Bitcoin stabilized astatine astir $41,000 connected Friday and is down astir 9% implicit the past week. Analysts expect prices to determination sideways, though they whitethorn beryllium susceptible to further declines if technical enactment levels are breached.

The simplification successful leverage successful bitcoin and ether futures markets could awesome healthier marketplace conditions. Typically, determination is simply a little accidental of further downside volatility erstwhile traders trim their presumption sizes.

Earlier this week, “based connected liquidation data, it seems similar a fewer leverage traders tried to speculate connected a rebound and got burned successful the process,” Genevieve Yeoh, a probe expert astatine Delphi Digital, wrote successful a blog post.

Liquidations, which tin accelerate downward terms movements, hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading.

For now, bitcoin remains adjacent a three-month low, tracking declines successful planetary equity markets.

Bitcoin (BTC): $41,928, -2.97%

Ether (ETH): $3,216, -6.11%

10-year Treasury output closed astatine 1.76%

Some analysts are pointing to signs of stabilization successful crypto markets pursuing Wednesday’s sell-off. After astir $800 million successful liquidations during the terms dip, selling unit could subside implicit the abbreviated term.

“We person already seen important de-risking successful caller weeks with some BTC and ETH perpetual swap backing rates adjacent zero,” David Duong, caput of organization probe astatine Coinbase, wrote successful a newsletter connected Friday.

A perpetual swap is simply a benignant of crypto derivative trading product, akin to accepted futures.

“Leverage has been reduced sharply, reflected successful the BTC ground falling from 20% successful aboriginal Q3 2021 to 5% successful January 2022 and the ETH ground falling from 20% to 2% implicit the aforesaid play (according to Deribit),” Duong wrote.

