Bitcoin (BTC) traded astir level implicit the past 24 hours, though immoderate analysts expect an summation successful volatility implicit the adjacent fewer days.

On Monday, a connection that could person required cryptocurrencies similar bitcoin to displacement to much environmentally affable mechanisms was rejected successful a European Union (EU) parliament committee vote. The connection was added to a draught of the Markets successful Crypto Assets (MiCA) model past week, which was met with a heavy backlash from crypto advocates worldwide.

There was small marketplace absorption pursuing the EU rejection, though immoderate alternate cryptocurrencies (altcoins) specified arsenic dogecoin (DOGE) pared earlier gains. Meanwhile, bitcoin experienced little selling unit than altcoins connected Monday, suggesting little appetite for hazard among crypto traders.

In accepted markets, the S&P 500 extended losses connected Monday portion golden and lipid prices tumbled. Some traders expect the U.S. Federal Reserve to admit soaring vigor prices, which could pb to slower economical growth, during the decision of their two-day argumentation gathering connected March 15-16.

●Bitcoin (BTC): $38,835, +0.45%

●Ether (ETH): $2,541, −0.20%

●S&P 500 regular close: $4,173, −0.74%

●Gold: $1,955 per troy ounce, −1.41%

●Ten-year Treasury output regular close: 2.14%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

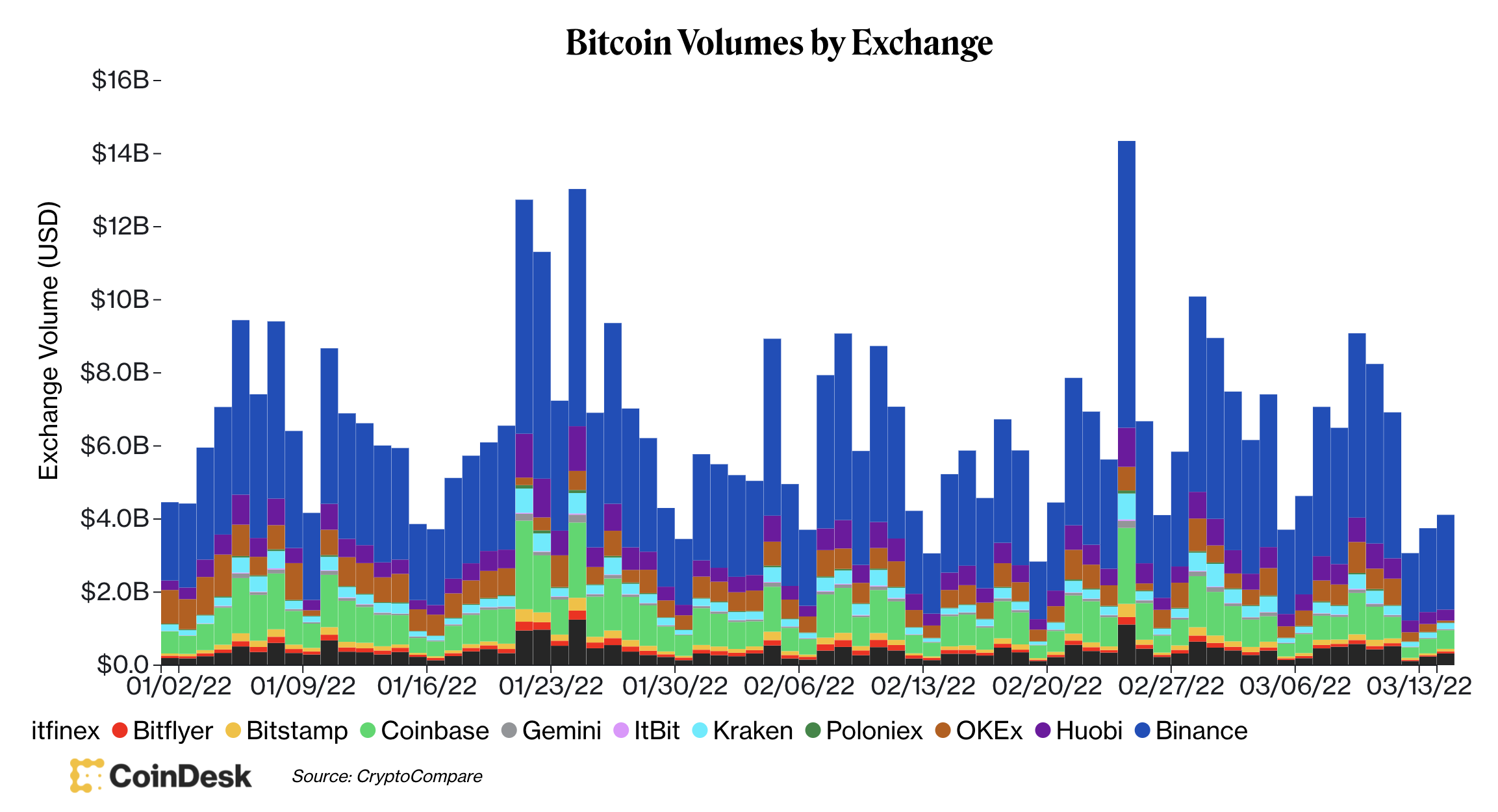

Bitcoin's trading measurement crossed large exchanges declined to its lowest level since Feb. 19 implicit the past weekend. That could bespeak immoderate caution among traders up of the Fed gathering this week.

