Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

It was a oversea of reddish successful crypto markets connected Wednesday arsenic stablecoin woes kept immoderate traders connected edge.

Terra's LUNA token plunged for the 3rd consecutive day, declining by arsenic overmuch arsenic 96% implicit the past 24 hours. LUNA was meant to beryllium a buffer against volatility for the stablecoin TerraUSD (UST), but it has succumbed to utmost selling pressure. The Luna Foundation Guard moved the entirety of its reserves to bitcoin exchanges to support its UST stablecoin’s 1:1 dollar peg connected Wednesday.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Further, the European Commission is considering a prohibition connected large-scale stablecoins, which person go wide utilized successful spot of fiat currency, according to a document seen by CoinDesk.

Bitcoin (BTC) declined by arsenic overmuch arsenic 6% implicit the past 24 hours, compared with a 9% diminution successful ether (ETH) and a 30% diminution successful Solana's SOL token. Bitcoin is outperforming astir alternate cryptos (altcoins), which typically occurs successful a down marketplace due to the fact that of its little hazard illustration comparative to smaller tokens.

●Bitcoin (BTC): $29,155, −6.40%

●Ether (ETH): $2,104, −10.31%

●S&P 500 regular close: $3,935, −1.65%

●Gold: $1,853 per troy ounce, +0.71%

●Ten-year Treasury output regular close: 2.92%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

