Most cryptocurrencies traded little connected Thursday, indicating a intermission successful bullish sentiment.

Bitcoin (BTC) dipped beneath $47,000, though technicals suggest enactment astir $43,000 could stabilize the pullback. The cryptocurrency besides saw a beardown uptick successful short-term volatility implicit the past 24 hours, akin to what occurred during bitcoin's breakout supra $45,000 past week, according to information provided by Skew.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why. Coming April 4.

On Thursday, European Union lawmakers voted successful favour of arguable measures to outlaw anonymous crypto transactions. The proposals are intended to widen anti-money laundering (AML) requirements that use to accepted payments implicit EUR 1,000 ($1,114) to the crypto sector. BTC fell by 2% wrong minutes arsenic the ballot came through.

Meanwhile, alternate cryptocurrencies (altcoins) underperformed connected Thursday, suggesting a little appetite for hazard among crypto traders. For example, ether (ETH) declined by arsenic overmuch arsenic 4% implicit the past 24 hours, and AAVE mislaid arsenic overmuch arsenic 9%, compared with a 3% dip successful BTC implicit the aforesaid period.

The S&P 500 was besides little connected Thursday and snapped a four-day winning streak. Traditional harmless havens specified arsenic golden and the U.S. dollar rose, portion the 10-year Treasury output continued to diminution from Tuesday's precocious of 2.5%.

Still, existent pullbacks crossed speculative assets could beryllium limited. Historical information suggests further upside successful April and May, albeit with greater volatility due to the fact that of ongoing macroeconomic and geopolitical risks.

●Bitcoin (BTC): $45,558, −3.13%

●Ether (ETH): $3,286, −3.25%

●S&P 500 regular close: $4,530, −1.56%

●Gold: $1,942 per troy ounce, +0.41%

●Ten-year Treasury output regular close: 2.33%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Adding bitcoin to the mix

