After bitcoin neared $25K astir 44 days ago, the crypto asset’s terms has mislaid much than 17.88% successful worth against the U.S. dollar. Onchain investigation from researchers astatine Glassnode details that the terms driblet has placed short-term holders into “severe unrealized loss.” Long-term holders, connected the different hand, are holding beardown and Glassnode researchers accidental galore metrics are “displaying a afloat rhythm detox.”

Long-Term Bitcoin Holders Hold Tight

The crypto carnivore marketplace continues to plague short-term holders, according to a caller onchain newsletter written by Glassnode and Ukuria On-Chain. While bitcoin (BTC) has mislaid 17.88% successful worth against the U.S. dollar since August 14, 14-day statistic amusement BTC is down astir 9.3%, and year-to-date, bitcoin has shed 53.2%.

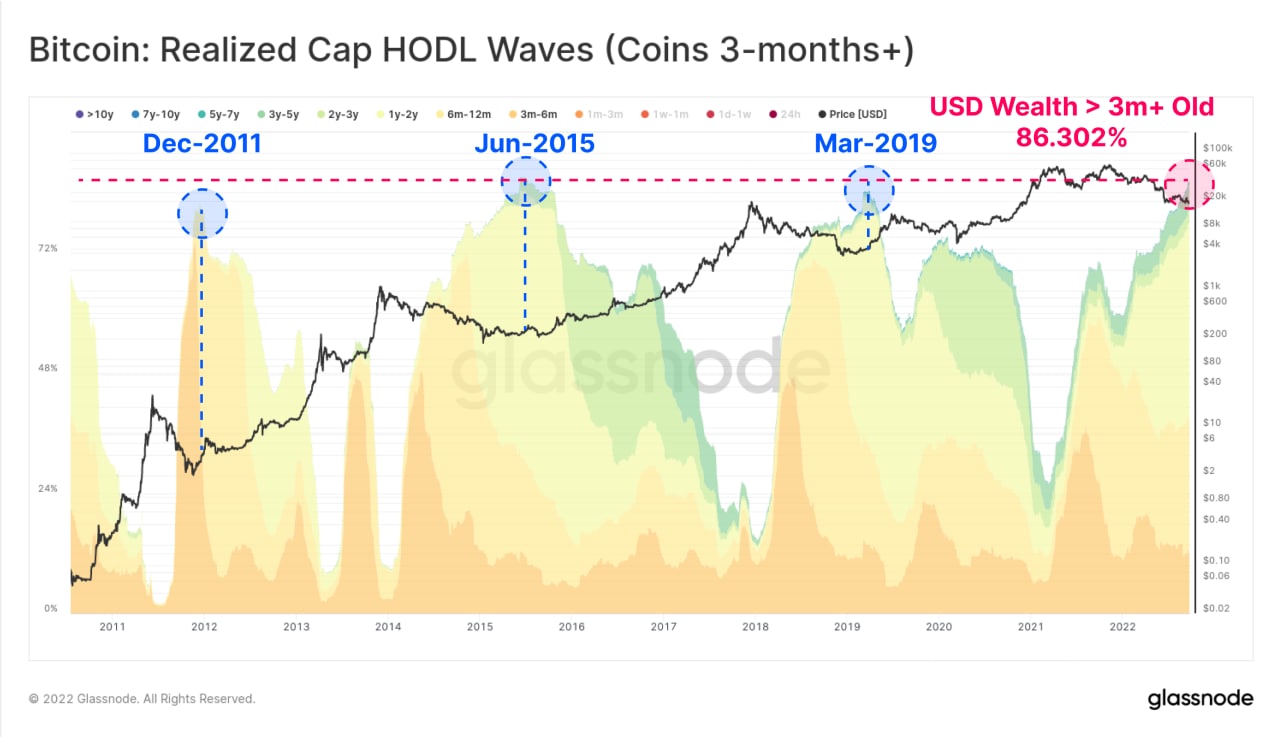

Furthermore, since the crypto asset’s beingness terms high, 11 months agone connected November 10, 2021, BTC is down 71.3%. Glassnode’s newsletter published connected September 26 highlights the Bitcoin Realized Cap HODL Waves chart which shows however BTC’s semipermanent holders stay steadfast.

According to the information from Glassnode’s Telegram transmission anterior to publishing the onchain newsletter, “coins aged 3-months+ present relationship for an all-time precocious (ATH) of 86.3% of each USD wealthiness held by the BTC supply.” Glassnode’s study details that the Realized Capitalization HODL Waves illustration shows the U.S. dollar wealthiness held by idiosyncratic property bands.

“With mature spending severely muted, the grade of HODLing behaviour is historically high,” Glassnode details. “In a binary strategy of conscionable Young and Mature coins, an summation successful mature coin wealthiness held successful BTC straight leads to an equivalent alteration successful Young coin wealth.”

In presumption of semipermanent holders, Glassnode’s study called “The Great Detox” states:

Currently, wealthiness held by mature coins is astatine an ATH, owed to the ascendant capitalist behaviour being a refusal to walk contempt exceedingly uncertain planetary markets. Thus, astir each marketplace enactment is being conducted by the aforesaid cohort of young coins repeatedly changing hands. As the fig of young churning coins incrementally decreases, it tin pb to an eventual proviso compression if and erstwhile the marketplace tides turn.

Bitcoin’s ‘Bottoming Process’ and the 4-Year Trend

There are galore believers successful bitcoin’s semipermanent game. “After months of waiting, for conscionable the 4th clip ever bitcoin’s short-term holder outgo ground has fallen beneath its semipermanent holder outgo basis,” Will Clemente wrote connected September 24. “This indicates a bottoming process. The adjacent transverse to ticker for is simply a bull transverse of the abbreviated word backmost supra the agelong term.”

On galore occasions, Microstrategy’s Michael Saylor has talked astir BTC’s four-year cycles. On September 26, erstwhile the U.S. dollar continued to depress a ample basket of fiat currencies, Saylor spoke astir bitcoin’s narration with the greenback crossed 4 years.

“Over the past twelvemonth currencies person collapsed against the dollar,” Saylor tweeted. “CAD -8%, CNY -9%, AUD -11%, ZAR -17%, KRW -18%, EUR -18%, PLN -21%, GBP -22%, JPY -23%, TRY -52%. Over the past 4 years, the dollar has collapsed -67% against bitcoin,” the Microstrategy enforcement added.

What bash you deliberation astir the information that semipermanent holders person been holding beardown successful opposition to short-term holders? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)