Bitcoin (BTC) and ether (ETH) options worthy implicit $14.6 cardinal are acceptable to expire Friday connected Deribit successful what's shaping up to beryllium 1 of the astir important derivative events of 2025.

The expiry is heavy skewed toward BTC enactment options, underscoring a continued request for downside protection, whereas it's much balanced for ether.

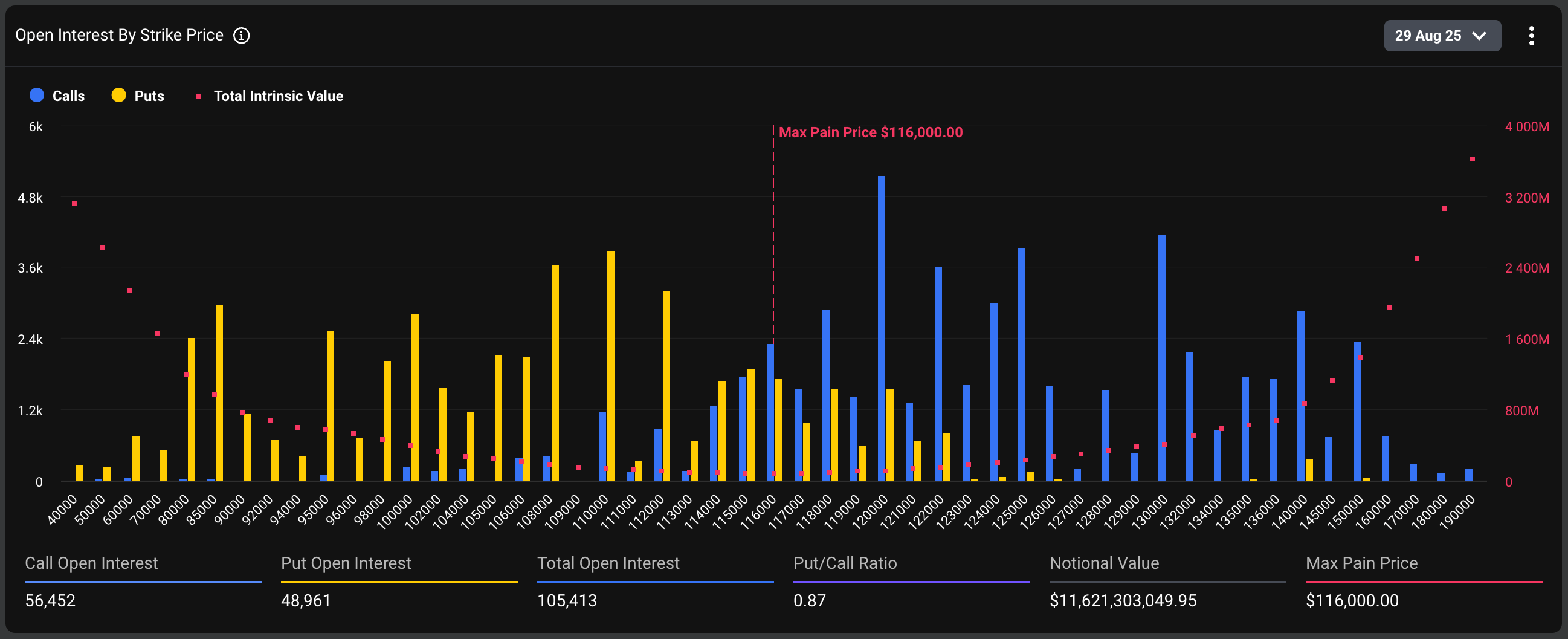

As of the clip of writing, 56,452 BTC telephone enactment contracts and 48,961 enactment enactment contracts were owed for settlement, totalling a notional unfastened involvement of $11.62 billion, according to information root Deribit Metrics. Deribit is the world's largest crypto options exchange, accounting for 80% of the planetary activity. On Deribit, 1 enactment declaration represents 1 BTC oregon ETH.

A person look astatine unfastened involvement reveals concentrated enactment successful enactment options with onslaught prices betwixt $108,000 and $112,000. Conversely, the astir fashionable telephone options are clustered astatine $120,000 and above.

In different words, near-the-money puts astir BTC's existent marketplace terms of astir $110,000 are highly sought after, portion calls with higher onslaught prices bespeak hopes for further upside.

