Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC) continued to commercialized sideways connected Wednesday, indicating a intermission successful bearish sentiment among traders.

However, astir alternate cryptos traded higher connected Wednesday, paring losses from past week. For example, Decentraland's MANA token was up by 3% implicit the past 24 hours and is astir level implicit the past week. Meanwhile, The Sandbox's SAND token roseate by 7% connected Wednesday. MANA and SAND are metaverse tokens, utilized to speech worth successful a virtual crippled setting.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Also, connected Wednesday, the U.S. Federal Reserve published minutes from its committee meeting of earlier this month, which indicated that aggregate 50 ground constituent involvement complaint increases could hap implicit the adjacent respective meetings.

Stocks traded somewhat higher, portion golden and the 10-year Treasury enslaved output ticked little implicit the past 24 hours.

●Bitcoin (BTC): $29,578, +0.68%

●Ether (ETH): $1,950, −0.59%

●S&P 500 regular close: 3,979, +0.95%

●Gold: $1,853 per troy ounce, −0.64%

●Ten-year Treasury output regular close: 2.75%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

Range-bound terms enactment typically results successful a volatile breakout oregon breakdown.

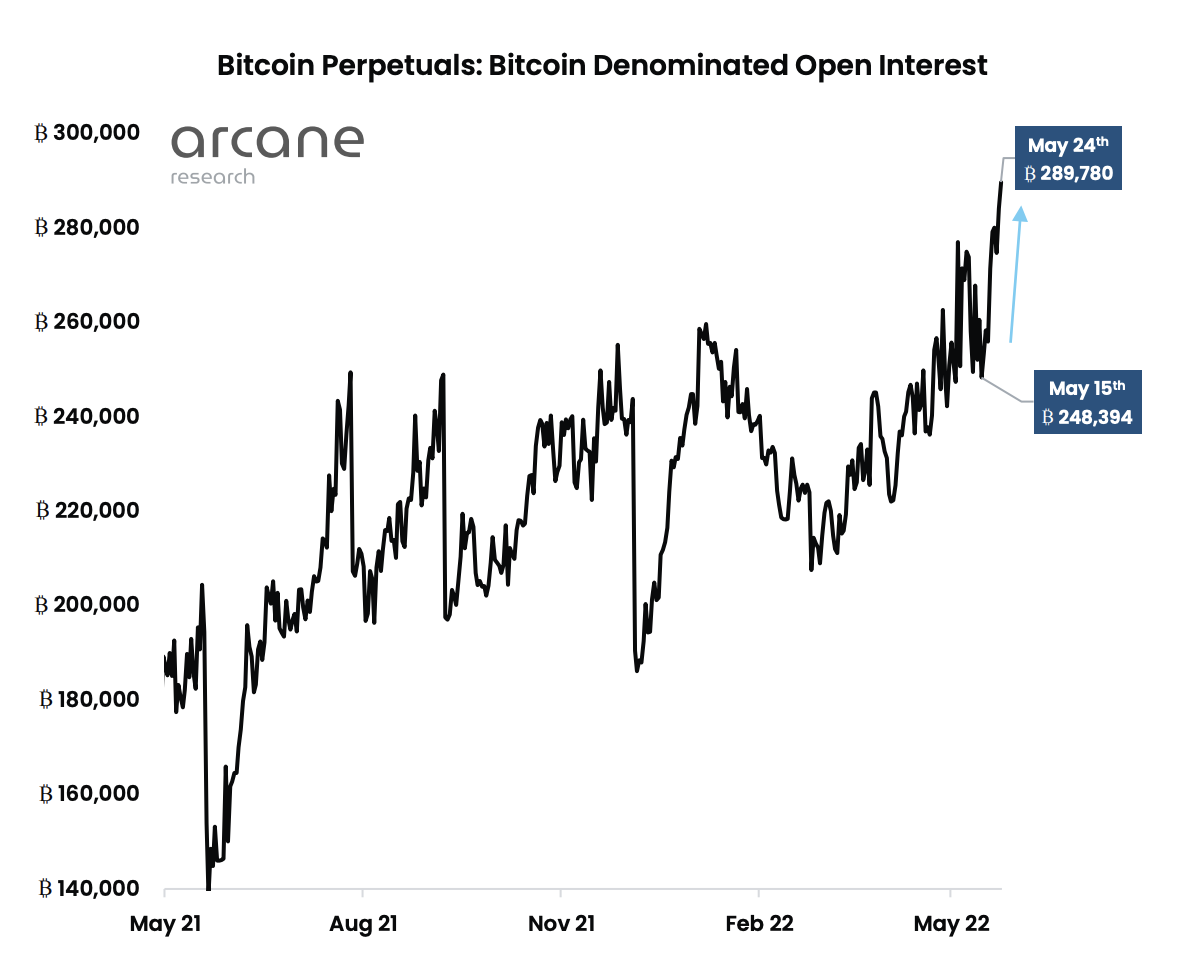

The illustration beneath shows the caller emergence successful unfastened interest, oregon the fig of outstanding contracts, successful the bitcoin perpetual futures market. "Rapid surges successful unfastened involvement thin to foreshadow ample moves successful the market," Arcane Research wrote successful a study this week.

For example, a akin emergence successful unfastened involvement occurred soon earlier a short squeeze successful July of past twelvemonth erstwhile BTC was trading astir $30,000. But a emergence successful unfastened involvement besides coincided with BTC's terms highest of astir $48,000 successful March, and remained elevated during consequent sell-offs successful price, according to Arcane.

Bitcoin perpetual unfastened involvement (Arcane Research)

