Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Cryptocurrencies were mixed connected Tuesday, indicating uncertainty among traders up of the U.S. Federal Reserve's interest complaint decision tomorrow.

The Fed is expected to hike rates by 50 ground points (0.5 percent point), which would beryllium the archetypal fractional constituent emergence successful 22 years. And implicit the adjacent fewer meetings, the Fed could rise rates expeditiously to dilatory the gait of inflation.

Many cardinal banks extracurricular of the U.S., peculiarly successful emerging markets, person already started to rise involvement rates. Meanwhile, the operation of slower economical maturation and tighter monetary argumentation has weighed connected speculative assets including stocks and cryptos.

The Fed gathering could beryllium a root of rising volatility, according to immoderate analysts. For example, FundStrat, a planetary advisory steadfast noticed a emergence successful ether's (ETH) put/call ratio since the opening of the year, which means enactment traders person started to hedge against further terms declines.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Bitcoin (BTC) has been astir level implicit the past week, struggling beneath $40,000, which is the midpoint of a three-month terms range. Technical indicators amusement a decline successful upside momentum implicit the past month, which could summation the hazard of a terms breakdown. That means upside could beryllium constricted going forward.

For now, analysts expect higher volatility successful cryptos, tracking moves successful equity markets.

"Bitcoin has seen comparative spot neutralize versus ether, possibly reflecting indecisiveness among investors who are confused arsenic to whether the risk-off successful equities volition beryllium a bigger resistance connected cryptos," Katie Stockton, managing spouse astatine Fairlead Strategies, a method probe firm, wrote successful a probe note.

●Bitcoin (BTC): $37,711, −1.98%

●Ether (ETH): $2,772, −2.28%

●S&P 500 regular close: $4,175, +0.48%

●Gold: $1,866, per troy ounce, +0.23%

●Ten-year Treasury output regular close: 2.96%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Profit taking up of volatility

Long-term bitcoin holders are starting to instrumentality immoderate profits, which has been a root of selling unit implicit the past fewer months.