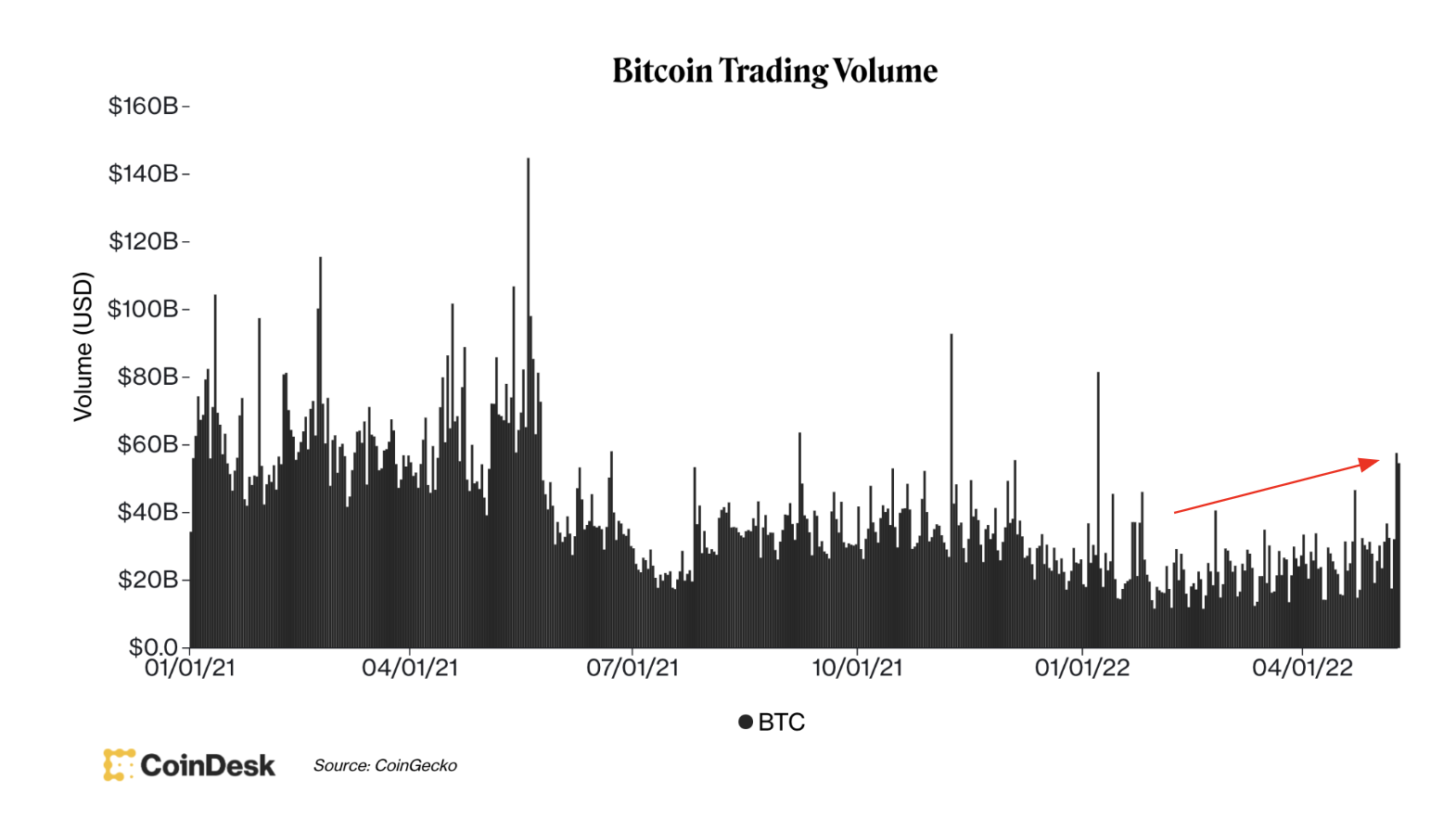

Bitcoin's trading measurement has ticked higher implicit the past fewer days, albeit by little than successful erstwhile spikes. That could beryllium an archetypal motion of capitulation arsenic BTC stabilizes astatine astir $30,000.

"The measurement surge is particularly absorbing considering the dwindling spot volumes we person seen during the latest month, arsenic April saw the lowest bitcoin spot volumes since past summer," Arcane Research wrote successful a study earlier this week. "The caller uptick successful volatility seems to person woken up traders."

Bitcoin's trading measurement (CoinDesk, CoinGecko)

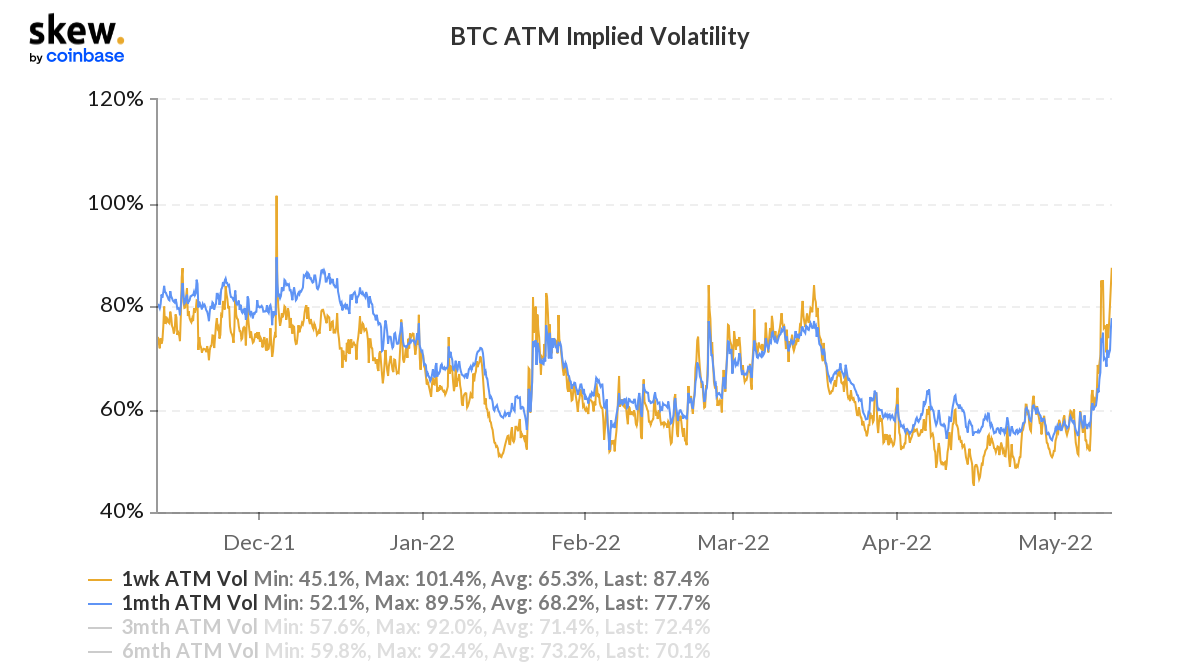

BTC's front-month implied volatility besides spiked to its highest level since March. Traders are expecting greater terms swings implicit the abbreviated term, though volatility spikes thin to beryllium short-lived.

QCP Capital, a Singapore-based crypto trading firm, noted ample amounts of enactment request from its enactment trading table this week, which pushed BTC and ETH hazard reversals (calls minus puts) adjacent much antagonistic from -8% to -15%. QCP expects much volatility implicit the abbreviated term.

