Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Most cryptocurrencies traded higher connected Friday arsenic bearish sentiment waned. It appears that short-term buyers person returned from the sidelines, though method indicators amusement limited upside from here.

Bitcoin (BTC) returned toward the $30,000 terms level and was up by arsenic overmuch arsenic 5% implicit the past 24 hours. Still, momentum signals stay antagonistic connected the charts aft BTC's 17% dip implicit the past week.

For now, cryptos and stocks are experiencing a alleviation bounce, which could past for a fewer much days. Alternative cryptos (altcoins) outperformed connected Friday, which reflects a greater appetite for hazard among traders. For example, ICP, MANA and DOGE rallied by much than 20% implicit the past 24 hours.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Meanwhile, the Terra blockchain resumed enactment connected Friday pursuing a nine-hour halt. The LUNA token continued to commercialized beneath 1 cent astatine the clip the web was halted.

Also, connected Friday, the Grayscale Bitcoin Trust's (GBTC) discount widened to an all-time debased of 30.79%. The caller crypto sell-off besides whitethorn person contributed to a wider GBTC discount. (Grayscale is simply a CoinDesk sister company.)

●Bitcoin (BTC): $29,980, +5.17%

●Ether (ETH): $2,057, +6.60%

●S&P 500 regular close: $4,024, +2.39%

●Gold: $1,808 per troy ounce, −0.88%

●Ten-year Treasury output regular close: 2.94%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