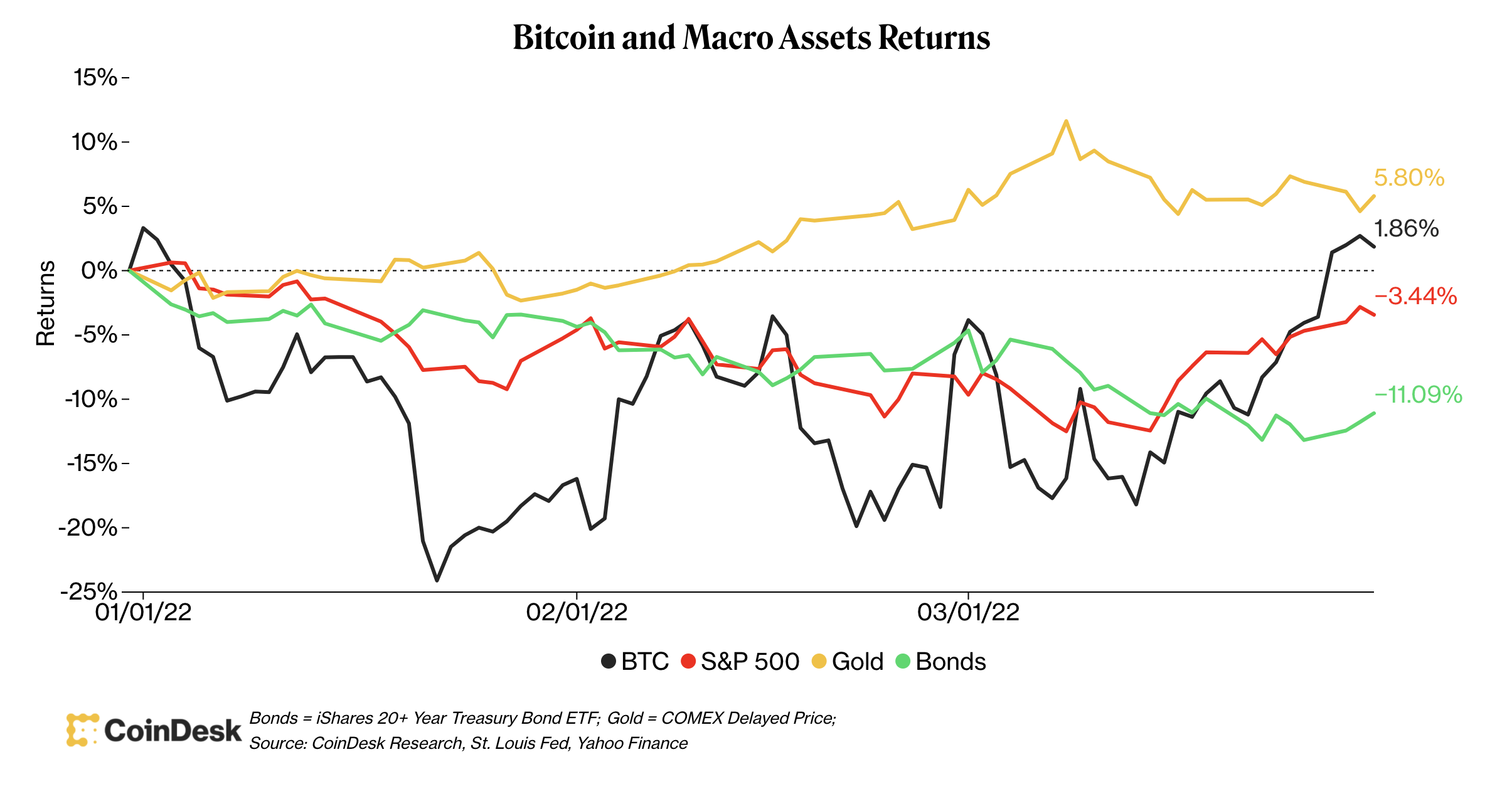

Bitcoin is outperforming the S&P 500 truthful acold this year, albeit with higher volatility.

On a risk-adjusted instrumentality basis, however, bitcoin is somewhat beneath the S&P 500 implicit the past 30 days, according to information from IntoTheBlock. Generally, implicit time, crypto investors are compensated for higher volatility successful the signifier of higher returns versus accepted equities.

For immoderate investors, diversification has been challenging implicit the past fewer months due to the fact that of bitcoin's rising correlation with stocks. Further, antagonistic returns successful Treasury bonds and stocks contributed to a little appetite for hazard among planetary investors.

Still, golden and different commodities outperformed implicit the past 3 months, which is emblematic during times of rising volatility and higher inflation.

