Cryptocurrencies are starting to stabilize aft falling successful January, and immoderate analysts expect prices to retrieve this month, particularly arsenic respective alternate cryptocurrencies (altcoins) outperformed bitcoin implicit the past week.

Bitcoin was astir level implicit the past 24 hours, versus a 2% summation successful ether (ETH) and a 10% summation successful SOL implicit the aforesaid period. Metaverse tokens specified arsenic MANA and SAND failed to prolong Monday's rally arsenic some tokens declined arsenic overmuch arsenic 5% implicit the past 24 hours.

On Tuesday, Indian Finance Minister Nirmala Sitharaman announced a 30% tax connected immoderate income from the transportation of virtual integer assets, a archetypal for the nation. "India is yet connected the way to legitimizing the crypto assemblage successful India," said Nischal Shetty, co-founder and CEO of WazirX, 1 of India’s largest crypto exchanges. The announcement didn't trigger a important marketplace response.

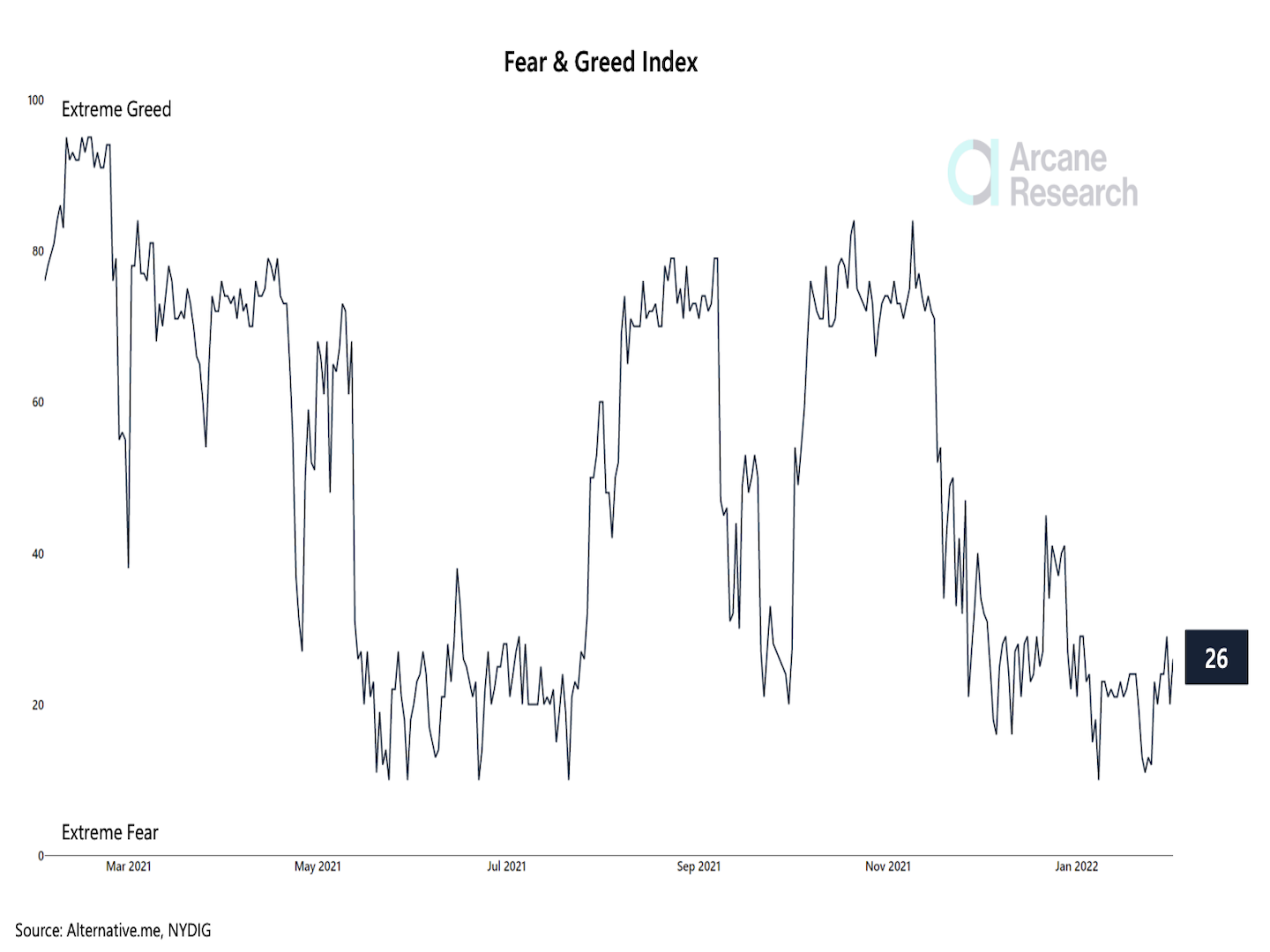

Analysts expect regulatory headwinds to slice implicit the abbreviated term, which could boost capitalist sentiment. For example, the crypto Fear & Greed Index is starting to emergence from utmost lows, indicating much bullish activity. And successful the bitcoin futures market, determination are signs of a pending abbreviated squeeze, which occurs erstwhile prices unexpectedly rise, forcing short sellers to exit positions.