Bitcoin's implied volatility (Skew)

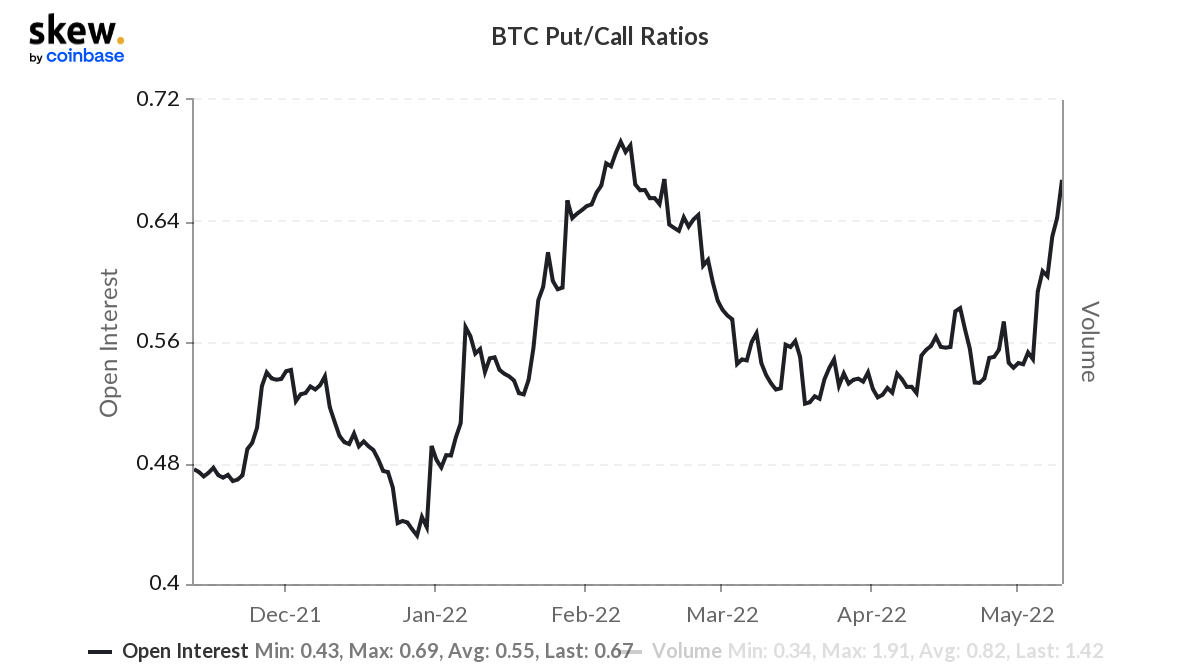

The illustration beneath shows a emergence successful BTC's put/call ratio, which suggests bearish sentiment among enactment traders. The ratio is astatine its highest level since February, which preceded an upswing successful price.

Further, unfastened involvement successful bitcoin's perpetual swaps marketplace surged to a caller precocious connected Tuesday. That suggests an summation successful leverage among derivative traders, which typically leads to crisp terms swings – a alleviation rally oregon breakdown.

Still, the outgo to money agelong positions (funding rate) remains neutral, which means immoderate traders are inactive consenting to summation vulnerability to BTC contempt the existent stress. Typically, backing rates illness during sell-offs.

Bitcoin's put/call ratio (Skew)

Terra to the ground: The Terra blockchain’s autochthonal token, LUNA, plunged to arsenic debased arsenic $1, shedding 96% of its worth successful conscionable a day. LUNA is expected to sorb terms shocks of the blockchain algorithmic stablecoin, TerraUSD (UST), but UST’s nonaccomplishment to regain its $1 peg made LUNA virtually worthless. Some traders betted connected LUNA to retrieve connected the futures market, but aft prices continued nosediving, liquidations amounted to $106 million. Read much here

Contagion spreads to algos: UST’s situation puts immense unit connected different algorithmic stablecoins. Neutrino USD (USDN), the stablecoin of the Waves decentralized finance protocol, seems to beryllium the archetypal to shake: USDN dropped beneath 80 cents connected definite exchanges from its $1 peg, portion the protocol's autochthonal token, WAVES, fell by 26% successful a day. Delphi Digital reported earlier this week that the FRAX, FEI and USDN stablecoins are facing the aforesaid information arsenic UST due to the fact that of their similarity successful plan and anemic points. Read much here

Stepn up: Stepn, a "move-to-earn" exertion connected the Solana (SOL) blockchain that allows users to get cryptocurrency rewards from walking oregon jogging, is getting traction successful digital-asset markets. The fittingness app has grown to much than 300,000 regular progressive users successful a fewer months, portion its autochthonal token GMT is traded astatine 17 times its motorboat terms successful March. “This really has worth successful the agelong run,” Fundstrat’s Will McEvoy said. Read much here

Listen 🎧: The CoinDesk Markets Daily podcast takes a heavy dive into the Fed and caller marketplace volatility.

Most integer assets successful the CoinDesk 20 ended the time lower.

Biggest Gainers

There are nary gainers successful CoinDesk 20 today.

Biggest Losers

`

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)