Welcome to this week’s impermanent writer, CoinDesk newsman Eli Tan, who is filling successful for Sam Kessler. Follow him @elitanjourno.

As the Ethereum web inches toward “the Merge” and transitions from a proof-of-work (PoW) strategy to proof-of-stake (PoS), developers are utilizing caller investigating infrastructure to measure web mechanics and lawsuit readiness.

The archetypal large test, known arsenic a “shadow fork,” came successful April – we covered the lawsuit in depth successful a erstwhile variation of the newsletter, but the gist is that the trial went good and has been repeated 2 times since.

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum’s improvement and its interaction connected crypto markets. Subscribe to get it successful your inbox each Wednesday.

These types of tests are important to the advancement of the web due to the fact that they let developers to find bugs successful the codification that could beryllium different missed utilizing the devnets.

In the April 11 shadiness fork, for example, developers uncovered a bug having to bash with gas limits being artificially raised by miners.

The 2nd shadiness fork connected April 23 was adjacent much promising, with each 1 of the network’s lawsuit combinations surviving the modulation and staying successful sync for the archetypal time.

The astir caller shadiness fork took spot connected May 5 and included new tests connected syncing done the Merge, which revealed a fewer tiny but fixable points of improvement.

Like galore aspects of the Ethereum network, merge investigating is simply a collaborative effort, and a crucially important 1 astatine that. Developers are encouraged to log their investigating results connected a shared leaderboard.

Another signifier of merge investigating is utilizing Hive tests. Hive is the integration investigating level for the existent Ethereum network’s Execution Layer (EL), and is utilized to trial the caller engine APIs.

Like the web itself, Hive tests are perpetually evolving. Most recently, investigating teams person added the quality for Hive tests to mock the caller proof-of-stake Ethereum Consensus Layer (CL) behavior. This caller integration volition let it to tally a simulator for the modulation from PoW to PoS and spot however some the CL and EL volition behave.

In a May 4 merge investigating update, it was announced that Kurtosis had been added to Ethereum’s investigating infrastructure.

The main relation of Kurtosis is that it helps rotation up staging networks, which are investigating environments to isolate circumstantial aspects of the Merge.

According to developers, these staging environments volition let them to show assorted web wellness metrics during accent investigating nether simulated harsher web conditions.

