Most cryptocurrencies traded higher connected Friday aft a volatile week.

Equities were besides higher connected Friday, portion gold, a accepted harmless haven asset, traded lower. The rebound successful stocks and the outperformance of respective alternate cryptocurrencies (altcoins) suggests a greater appetite for hazard among investors.

But determination is inactive the imaginable for greater terms swings successful the adjacent term. "Despite the risk-on week for crypto assets, we volition apt brushwood further volatility successful the adjacent term. We stay optimistic that immoderate dips for ETH and BTC are buying opportunities," Sean Farrell, vice president of integer plus strategy astatine FundStrat, wrote successful a Friday email.

●Bitcoin (BTC): $42,243, +2.83%

●Ether (ETH): $2,981, +4.80%

●S&P 500 regular close: $4,463, +1.17%

●Gold: $1,920 per troy ounce, −1.16%

●Ten-year Treasury output regular close: 2.15%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Bitcoin's trading measurement crossed exchanges continued to diminution aft the spike connected Wednesday. Further, the measurement of bargain orders versus merchantability orders successful the futures marketplace was balanced connected Friday, which could mean the existent upswing successful terms lacks conviction.

The mean backing rate, oregon the outgo of holding agelong BTC positions successful the perpetual futures listed connected large exchanges successful the perpetual swaps market, ticked higher, perchance reflecting bullish sentiment.

In different news, the Bored Ape Yacht Club-linked ApeCoin (APE) was up 90% connected its 2nd time of trading, rebounding to implicit $15 aft lows of $6.48 connected Thursday. That's a beardown rebound from an 80% decline connected Thursday.

Ether bounces connected merge progress

Ether's emergence is partially owed to advancement connected the merge of the Ethereum blockchain's mainnet with the Beacon Chain.

Earlier this week, Ethereum merged connected the Kiln testnet up of the blockchain's eventual determination to a proof-of-stake network, with web validators present producing post-merge blocks containing transactions, CoinDesk's Shaurya Malwa wrote (read much here).

"We person seen a corresponding summation successful the fig of progressive validators connected the Beacon Chain from 300,702 astatine the extremity of February to 315,576 arsenic of March 17. That’s a 4.9% summation successful conscionable 17 days compared to 3.9% during the afloat period of February oregon 4.8% during the afloat period of January," David Duong, caput of organization probe astatine Coinbase, wrote successful a Friday newsletter.

From a method perspective, the emergence successful ether has outpaced bitcoin, which could spot further upside implicit the abbreviated term. The ETH/BTC terms ratio held support astatine 0.064 and faces absorption astatine 0.073, which is astir 4% away.

The ETH/BTC terms ratio (Damanick Dantes/CoinDesk, TradingView)

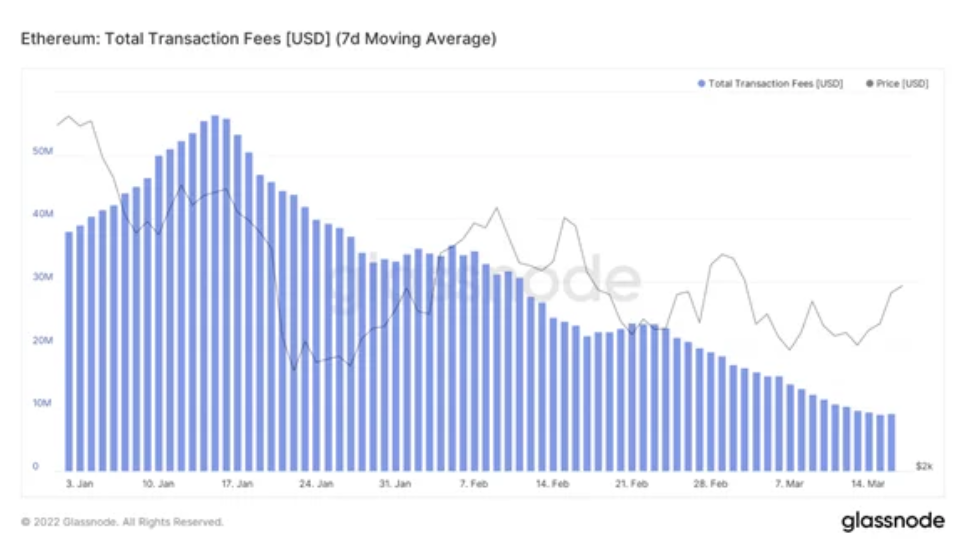

On the flip side, analysts besides noticed slowing enactment connected the Ethereum network.

The illustration beneath shows the caller diminution successful full transaction fees connected the Ethereum blockchain, which means miners are paid less.

One crushed down the slowdown is simply a simplification successful request for costly non-fungible tokens (NFTs), which are predominantly minted and traded connected the Ethereum network, according to FundStrat's Farrell, who besides noted that Google hunt involvement for NFTs peaked successful mid-January.

Farrell besides highlighted a crisp emergence successful ETH's a price-to-sales multiple, which is present supra 50 compared with 17 a fewer months agone – a important leap that could awesome a frothy market.

Ethereum's transaction fees (Glassnode)

ApeCoin Rebound: The ApeCoin's surge connected Friday gives the token a $3.8 cardinal marketplace cap, making it the 33rd-largest coin, according to CoinMarketCap. CoinGecko lists it astatine 66th with a marketplace headdress of $1.7 billion. Read much here.

DeFi 'Super App': Polkadot-based lending protocol Parallel Finance is trying to go a one-stop store for each corners of decentralized concern (DeFi). That effort accelerated Friday with the archetypal motorboat of six products spanning the DeFi spectrum from wallets to staking. “Overall, we’re gathering a ’super app,’ an end-to-end DeFi level for Polkadot to start,” laminitis Yubo Ruan told CoinDesk successful an interview. Read much from CoinDesk's Danny Nelson, here.

Altcoin measurement update: "BTC continues to beryllium the ascendant plus traded by our user lawsuit base," Coinbase wrote successful a newsletter. BTC volumes correspond an overwhelming 32.1% of volumes traded, though ample marketplace headdress tokens specified arsenic AVAX, SOL, LUNA and ADA person seen a pickup successful trading enactment pursuing terms increases. Coinbase besides noticed immoderate hedge funds buying into the caller terms bounce, portion others utilized the accidental to trim risk.

Digital assets successful the CoinDesk 20 ended the time higher.

There were nary losers successful the CoinDesk 20 connected Friday.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)