Most cryptocurrencies experienced choppy trading conditions connected Thursday, indicating a deficiency of condemnation among traders and investors.

Geopolitical uncertainty has kept investors connected edge, particularly arsenic Russia attacks connected Ukraine intensify. Meanwhile, talks betwixt diplomats person faltered, arsenic the 2 sides didn't scope an agreement connected a cease-fire connected Thursday.

On the macro front, the European Central Bank announced its plans to signifier retired of its bond-buying programme by September, which could pb to higher involvement rates. John Hardy, caput of foreign-exchange strategy astatine Saxo Bank, described the announcement arsenic a "game-changer" successful a enactment connected Thursday, pointing to increasing unit connected cardinal banks to combat ostentation by tightening monetary policy, which could measurement connected speculative assets.

Cryptos and stocks were somewhat little connected Thursday, portion lipid prices declined. Traditional harmless havens specified arsenic golden and the U.S. dollar traded higher.

Alternative cryptocurrencies (altcoins) experienced little selling unit comparative to bitcoin (BTC) connected Thursday. Ether (ETH) is down 3% implicit the past 24 hours, compared with a 6% diminution successful BTC. Meanwhile, STX, the autochthonal token of the Stacks web that is utilized to substance smart contracts, roseate by arsenic overmuch arsenic 20% connected Thursday.

●Bitcoin (BTC): $39,560, −5.40%

●Ether (ETH): $2,616, −2.77%

●S&P 500 regular close: $4,260, −0.43%

●Gold: $2,002 per troy ounce, +0.81%

●Ten-year Treasury output regular close: 2.01%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