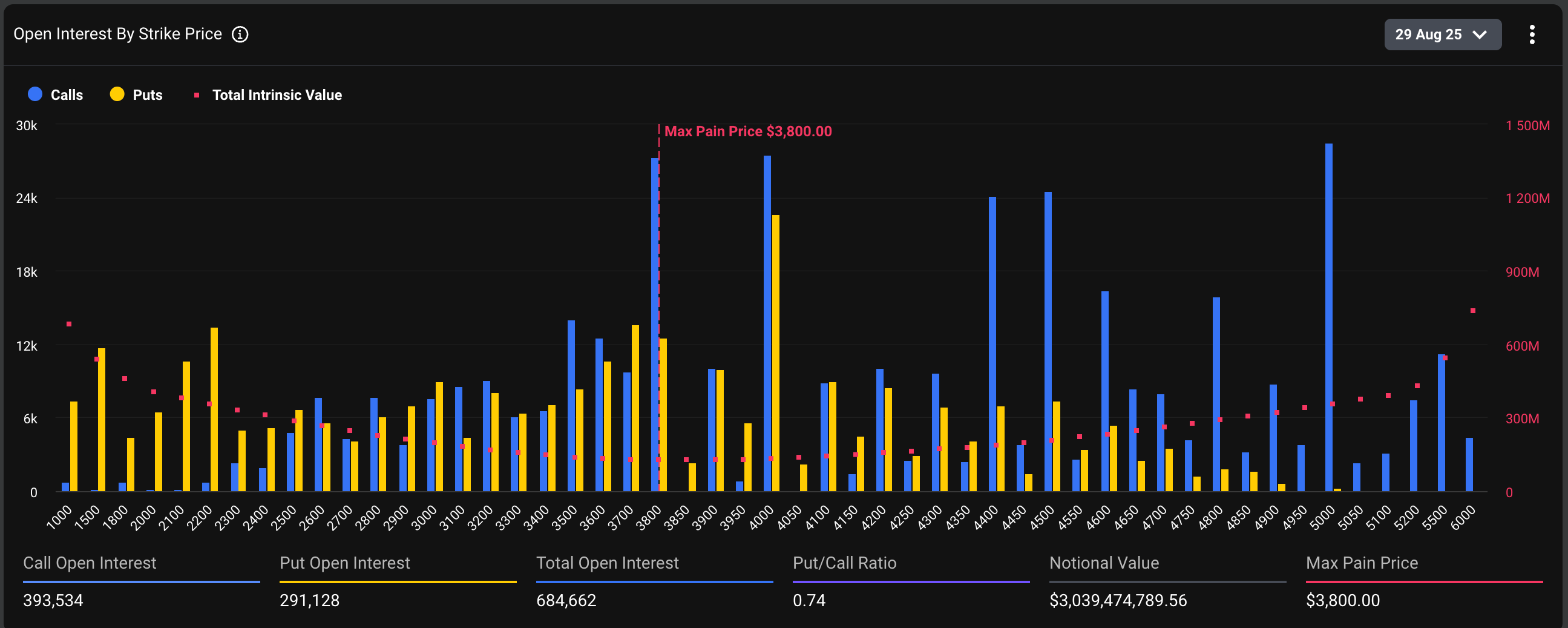

In ether's case, a full of 393,534 calls are owed for settlement, outstripping the enactment tally of 291,128 by a important margin, some totaling $3.03 cardinal successful notional unfastened interest.

Significant OI is concentrated successful calls astatine strikes $3,800, $4,000 and $5,000, and enactment options astatine strikes $4,000, $3,700 and $2,200.

"BTC expiry points to persistent request for downside protection, portion ETH looks much neutral. Combined with Powell’s Jackson Hole signal, this expiry whitethorn assistance acceptable the marketplace code for September," Deribit said connected X.

Options are derivative contracts that springiness the purchaser the close to bargain oregon merchantability the underlying plus astatine a predetermined terms connected oregon earlier a specified aboriginal date. A telephone enactment gives the close to bargain and represents a bullish stake connected the market. Meanwhile, a enactment enactment provides security against terms slides.

The options marketplace has grown leaps and bounds since 2020, with monthly and quarterly settlements gaining prominence arsenic large market-moving events.

By 2021, immoderate observers projected that prices thin to gravitate toward 'max pain' levels – the onslaught prices wherever options holders endure the top losses – successful the days starring up to expiry. However, the validity of this mentation remains a substance of statement among traders and analysts.

As of writing, the max symptom levels for bitcoin and ether are 116,000 and $3,800, respectively, serving arsenic focal points for believers of the max symptom theory.

Read more: Ether, Dogecoin, Bitcoin Plunge Sees $900M successful Bullish Bets Liquidated

1 month ago

1 month ago

English (US)

English (US)