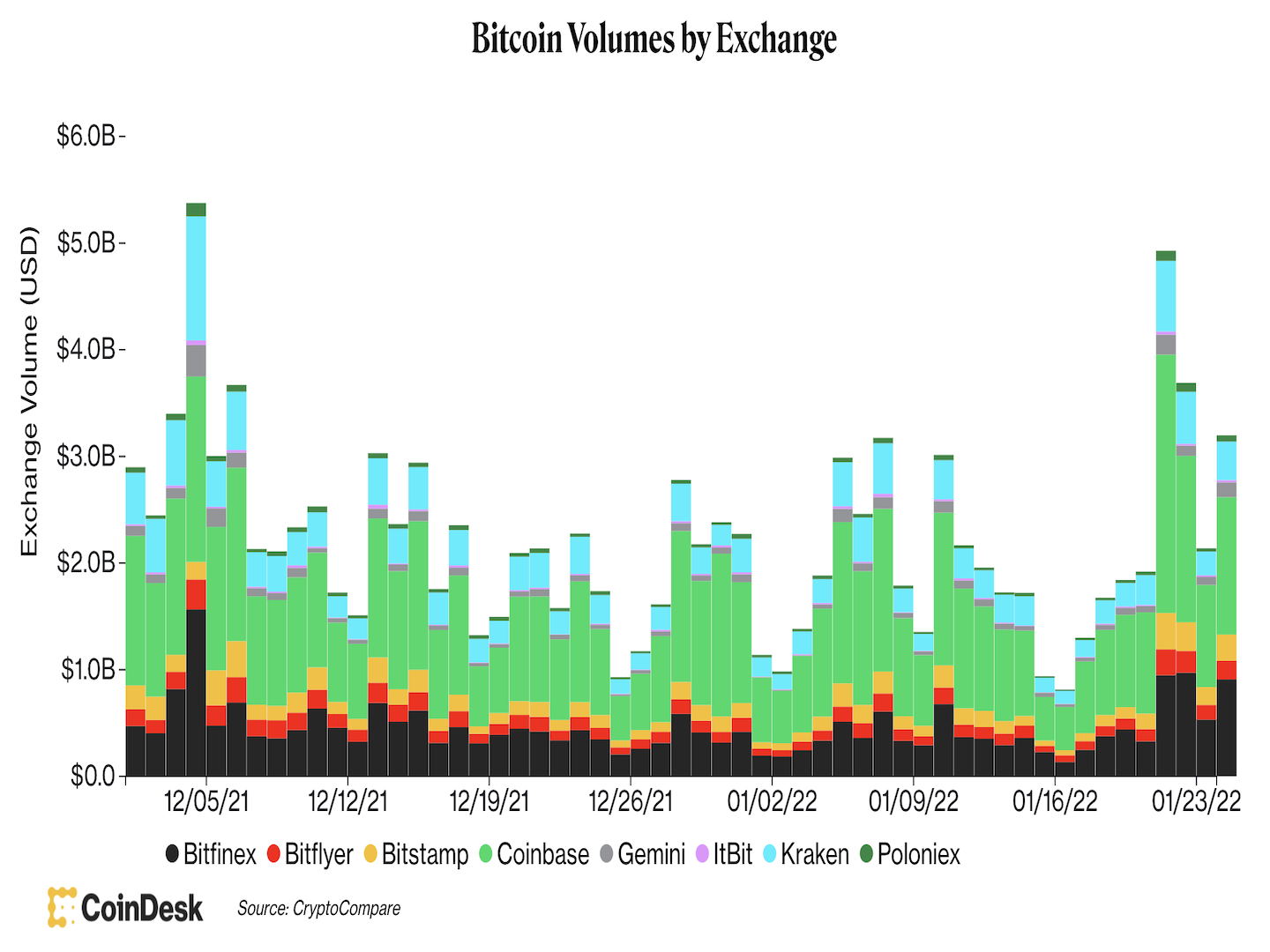

The illustration beneath shows the caller summation successful bitcoin's spot trading volume. Short-term traders person been progressive contempt the uncertainty regarding aboriginal terms direction.

Bitcoin's trading measurement (CoinDesk)

