Microstrategy's $205 cardinal Bitcoin-backed indebtedness would beryllium taxable to a borderline telephone if Bitcoin dropped to $21,000

Cover art/illustration via CryptoSlate

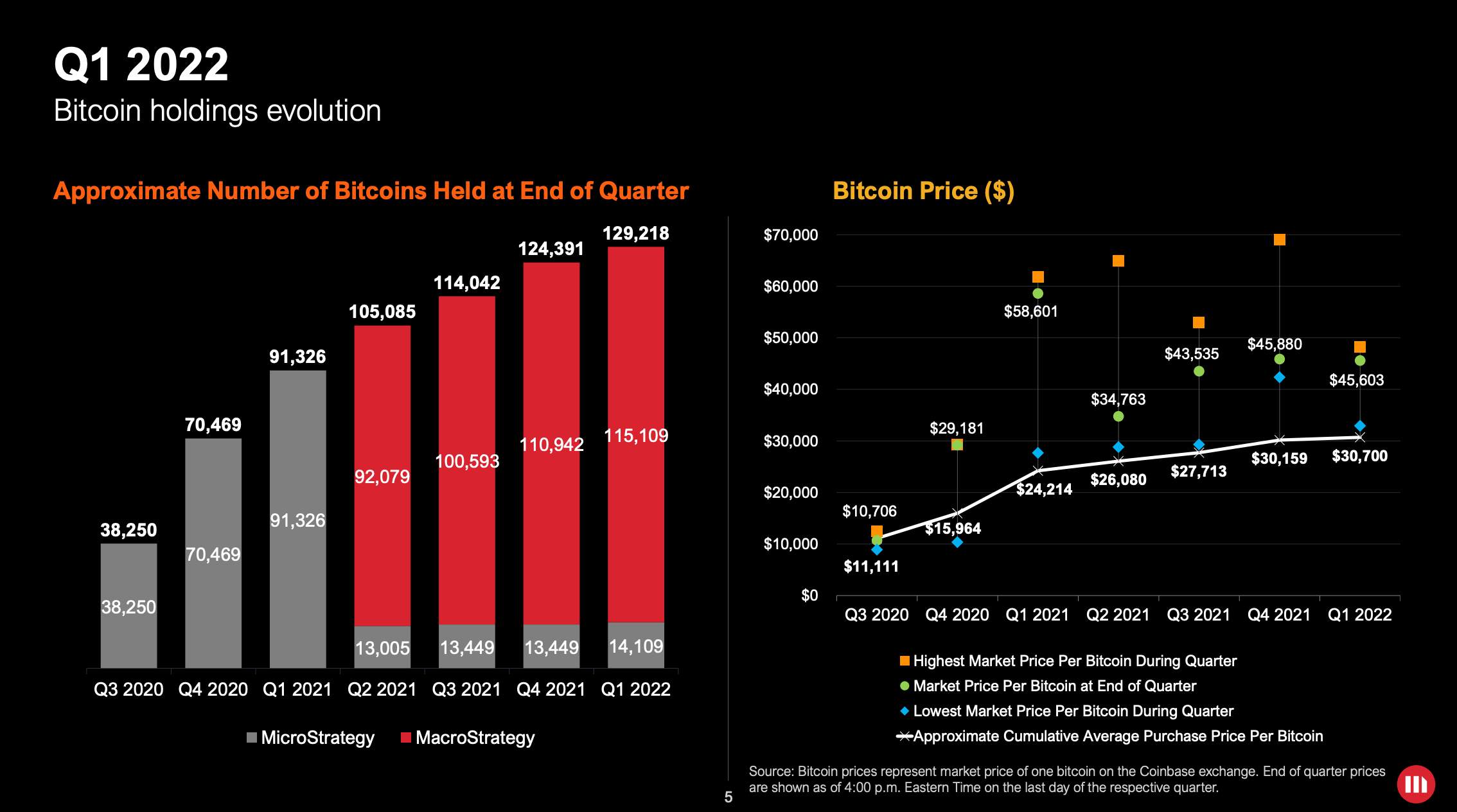

The Microstrategy Q1 net telephone has revealed that they person a vested involvement successful keeping Bitcoin supra $21,000 should determination beryllium a marketplace capitulation. Microstrategy presently owns 129,200 bitcoins, according to their CEO, Michael Saylor, who is 1 of the biggest supporters of Bitcoin. The institution recently took retired a $205 cardinal indebtedness backed by their bitcoin holdings to acquisition further Bitcoin.

In the net call, Phong Le, the CFO of Microstrategy, explained that they person an LTV connected the indebtedness of 25%, meaning that they person enactment up 19,466 Bitcoin arsenic collateral. Therefore, if the terms of Bitcoin were to autumn to $21,000, past they would beryllium a borderline telephone arsenic the LTV would emergence to 50%.

However, determination is nary proposition that determination would beryllium an automatic liquidation. Microstrategy would beryllium required to adhd further to the collateral held nether custody. As they person astir $4.9 cardinal successful Bitcoin nether their ownership, this should beryllium imaginable arsenic agelong arsenic that Bitcoin is liquid and not besides earmarked arsenic collateral for thing else.

However, Cointelegraph has suggested that Microstrategy could besides acquisition further Bitcoin astatine a discounted terms to adhd to the collateral package. They bash not person to instrumentality Bitcoin from their existent reserves to enactment their loan. Saylor tweeted precocious that “people who recognize #bitcoin bargain it. People who don’t recognize #bitcoin speech astir it.” Given however bullish Saylor has been connected Bitcoin, it is hard to judge that, if they person the liquidity, helium volition implore Microstrategy to acquisition much Bitcoin for $21,000. This is particularly existent fixed that Saylor revealed earlier this twelvemonth that their mean outgo terms per Bitcoin is $30,200.

Source: Microstrategy Q1 Earnings Report

Source: Microstrategy Q1 Earnings ReportIt is chartless whether Microstrategy would proceed to acquisition Bitcoin to support little absorption levels oregon determination their presently held Bitcoin to woody with a borderline call. However, it would beryllium a divergence from Saylor’s strategical communicative not to bash truthful if they had funds available. They whitethorn besides person the enactment to enactment up much Bitcoin arsenic collateral for an adjacent bigger loan. When it comes to Bitcoin, helium appears precise single-minded;

“#Bitcoin is simply a slope successful cyberspace, tally by incorruptible software, offering a global, affordable, simple, & unafraid savings relationship to billions of radical that don’t person the enactment oregon tendency to tally their ain hedge fund.”

3 years ago

3 years ago

English (US)

English (US)