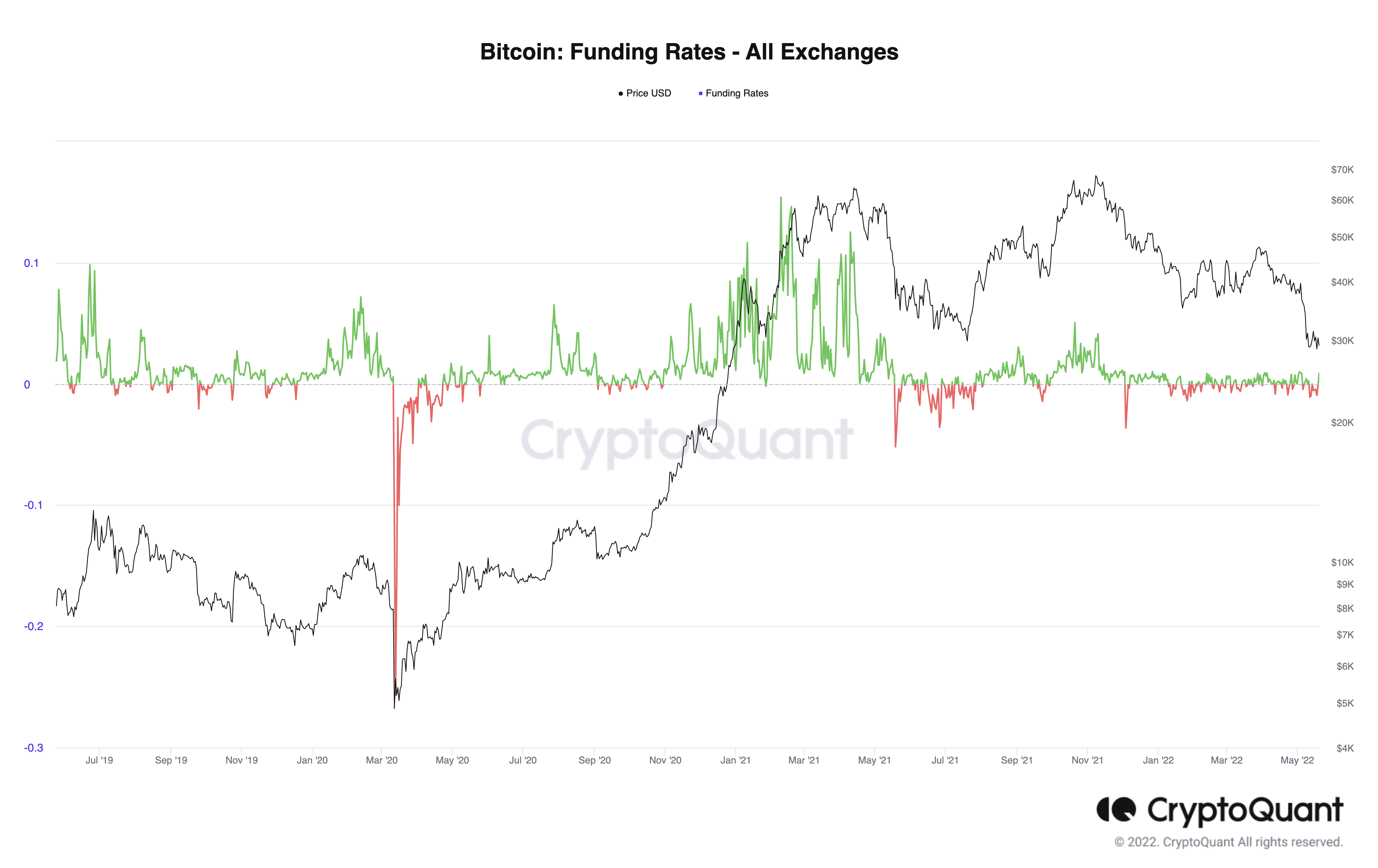

With truthful overmuch uncertainty, traders person been unwilling to explicit a beardown bullish oregon bearish bias. For example, backing rates, oregon the outgo to money agelong and abbreviated positions successful the perpetual futures market, person been moved betwixt neutral and antagonistic implicit the past fewer months. That means traders holding abbreviated positions person been ascendant successful the market, consenting to wage agelong traders to explicit a bearish view.

Still, backing rates person not been profoundly antagonistic successful a while, which typically occurs astir terms bottoms. Likewise, utmost rises successful backing rates person typically occurred astir terms peaks. That suggests the excess speculative enactment that defined the 2020-2021 bull marketplace has receded.

Bitcoin mean backing complaint (CryptoQuant)

Terra 2.0 and LUNA airdrop incoming: Revival plans for the Terra blockchain are taking signifier 2 weeks aft the network’s stablecoin (UST) and its autochthonal token (LUNA) fell to nearly zero. There has been a heated statement astir what's adjacent for Terra, with the assemblage being divided. The decision is simply a motorboat of a parallel “Terra 2.0” aboriginal this week, with a program to compensate LUNA holders gradually implicit clip to mitigate selling pressure. Validators, which tally the blockchain and involvement LUNA by managing staking pools, approved the revival plans, much to the dismay of the Terra community’s majority, including 1 of the largest decentralized concern platforms, Lido, voting against supporting the caller Terra blockchain. Read much here.