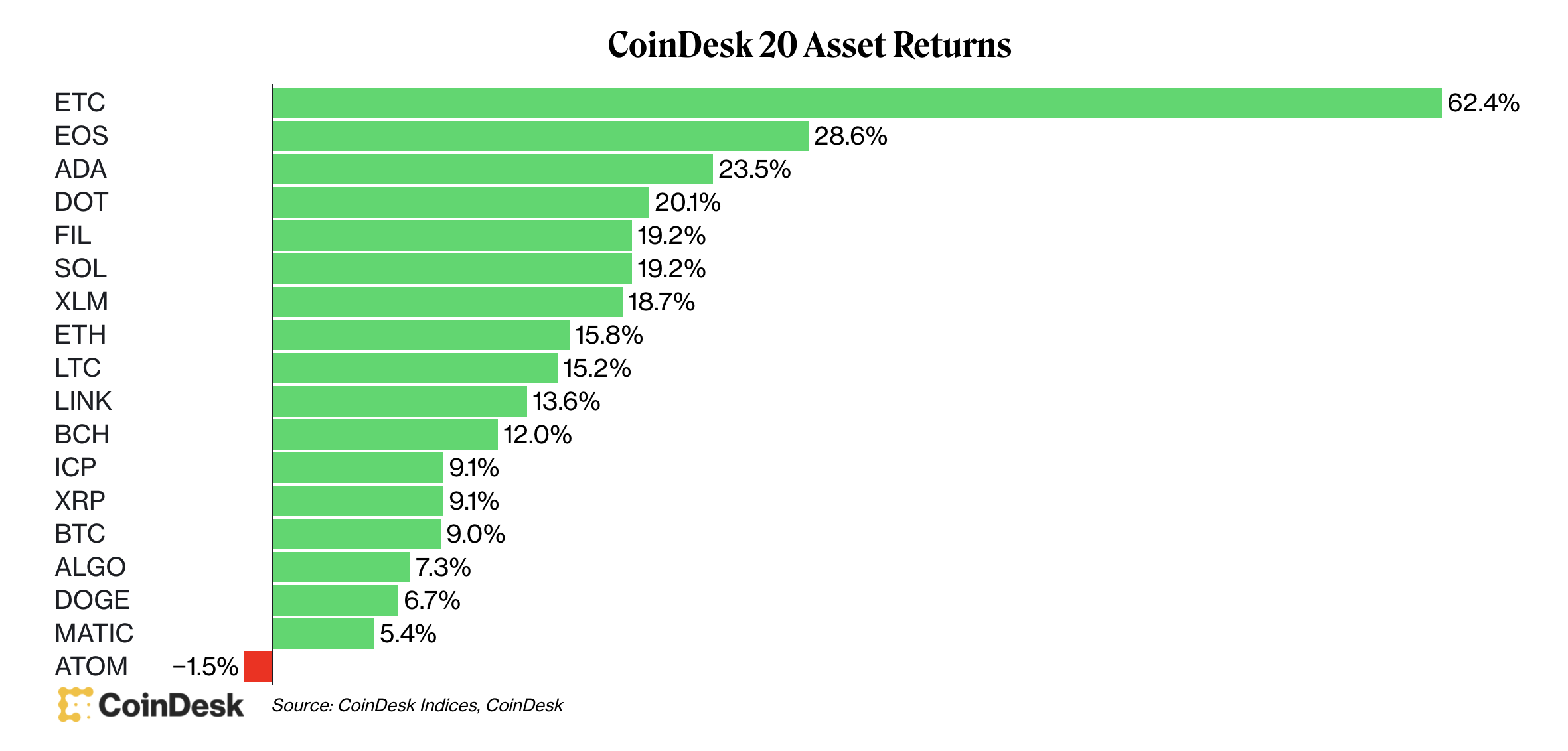

The illustration beneath shows returns crossed the CoinDesk 20 successful March. The CoinDesk 20 filters from the larger beingness of thousands of cryptocurrencies and integer assets by trading measurement and marketplace capitalization.

ETC, the autochthonal cryptocurrency of Ethereum Classic, a blockchain task that was created successful 2016 erstwhile Ethereum’s blockchain divided into 2 abstracted chains, posted the highest instrumentality successful the CoinDesk 20 successful March. Meanwhile, ETH was up 15% successful March, compared with a 9% summation successful BTC implicit the aforesaid period.

Typically, altcoins outperform successful a rising marketplace due to the fact that of their higher hazard illustration comparative to BTC.

