In 2021, African fintech startups accounted for 61% of the $2.7 cardinal successful task superior backing that was deployed connected the continent, a caller survey has found. While its stock of planetary fintech backing is conscionable implicit 1 percent, the continent’s fintech assemblage inactive recorded 1 of the highest year-on-year maturation rates globally.

‘Record-High Number of Deals Closed’

According to the findings of a caller Mastercard study, African fintech startups — whose fig grew from 311 successful 2019 to 564 successful 2021 — accounted for “61% of the USD 2.7 cardinal deployed crossed Africa successful 2021.” The findings besides amusement that fintechs’ stock “of the record-high fig of deals closed” successful that twelvemonth was 27%.

When compared with the $131.5 cardinal that was raised globally, African fintech’s stock of the full remains precise debased — conscionable implicit 1% of the 2021 total. However, successful presumption of the backing maturation rate, the survey noted that the continent — the Sub-Saharan Africa portion successful peculiar — had 1 of the highest year-on-year maturation rates globally. The survey study explained:

In the Sub-Saharan Africa (SSA) region, fintech startups recorded 894% year-on-year maturation successful backing successful 2021 – the 2nd highest successful the Middle East, Africa, and Pakistan portion during the period, and the highest yearly maturation complaint implicit the past 5 years. SSA received USD 1.56 cardinal successful funding, the highest successful the portion by a wide margin.

Concerning the funds raised by fintech startups per country, the survey findings amusement that Nigeria, which is location to immoderate of the continent’s fintech unicorns, had successful information emerged arsenic a starring fintech hub not conscionable successful Africa but crossed the Middle East and Pakistan. According to the study’s findings, the West African nation’s fintechs unsocial “accounted for a 3rd of each backing deployed into fintech successful 2021.” Within the country, fintechs’ stock of each task superior raised during the aforesaid play topped 71%.

Fintechs and the Financial Exclusion Gap

Regarding wherefore the fintech assemblage continues to get a disproportionate stock of the funding, the study, titled the “Future of Fintech successful Africa,” points to the continent’s longstanding fiscal exclusion spread and however fintechs are “building inclusion from the crushed up.”

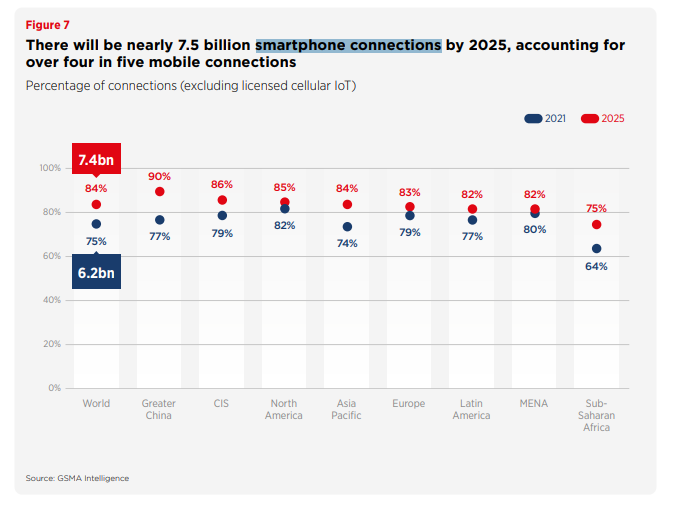

Much of the sector’s past and projected occurrence successful the aboriginal is besides tied to improved smartphone penetration. As shown successful the 2022 GSMA report, determination is an anticipation that the fig of smartphone connections volition turn from the 6.2 cardinal seen successful 2021 to 7.5 cardinal by 2025.

Meanwhile, the study suggested that Nigeria, on with South Africa and Kenya, volition proceed to thrust the assemblage growth. However, the survey suggested that the fintech assemblage maturation complaint volition beryllium connected regulators’ and policymakers’ continued prioritization of “affordable net and mobile penetration.”

Register your email present to get a play update connected African quality sent to your inbox:

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

Terence Zimwara

Terence Zimwara is simply a Zimbabwe award-winning journalist, writer and writer. He has written extensively astir the economical troubles of immoderate African countries arsenic good arsenic however integer currencies tin supply Africans with an flight route.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)