ETH merge successful a carnivore market: The second-largest blockchain’s long-anticipated (and delayed) modulation to proof-of-stake whitethorn yet be acceptable successful August. For a while, the upcoming Merge was hyped to nonstop ether’s terms to the satellite – adjacent speculating astir surpassing bitcoin successful an lawsuit called the “flippening.” But marketplace conditions person drastically changed since past (Fed tightening, risk-asset sell-off, war, decades-high ostentation and truthful on), and the Merge’s desired interaction connected the terms whitethorn good crook retired to beryllium lukewarm. Read much here.

Whales ditched Tether to USDC: Terra’s UST nonaccomplishment prompted a shake-up connected the stablecoin market, and ample investors person a caller favorite. Data by CoinMetrics shows that crypto whales – addresses that clasp much than $1 cardinal – connected the Ethereum blockchain near Tether’s USDT for the perceived information of its biggest competitor, USDC. Since Terra’s collapse, USDT saw $10 cardinal successful redemptions. It’s inactive the astir fashionable stablecoin – cryptocurrencies with a terms pegged to different asset, usually to the U.S. dollar – but USDC gained astir $5 billion, eating into USDT’s marketplace share. Read much here.

Most integer assets successful the CoinDesk 20 ended the time higher.

Biggest Gainers

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)