MicroStrategy acquired astir 18,300 Bitcoin for $1.1 cardinal betwixt Aug. 6 and Sept. 12 astatine an mean terms of $60,408 per BTC, according to a Sept. 13 filing with the US Securities and Exchange Commission (SEC).

Coinflip information shows the company’s latest acquisition already has a insubstantial nonaccomplishment of $2.2 cardinal owed to the apical integer asset’s existent volatility.

Funding

The steadfast stated that the acquisition was funded by selling more than 8 cardinal institution shares via a income statement with respective fiscal institutions, including TD Securities, The Benchmark Company, BTIG, Canaccord Genuity, Maxim Group, and SG Americas Securities.

The superior raised from these income was straight utilized to grow its Bitcoin holdings.

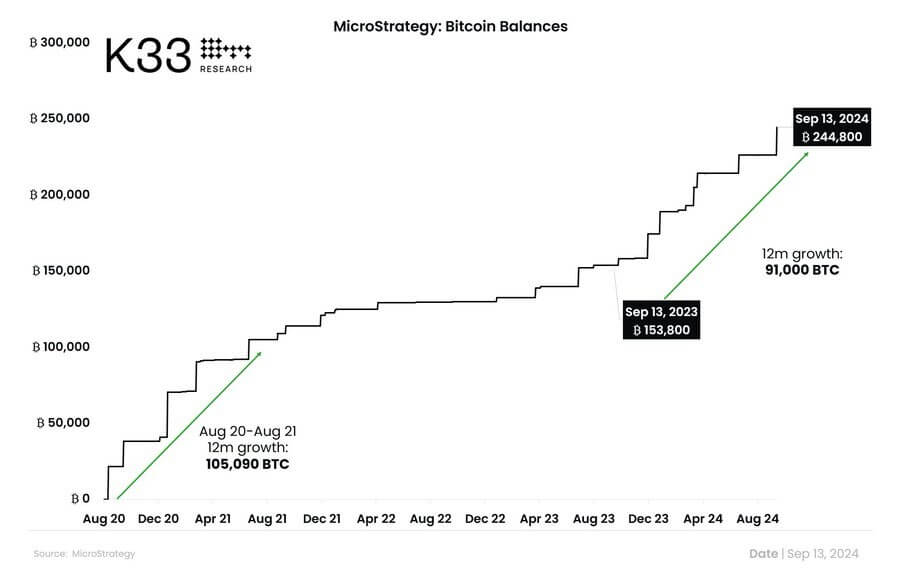

Notably, the steadfast has pursued this backing strategy aggressively during the past twelvemonth to accumulate the apical integer asset. K33 Research stated that the steadfast has bought astir 91,000 BTC betwixt Sept. 2023 and today.

It added:

“August 2020-21 is the lone play featuring a higher YoY maturation successful MSTR’s BTC vulnerability of 105,090 BTC.”

MicroStrategy Bitcoin Balance. (Source: K33 Research)

MicroStrategy Bitcoin Balance. (Source: K33 Research)Meanwhile, this latest acquisition brought MicroStrategy’s full Bitcoin holdings to 244,800 BTC, valued astatine implicit $14 cardinal astatine existent prices. The company’s full concern successful Bitcoin is $9.45 billion, with an mean acquisition terms of $38,585 per Bitcoin.

Saylortracker data indicates the steadfast holds an unrealized nett of much than $4 billion.

Bitcoin yield

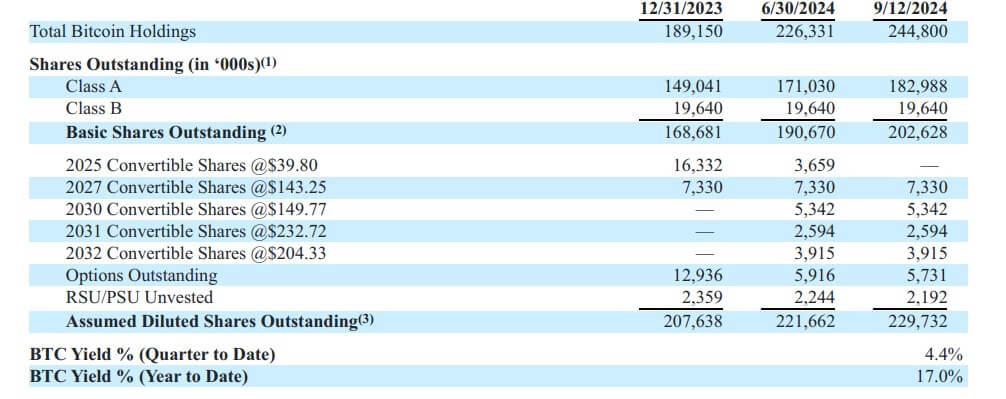

MicroStrategy Executive Chairman Michael Saylor reported a Bitcoin output of 4.4% for this 4th and 17% year-to-date connected its holdings.

MicroStrategy Bitcoin Yield. (Source: MicroStrategy)

MicroStrategy Bitcoin Yield. (Source: MicroStrategy)According to the SEC filing, this cardinal show indicator (KPI) helps measure the firm’s strategy for acquiring Bitcoin. The BTC output metric tracks the percent alteration implicit clip successful the ratio of MicroStrategy Bitcoin holdings to diluted shares.

The institution believes this measurement tin heighten investors’ knowing of its determination to money Bitcoin purchases done issuing further shares oregon convertible instruments.

Despite quality of the latest purchase, MicroStrategy’s shares stay level successful premarket trading. However, it has risen 91% year-to-date.

The station MicroStrategy buys $1.1 cardinal successful Bitcoin amid marketplace volatility appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)