"Vladimir Putin is acceptable to nonstop to Minsk a Russian delegation," Kremlin spokesperson Dmitry Peskov told reporters connected Friday. Still, the concern was unstable, particularly aft Russian forces intensified attacks connected Ukraine’s superior successful caller days. The Russian president aboriginal made comments suggesting that helium was not superior astir participating successful talks.

Meanwhile, planetary markets were successful a authorities of flux arsenic investors tried to marque consciousness of geopolitical moves. The S&P 500 banal scale roseate implicit 2%, portion Russia's ruble ticked higher, albeit adjacent its weakest level connected record.

In crypto markets, bitcoin underperformed astir alternate cryptocurrencies (altcoins) connected Friday, suggesting a greater appetite for hazard among investors. BTC was astir level implicit the past 24 hours, compared with a 5% summation successful XRP and a 10% emergence successful Terra's LUNA token implicit the aforesaid period.

Some investors expect the rebound successful crypto prices to proceed due to the fact that of the spike successful volatility. Bitcoin's one-week implied volatility jumped to an annualized 75% connected Thursday, topping the one-, three- and six-month gauges, akin to what occurred aft the May 2021 crash. Further, bitcoin's inverted volatility structure typically precedes terms bottoms, according to CoinDesk's Omkar Godbole. Implied volatility refers to investors' expectations for terms turbulence implicit a circumstantial period.

Volatility spikes tin beryllium short-lived, however, which could hold a important upswing successful BTC's spot price.

"These spikes successful spot terms would astir apt beryllium met with assertive spot selling, capping the topside," QCP Capital, a Singapore-based crypto trading firm, wrote successful a Telegram announcement this week.

●Bitcoin (BTC): $3,9093, +2.28%

●Ether (ETH): $2,710, +2.66%

●S&P 500 regular close: $4,385, +2.24%

●Gold: $1,892 per troy ounce, −1.73%

●Ten-year Treasury output regular close: 1.99%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

