“Not rather ready” — MicroStrategy CEO Michael Saylor said that accepted fiscal markets aren’t prepared for bonds backed by Bitcoin.

MicroStrategy CEO and Bitcoin permabull, Michael Saylor believes that accepted fiscal markets aren’t rather acceptable for Bitcoin-backed bonds.

Saylor told Bloomberg connected Tuesday, that he’d emotion to spot the time travel wherever Bitcoin-backed bonds are sold similar mortgage-backed securities, but warned that, “the marketplace is not rather acceptable for that close now. The adjacent champion thought was a word indebtedness from a large bank.”

MacroStrategy, a subsidiary of @MicroStrategy, has closed a $205 cardinal bitcoin-collateralized indebtedness with Silvergate Bank to acquisition #bitcoin. $MSTR $SIhttps://t.co/QYw2ZgeE3U

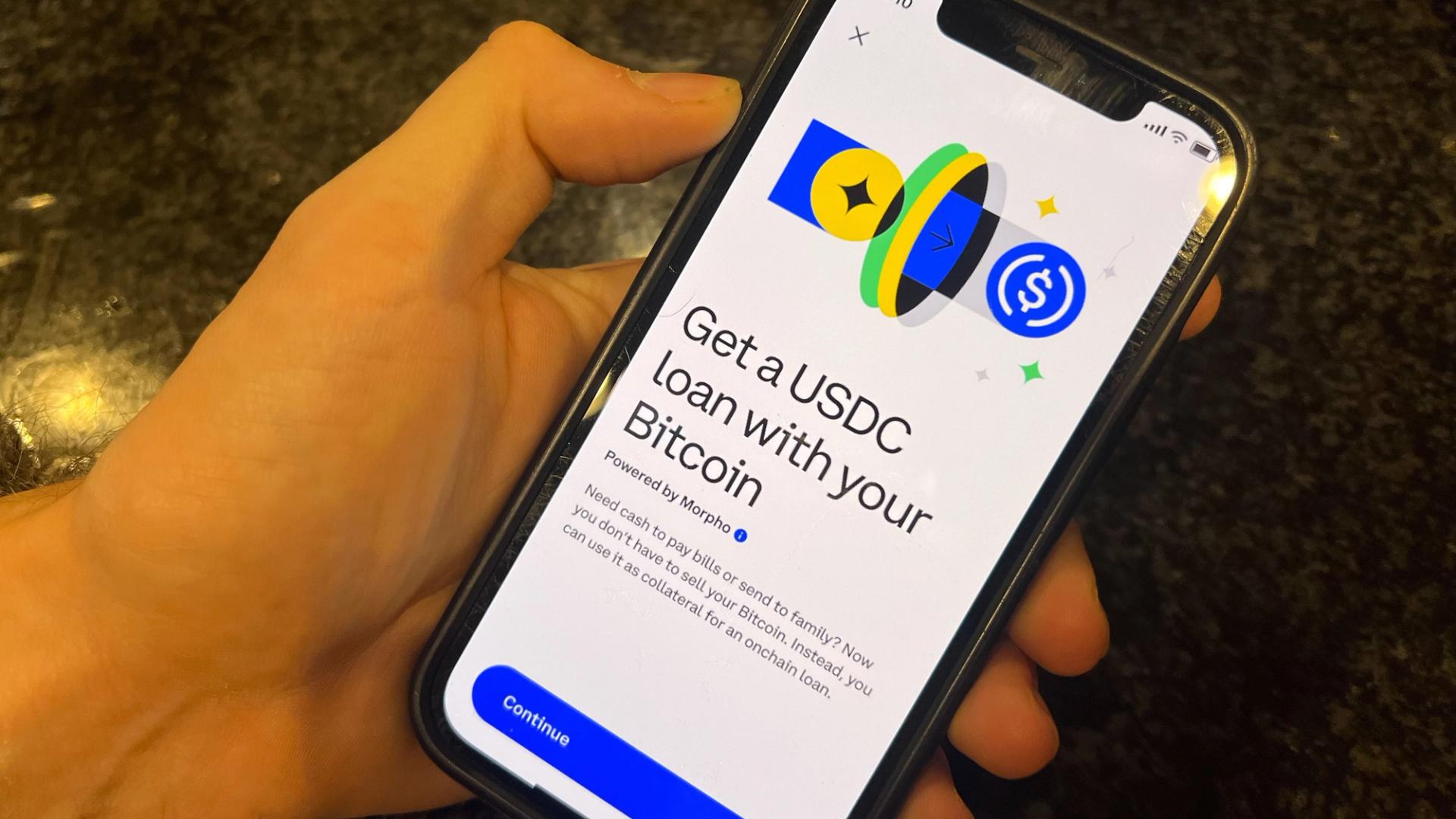

— Michael Saylor⚡️ (@saylor) March 29, 2022The remarks travel 2 days aft MicroStrategy’s (MSTR) Bitcoin-specific subsidiary MacroStrategy, announced that it had taken retired a $205 cardinal Bitcoin-collateralized indebtedness to acquisition adjacent much Bitcoin. This indebtedness was unique, arsenic it marked MicroStrategy’s archetypal clip borrowing against its ain Bitcoin reserves — which are presently valued astatine astir $6 cardinal — to bargain much of the cryptocurrency.

Saylor’s comments besides travel El Salvador’s caller decision to postpone the issuance of its $1 cardinal dollar Bitcoin-backed “Volcano Bond” connected March 23rd. According to El Salvador’s Finance Minister Alejandro Zelaya, the determination to hold the enslaved was owed to wide fiscal uncertainty successful the planetary marketplace driven by struggle successful Ukraine.

In a imaginable informing to El Salvador, Saylor said that the country’s Volcano Bond was somewhat much risky than his company’s Bitcoin-collateralized loan,

“That’s a hybrid sovereign indebtedness instrumentality arsenic opposed to a axenic Bitcoin-treasury play. That has its ain recognition hazard and has thing to bash with the Bitcoin hazard itself entirely.”Saylor added that helium remains highly bullish connected the semipermanent imaginable for Bitcoin-based bonds, going arsenic acold to accidental that it would beryllium a bully thought for cities similar New York to usage Bitcoin arsenic a indebtedness instrument.

“New York tin contented $2 cardinal of indebtedness and bargain $2 cardinal worthy of Bitcoin — the Bitcoin is yielding 50% oregon more, the indebtedness costs 2% oregon less.”Related: MicroStrategy CEO won’t merchantability $5B BTC stash contempt crypto winter

Since its archetypal $250-million Bitcoin concern successful August 2020, MicroStrategy has present amassed a important 125,051 BTC — which astatine the existent terms of $44,547 equates to $5.5 billion. MicroStrategy has made a bid of abstracted BTC purchases utilizing the company’s currency connected manus arsenic good arsenic the proceeds of income of convertible elder notes successful backstage offerings to organization buyers.

Saylor’s actions person gradually transformed MicroStrategy into a partially leveraged Bitcoin holdings company, with MSTR shares intimately correlated with the terms of Bitcoin.

3 years ago

3 years ago

English (US)

English (US)