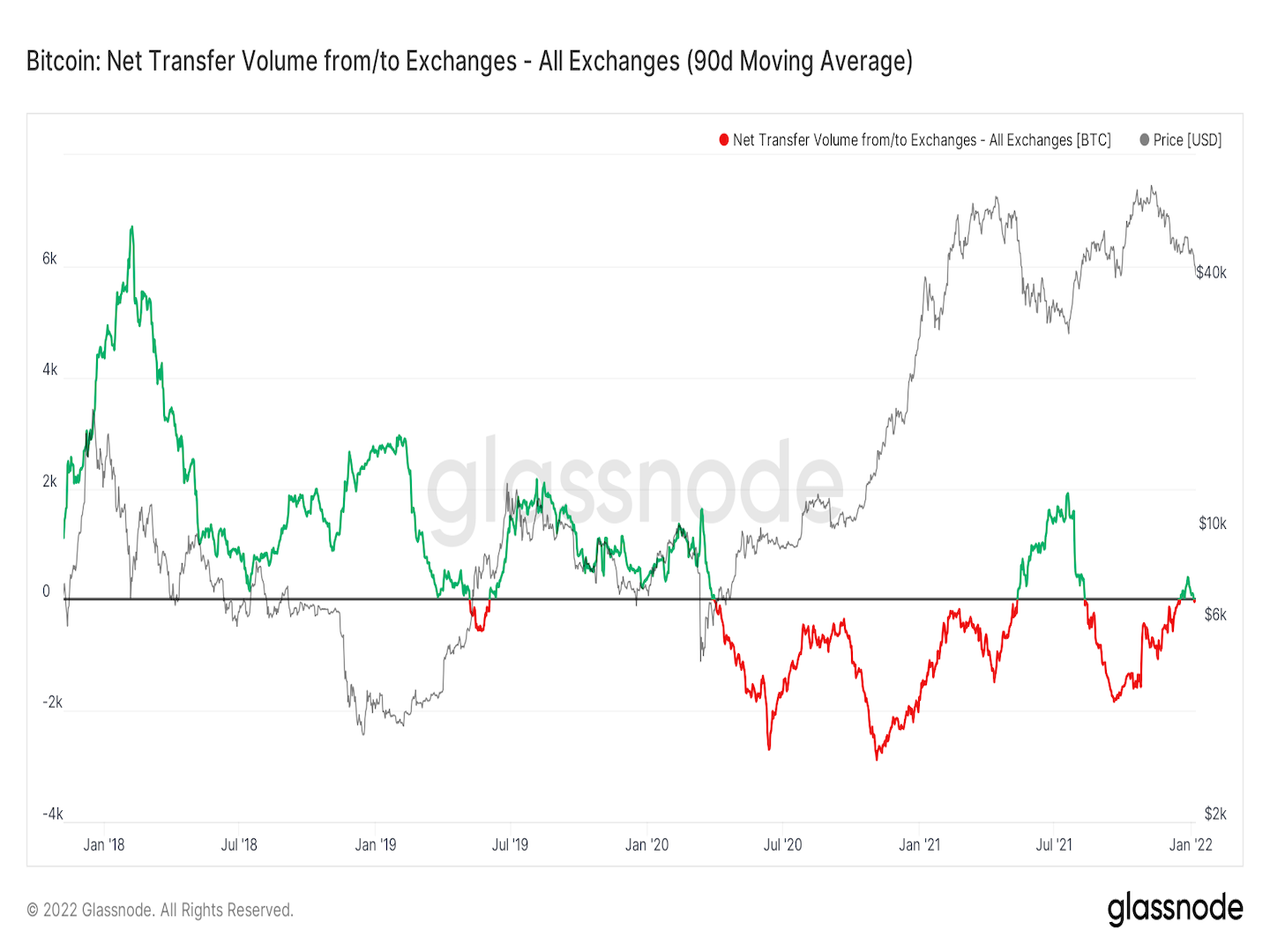

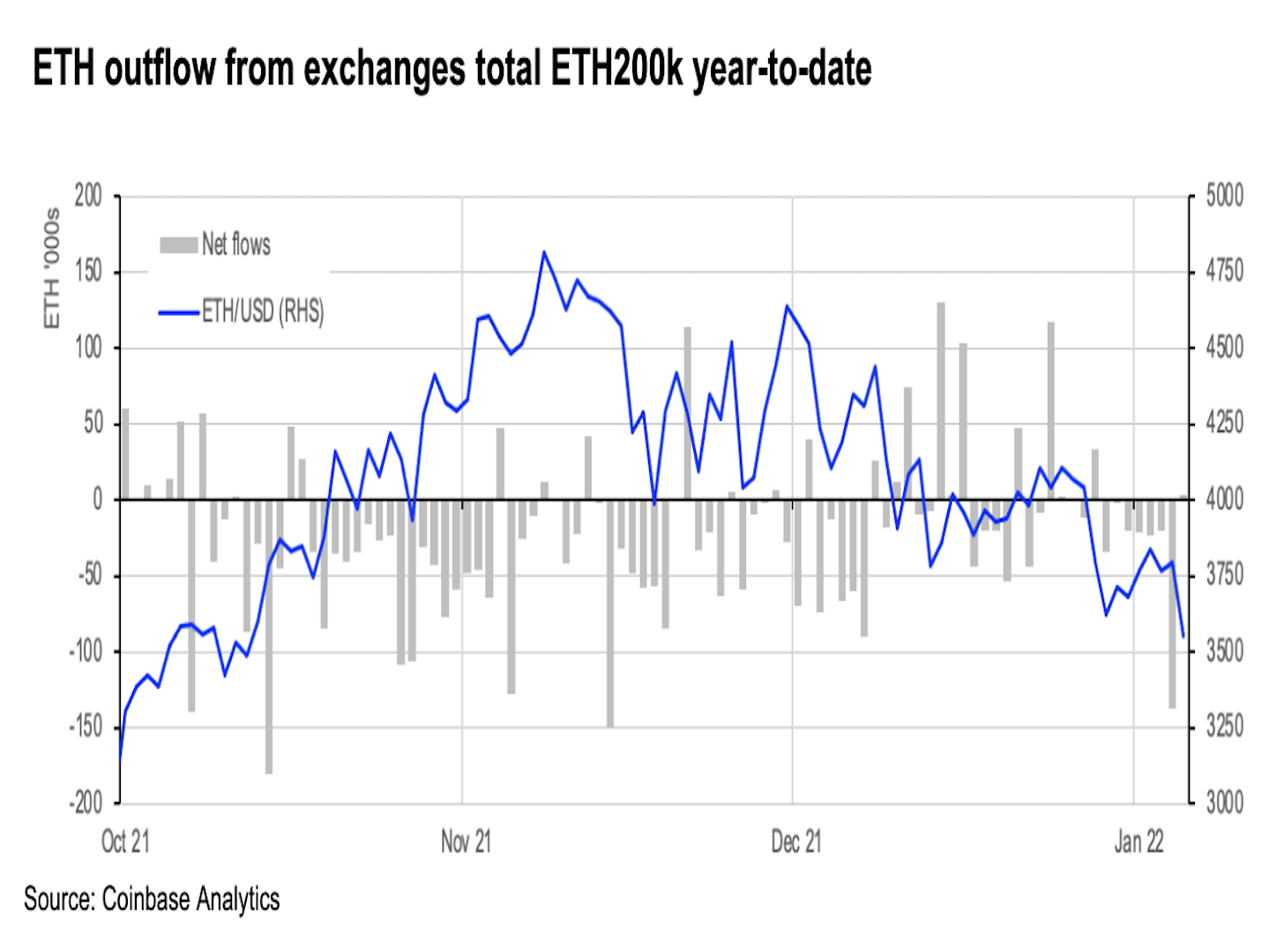

The nett travel of bitcoin and ether to and from exchanges has trended little implicit the past year. This week, however, much BTC moved into exchanges, which could awesome a bearish displacement successful capitalist sentiment.

Net inflows connote capitalist volition to sell, portion accordant outflows correspond beardown holding sentiment and instrumentality retired circulating proviso from the market, paving the mode for terms rallies.

While the caller uptick successful nett inflows to exchanges doesn’t awesome a inclination shift, analysts are intimately monitoring a sustained emergence akin to January, which could pb to a prolonged marketplace sell-off.

Bitcoin's nett transportation measurement to and from exchanges (Glassnode)

ETH outflow from exchanges (Coinbase Analytics)

Ether liquidations: Traders racked up $182 cardinal successful losses connected ether-tracked futures products successful the past 24 hours, according to information from analytics tools Coinglass. That is $14 cardinal higher than bitcoin-tracked futures, which usually spot the largest liquidations successful the crypto market, during a comparable period.

Serum’s money raise: The protocol that undergirds overmuch of decentralized concern (DeFi) connected the Solana blockchain is raising funds to grow operations, and astir $70 cardinal has been committed truthful far. Buyers successful the backing circular received some Serum’s SRM tokens arsenic good arsenic a information of the ecosystem fund, with 85% going into the fund. Ecosystem funds are a increasing inclination among large projects. Read much here.

Avalanche’s wonderland: Algorithmic wealth marketplace Wonderland has made a seed investment successful Polygon-based decentralized betting exertion BetSwap, the squad said successful a post connected Friday. The determination marked 1 of the archetypal instances of a community-governed crypto task investing successful a DeFi protocol, which trust connected smart contracts alternatively of 3rd parties successful providing fiscal services.

Most integer assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)