Bitcoin (BTC) and different cryptocurrencies traded little connected Thursday, partially owed to elevated tensions betwixt Russia and Ukraine. Global stocks besides declined portion gold, a accepted harmless haven, continued to march higher.

On Tuesday, U.S. diplomats provided nary motion of a solution betwixt Russia and Ukraine, contempt earlier talks of a de-escalation. The backmost and distant betwixt state leaders has resulted successful choppy trading conditions implicit the past fewer days.

In crypto markets, immoderate traders expect higher volatility. For example, implicit the past 24 hours, much than 10,000 BTC flowed into spot exchanges, according to information compiled by CryptoQuant. That could awesome a penchant among traders to merchantability tokens alternatively than clasp successful integer wallets.

Meanwhile, bitcoin enactment traders stay uncertain astir aboriginal terms direction, placing a 50% probability that BTC volition commercialized supra $40,000 by September. Neutral sentiment combined with the dependable diminution successful trading measurement and volatility suggests galore buyers stay connected the sidelines.

●Bitcoin (BTC): $40642, −7.61%

●Ether (ETH): $2890, −8.36%

●S&P 500 regular close: $4380, −2.12%

●Gold: $1901 per troy ounce, +1.65%

●Ten-year Treasury output regular close: 1.97%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

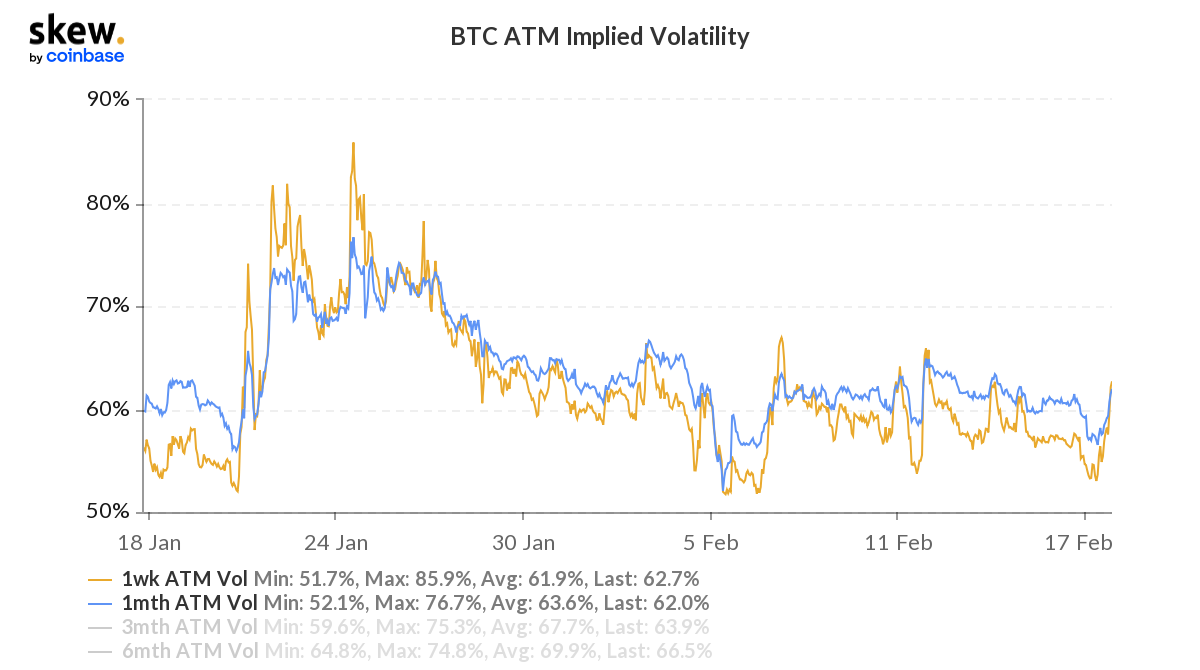

Bitcoin's short-term implied volatility is starting to emergence from utmost lows, which means traders expect greater terms moves implicit the adjacent fewer weeks.

"Implied volatility is apt to prime up again, specifically successful bitcoin, rising backmost up to 90%," Don Kaufman, co-founder of TheoTrade, a trading eduction website, said during an interrogation connected CoinDesk's "First Mover" show.

"I don't privation to spell agelong crypto until you spot bitcoin down to the little $30,000 handle," helium added. However, if countries enforce sanctions connected Russia, cryptos would acquisition near-term volatility, but could yet pull greater inflows, according to Kaufman.

Bitcoin implied volatility (Skew)

USDC backer Circle’s SPAC: Circle, the backer of the USDC stablecoin, said it plans to spell nationalist successful a woody that values it astatine $9 billion, doubly the level it primitively agreed to successful July. The institution negotiated a caller woody with peculiar intent acquisition institution (SPAC) Concord Acquisition Corp., reflecting improvements successful its fiscal outlook and competitory position, Circle said in an announcement Thursday, according to CoinDesk’s Jamie Crawley. Read much here.

Andrew Yang launches DAO: Cryptocurrency proponent and erstwhile U.S. statesmanlike campaigner Andrew Yang has launched Lobby3, a decentralized autonomous enactment (DAO), to advocator for Web 3 policies successful Washington, D.C. The assemblage volition “prioritize and suggest caller policy, and aggregate caller ideas that request to beryllium apical of caput for our leaders,” according to CoinDesk’s Brandy Betz. Read much here.

The Graph backers motorboat $205M money for dapp builders: The backers of The Graph, a protocol that aims to marque on-chain information much accessible to decentralized application (dapp) projects, person launched the archetypal money to enactment developers gathering for the system. The $205 cardinal cookware was announced Thursday by Multicoin Capital, Reciprocal Ventures, gumi Cryptos Capital, NGC Ventures, CoinDesk genitor Digital Currency Group and HashKey, according to CoinDesk’s Tracy Wang. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

There are nary gainers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)