Bitcoin (BTC) held supra $37,000 connected Friday and was up astir 3% implicit the past 24 hours. Meanwhile, immoderate alternate cryptocurrencies began to stabilize aft a volatile week.

Analysts were besides looking for signs of a imaginable bounce successful equity markets, which could promote crypto buying. So far, immoderate traders look to beryllium connected the sidelines successful some accepted and crypto markets. The S&P 500 is astir level implicit the past week, compared with a 1% summation successful BTC and a 3% driblet successful ETH implicit the aforesaid period.

"Investors proceed to retreat from U.S. stocks amid the expected tightening of the US Federal Reserve's monetary policy," Alex Kuptsikevich, an expert astatine FxPro, wrote successful an email to CoinDesk.

If selling continues, much investors could commencement to trim their positions connected risky assets, and cryptocurrencies whitethorn beryllium deed first, according to Kuptsikevich. That means a short-term terms bounce could beryllium limited.

Further, fixed macroeconomic headwinds, immoderate analysts are acrophobic astir a coming "crypto winter," akin to what occurred successful 2017-2018. But it appears that wintertime is already here, particularly fixed the astir 40% driblet successful BTC from its all-time precocious of adjacent to $69,000 successful November.

●Bitcoin (BTC): $37696, +5.55%

●Ether (ETH): $2517, +7.51%

●S&P 500 regular close: $4432, +2.43%

●Gold: $1790 per troy ounce, −0.17%

●Ten-year Treasury output regular close: 1.78%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Systemic hazard successful crypto markets?