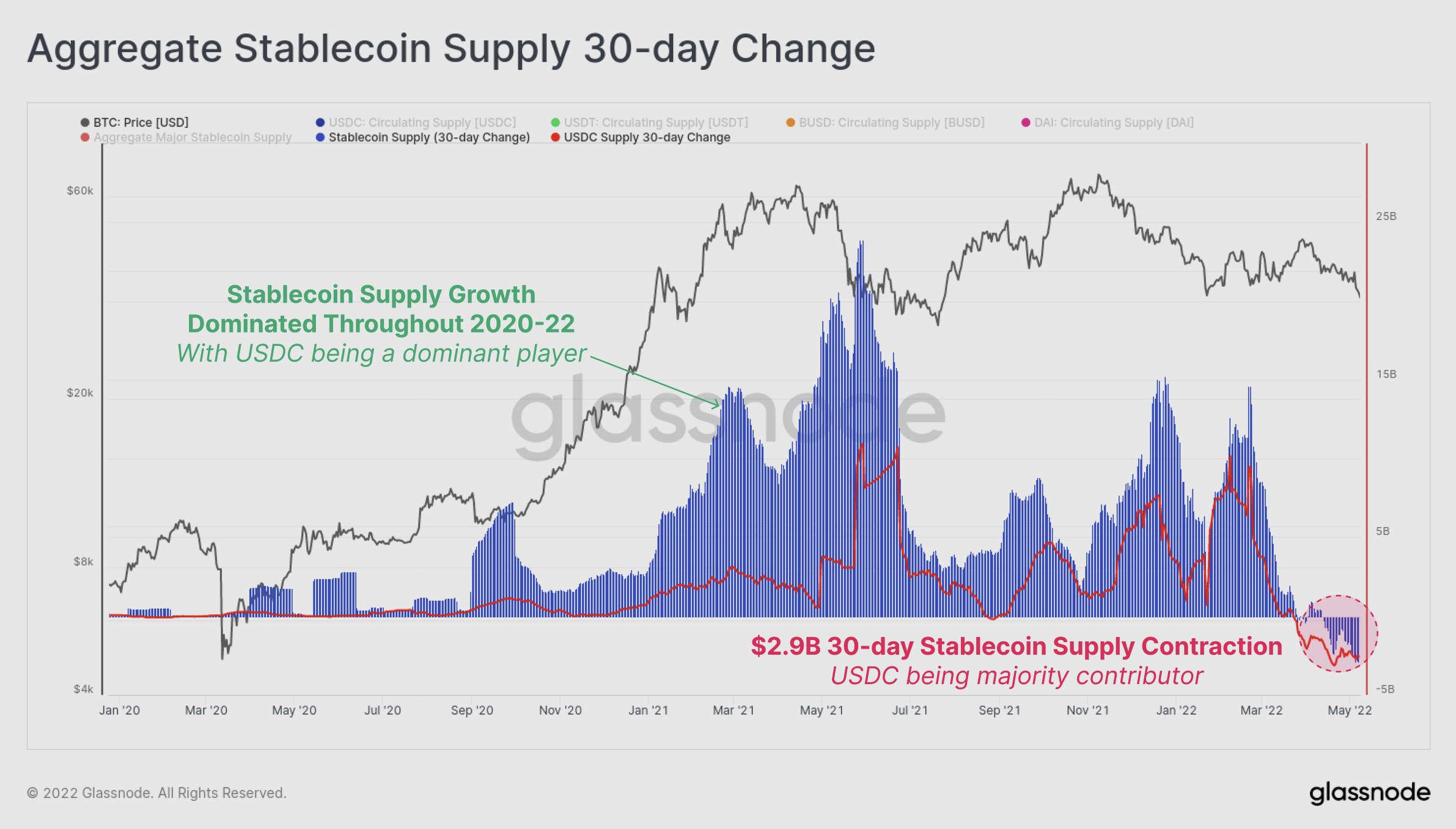

Fewer crypto traders sought refuge successful stablecoins during the caller marketplace sell-off. That suggests investors are starting to exit crypto markets.

The illustration below, provided by Glassnode, shows the 30-day alteration successful aggregate stablecoin proviso (blue) alongside the publication by stablecoin USDC (red). Since past May, USDC has been a important contributor to full stablecoin proviso growth. Recently, however, USDC has been the superior stablecoin plus experiencing redemption.

Stablecoin proviso contraction signals a grade of nett superior outflow from the cryptocurrency manufacture astatine large, according to Glassnode. "Overall, determination are a fig of signals of nett weakness successful the space, galore of which bespeak that risk-off sentiment remains the halfway marketplace presumption astatine this time," Glassnode wrote successful a blog post.

Stablecoin proviso alteration (Glassnode)

Interestingly, Tether's USDT has seen its proviso proceed to grow implicit the aforesaid play of USDC outflows. But since the commencement of April the aggregate stablecoin proviso has plateaued.

It remains to beryllium seen if spot successful stablecoins volition instrumentality pursuing Terra's faulty experimentation utilizing algorithms. Some stablecoin issuers person assured marketplace participants that not each stablecoins are the same (some are backed by cash-like instruments, portion others try to support their worth based connected an algorithm that balances the stablecoin with a spouse token). But caller episodes person exposed instability successful the alleged unchangeable country of the crypto universe.

For now, cryptos could look further volatility ahead, which could support immoderate buyers connected the sidelines (in stablecoins oregon cash).

