Cryptocurrencies and equities continued to endure Tuesday amid expanding geopolitical tensions.

Western nations prepared to motorboat sanctions against Russian fiscal interests aft efforts to de-escalate the struggle betwixt Russia and Ukraine soured implicit the past fewer days. On Tuesday, U.S. officials declared Russia's question of troops into the eastern, separatist portion of Ukraine arsenic "the opening of an invasion."

Bitcoin (BTC) and ether (ETH) were astir level implicit the past 24 hours, compared with a 7% driblet successful XRP and a 5% nonaccomplishment successful SHIB. Most alternate cryptocurrencies (altcoins) underperformed BTC connected Tuesday, suggesting a little appetite for hazard among crypto traders.

Some analysts expect choppy terms enactment to persist implicit the abbreviated term, though marketplace panic could yet fade.

Typically, S&P 500 banal scale sell-offs due to the fact that of geopolitical events person been short-lived, according to a study by Deutsche Bank. The firm's probe shows the median sell-off was -5.7%, lasting astir 3 weeks, earlier reaching a trough, and past different 3 weeks to betterment from anterior levels.

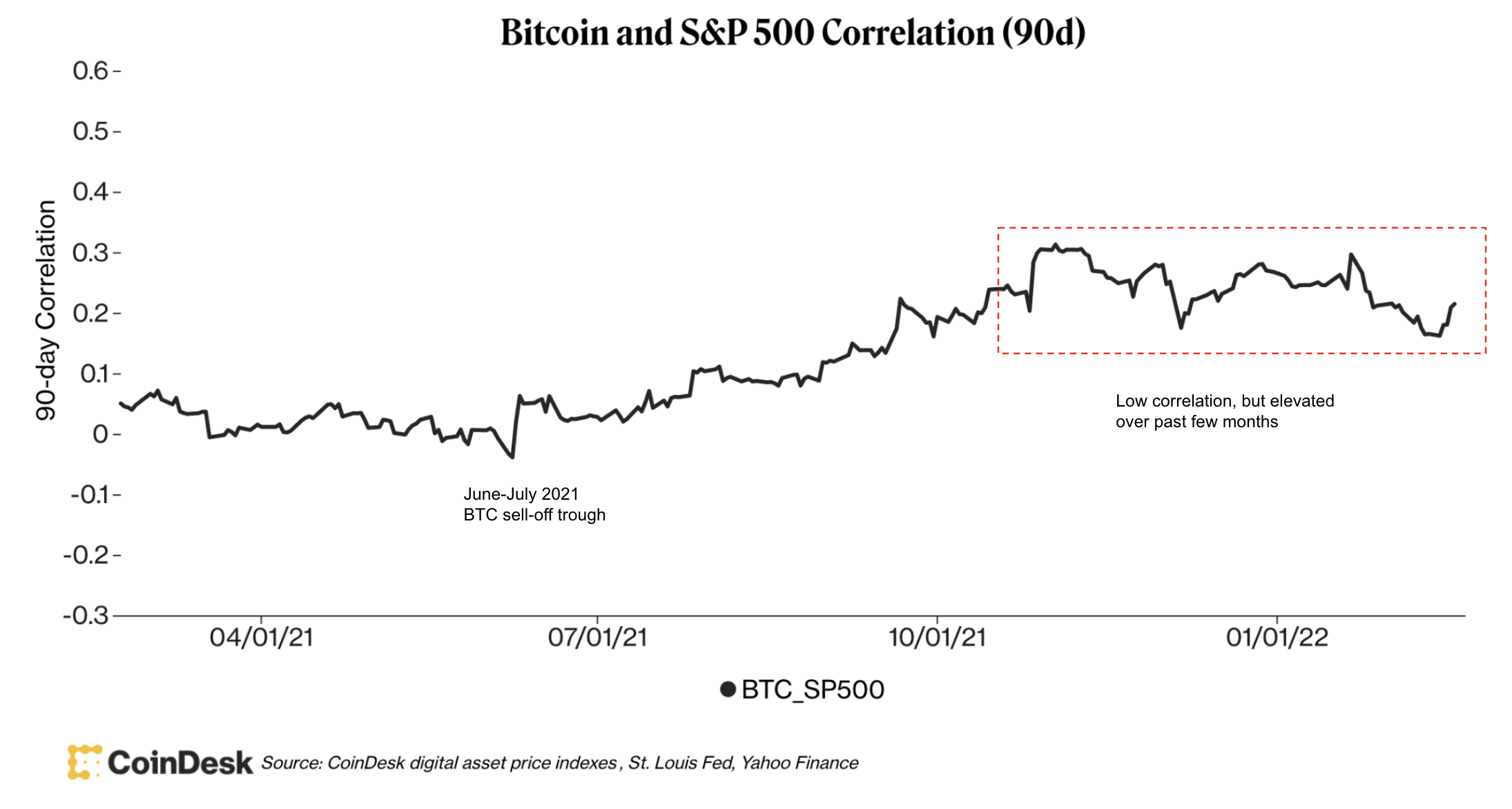

Given the rising correlation betwixt BTC and the S&P 500, immoderate traders are patiently waiting for the diminution crossed speculative assets to settle.

●Bitcoin (BTC): $38032, −0.73%

●Ether (ETH): $2613, −1.73%

●S&P 500 regular close: $4305, −1.02%

●Gold: $1903 per troy ounce, +0.22%

●Ten-year Treasury output regular close: 1.95%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Bitcoin and S&P 500 correlation (CoinDesk integer plus terms indexes, St. Louis Fed, Yahoo Finance)

Technicals amusement short-term enactment for BTC astatine $37,000, though stronger enactment is astir $30,000. For now, upside appears to beryllium constricted toward the $40,000-$45,000 absorption zone.

But the way guardant for bitcoin could beryllium volatile.

"We've been seeing assertive volatility selling with each BTC spike," QCP Capital, a Singapore-based crypto trading steadfast wrote successful a Telegram announcement.

The steadfast expects BTC to grind little with the anticipation of a short squeeze connected affirmative headlines. However, "these spikes successful spot terms would astir apt beryllium met with assertive spot selling, capping the topside," QCP wrote.

