Bitcoin (BTC) traded higher connected Wednesday aft U.S. President Biden issued a long-awaited enforcement bid connected crypto, which did not enforce caller regulations connected the industry.

Instead, the executive order directs national agencies to amended pass astir their enactment successful the integer plus sector. It does not laic retired circumstantial positions the medication wants agencies to adopt, according to CoinDesk's Nikhilesh De. Still, the bid could pb to further regularisation successful the future.

"The bid seems comparatively benign, hence giving the marketplace immoderate clarity," Marcus Sotiriou, an expert astatine the U.K.-based integer plus broker GlobalBlock, wrote successful an email to CoinDesk. "As galore investors had prepared for the downside risks of this lawsuit by waiting connected the sidelines, we are seeing galore bargain bitcoin backmost successful what appears to beryllium a spot-driven rally."

"A twelvemonth ago, bitcoin holders were acrophobic of regulation, and present the U.S. authorities sees the worth and semipermanent prospects for innovation and opportunity," Edward Moya, an expert astatine Oanda, told CoinDesk. "Regulation is viewed arsenic a affirmative for crypto. Large parts of the crypto manufacture request to get cleaned up and that should hap erstwhile crypto companies person regulatory clarity."

Bitcoin roseate arsenic overmuch arsenic 10% pursuing the merchandise of the enforcement order, and traded supra $40,000 implicit the past 24 hours. Meanwhile, ether (ETH) roseate astir 5% implicit the past 24 hours. Equities were besides higher connected Wednesday, portion accepted harmless havens specified arsenic golden and the U.S. dollar declined.

●Bitcoin (BTC): $41,896, +8.60%

●Ether (ETH): $2,697, +5.39%

●S&P 500 regular close: $4,278, +2.57%

●Gold: $1,997 per troy ounce, −2.09%

●Ten-year Treasury output regular close: 1.95%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

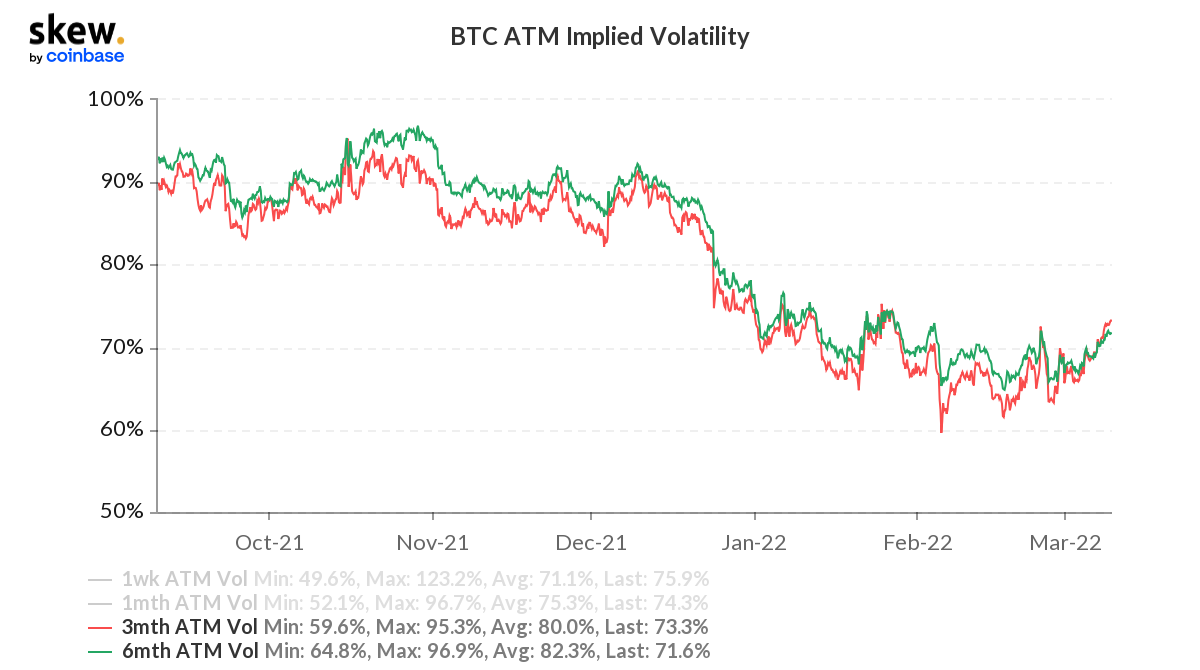

Implied volatility successful the bitcoin options marketplace is starting to emergence from utmost lows implicit the past fewer days. That could constituent to greater terms swings extracurricular of the $30,000-$40,000 BTC terms range, particularly up of the U.S. Federal Reserve's two-day policy meeting connected March 15-16.

QCP Capital, a Singapore-based crypto trading firm, noticed accrued enactment successful short-term BTC and ETH volatility markets, with important request during the Asia trading day. "We managed to instrumentality immoderate nett connected our March 18 agelong volatility position," QCP wrote successful a Telegram announcement. Long volatility is simply a trading strategy that usually involves buying options to nett from a greater than expected emergence successful realized volatility.