Geopolitical uncertainty besides contributed to the caller slowdown successful trading activity, which is reflected successful blockchain data. So acold this twelvemonth request among bitcoin holders has flattened, reflecting the "impact of planetary macro uncertainty connected capitalist sentiment, with weaker BTC accumulation taking spot arsenic a result," Glassnode, a crypto information firm, wrote successful a blog post.

Further, the constrictive trading scope betwixt $35,000 and $40,000 could effect successful higher volatility implicit the adjacent 2 weeks, according to immoderate method indicators.

Bitcoin trading volumes (CoinDesk, CryptoCompare)

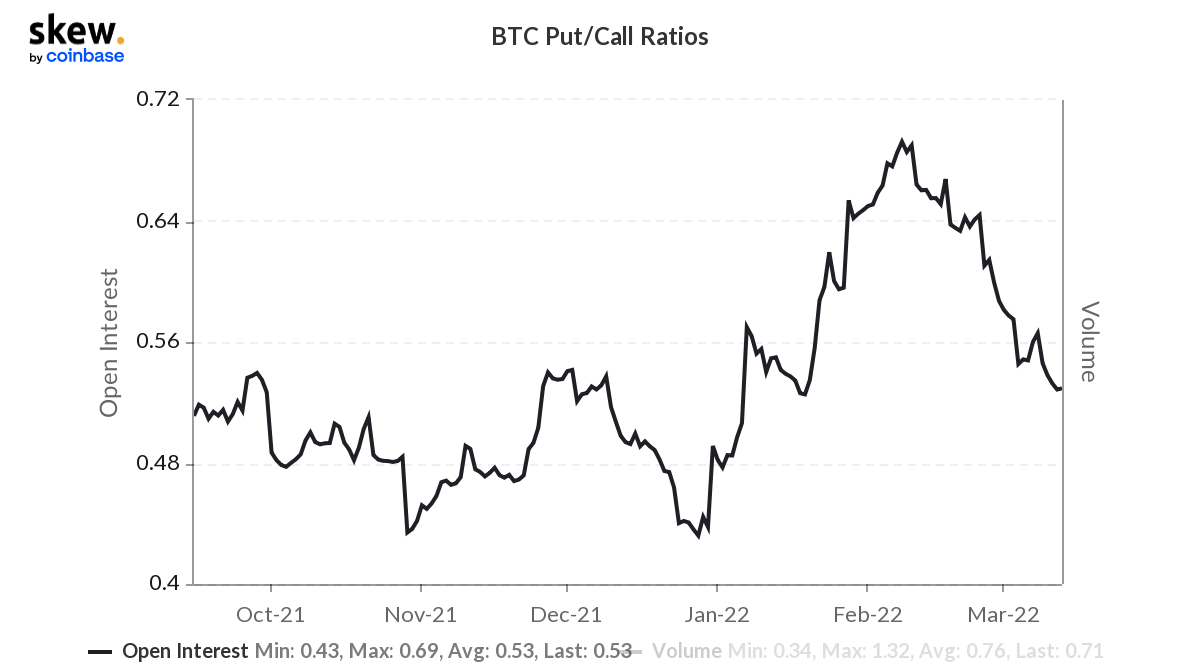

The put/call ratio continued to diminution implicit the past fewer days, indicating little bearish sentiment among bitcoin options traders. The ratio is presently astatine the lowest level successful a month, albeit inactive supra the Jan. 19 trough.

"Despite the looming involvement complaint summation expected from the Fed this week, the BTC put/call ratio continues to diminution from an aboriginal February high," Fundstrat Global Advisors wrote successful a Monday email. "This diminution successful the wide ratio mightiness bespeak that investors are starting to presumption for longer-term risk."

Bitcoin put/call ratio (Skew)

Ethereum staking protocol Swell raises $3.75M arsenic locked ETH tops $26B: Ethereum reached a major milestone past week successful its highly anticipated modulation to proof-of-stake, with 10 cardinal ETH (about $26 billion) present locked successful the Ethereum 2.0 staking contract. Against that backdrop, a caller staking protocol, Swell, has joined the ranks of projects helping investors get staking rewards for stashing their ether. The squad announced Monday a $3.75 cardinal effect circular co-led by Framework, IOSG Ventures and Apollo Capital, according to CoinDesk’s Sam Kessler. Read much here.

Dogecoin spikes concisely aft Musk says helium won't merchantability his crypto holdings: Dogecoin (DOGE) concisely jumped arsenic overmuch arsenic 10% during Asian trading hours connected Monday aft Tesla CEO Elon Musk said successful a tweet that helium is not selling his crypto holdings, which see DOGE. DOGE erased immoderate gains toward the extremity of the New York trading time amid a mostly level crypto market. It is present down astir 2% implicit the past 24 hours. Read much here.

Merit Circle and MetalCore: Merit Circle, the DAO focused connected profiting done the metaverse and gaming, is partnering with the open-world blockbuster crippled institution MetalCore done buying $1,000,000 worthy of in-game assets. Players volition request to trust connected a multitude of antithetic NFTs to immersively prosecute with the MetalCore world. In-game items specified arsenic warfare machines, vehicles, onshore and cogwheel are each disposable arsenic NFTs which tin beryllium traded connected the MetalCore marketplace. This is Merit Circle’s effort to prosecute successful play-to-earn games that span the prime spread betwixt accepted games and blockchain games. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)