Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

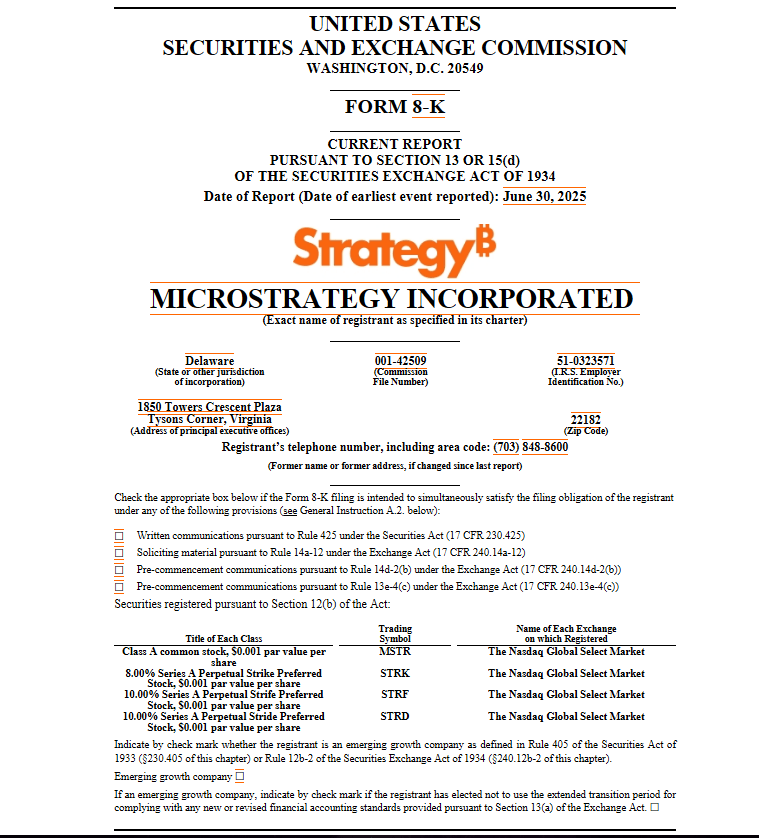

MicroStrategy has conscionable added different 4,980 Bitcoin to its stash, spending astir $531 million astatine an mean of $106,801 per coin. That brings the company’s full haul to 597,325 BTC.

At today’s marketplace price, those holdings are worthy implicit $64 billion, compared with the astir $42.4 cardinal MicroStrategy (now Strategy) has enactment in, fees included.

According to the June 30 filing with the US Securities and Exchange Commission, Strategy – led by billionaire Michael Saylor – is sitting connected astir $21.6 cardinal successful unrealized gains.

Source: US SEC.

Source: US SEC.Strategic Bitcoin Push

Strategy bought its latest batch during the week ending June 29. The steadfast has already snapped up 88,062 BTC worthy astir $10 billion truthful acold this year. Back successful 2024, the institution picked up 140,538 BTC astatine a outgo of $13 billion.

Company information shows a Bitcoin output of astir 20% year‑to‑date, with 7.8% gained successful the 2nd 4th alone. That edges Strategy person to its extremity of a 25% output by the extremity of 2025.

Strategy has acquired 4,980 BTC for ~$531.9 cardinal astatine ~$106,801 per bitcoin and has achieved BTC Yield of 19.7% YTD 2025. As of 6/29/2025, we hodl 597,325 $BTC acquired for ~$42.40 cardinal astatine ~$70,982 per bitcoin. $MSTR $STRK $STRF $STRD https://t.co/xvWnSkfukS

— Michael Saylor (@saylor) June 30, 2025

Corporate Treasury Trend

Strategy present controls astir 3% of each the Bitcoin ever mined retired of the 21 cardinal cap. That dominance has inspired 134 publically traded firms to travel suit, adding Bitcoin to their firm treasuries.

Recent adopters see Twenty One, US President Donald Trump’s media steadfast Trump Media, and GameStop. In Japan, Metaplanet added 1,005 BTC this week to bring its full to 13,350 BTC.

Over successful Europe, The Blockchain Group bought 60 BTC, lifting its holdings to 1,788 BTC valued astatine astir €161.3 million.

🟠 The Blockchain Group has acquired 60 BTC for ~€5.5 cardinal astatine ~€91,879 per bitcoin and has achieved BTC Yield of 1,270.7% YTD, 69.3% QTD. As of 6/30/2025, $ALTBG holds 1,788 $BTC for ~€161.3 cardinal astatine ~€90,213 per bitcoin⚡️@_ALTBG Europe’s First Bitcoin Treasury Company… https://t.co/BmcqZzvfoz

— Alexandre Laizet ⚡️ (@AlexandreLaizet) June 30, 2025

New Trading Products Arrive

Cryptocurrency exchanges are racing to conscionable each this demand. On June 28, Gemini rolled retired a tokenized mentation of Strategy banal for investors successful the EU. That marks the exchange’s archetypal tokenized equity offering successful that region.

Shares of Strategy person climbed astir 5% implicit the past month, trading astir $391, according to Google Finance data.

Price Resistance Looms

Bitcoin itself has been holding adjacent $108,000. It roseate arsenic overmuch arsenic 3% implicit the play to deed $108,798.

Some traders, similar MN Capital laminitis Michael van de Poppe, expect a little pullback earlier BTC tries to breach $109,000. That level sits connected the four-hour illustration arsenic a wide absorption point.

Data from CoinGlass shows astir $50 cardinal successful liquidity stacked astatine $109,500. If Bitcoin tin wide the $110,000–$112,300 zone, it could trigger a abbreviated compression that pushes prices into caller grounds territory.

Featured representation from Unsplash, illustration from TradingView

7 hours ago

7 hours ago

English (US)

English (US)