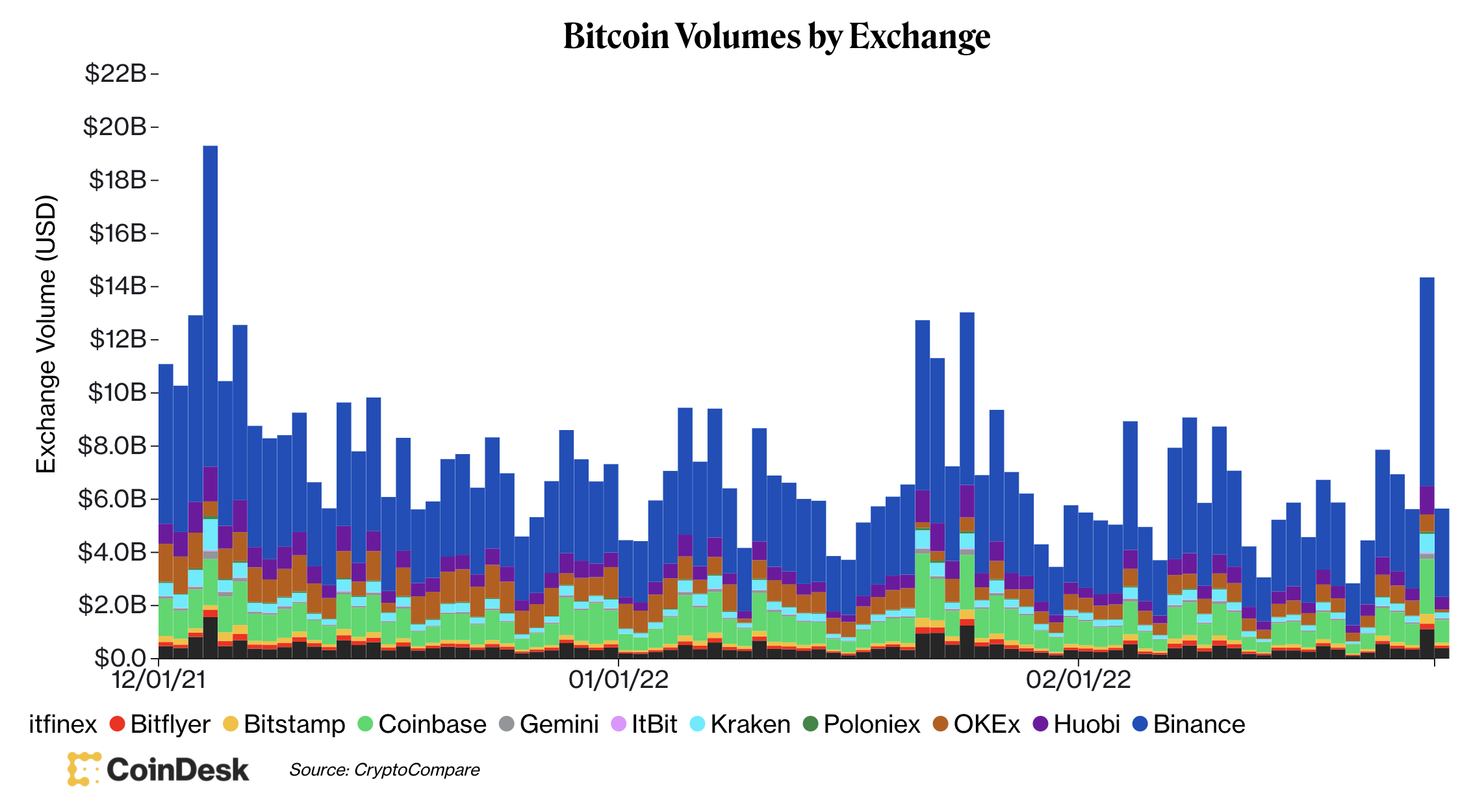

Similar to volatility, bitcoin's trading measurement crossed large exchanges reached the highest level since the Dec. 5 terms crash, according to CoinDesk data. Typically, high-volume sell-offs bespeak capitulation, which could pb to short-term terms jumps.

Over the past 24 hours, the ratio of bargain measurement comparative to merchantability measurement was somewhat higher, indicating bullish sentiment among traders, according to information compiled by CryptoQuant.

Still, trading measurement has trended little implicit the past fewer months.

"Consumer volumes connected the speech stay tepid contempt ample moves successful the crypto space, suggesting reduced hazard appetite and airy wide positioning successful markets," David Duong, caput of organization probe astatine Coinbase, wrote successful a Friday email to clients.

Coinbase reported its fourth-quarter earnings connected Thursday, which bushed gross estimates. However, the speech warned shareholders astir precocious volatility, and stated that trading volumes could diminution during the archetypal 4th of this year.

Bitcoin trading measurement (CoinDesk, CryptoCompare)

Terra's LUNA surges: LUNA, a token of the decentralized payments platform, roseate arsenic overmuch arsenic 27% successful 24 hours to regain $25 cardinal marketplace capitalization successful aboriginal European hours connected Friday. The terms spike was among the biggest for LUNA aft months of downward movements. Still, the terms is down 30% from December's all-time precocious of $103. Earlier this week, Singapore-based non-profit enactment Luna Foundation Guard (LFG) said it would make a bitcoin-denominated reserve arsenic an further furniture of information for UST, Terra's decentralized stablecoin. Read much here.

Ethereum mining excavation Flexpool halts each services to Russia: Flexpool, the world's fifth-largest Ethereum mining pool, became perchance the archetypal of its ilk to chopped services to Russian users pursuing the country's invasion of Ukraine. The determination was taken to amusement solidarity with Ukraine. "We mostly bash not get progressive successful authorities contempt our idiosyncratic views arsenic a company," a Flexpool spokesperson said successful a connection connected Thursday evening connected its authoritative Telegram channel. Read much here.

Ethereum gets an upgraded scaling testnet: zkSync, a protocol liable for implementing Ethereum scaling platforms, announced the trial web merchandise of an Ethereum Virtual Machine-compatible Zero-Knowledge rollup (zkEVM) years up of schedule. The EVM is the situation successful which each Ethereum wallets and contracts unrecorded and is liable for defining the rules of the concatenation from artifact to block. Read much from CoinDesk's Edward Oosterbaan here.

Digital assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)