Seasonal spot successful April and May

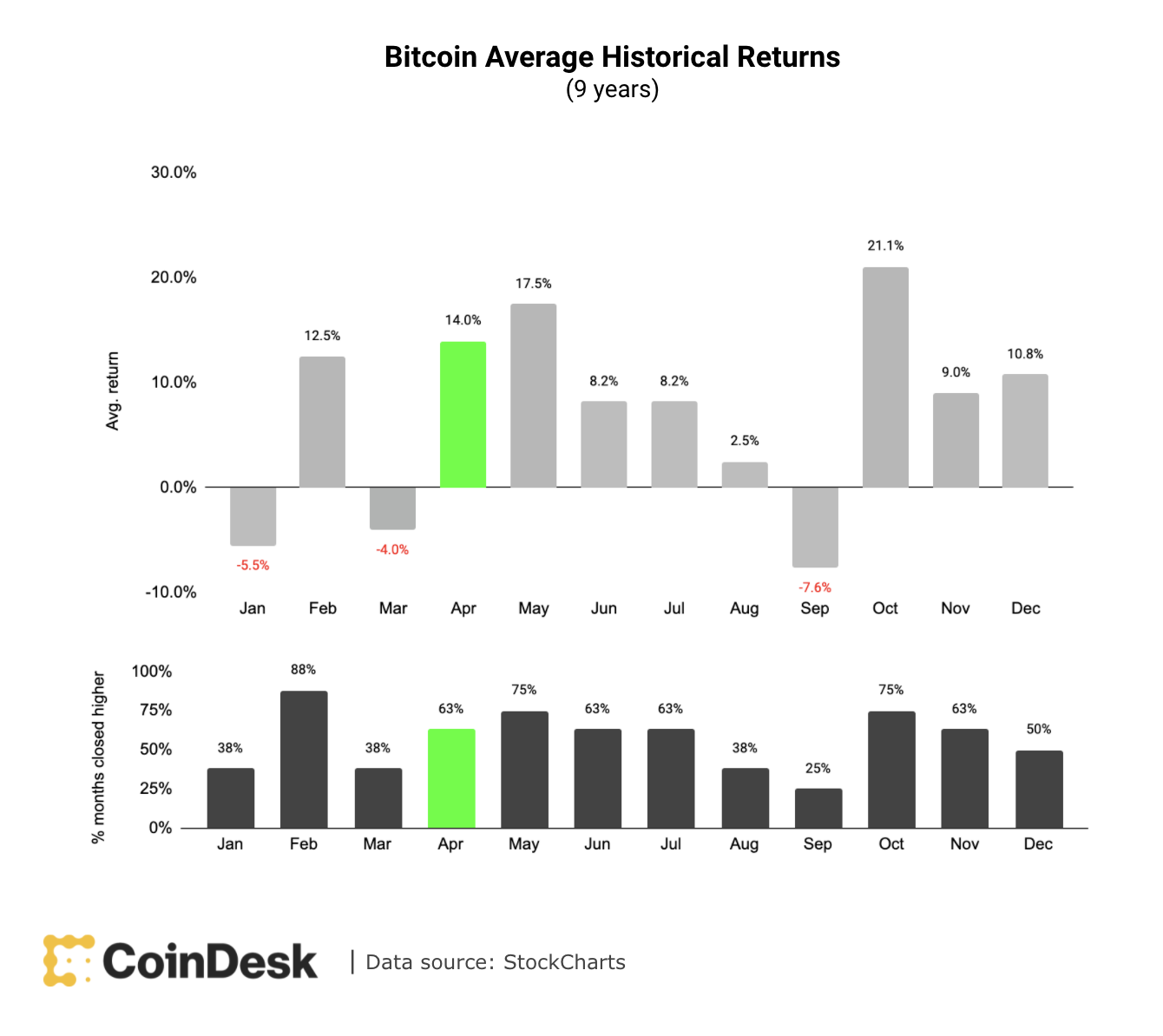

So far, bitcoin's affirmative instrumentality successful March is good up of its seasonal norm. On average, March is typically a anemic period for BTC, albeit with a debased probability. Instead, April and May person a beardown probability of affirmative returns.

The illustration beneath shows bitcoin's mean humanities returns alongside the percent of times erstwhile BTC produced a affirmative instrumentality by month. Still, humanities returns are nary warrant of aboriginal returns, particularly during times of warfare and unprecedented monetary policy.

Iconic launches World's First EOS ETP: The Iconic Physical EOS ETP volition beryllium listed and statesman trading connected European banal markets successful the coming weeks. The ETP volition beryllium a elemental and cost-effective mode for investors to summation vulnerability to EOS, the blockchain protocol based connected the cryptocurrency EOS, connected European banal markets with a full disbursal ratio of 0.95%, according to an email from Iconic Funds.

Shiba inu's metaverse volition diagnostic much onshore plots: Developers down fashionable meme cryptocurrency shiba inu (SHIB) person unveiled details of their virtual world task "SHIB: The Metaverse," announcing 100,595 onshore plots, immoderate of which volition stay private. Developers person decided to usage Ethereum's autochthonal cryptocurrency, ether, arsenic a onshore pricing token, according to CoinDesk’s Omkar Godbole. Read much here.

BNY Mellon to custody assets backing Circle's USDC stablecoin: BNY Mellon, 1 of the oldest U.S. banks and 1 of the archetypal to thin into custodying integer assets, volition service arsenic the “primary custodian” for the reserve assets down the USDC stablecoin, its issuer Circle Internet Financial said Thursday. The narration apt carries publicity upside for some fiscal brands, according to CoinDesk’s Danny Nelson. Read much here.

Digital assets successful the CoinDesk 20 ended the time lower.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)