Key takeaways:

Michael Saylor transformed MicroStrategy from a concern quality steadfast into the world’s largest firm Bitcoin holder.

Saylor’s condemnation redefined firm strategy, turning volatility into accidental done long-term, dollar-cost averaging purchases.

His attack acceptable the modular for organization Bitcoin adoption contempt concerns implicit dilution and debt.

Saylor’s playbook highlights research, perseverance, hazard power and semipermanent reasoning successful Bitcoin investing.

Saylor’s Bitcoin awakening

In August 2020, Michael Saylor transformed from a exertion enforcement into a awesome of firm crypto adoption.

Saylor, agelong known arsenic the co-founder and caput of enterprise-software steadfast Strategy (previously MicroStrategy), made his archetypal bold determination into cryptocurrencies by allocating $250 cardinal of the company’s currency to acquisition Bitcoin (BTC).

He cited a weakening dollar and semipermanent ostentation risks arsenic the underlying reasons down this strategical move. Incidentally, it marked the largest acquisition of Bitcoin by a publically traded institution astatine that clip and acceptable a caller precedent.

Within months, Strategy expanded its holdings: $175 cardinal much successful September, $50 cardinal successful December and a $650-million convertible-note issuance, bringing Bitcoin holdings implicit $1 billion.

He recognized Bitcoin arsenic “capital preservation,” comparing it to “Manhattan successful cyberspace,” a scarce, indestructible asset.

The determination drew some praise and criticism. Skeptics called it reckless, portion supporters saw it arsenic a bold innovation astatine a clip erstwhile fewer dared to enactment Bitcoin connected a company’s equilibrium sheet. For Saylor, though, it wasn’t a gamble. It was a calculated hedge against monetary uncertainty and a awesome that integer assets would reshape superior strategy.

Did you know? In 2013, Saylor tweeted that Bitcoin’s days were numbered, predicting it would “go the mode of online gambling.” That station resurfaced successful 2020, close arsenic helium pivoted Strategy into the biggest Bitcoin holder among nationalist companies. He has since referred to it arsenic the “most costly tweet successful history.”

Saylor’s Bitcoin expansion

From that archetypal introduction point, Saylor doubled and tripled down connected his content successful Bitcoin. He applied structured concern tools to standard holdings and signifier Strategy into a “Bitcoin treasury company.”

It each started during the July 2020 net calls erstwhile Saylor announced his program to research alternate assets, specified arsenic Bitcoin and gold, alternatively of holding cash. He enactment the program into question with quarterly Bitcoin buys that rapidly scaled holdings to tens of thousands of coins astatine a favorable outgo basis.

By aboriginal 2021, Saylor had borrowed implicit $2 cardinal to grow his Bitcoin position, an assertive posture powered by conviction, not speculation. He articulated a imaginativeness of semipermanent ownership by saying that Strategy volition hold its Bitcoin concern for astatine slightest 100 years.