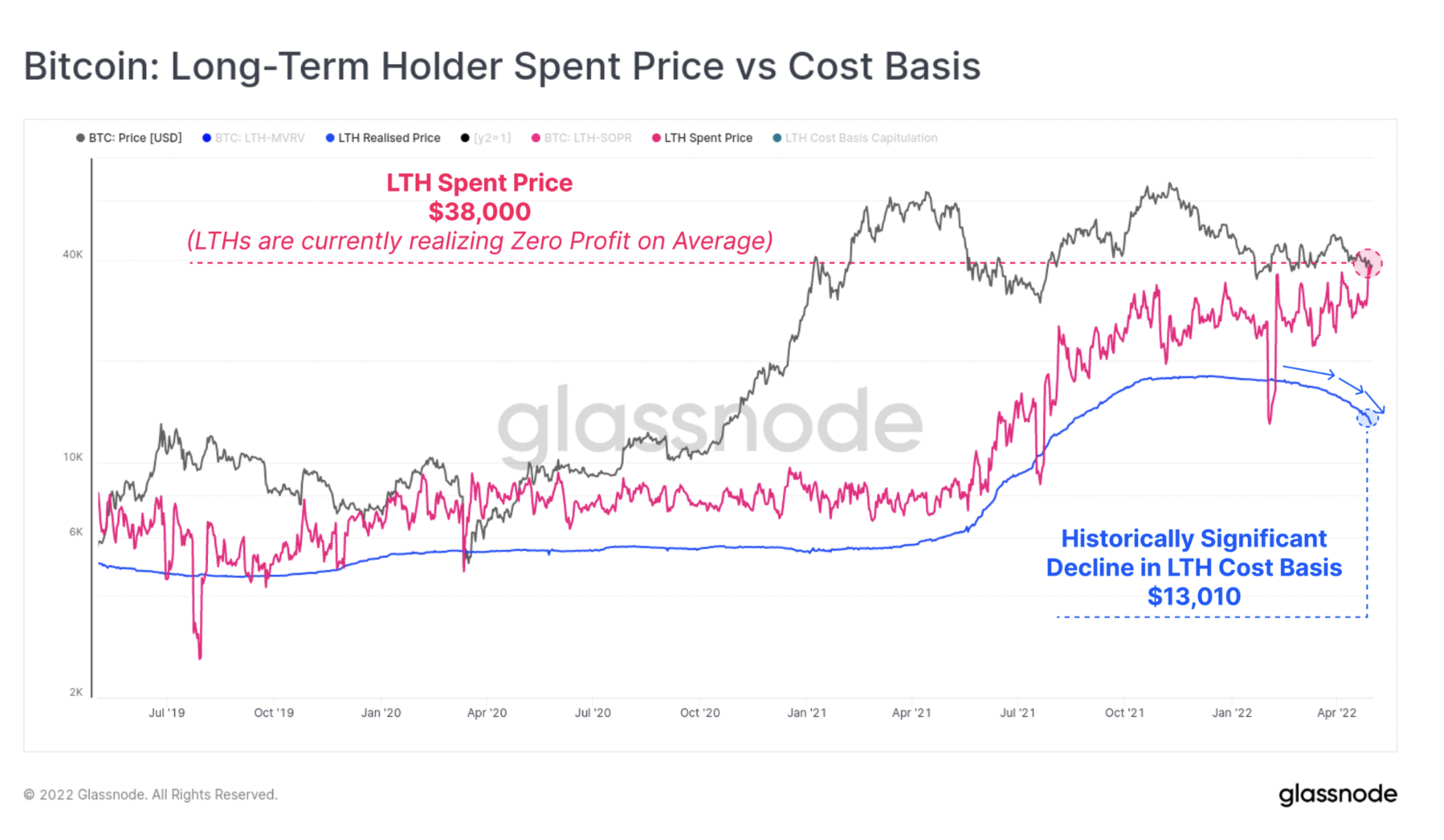

The illustration beneath shows the caller diminution successful the outgo ground of semipermanent holders overlaid with the mean selling terms (currently astir $38,000, indicating zero profit).

So far, nett taking among semipermanent holders is occurring astatine the astir important complaint successful bitcoin's history, according to Glassnode data. "This indicates that semipermanent holders from the 2021-2022 rhythm are capitulating, spending and redistributing their coins, specifically during the past 3 months," the steadfast wrote successful a blog post.

For short-term holders, realized losses are overmuch worse. "The on-chain outgo ground of short-term holders is astatine $46,910, putting the mean coin held by this cohort astatine an unrealized nonaccomplishment of -17.9%," Glassnode wrote.

Currently, astir 70% of each BTC holders are successful nett (30% held astatine a loss). In erstwhile crypto carnivore markets, betwixt 45%-57% of the marketplace was successful profit, according to Glassnode's data, which suggests much clip earlier a terms debased is reached.

Long-term bitcoin holder spending (Glassnode)

