Bitcoin (BTC) retreated from a precocious of $47,431 connected Monday arsenic bullish sentiment waned.

Meanwhile, WAVES fell by 25% aft USDN, an algorithmic stablecoin of the Waves ecosystem, mislaid its U.S. dollar peg. Last week, respective radical connected Twitter accused the Waves squad of manipulating the terms of its autochthonal token done its decentralized finance (DeFi) lending level Vires.finance.

Just launched! Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

Despite the existent pullback, immoderate analysts stay optimistic astir bitcoin's aboriginal terms direction, pointing to improving blockchain data.

"BTC is flowing retired of exchanges astatine a complaint of implicit 96,000 BTC per month, which means beardown accumulation is taking place," Glassnode, a crypto information provider, wrote successful a blog post connected Monday. Both tiny and large-size holders person been accumulating bitcoin, particularly aft the Luna Foundation Guard (LFG) purchased much than 30,000 BTC implicit the past week (track LFT reserve purchases here).

Still, the emergence successful BTC request volition request to beryllium sustained to enactment the terms recovery. "A breakout of the 200-day moving average is required to corroborate bullish sentiment," Alex Kuptsikevich, an expert astatine FxPro, wrote successful an email. "Breaking retired of the $45K-48K scope could awesome the commencement of a broader inclination successful the absorption of the breakout."

●Bitcoin (BTC): $45,907, −1.10%

●Ether (ETH): $3,488, +0.12%

●S&P 500 regular close: $4,583, +0.81%

●Gold: $1,935 per troy ounce, +0.83%

●Ten-year Treasury output regular close: 2.41%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Bitcoin's trading measurement crossed spot exchanges ticked little implicit the past fewer days, according to CoinDesk data. There has been a persistent diminution successful trading enactment since the Feb. 24 terms dip toward $34,500, indicating immoderate uncertainty among marketplace participants contempt the caller terms rally.

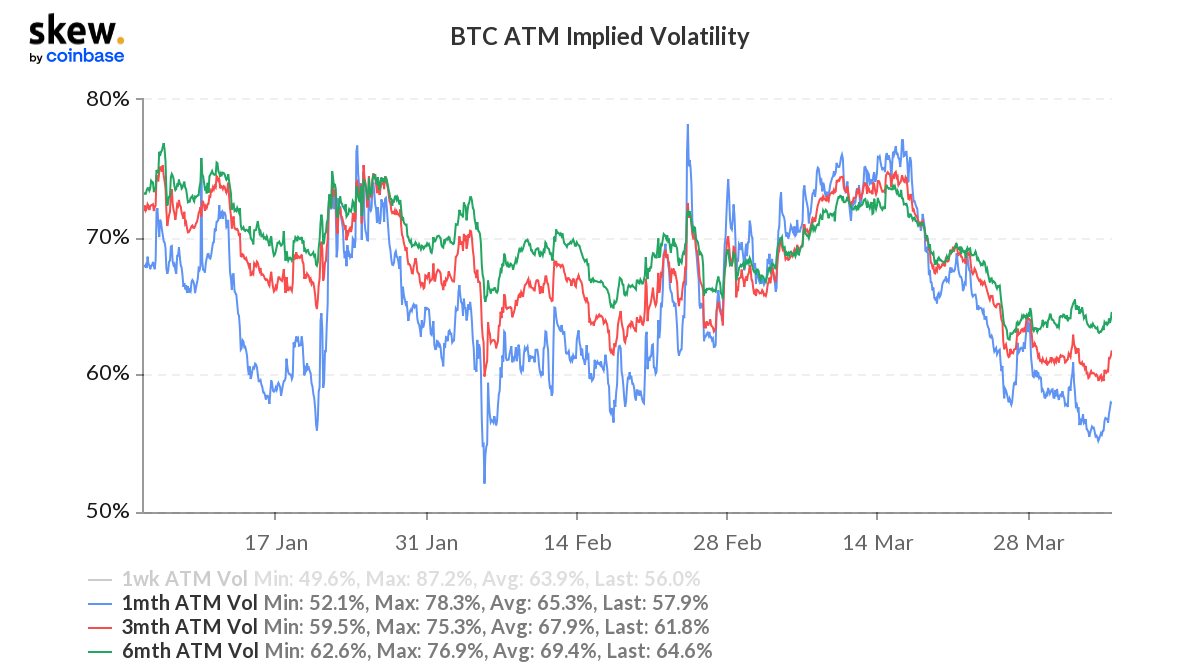

Similarly, volatility successful the bitcoin options marketplace is besides trending lower, portion immoderate traders person positioned themselves for a bullish tally successful the spot price.

"Our condemnation presumption present is to beryllium abbreviated volatility arsenic macroeconomic factors spot unit connected markets portion the LFG [buying] supports the market," QCP Capital, a Singapore-based crypto trading firm, wrote successful a Telegram announcement. "We deliberation crypto prices volition grind higher toward the 2nd fractional of the twelvemonth and immoderate dip volition beryllium met with assured buying."

Bitcoin's implied volatility (Skew, Coinbase)

Ether, the world's second-largest cryptocurrency by marketplace cap, is up by 28% implicit the past month, compared with a 14% emergence successful bitcoin.