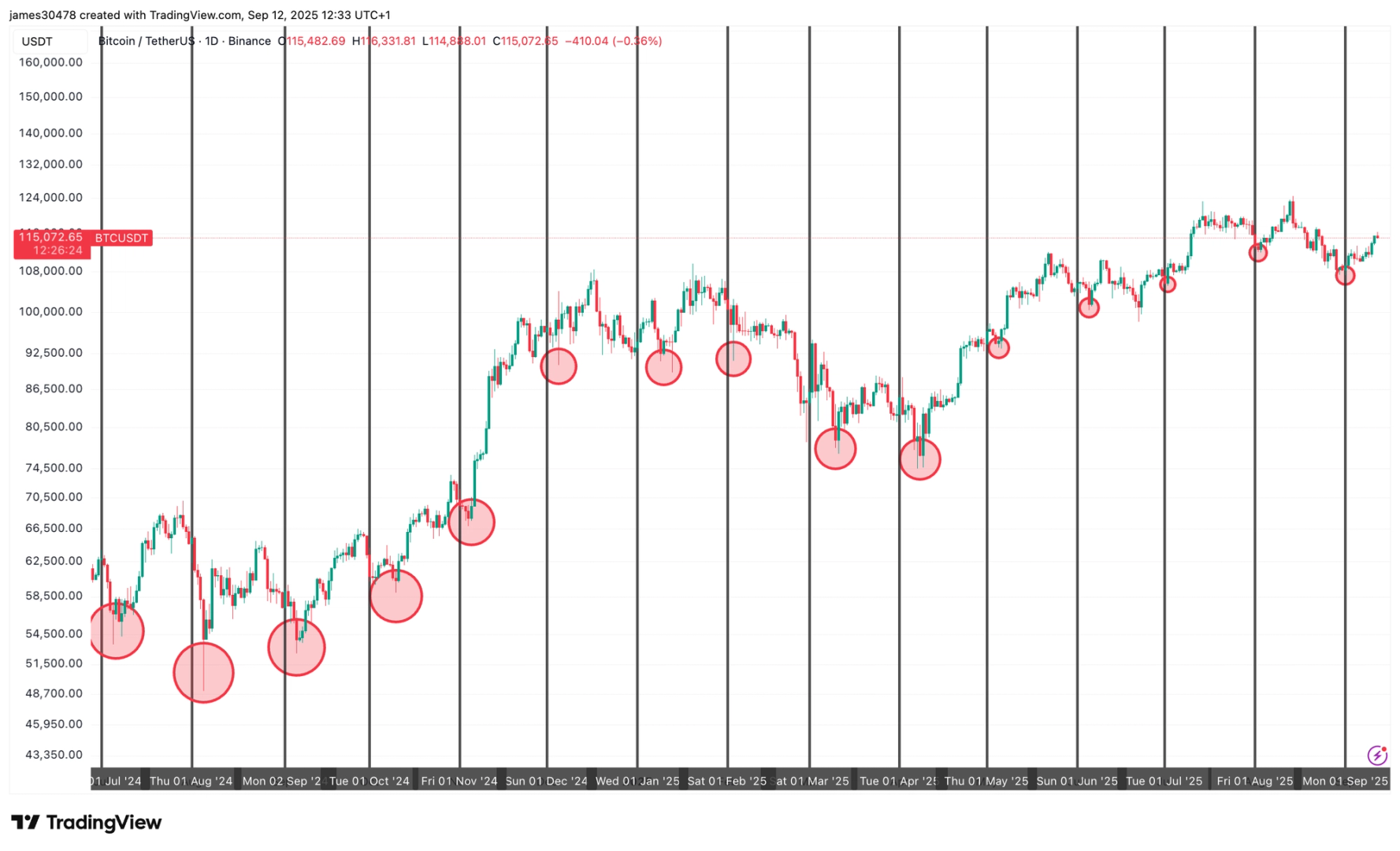

Despite Bitcoin’s utmost volatility, soaring to $64,000 from $11,000 successful 2021 and past plunging to adjacent $16,000 by the extremity of 2022, Saylor remained unwavering. In enactment of the assertion that Bitcoin is the apex of monetary structure, his squad utilized dollar-cost averaging to instrumentality vantage of terms dips to summation holdings.

Saylor’s strategy worked: His company’s banal surged, often outperforming Bitcoin itself. By precocious 2024, Strategy’s banal had gained multiples of S&P 500 returns, and the concern became viewed little arsenic a bundle steadfast and much arsenic a leveraged crypto proxy.

Saylor’s Bitcoin financing

Saylor’s obsession evolved from a bold introduction to dominating firm request for Bitcoin, shifting marketplace dynamics done sheer scale. By aboriginal 2025, Strategy held implicit 2% of Bitcoin’s full fixed supply, astir fractional a cardinal BTC.

Year-to-date, Strategy acquired much than 150,000 BTC astatine mean prices adjacent $94,000, putting its holdings’ marketplace worth supra $50 billion.

These monolithic allocations exert structural unit connected Bitcoin’s finite supply, and corporations present vie for scarce coins. Saylor acceptable a benchmark that different firms began to follow. In the archetypal 5 months of 2025 alone, organization and firm Bitcoin purchases surpassed $25 billion.

This standard shifted Strategy’s identity: Software gross was dwarfed by Bitcoin’s interaction connected valuation. The equity-raising strategy, issuing banal and indebtedness to money purchases, was scrutinized arsenic a recursion: If Bitcoin fell, indebtedness could strain the company; if banal was diluted excessively much, capitalist assurance could wane.

In June 2025, Strategy added 10,100 BTC via a $1.05-billion purchase, having spent astir $42 cardinal connected Bitcoin overall. The company’s exemplary was present replicable, but not without expanding systemic risk.

Saylor’s translation from tech CEO to crypto-treasury designer made him a polarizing fig and inspired imitators. His assertive playbook reframed not conscionable Strategy’s valuation but the broader organization adoption narrative.

Did you know? Saylor disclosed that anterior to converting institution assets into Bitcoin, helium had used his ain funds to bargain 17,732 BTC, which astatine the clip was valued astatine astir $175 million. This gave him capable condemnation to propulsion for Strategy’s firm allocation.

What’s adjacent for Saylor and Bitcoin?

Saylor has shown nary signs of slowing down. Strategy continues to treble down connected Bitcoin, adjacent financing caller purchases done convertible indebtedness and different originative instruments. With halving cycles tightening supply and organization involvement accelerating, Saylor positions Bitcoin not conscionable arsenic a store of worth but arsenic a firm treasury standard.

Looking ahead, the main questions are whether much businesses volition travel Strategy’s example, however firm adoption volition beryllium influenced by regulatory frameworks and whether Bitcoin’s relation volition beryllium constricted to equilibrium sheets oregon widen to different areas of the fiscal system. If Saylor’s mentation is correct, helium mightiness not lone beryllium known arsenic a bold CEO but besides arsenic 1 of the cardinal players who revolutionized concern financing successful narration to Bitcoin.

What tin you larn from Saylor’s Bitcoin obsession?

Saylor’s travel is unique, but determination are applicable lessons anyone exploring Bitcoin tin instrumentality from his approach:

Do your probe earlier committing: Before making an investment, Saylor studied the fundamentals of Bitcoin for months. For novices, this means avoiding hype and opening with reputable sources, white papers and competent analysis.

Think agelong term: Saylor has nary volition of making a speedy profit. For individuals, this translates into lone investing what you tin clasp done volatility alternatively than trying to clip the market.

Risk absorption matters: Strategy took a hazardous but audacious measurement by borrowing wealth to acquisition Bitcoin. Retail investors ought to workout greater caution, refrain from taking connected excessive indebtedness and support cryptocurrency arsenic a information of a larger portfolio.

Have conviction, but enactment flexible: Throughout the years, Saylor methodically planned his purchases, but helium besides doubled down connected Bitcoin adjacent during downturns. For beginners, dollar-cost averaging whitethorn go a utile strategy.

Separate idiosyncratic content from institution strategy: Not everyone has a corp to backmost Bitcoin bets. Saylor blended idiosyncratic holdings and Strategy’s treasury. For individuals, it’s amended to intelligibly abstracted idiosyncratic savings from speculative investments.

Even if you don’t person Saylor’s fortune, you tin inactive usage immoderate of his strategies to amended navigate Bitcoin, specified arsenic doing your ain probe and being diligent and disciplined.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 hour ago

1 hour ago

English (US)

English (US)