Most cryptocurrencies declined connected Friday arsenic traders reacted to geopolitical risks emanating from Russia and Ukraine.

On Friday, U.S. President Biden urged Americans to permission Ukraine immediately, informing “an penetration could statesman astatine immoderate time.” For now, the U.S. has ruled retired sending troops into Ukraine contempt Russia's subject activities.

Bitcoin (BTC) dropped arsenic overmuch arsenic 5% implicit the past 24 hours, compared with a 4% diminution successful ETH and a 7% dip successful SOL. Stocks were besides little portion accepted harmless havens specified arsenic golden and the U.S. dollar rose. Markets yet stabilized aboriginal successful the New York trading day.

Technical indicators are mostly neutral for bitcoin, showing enactment astatine $35,000-$40,000 and absorption astatine $46,000.

Over the past 10 days, a bulk of trading measurement occurred astatine $41K-$41.5K BTC, according to Jason Pagoulatos, an expert astatine Delphi Digital, a crypto probe firm. "If that level is lost, we apt determination towards the measurement gaps near behind, which happens to coincide with $38.5K."

●Bitcoin (BTC): $42334, −4.23%

●Ether (ETH): $2914, −6.53%

●S&P 500 regular close: $4418, −1.90%

●Gold: $1865 per troy ounce, +1.55%

●Ten-year Treasury output regular close: 1.96%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

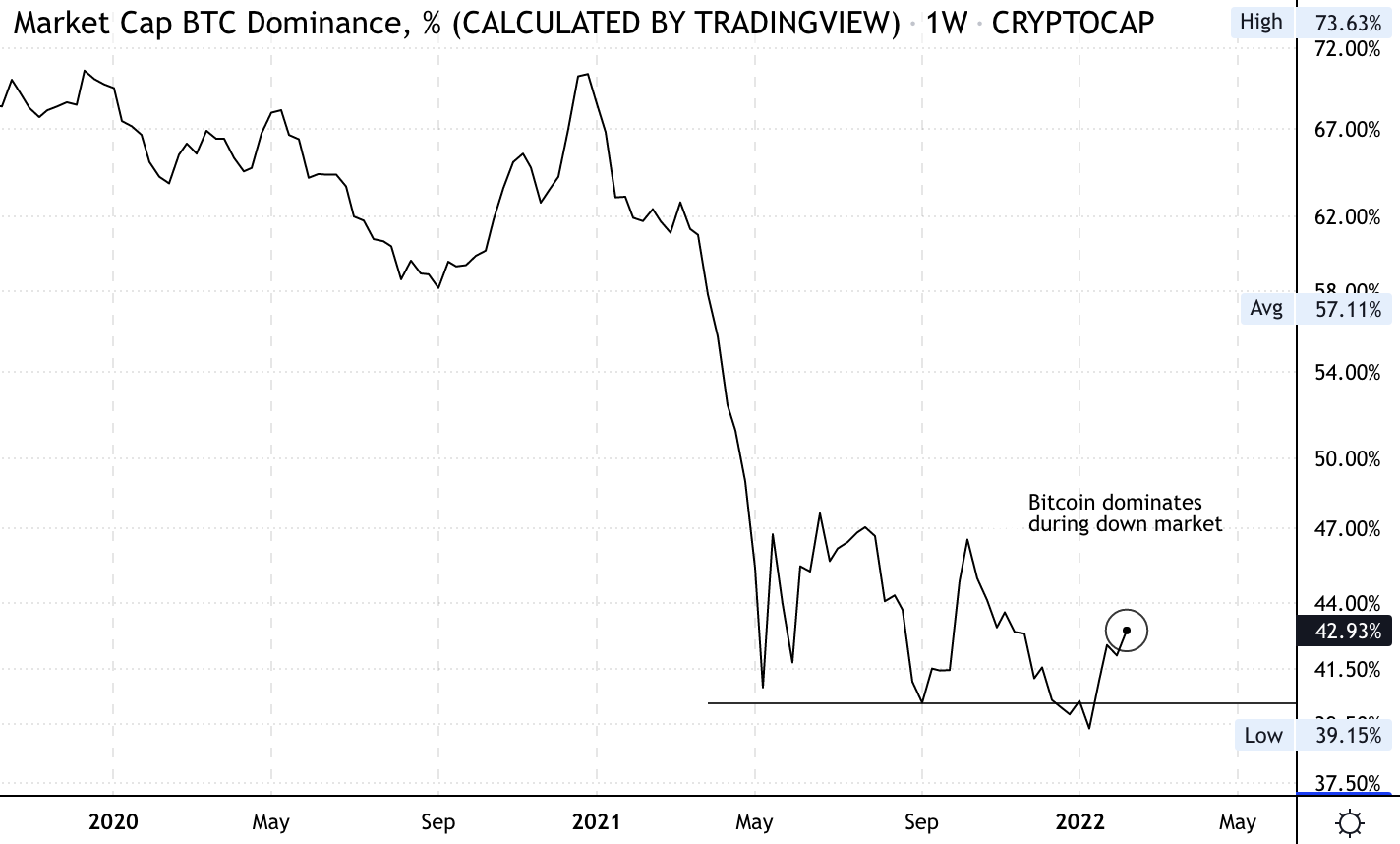

Bitcoin's marketplace capitalization comparative to the wide crypto marketplace headdress roseate supra 40% this week. Typically, traders overweight bitcoin during marketplace downturns due to the fact that of its little hazard illustration comparative to alternate cryptocurrencies (altcoins).

During the 2018 crypto carnivore market, the BTC dominance ratio roseate from a debased of 35% to a precocious of 72%. And implicit the past year, the ratio declined by 30 percent points arsenic altcoins rallied up of bitcoin.

Some analysts expect bitcoin to stay nether unit for a fewer much months. "In past spring’s drawdown, it took astir six months for bitcoin to recover," NYDIG, a bitcoin holding company, wrote successful a newsletter this week. "A akin timeline successful the existent drawdown would enactment a betterment day sometime successful May."

The bitcoin dominance ratio (CoinDesk, TradingView)

Polkadot incentives: Astar Network, a parachain oregon parallel concatenation of the Polkadot network, has announced the $100 cardinal Astar Boost Program fund to supply liquidity and connection fiscal enactment and inducement programs to smart contract developers. The institution told CoinDesk that the programme was funded done $22 cardinal successful fundraising, arsenic good arsenic an allocation of the autochthonal ASTR token. Read much here.

Tether blacklists Ethereum code linked to Multichain hack: The code traces backmost to hackers who stole $3 million successful cryptocurrency connected the cross-chain span Multichain astir a period ago, according to Etherscan's labeling of transactions involving the wallet arsenic good arsenic a CoinDesk analysis. Whoever controls the code won't beryllium capable to determination funds truthful agelong arsenic they are frozen. Read much here.

NFT-linked location sells for $650K: Real property startup Propy has sold its archetypal NFT-backed spot successful the U.S., the institution announced Friday. The 2,164-square-foot location successful Gulfport, Fla., fetched $653,000 (210 ETH) astatine auction, with the winning bidder being awarded a non-fungible token arsenic impervious of the home’s ownership. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)