For now, immoderate buyers proceed to instrumentality connected dips. MicroStrategy (Nasdaq: MSTR), the bundle institution that’s taken to accumulating bitcoin, said it bought astir 660 bitcoins for astir $25 cardinal betwixt Dec. 30 and Jan. 31.

Technical indicators suggest a imaginable emergence successful BTC could beryllium constricted astatine the $40,000-$45,000 range arsenic semipermanent momentum weakens.

●Bitcoin (BTC): $38587, +0.35%

●Ether (ETH): $2775, +3.35%

●S&P 500 regular close: $4546, +0.68%

●Gold: $1801 per troy ounce, +0.31%

●Ten-year Treasury output regular close: 1.80%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

The crypto Fear & Greed Index roseate from "extreme greed" territory past week, which means bearish sentiment has started to fade. The scale is present adjacent its July 2020 lows, which preceded a betterment successful crypto prices.

"On Sunday, the scale concisely deed 30 - the highest level successful 2022," Arcane Research wrote successful a Tuesday report. Still, immoderate analysts similar to spot an summation successful trading measurement to corroborate a displacement from bearish to bullish sentiment.

"Bitcoin is presently warring with the $40,000 resistance, and if it manages to interruption it, we mightiness spot a akin measurement detonation arsenic erstwhile it dropped beneath this level. Until then, trading enactment mightiness beryllium muted arsenic momentum traders often hold for circumstantial terms enactment earlier making directional bets," Arcane Research wrote.

Crypto fearfulness & greed scale (Arcane Research; Alternative.me)