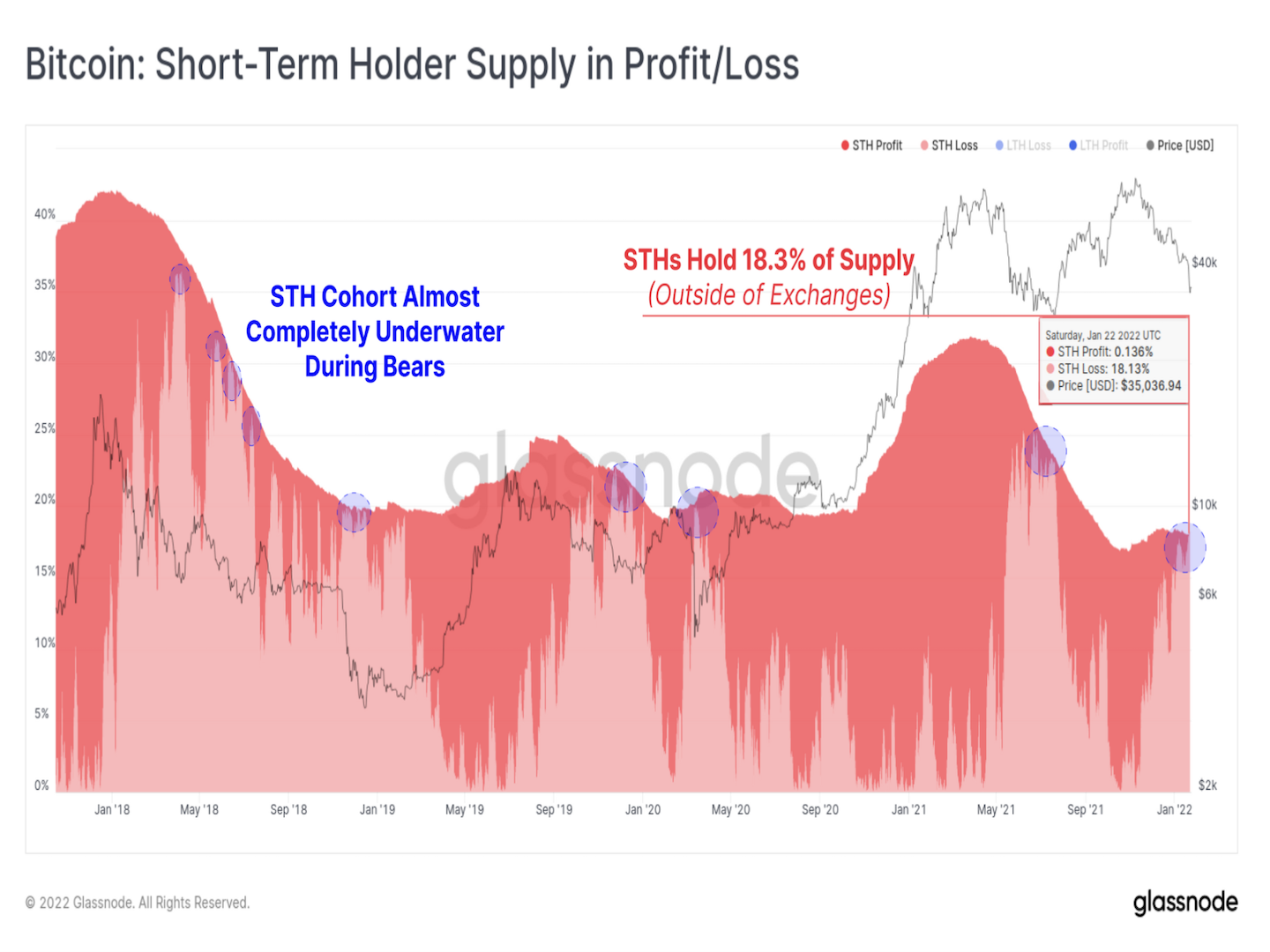

Short-term holders underwater

Losses are adding up for astir short-term bitcoin holders, according to blockchain data.

The illustration beneath indicates that 18% of short-term bitcoin holder proviso is astatine a nonaccomplishment (BTC trading beneath its mean outgo basis), which could constituent to further selling. A akin script occurred during the 2018 carnivore marketplace and consequent terms corrections.

Still, semipermanent bitcoin holders look unfazed by the caller terms dip. "The proportionality of semipermanent holder proviso has really returned to a humble uptrend, which indicates a wide unwillingness for this cohort to liquidate," Glassnode, a crypto information firm, wrote successful a blog post connected Monday.

Short-term bitcoin holder proviso successful profit/loss (Glassnode)

Crypto funds pull caller capital

Inflows into digital-asset funds past week – aft 5 consecutive weeks of outflows – suggest investors were taking vantage of the terms dip.

Cryptocurrency funds brought successful $14.4 cardinal of caller capitalist wealth during the 7 days done Friday, ending a streak of 5 consecutive weeks of outflows, according to a report Monday from the digital-asset manager CoinShares.

Last week's inflows were led by bitcoin-focused funds, which brought successful $13.8 million. Meanwhile, ethereum-focused funds suffered $15.6 cardinal of outflows. Read much here.

Solana Slides 17% to pb losses amid crypto marketplace plunge: Major cryptocurrencies fell arsenic overmuch arsenic 17% successful 24 hours arsenic the crypto marketplace followed a broader decline successful U.S. banal scale futures connected Monday. Last Friday, traders complained astir web congestion connected Solana and doubted its quality to pull existent superior with that benignant of meltdown. Solana has been charismatic to ample trading shops partially due to the fact that it has prioritized scale. Still, erstwhile the web gets overcrowded, it has shown that it tin stall out. Read much here.

Luxor tries to support Proof-of-Work Mechanism connected Ethereum: Crypto bundle and services institution Luxor is launching an Ethereum mining excavation adjacent arsenic it is planning to abolish mining from its network. The institution is moving with ample organization miners, including Hut 8 and respective retail miners successful North America, to supply a U.S.-based Ethereum mining pool, the institution said successful a connection connected Monday, according to Aoyon Ashraf. Read much here.

OpenSea bug allows attackers to get monolithic discount connected fashionable NFTs: A bug connected the non-fungible tokens (NFT) marketplace OpenSea has allowed astatine slightest 3 attackers to unafraid monolithic discounts connected respective NFTs and marque a immense profit. The bug, which was discovered arsenic aboriginal arsenic Dec. 31, allowed the attackers to bargain NFTs astatine older, little prices, and merchantability them for a hefty profit, according to Eliza Gkritsi. Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)