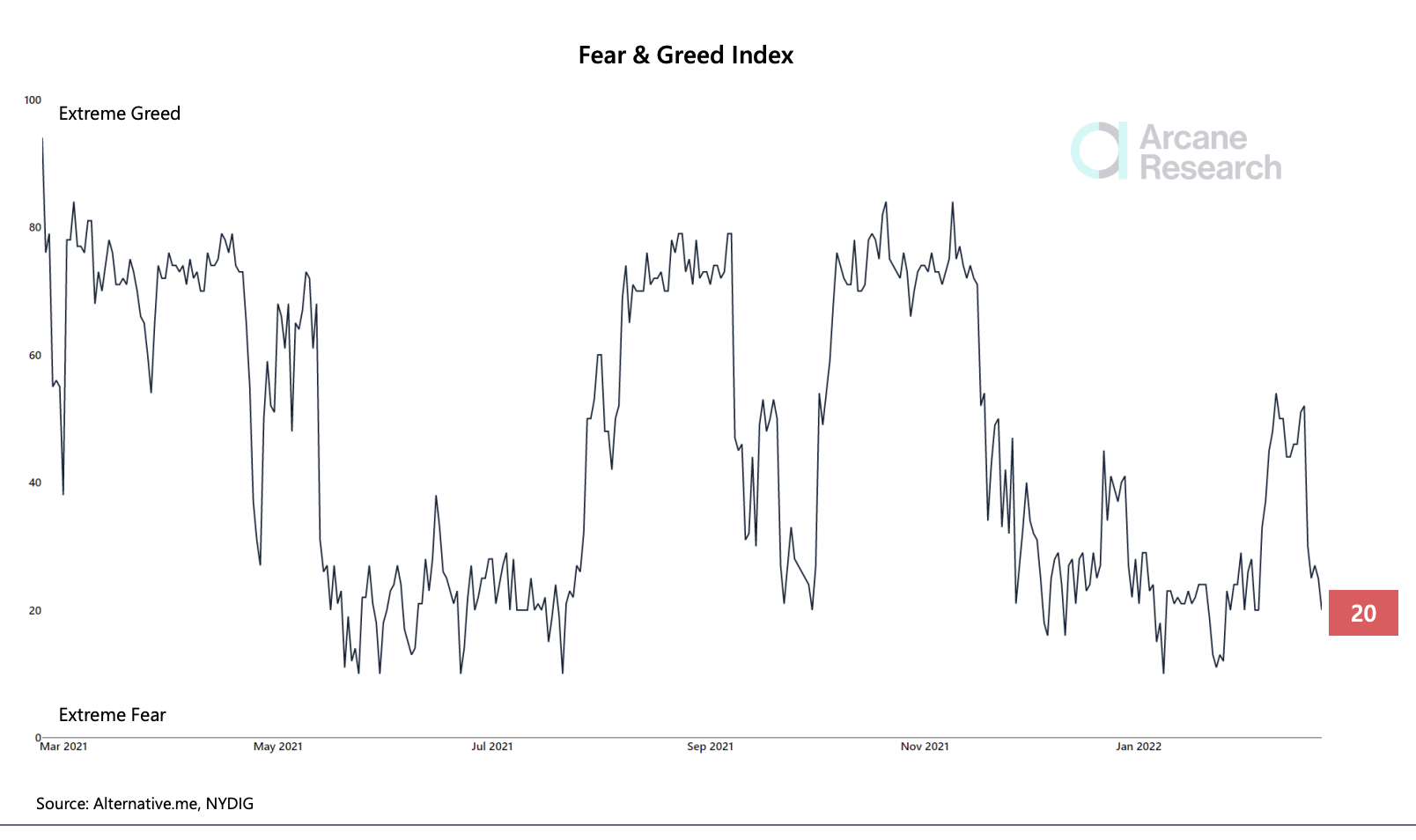

The bitcoin Fear & Greed Index entered "extreme fear" territory past week. Similar to equities, crypto markets are experiencing an uptick successful bearish sentiment, driven by macroeconomic and geopolitical concerns.

In the bitcoin futures market, sentiment remains bearish, but not extreme. "Liquidations inactive stay idle, erstwhile again suggesting that traders are cautious with leverage," Arcane Research wrote successful a Tuesday report.

And blockchain information amusement debased web enactment among bitcoin users.

"This week, the grade of on-chain enactment is languishing astatine the lower-bound of the carnivore marketplace channel, which tin hardly beryllium interpreted arsenic a awesome of accrued involvement and request for the asset," Glassnode wrote successful a blog post.

Bitcoin Fear & Greed Index (Arcane Research)

SAND token joins broader crypto marketplace successful gloomy outlook: SAND, the autochthonal token of the Ethereum-based virtual-reality level The Sandbox, dipped beneath the wide tracked 200-day moving mean (MA) connected Tuesday, joining peers from different crypto sub-sectors successful signaling a gloomy marketplace mood, according to CoinDesk’s Omkar Godbole. Read much here.

Tether slashes commercialized insubstantial holdings by 21%: Tether has reduced its commercialized insubstantial holdings by $6.2 cardinal implicit the past 4th successful 2021, according to its latest attestation report. The largest stablecoin issuer by full proviso chopped its assets held successful commercialized insubstantial from $30.5 cardinal successful the play ending successful September to $24.2 cardinal successful December. Tether besides drastically reduced its currency assets, from $7.2 cardinal to $4.2 billion, according to CoinDesk’s Helene Braun. Read much here.

Small economies dislike stablecoins: For example, Taiwan’s cardinal slope is not a large instrumentality of the Taiwan dollar being utilized to settee transactions that don’t person a nexus to Taiwan, thing a stablecoin is specifically designed to do, according to CoinDesk’s Sam Reynolds. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

There are nary gainers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)