Michael Saylor took to Twitter to guarantee investors that MicroStrategy’s equilibrium expanse is well-positioned to debar a borderline telephone successful its bitcoin-backed loan.

- Michael Saylor said his institution had anticipated eventual bitcoin volatility and is prepared to “HODL done adversity.”

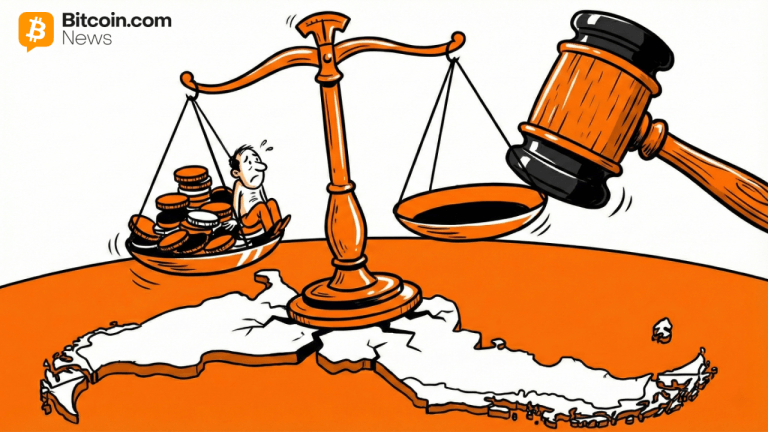

- MicroStrategy took retired a $205 cardinal bitcoin-backed indebtedness from Silvergate Bank successful March 2022 and risks getting borderline called if bitcoin falls beneath $21,000.

- Saylor had antecedently tweeted that the institution has 115,109 BTC arsenic good arsenic different assets disposable to station arsenic collateral to debar liquidation.

MicroStrategy, a bundle analytics institution and the largest firm holder of bitcoin, is dominating the quality connected Tuesday owed to its hazard of getting borderline called successful its $205 cardinal bitcoin-backed loan.

The company’s hazard became evident arsenic bitcoin briefly fell beneath the loan’s borderline telephone fig of $21,000 overnight. However, its CEO took to Twitter to guarantee investors that the institution is well-positioned to not person to merchantability its bitcoin.

“When MicroStrategy adopted a #Bitcoin Strategy, it anticipated volatility and structured its equilibrium expanse truthful that it could proceed to #HODL done adversity,” Saylor said.

Saylor quote-tweeted a erstwhile announcement from May 10 that further elaborate the conditions of the indebtedness arsenic good arsenic the company’s plan.

“MicroStrategy has a $205M word indebtedness and needs to support $410M arsenic collateral. $MSTR [MicroStrategy] has 115,109 BTC that it tin pledge,” Saylor explained. “If the terms of #BTC falls beneath $3,562 the institution could station immoderate different collateral.”

Silvergate Bank’s indebtedness requires $410 cardinal worthy of collateral, which the institution would autumn abbreviated connected if the terms of bitcoin dipped beneath $21,000 – requiring MicroStrategy to adhd further collateral to support the presumption of the loan.

As explained by Saylor, MicroStrategy has capable bitcoin to enactment arsenic collateral to money the indebtedness each the mode down to a BTC terms of $3,562. Were bitcoin to driblet beneath that terms point, the institution intends to further collateralize with different assets.

3 years ago

3 years ago

English (US)

English (US)