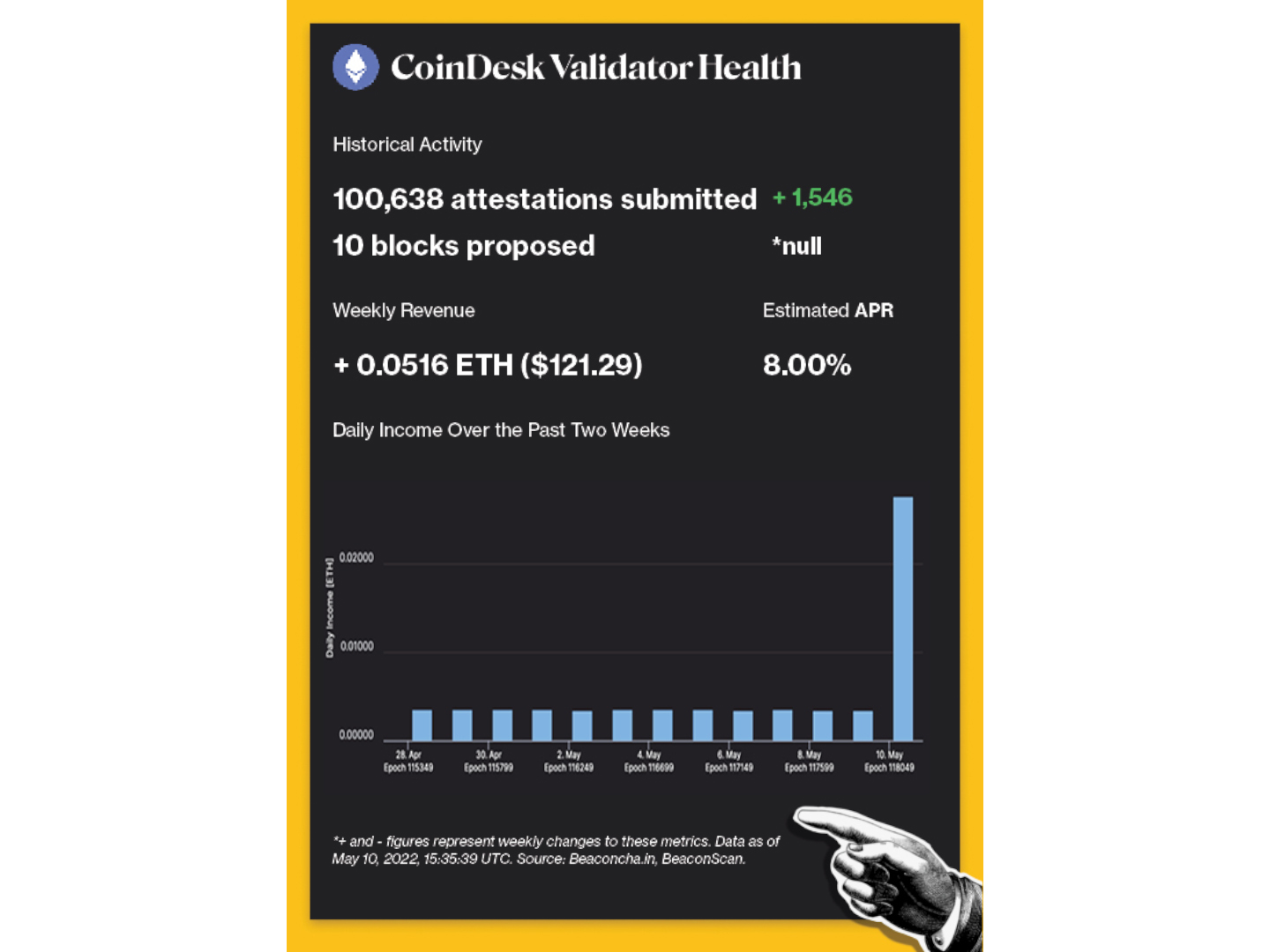

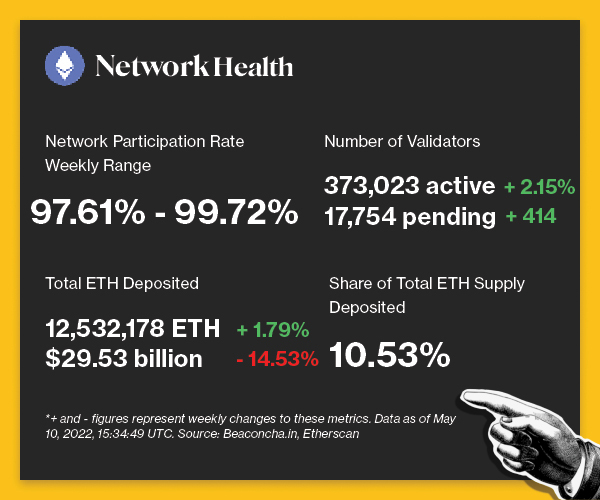

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

(Beaconcha.in, BeaconScan)

(Beaconcha.in, Etherscan)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

Algorithmic stablecoin UST mislaid its $1 peg for the 2nd clip successful 3 days.

WHY IT MATTERS: Since May 9, UST fell arsenic debased arsenic $0.65 portion its sister token LUNA dropped arsenic debased arsenic $24.85, according to information from CoinGecko. The Luna Foundation Guard drained its $1.5 cardinal bitcoin (BTC) reserve and bought $850 cardinal much successful BTC successful a bid to support UST’s peg. UST has since returned to $0.90 pursuing LFG’s deployment of further bitcoin. Treasury Secretary Janet Yellen focused connected the ongoing distress of the stablecoin during grounds earlier a U.S. Senate sheet connected May 10.

Total worth locked (TVL) connected decentralized concern (DeFi) protocols acceptable 2022 lows astatine $160.74 cardinal arsenic of May 10.

WHY IT MATTERS: $44.43 cardinal successful locked worth was mislaid since May 5, according to information from DeFiLlama. Stablecoin swap level Curve, the largest DeFi protocol by TVL, saw a 16% driblet successful the past week. Lido, the starring liquid staking solution, saw a alteration of astir 29%. TVL for Terra’s Anchor slid 57%. Tokens of the broader DeFi assemblage mislaid 34% connected average; by comparison, the meme coin assemblage mislaid conscionable 16%.

Compound Treasury received a B- recognition standing from S&P Global Ratings, making it the archetypal organization DeFi offering to beryllium rated by a recognition standing agency.

WHY IT MATTERS: S&P indicated that uncertain regulations for stablecoins, risks successful converting stablecoins to fiat currency and Compound Treasury’s constricted superior basal were immoderate factors contributing to its assigned rating. With a B- grade, the USDC-powered output level is judged to beryllium “speculative” but “currently has the capableness to conscionable fiscal commitments.”

Instagram is investigating non-fungible token (NFT) integrations.

WHY IT MATTERS: With implicit 1 cardinal monthly progressive users, Instagram volition initially enactment Ethereum-based NFTs, with integrations connected Polygon, Solana and Flow to beryllium added astatine a aboriginal date. Instagram genitor Meta (FB) is moving connected three-dimensional, augmented-reality non-fungible tokens (NFT) with its Spark AR software, which volition archetypal beryllium compatible with Instagram stories. While Instagram volition not complaint users for posting and sharing NFTs, it hopes to crook NFTs into a gross watercourse for creators.

The U.K. to present authorities to modulate the crypto industry.

WHY IT MATTERS: The Economic Crime and Corporate Transparency Bill volition make “powers to much rapidly and easy prehend and retrieve crypto assets, which are the main mean utilized for ransomware.” The purpose is to “mitigate the hazard posed by those who cannot beryllium criminally prosecuted but usage their funds to further criminality.”

.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)