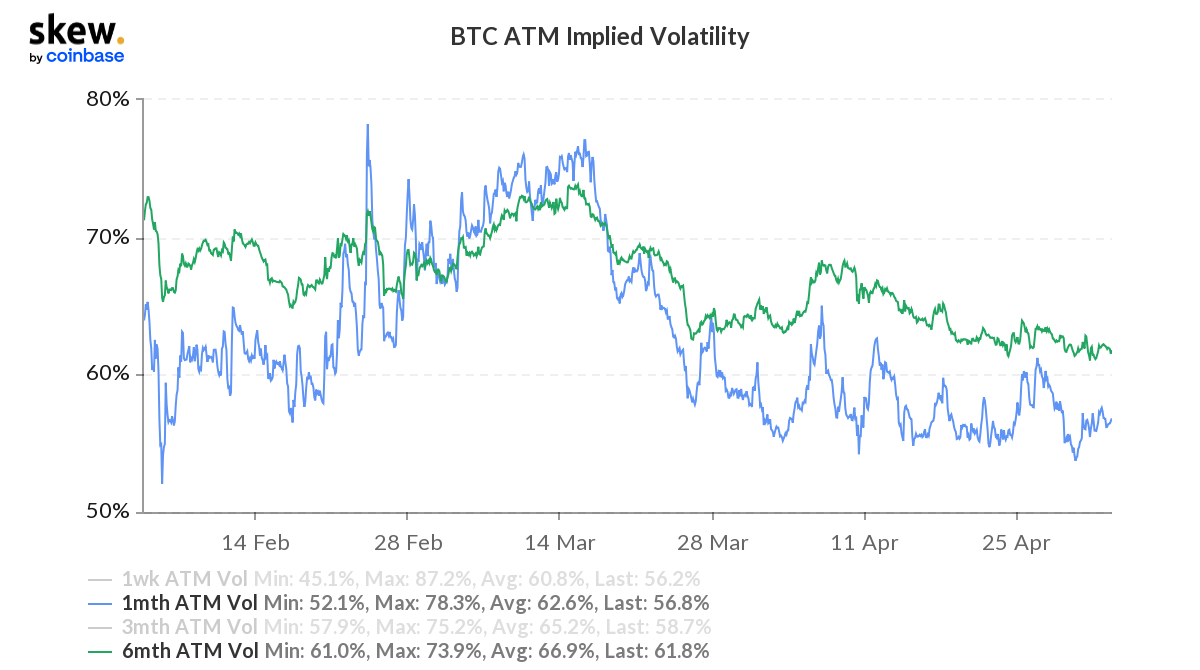

Some traders are betting connected higher short-term volatility due to the fact that of the uncertainty implicit BTC's terms absorption and lingering macroeconomic risk.

"It is apt that front-end implied volatility volition rally into Fed decision, but this could beryllium an accidental to merchantability volatility arsenic we expect the mean-reversion to hap precise rapidly into the extremity of the week," QCP Capital, a Singapore-based crypto trading firm, wrote successful a Telegram announcement connected Tuesday.

Bitcoin implied volatilities (Glassnode)

Algorand scores FIFA partnership, ALGO terms surges: FIFA, soccer's planetary governing body, locked successful Algorand arsenic an authoritative blockchain spouse earlier the World Cup contention that starts successful November successful Qatar. According to the agreement, Algorand volition beryllium a "regional supporter" for North America and Europe astatine the World Cup and an authoritative sponsor of the Women's World Cup successful Australia and New Zealand adjacent year. Algorand’s ALGO token was up by arsenic overmuch arsenic 15% implicit the past 24 hours. Read much here.

Reasons down Solana’s shutdown: Bots tied to a caller non-fungible token (NFT) task built connected Solana caused a seven-hour web outrage connected Saturday, task developers confirmed successful a post connected Tuesday. No caller blocks were produced by the web during that time. Solana processes an mean of 2,700 transactions per 2nd (tps), blockchain explorers show, with an precocious highest of implicit 710,000 tps connected a modular network, arsenic per developer documents, according to CoinDesk’s Shaurya Malwa. Read much here.

‘Smart Money’ wallets are unloading APE, filling up connected aSTETH: Prolific and progressive cryptocurrency traders person been unloading Yuga Labs’ ApeCoin and filling up connected Aave’s aSTETH, according to information from blockchain analytics steadfast Nansen. Over the past 24 hours, $1.28 cardinal worthy of APE has flowed retired of wallets that Nansen has categorized arsenic belonging to “smart money,” much than immoderate different token tracked by the firm, according to CoinDesk’s Sage D. Yang. Read much here.

Listen 🎧: CoinDesk's "Markets Daily" podcast takes a look astatine the imaginable usage of crypto successful retail payment.

Most integer assets successful the CoinDesk 20 ended the time lower.

Biggest Gainers

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)