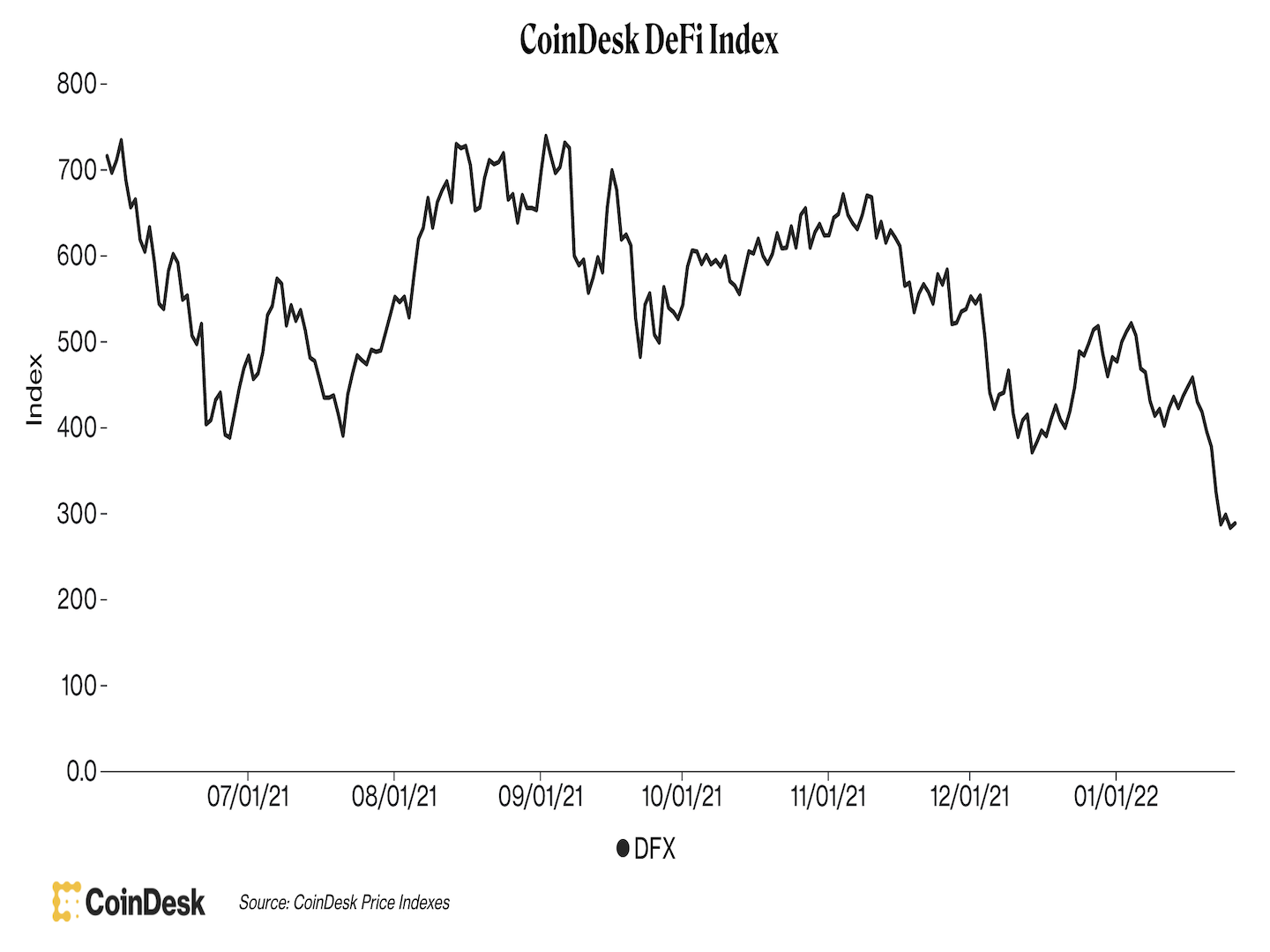

The caller underperformance successful immoderate altcoins and decentralized concern (DeFi) tokens indicates heightened hazard successful crypto markets. And erstwhile uncertainty is high, immoderate traders thin to rotate into bitcoin, which is deemed to beryllium little risky successful the crypto market.

CoinDesk DeFi Index is trending lower. (CoinDesk)

The CoinDesk markets squad has covered the crisp sell-offs crossed assorted tokens implicit the past 2 weeks, which could support immoderate crypto buyers connected the sidelines. Here is simply a rundown of risks we identified.

Tokens related to Wonderland developer plunged:

In the past 24 hours, Popsicle Finance’s ICE fell arsenic overmuch arsenic 22%, Wonderland’s TIME fell 15%, and Abracadabra’s SPELL dropped 15%. These are tokens created by Daniele Sestagalli, who gained a cult pursuing successful caller months acknowledgment to his community-centric attack toward crypto projects. His protocols were worthy billions of dollars astatine their peak, but those fortunes person since faded away, CoinDesk's Shaurya Malwa reported.

A falling retired betwixt 2 startup projects connected Cardano:

On Wednesday, CoinDesk's Lyllah Ledesma wrote astir the SundaeSwap debacle that near CardStarter users with steep losses. The struggle is betwixt CardStarter, which describes itself arsenic a "decentralized accelerator" for startup projects focused connected Cardano, and SundaeSwap, a decentralized speech built connected the Cardano platform.

And then, there's imaginable contagion hazard successful Terra's UST stablecoin:

LUNA, Terra’s autochthonal token, was down arsenic overmuch arsenic 10% during the past 24 hours owed to yet different scandal. LUNA is connected Abracadabra, a DeFi lending level tally by Sestagalli. LUNA was partially created for issuing stablecoins. The reserves of Terra-based lending and borrowing protocol Anchor, which offers a supposedly industry-beating benchmark deposit complaint of astir 20%, are besides sliding accelerated arsenic a effect of the crypto marketplace crash. Read much here.

Terra’s UST stablecoin was thrown into flux due to the fact that the tokens utilized to leverage immoderate stablecoins related to Sestagalli are successful a mess. Some observers pursuing the plus peg saga are disquieted UST and MIM could service arsenic a “contagion” that destabilizes different pools connected Curve, CoinDesk's Andrew Thurman reported.

Sandbox (SAND) Announces $50,000,000 accelerator fund: Popular gaming crypto The Sandbox (SAND) is partnering with a planetary task institution to unfastened a money for processing metaverse startups. According to a news release, SAND has committed $50 cardinal to Hong Kong-based accelerator institution Brinc for The Sandbox Metaverse Accelerator Program, which volition put $250,000 successful 100 caller metaverse altcoins. Read much here.

ChainLink Capital targets $100M successful assets for 2 crypto funds: Crypto-focused task superior money ChainLink Capital Management has acceptable a people to scope $100 cardinal of assets nether absorption each for its Luna and Ama funds this year, wide spouse Andrew Hoppin told CoinDesk successful an interview. The funds had astir $30 cardinal and $13 cardinal nether management, respectively, astatine the extremity of past year. Read much here.

FriesDAO wants to commencement a crypto-crowdfunded fast-food franchise: The crypto radical plans to bargain a fast-food edifice pursuing ConstitutionDAO’s “let’s bargain (and govern) a real-world plus with crowdfunded tokens” playbook. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

There were nary losers successful the CoinDesk 20 connected Friday.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)