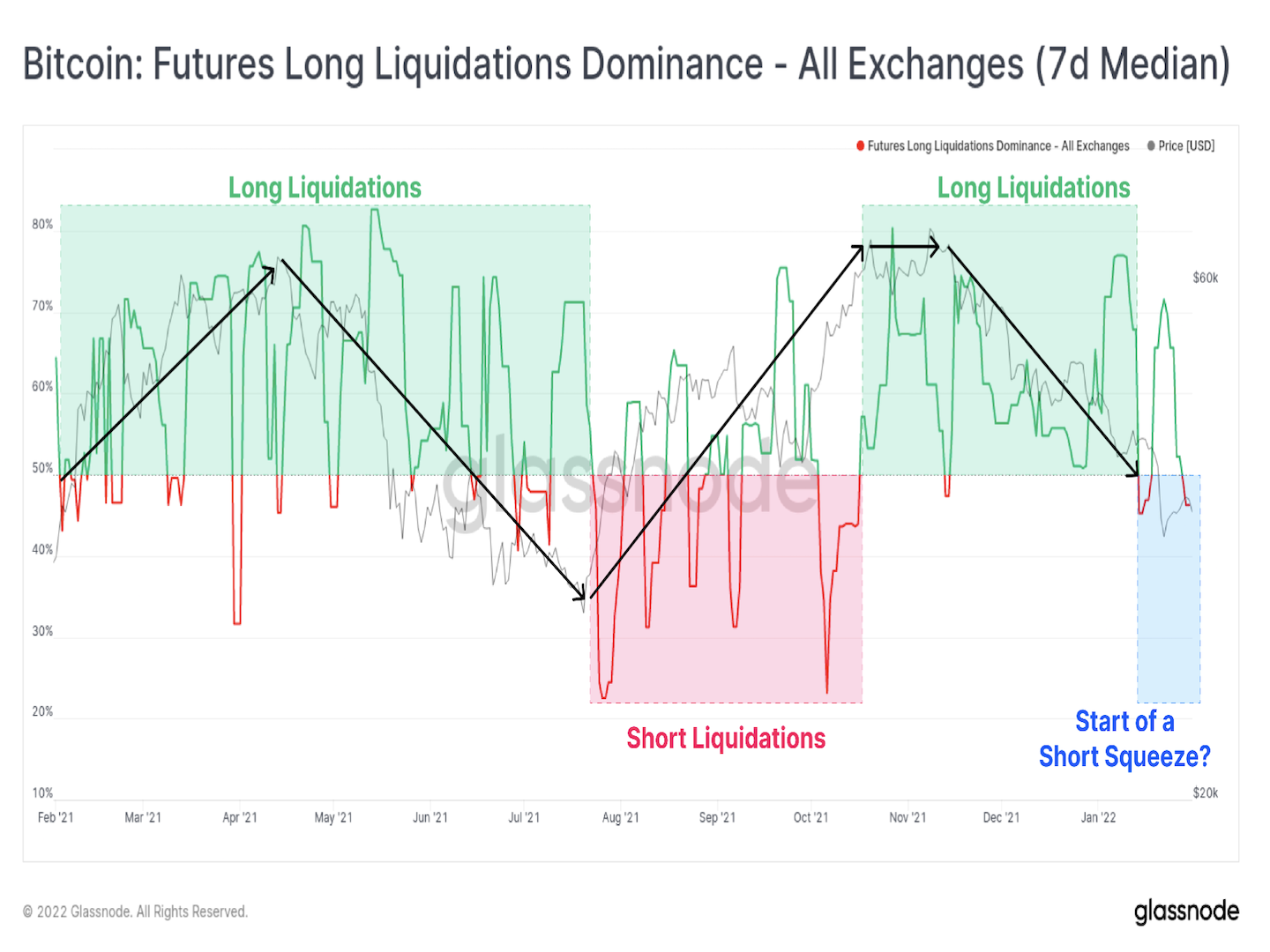

Bitcoin volition request to marque a decisive interruption supra $40,000 successful bid to trigger abbreviated liquidations. The illustration beneath shows the caller diminution successful agelong liquidations, which typically precede abbreviated liquidations (or a short squeeze) arsenic the terms of BTC recovers.

Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading.

"With precocious negativity, elevated leverage, and an wide abbreviated bias, a tenable statement could beryllium made for a imaginable counter-trend abbreviated compression successful the near-term," Glassnode, a crypto information firm, wrote successful a caller blog post.

Bitcoin futures agelong liquidations dominance (Glassnode)

Litecoin’s pivotal MWEB upgrade is present released: David Burkett, the pb developer down Litecoin’s Mimblewimble Extension Block (MWEB) upgrade arsenic a "RC" (release candidate), has confirmed that MWEB has present been officially released, pursuing an aggravated multiyear process of development, testing, reviewing and auditing, on with the assistance of dozens of cardinal contributors. Once miners person the completed code, they whitethorn statesman signaling for MWEB activation close away. Once a threshold is met, the activation day volition beryllium locked in, and arsenic a result, MWEB volition spell live. This merchandise comes aft Quarkslab, a respected information and codification auditing company, completed a review/audit of the MWEB code. Litecoin’s LTC token was up 5% implicit the past 24 hours. Read much here.

‘Pay’ merchandise connected Solana: Cryptocurrency’s archetypal usage lawsuit – payments – is getting a boost connected the Solana blockchain. New bundle co-developed by Solana Labs intends to assistance merchants judge crypto payments implicit the Solana network. Checkout.com, Circle and Citcon are supporting “Solana Pay,” which made its debut connected Tuesday with integrations with crypto speech FTX and ecosystem wallets Phantom and Slope, according to Danny Nelson. Read much here.

Wonderland laminitis tries to wrapper things up: On Monday, embattled developer Daniele Sestagalli took to Discord to reply questions from the Wonderland protocol assemblage – a rancorous 45 minutes featuring large promises and bluster, but fewer specifics connected however the task volition determination guardant connected leveraging its $325 cardinal treasury to present worth for token holders.

Digital assets successful the CoinDesk 20 ended the time higher.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)