- Microstrategy’s Former CEO Michael Saylor pointed retired successful a caller interrogation for Stansberry Research that helium would alternatively triumph successful a volatile manner than suffer slowly.

- Saylor continues to accidental that the volatility volition lone interaction short-term investors and nationalist companies. Bitcoin has outperformed each azygous institution connected the banal marketplace successful a longer timeframe.

MicroStrategy’s Former CEO and well-known Bitcoin advocator Michael Saylor addressed successful a caller interrogation with Stansberry Research that helium inactive believes successful Bitcoin successful the agelong term.

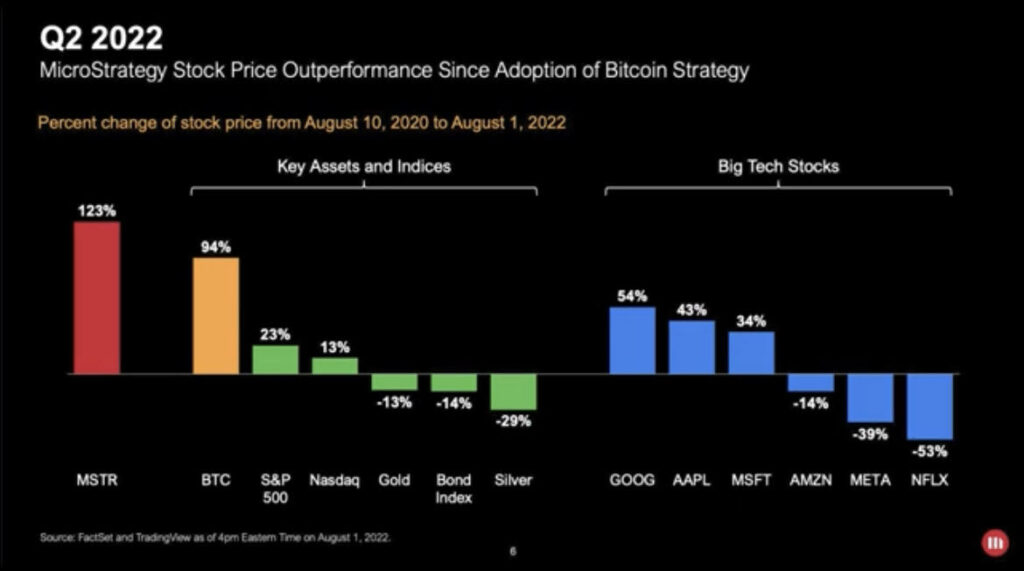

According to Saylor, since MicroStrategy adopted the Bitcoin Strategy, Bitcoin has heavy outperformed the S&P 500, Nasdaq, Gold, Bond Index, and immoderate Big Tech Stocks. He says that the lone banal that has outperformed Bitcoin successful this play is Microstrategy’s stock, MSTR.

When asked if helium thinks Bitcoin’s volatility is for everyone and immoderate marketplace participants cannot grip the utmost volatility, Saylor provides the beneath response.

“The mode to deliberation astir investing successful Bitcoin is, you should lone put what you volition clasp for 4 years oregon longer; ideally, it’s generational wealthiness transfer. The metric you privation to look astatine is the elemental four-year moving average.” If you person a abbreviated clip frame, it is going to beryllium overmuch much stressful due to the fact that it is simply a volatile asset. “

Saylor continues to item that Microstrategy has outperformed each asset, adjacent the salient large tech companies. He would alternatively triumph successful a volatile manner than suffer successful a non-volatile way.

Saylor’s Reasoning Behind Crypto’s Recent Downfall

Saylor firmly believes that the events that caused crypto’s caller downfall were triggered by the incoming involvement rates and the tightening of the fed. The adjacent catalyst was the large Terra Luna Meltdown, which affected a batch of cryptos. He believes that an algorithmic stablecoin was an mishap waiting to happen.

Saylor’s sentiment is that these events needed to hap to flush retired the industry’s atrocious actors. Market participants are present much educated and cautious astir banking applications that supply immense yields.

“If you judge successful dependable money, you should merchantability your golden and bargain bitcoin.” says Saylor.

Saylor Recently Stepped Down arsenic MicroStrategy CEO to Focus connected Bitcoin

After 33 years of being CEO of MicroStrategy, Micheal Saylor stepped down precocious alternatively of taking the relation of enforcement chairman. Phong Le, MicroStrategy’s existent president, volition instrumentality his relation arsenic CEO. MicroStrategy’s connection to investors was that Saylor is to proceed to supply oversight of the company’s bitcoin acquisition strategy arsenic caput of the Board’s Investments Committee.

3 years ago

3 years ago

English (US)

English (US)