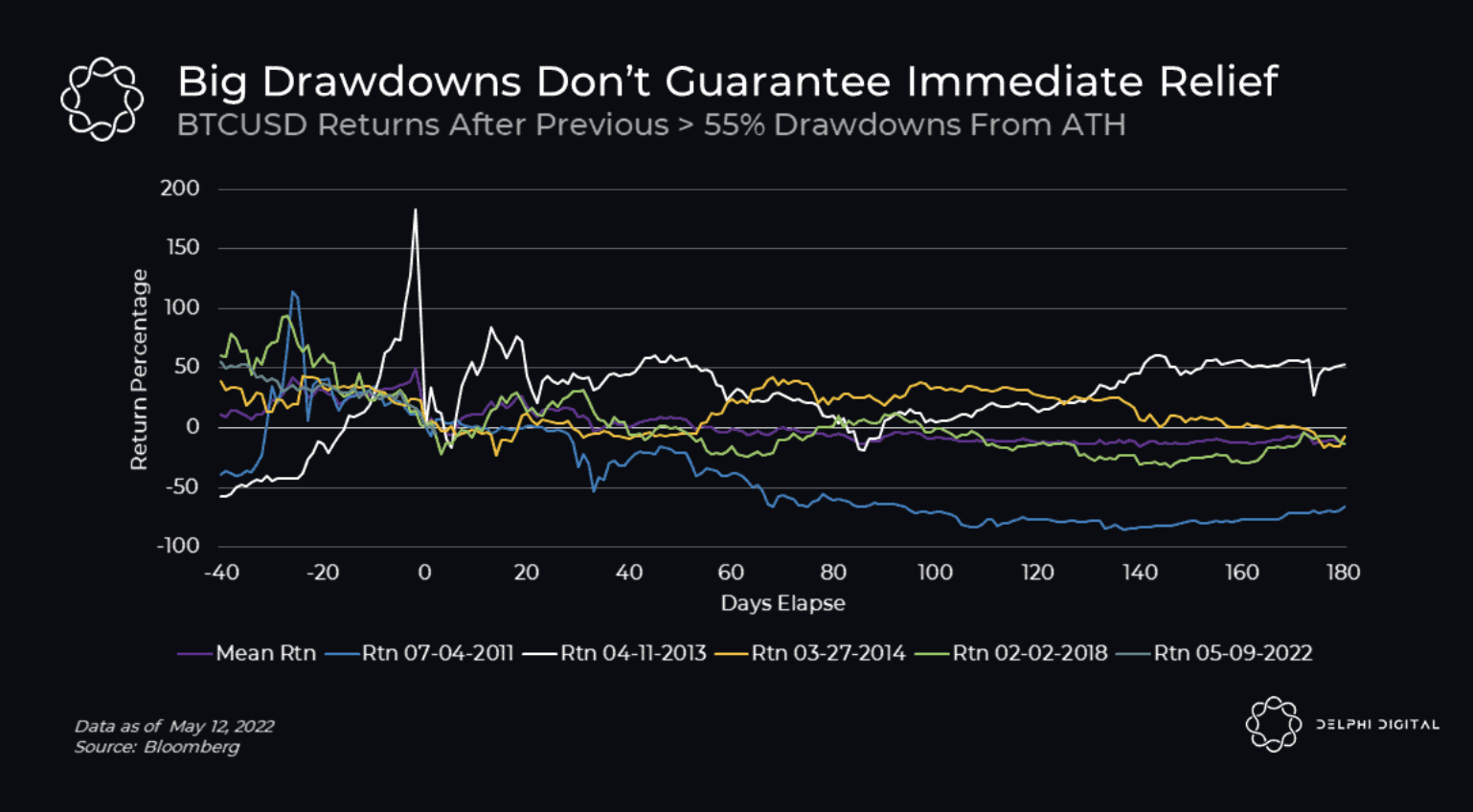

Despite the caller terms bounce, bitcoin's guardant returns pursuing a peak-to-trough diminution of 55% oregon much thin to beryllium level oregon antagonistic implicit the pursuing six months, according to Delphi Digital.

Bitcoin drawdown guardant returns (Delphi Digital)

LUNA exchange-traded merchandise issuances halted: VanEck, Valour and 21Shares, each of which connection LUNA-related exchanged-traded products (ETP) successful Europe, suspended issuing shares, citing the network’s caller issues, which see 2 implicit shutdowns of the purportedly decentralized network. All 3 products mislaid adjacent to 100% this week. Read much here.

Do Kwon’s Terra revival plan: A “Revival Plan” was submitted Friday by the Terraform Labs CEO. It's fundamentally a restart of the full Terra blockchain, with web ownership getting distributed wholly to UST and LUNA holders done 1 cardinal caller tokens. The program comes arsenic Terra’s terraUSD (UST) stablecoin, which is expected to beryllium pegged to the terms of $1, “death spiraled” beneath 15 cents this week – wiping retired implicit $30 cardinal successful value. Read much here.

ADA terms jump: Cardano’s ADA token jumped arsenic overmuch arsenic 40% implicit the past 24 hours, starring gains among the biggest cryptocurrencies. The cryptocurrency is inactive down by 82% from its all-time precocious of $3.10, achieved successful September of past year. Some analysts person attributed caller gains to a short-squeeze rally, which occurs erstwhile a ample fig of abbreviated sellers exit their positions.

Listen 🎧: With crypto markets trading successful the greenish aft a heavy slump, the CoinDesk Markets Daily podcast squad takes a look astatine however 1 of crypto’s astir ardent critics is present gathering thing similar a blockchain.

Most integer assets successful the CoinDesk 20 ended the time higher.

Biggest Gainers

Biggest Losers

There are nary losers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)