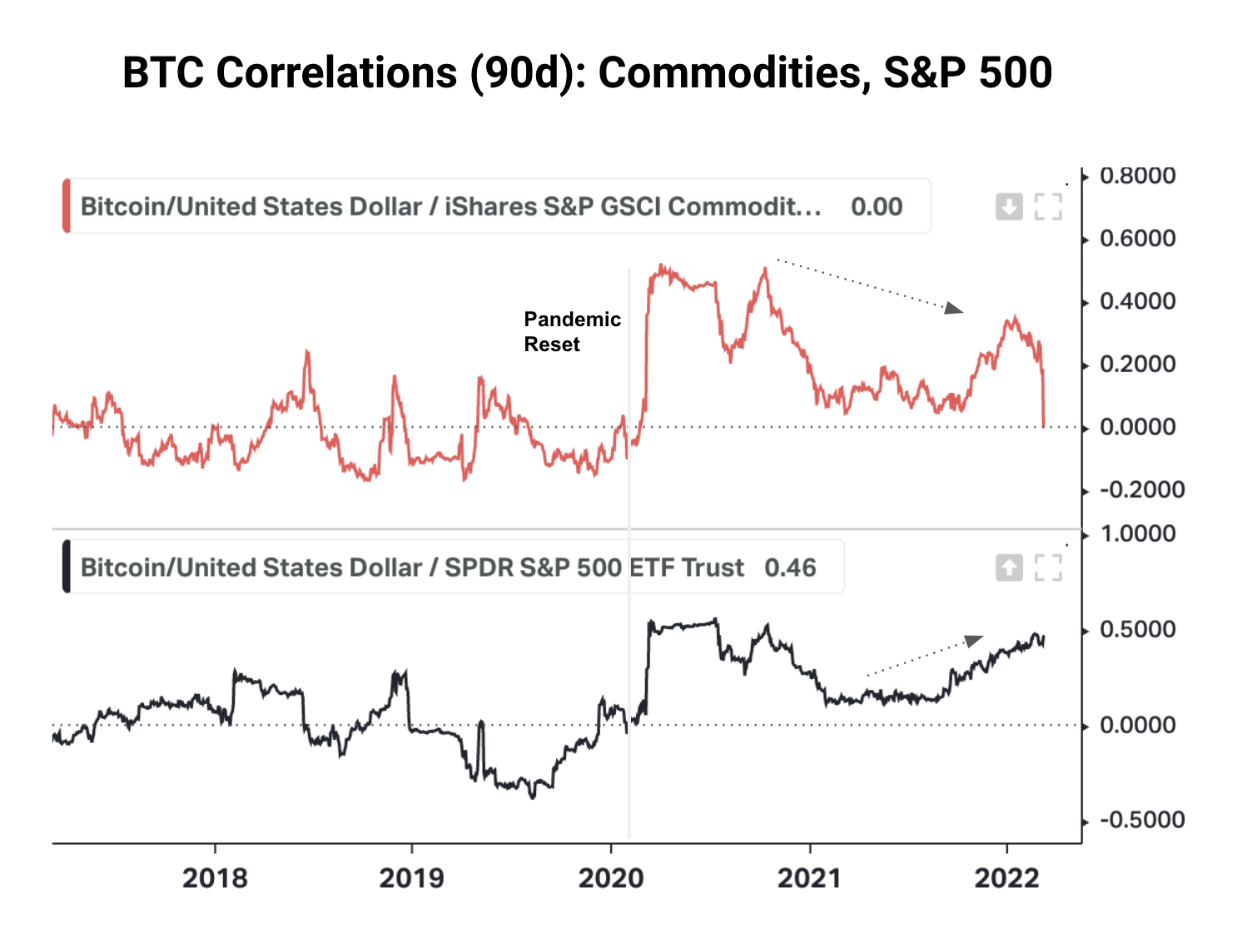

Bitcoin's correlation with the S&P 500 has risen implicit the past year, partially due to the fact that of the summation successful volatility successful assets astir the world. Typically, precocious volatility coupled with rising ostentation causes a affirmative displacement successful correlations, particularly betwixt stocks and bonds.

Investors thin to trim their vulnerability to hazard during times of marketplace stress. And the rising correlation betwixt the S&P 500 and bitcoin could constituent to a broader displacement distant from speculative assets.

This time, however, rising ostentation is thrown into the mix. Commodities, a accepted ostentation hedge, thin to rally during the commencement of an inflationary cycle. Therefore, the correlation betwixt bitcoin and commodities collapsed successful caller months to much mean levels (zero correlation).

A surge successful request for speculative assets occurred aft the March 2020 marketplace sell-off, and astatine the contiguous time, the macroeconomic situation has caused investors to unwind their risky bets. That could constituent to a play of little returns for some equities and cryptocurrencies.

Correlations betwixt bitcoin, S&P 500 and commodities (CoinDesk, Koyfin)

THORChain’s RUNE surged 37% aft DeFi synthetic assets goes live: Cross-chain protocol THORChain went live with synthetic assets trading connected its level Wednesday night, causing prices of its autochthonal token, RUNE, to leap arsenic overmuch arsenic 37% from Wednesday's debased of $4.05 to Thursday's highest of $5.56. Its trading measurement roseate 93% successful the past 24 hours. In this case, the synthetic assets – oregon blockchain-based representations of different plus – are backed by fractional the worth of their underlying plus and fractional successful RUNE. That allows users to clasp and commercialized a typical of a furniture 1, oregon base, blockchain plus faster and astatine a little cost, according to CoinDesk’s Shaurya Malwa. Read much here.

Fantom-based Algo protocol Fantasm exploited for $2.6M: Fantom-based algorithmic assets protocol Fantasm Finance was exploited for implicit $2.6 cardinal worthy of crypto aboriginal connected Thursday, with the stolen tokens swapped for ether utilizing privateness protocol Tornado Cash. “Our FTM collateral reserve has been exploited, determination is inactive 1,820,012 FTM excavation equilibrium remaining presently for redemption,” the project's leaders tweeted. FTM is Fantom’s autochthonal token and 1 of the tokens utilized arsenic collateral backing connected Fantasm, according to Shaurya Malwa. Read much here.

JustCarbon, Likvidi motorboat blockchain markets for c credits: JustCarbon and Likvidi some announced the commencement of trading platforms for tokenized c credits, giving participants the quality to commercialized greenhouse state emissions and little their c footprints. JustCarbon opened a marketplace for its JustCarbon Removal Units (JCRs), it said Thursday. Likvidi announced a level for its Liquid Carbon Credit (LCO2) connected Wednesday. Both LCO2 and JCRs are blockchain versions of c credits issued by Verra (VCS). JCRs besides correspond credits issued by Gold Standard. Each is equivalent to 1 metric ton of carbon, according to CoinDesk’s Will Canny. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

There are nary gainers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)