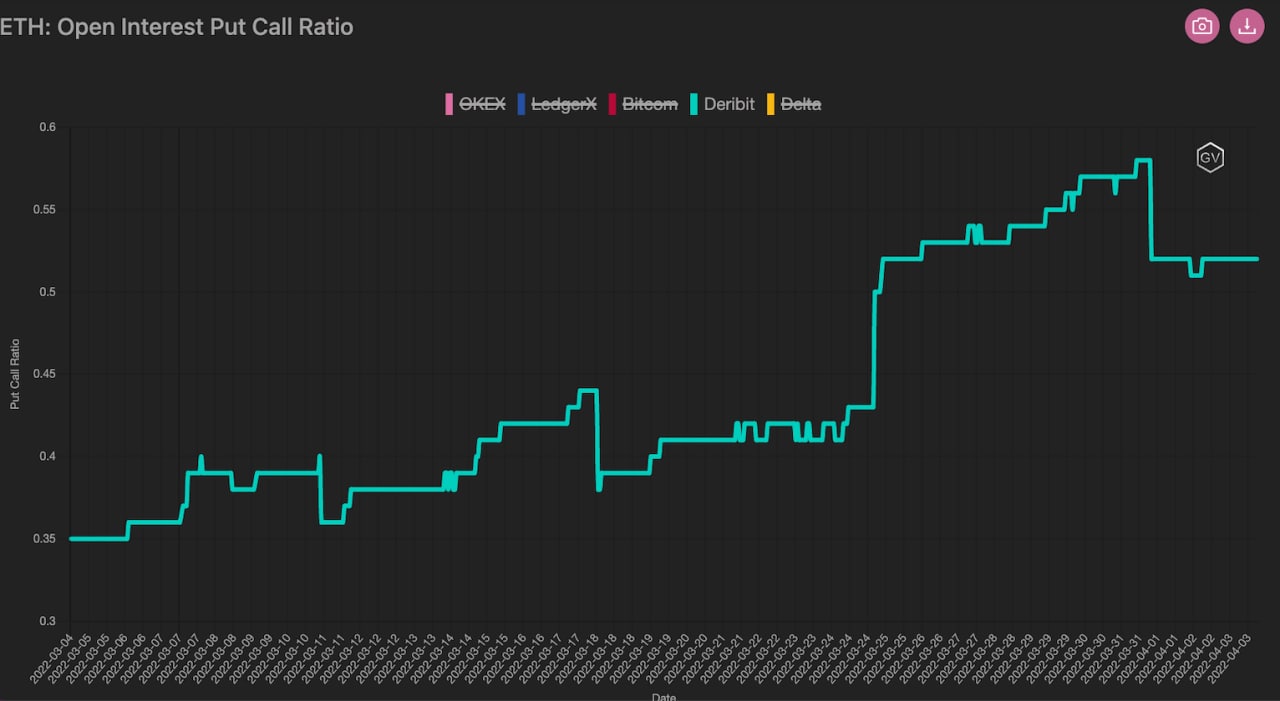

Further, ETH's put/call ratio importantly accrued astatine the extremity of March, which means traders began to merchantability acold out-of-the-money downside protection. The much antagonistic skew successful ETH presents an accidental for immoderate traders, according to Gregoire Magadini, CEO of Genesis Volatility.

"The seven-day enactment skew is astir -8 points, portion BTC is lone -4 points, contempt the wide at-the-month implied volatility dispersed betwixt ETH and BTC being alternatively close," Magadini wrote successful a connection to CoinDesk. "For those looking to bargain volatility, this means the short-term ETH calls are precise inexpensive compared with akin BTC calls."

Ether's put/call ratio (Genesis Volatility)

This illustration shows the ETH/BTC terms ratio, which is approaching archetypal absorption astatine 0.076. The ratio is overbought connected the regular chart, which typically precedes a little pullback. The adjacent large absorption level is astatine 0.082, which is astir 8% away.

The ETH/BTC regular terms ratio illustration shows adjacent absorption levels (Damanick Dantes/CoinDesk, TradingView)

Thousands of ether from Ronin exploit moved to Tornado Cash: The exploiter down Ronin’s unprecedented $625 cardinal span attack from past week seemingly moved 1,400 ethers (ETH) to privateness instrumentality Tornado Cash connected Monday greeting during the Asia trading day, and past the remaining 600 ETH during the European trading day, on-chain information connected to the exploit’s addresses show. Read much here.

Pudgy Penguins NFT collection’s $2.5 cardinal sale: The Pudgy Penguins non-fungible token (NFT) task is nether caller enactment aft the adjacent of a long-awaited 750 ETH ($2.5 million) sale. A radical led by Pudgy Penguins holder and Los Angeles-based entrepreneur Luca Netz volition bargain power of the project, on with royalties, from the archetypal 4 co-founders of the project, according to radical progressive with the deal. Read much here.

DeFi lender Inverse Finance exploited for $15.6 million: Ethereum-based lending level Inverse Finance (INV) said Saturday it suffered an exploit, with an attacker netting $15.6 cardinal worthy of stolen cryptocurrency. According to Inverse, the attacker targeted its Anchor (ANC) wealth marketplace – artificially manipulating token prices to get loans against highly debased collateral. This is the 3rd multimillion-dollar hack of a decentralized finance (DeFi) level that made headlines past week. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)