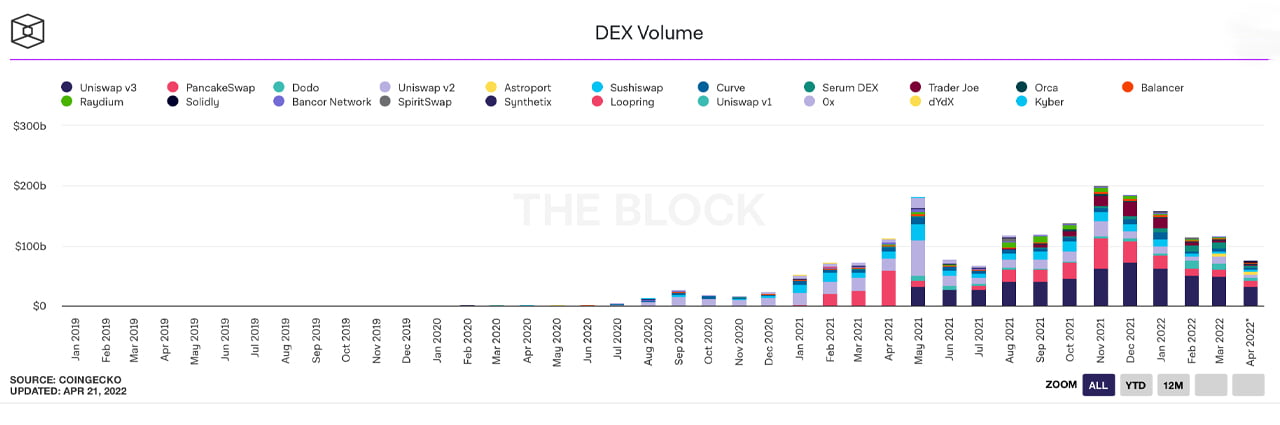

Decentralized speech (dex) volumes person been dropping since December 2021 according to existent statistics. However, past period dex commercialized volumes spiked 2.37% higher than the volumes recorded successful February. Despite the little spike and with lone 8 days near successful April, metrics amusement this month’s dex volumes volition apt beryllium overmuch little than successful March.

Decentralized Exchange Volumes Slip Month After Month — April’s Dex Volumes Remain Lackluster

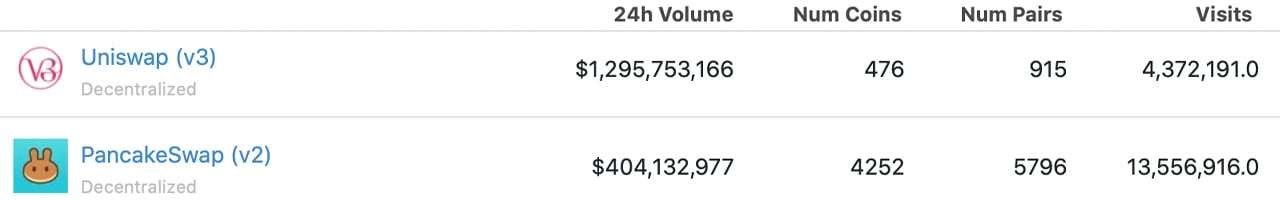

In 12 months, dex platforms recorded implicit $1 trillion successful commercialized measurement arsenic they person go salient fixtures successful the crypto industry. Today, information from coingecko.com, coinmarketcap.com, dune.com, and theblockcrypto.com indicates that Uniswap mentation 3 (v3) is the largest dex by 24-hour commercialized volume, with $1.29 cardinal during the past 24 hours. Following Uniswap v3, dex platforms similar Pancakeswap v2, Dydx, and Curve Finance clasp the apical 24-hour measurement positions astatine the clip of writing.

The apical 2 decentralized speech (dex) platforms during the past 24 hours connected April 21, 2022, according to coingecko.com stats.

The apical 2 decentralized speech (dex) platforms during the past 24 hours connected April 21, 2022, according to coingecko.com stats.The dashboard called “DEX Metrics” connected Dune Analytics, shows dex commercialized measurement during the past 7 days, retired of much than a twelve dex protocols, is astir $14 billion. The trailing seven-day metrics bespeak the dex volumes recorded connected the Dune Analytics’ dashboard are down 22%. Data from theblockcrypto.com’s crypto dashboard shows 30-day statistic stemming from 5 high-volume dex platforms and 16 smaller dex protocols.

Those statistic amusement a downward descent since December 2021 aft $186.03 cardinal was recorded that month. The pursuing period successful January, dex platforms saw $157.68 cardinal successful commercialized volume, and past successful February, it slid to $114.37 billion. That means betwixt December and February 2022, dex commercialized measurement plummeted by 38.52%.

As mentioned above, determination was a little spike successful dex trading measurement successful March, arsenic $117.09 cardinal was recorded during that timeframe. However, April’s statistic look arsenic though dex trading volumes volition beryllium lackluster and perchance little than February. As of Thursday, April 21, 2022, existent information shows that $75.11 cardinal successful trades person been recorded truthful far.

While the theblockcrypto.com’s dashboard covers 30-day stats, seven-day metrics from coinmarketcap.com dex measurement charts amusement an uninspiring week arsenic well. The Dune Analytics’ “DEX Metrics” dashboard indicates existent 30-day dex commercialized measurement is astir $70 billion. It volition instrumentality a batch of commercialized measurement to drawback up to March’s spike and arsenic of now, that doesn’t look arsenic though it volition happen.

Tags successful this story

What bash you deliberation astir dex trading measurement dropping since December? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, theblockcrypto.com dashboard, coingecko.com stats,

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)