Bitcoin implied volatility (Skew)

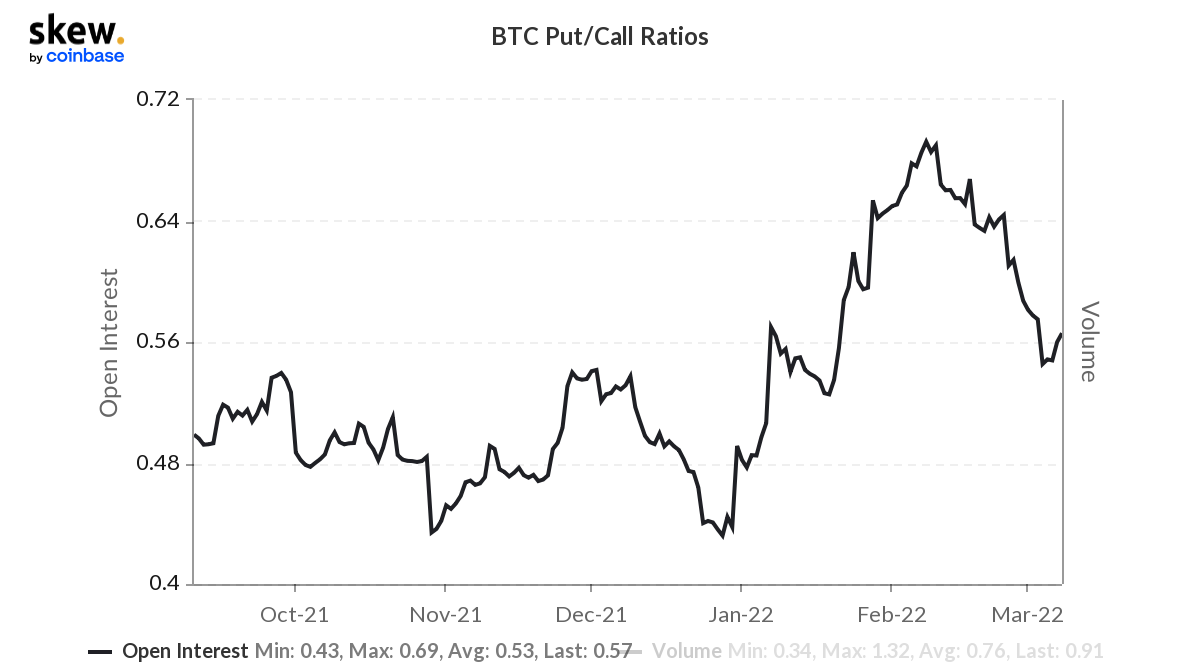

Sentiment has been little bearish among bitcoin enactment traders, evidenced by the diminution successful the put/call ratio implicit the past month. Still, determination has been a flimsy uptick successful the ratio successful caller days, indicating immoderate caution among traders.

Other indicators amusement immense bearish sentiment, which means traders are inactive skeptical contempt caller terms jumps. For example, "option buyers are consenting to wage higher premiums to hedge their expected terms diminution risk," Deribit, a crypto options and futures exchange, wrote successful a blog post.

During times of marketplace accent (such arsenic a war), however, sentiment tin fluctuate wildly.

"The interaction of section wars and consequent bid of events connected the marketplace has shown important “shortwave” characteristics: The volatility of options adjacent the expiration day jumps up and down rapidly, portion the volatility of options farther distant from the expiration day remains comparatively stable," Deribit wrote.

Bitcoin put/call ratio (Skew)

LUNA surges 25% to caller all-time precocious of $104: Terra’s LUNA token roseate to arsenic precocious arsenic $104.58 connected Wednesday morning, topping a erstwhile all-time grounds of $103.34 notched successful December. According to information from CoinMarketCap, LUNA was up 25% implicit the erstwhile 24 hours. The token precocious pulled backmost a spot to astir $99. LUNA has present much than doubled successful terms since putting successful a 2022 debased of astir $44 successful precocious January. Its existent valuation conscionable shy of $38 cardinal makes it the sixth-largest cryptocurrency by marketplace cap, according to CoinDesk’s Tracy Wang. Read much here.

Market headdress of gold-backed cryptos surpass $1B arsenic yellowish metallic nears grounds high: Crypto tokens tied to gold, a accepted ostentation hedge, proceed to spot coagulated maturation arsenic the specter of stagflation hangs implicit the planetary economy. Taken together, the marketplace capitalization of the apical gold-backed coins – PAX golden (PAXG) and tether golden (XAUT) – roseate supra $1 cardinal aboriginal this week, marking a 60% summation connected a year-to-date basis, according to information provided by Arcane Research. The full marketplace capitalization of each cryptocurrencies has declined 17.8% to $1.80 trillion this year, per illustration level TradingView, according to CoinDesk’s Omkar Godbole. Read much here.

EmpireDAO is gathering a WeWork for Web 3: In a DAO scenery often headlined by promises of real-world acquisitions, EmpireDAO has announced what fewer successful the abstraction person yet to propulsion disconnected – opening its doors. The decentralized autonomous organization, founded by entrepreneur Mike Fraietta successful October, aims to supply coworking abstraction for companies and individuals gathering Web 3 projects. It opened its archetypal carnal determination connected Tuesday successful New York City, according to CoinDesk’s Cheyenne Ligon and Eli Tan. Read much here.

Digital assets successful the CoinDesk 20 ended the time higher.

There are nary losers successful CoinDesk 20 today.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)