Ethereum mislaid the captious $3,000 level connected Sunday, sliding toward $2,800 and triggering a caller question of fearfulness crossed the market. The driblet highlights a deepening corrective signifier that has pushed short-term investors into dense unrealized losses, prompting galore to reassess their hazard exposure.

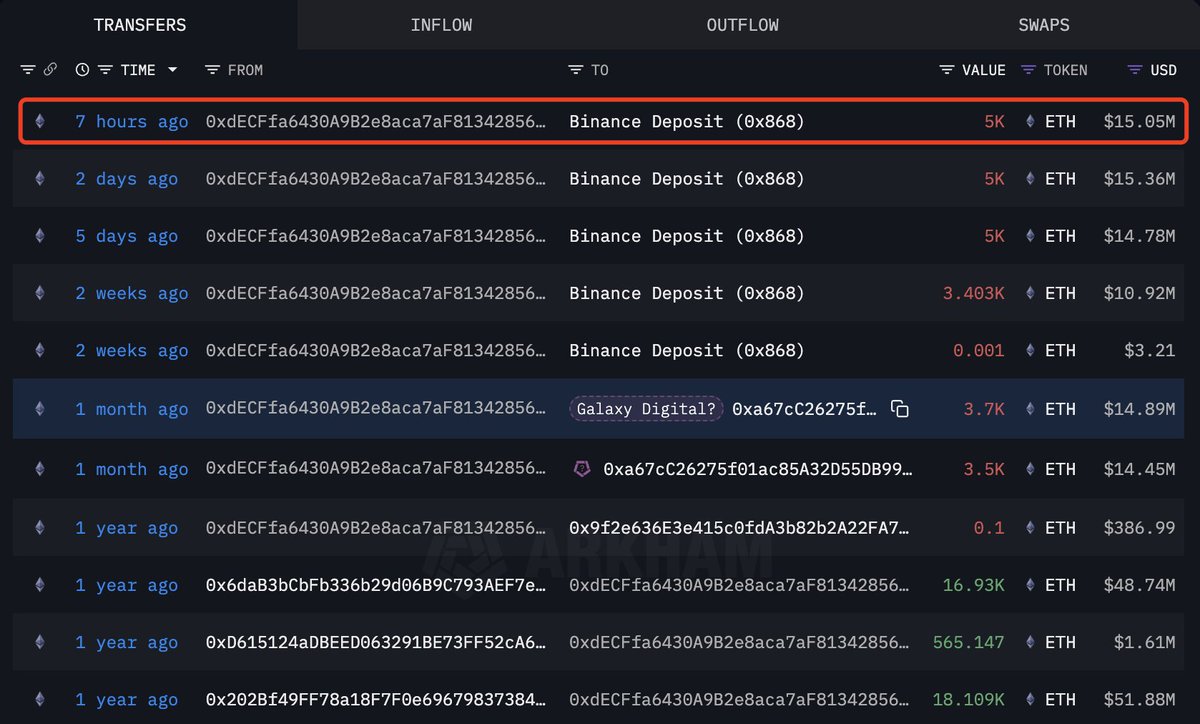

Adding to the uncertainty, caller on-chain data has revealed renewed organisation from large holders. According to information from Arkham, shared by Lookonchain, the well-known whale 0xdECF deposited different 5,000 ETH—roughly $15.05 million—into Binance.

Ethereum Whale Transfers | Source: Arkham

Ethereum Whale Transfers | Source: ArkhamThis determination expands a signifier of accordant selling unit from ample wallets, often seen during heightened marketplace stress. While 1 whale does not specify the broader trend, these deposits usually reenforce bearish sentiment among traders who show speech inflows arsenic a proxy for imaginable sell-side liquidity.

Whale Distribution Deepens Amid Broader Market Anxiety

Since October 28, the aforesaid whale wallet has accelerated its selling activity, unloading 25,603 ETH—approximately $85.44 million—across Binance and Galaxy Digital. Despite this assertive distribution, the wallet inactive holds 10,000 ETH valued astatine astir $30.34 million, leaving unfastened the anticipation of continued merchantability unit if marketplace conditions weaken further. Large-scale movements similar these often awesome a displacement successful sentiment from blase holders who thin to expect volatility earlier than the broader market.

This selling spree comes astatine a infinitesimal erstwhile assurance is already fragile. The caller Tether FUD, fueled by speculation astir reserve transparency and imaginable regulatory scrutiny, has added accent to liquidity conditions.

Meanwhile, renewed headlines astir a expected China Bitcoin prohibition person resurfaced connected societal media, amplifying fearfulness crossed some retail traders and short-term investors. Although neither communicative reflects caller cardinal risks, affectional markets often respond sharply to sensational quality during corrective phases.

Together, these factors make a backdrop wherever whale distributions summation outsized influence. If the remaining 10,000 ETH enters exchanges, it could deepen short-term downside pressure. Conversely, a intermission successful selling whitethorn suggest that the whale views existent levels arsenic near-capitulation territory, offering a imaginable level for stabilization.

Ethereum Price Tests Support arsenic Downtrend Remains Intact

Ethereum’s 4-hour illustration shows a marketplace inactive struggling to regain momentum aft losing the $3,000 handle. The broader operation remains decisively bearish, with terms trading beneath the 50 SMA, 100 SMA, and 200 SMA—a wide denotation that sellers proceed to power the trend. Each effort to retrieve supra the moving averages has been rejected, reinforcing the downtrend that began successful precocious October and has continued done November.

ETH investigating section debased liquidity | Source: ETHUSDT illustration connected TradingView

ETH investigating section debased liquidity | Source: ETHUSDT illustration connected TradingViewThe caller bounce from the $2,750–$2,800 enactment portion shows that buyers are defending this level, but the absorption lacks conviction. Volume remains muted, and the latest effort to reclaim $3,000 rapidly failed, forming different little high. This signals hesitation and suggests that bulls are not yet beardown capable to displacement marketplace structure.

The compression seen toward the extremity of the illustration formed a tiny symmetrical triangle, but the breakdown that followed confirms that sellers inactive predominate short-term momentum. As agelong arsenic ETH remains beneath the 200 EMA—now adjacent $3,350—the macro inclination favors continuation to the downside.

If $2,800 breaks cleanly, the adjacent liquidity pockets beryllium astir $2,600 and $2,450, levels that could pull stronger purchaser interest. For now, Ethereum indispensable reclaim $3,000 with sustained measurement to neutralize bearish pressure.

Featured representation from ChatGPT, illustration from TradingView.com

2 months ago

2 months ago

English (US)

English (US)