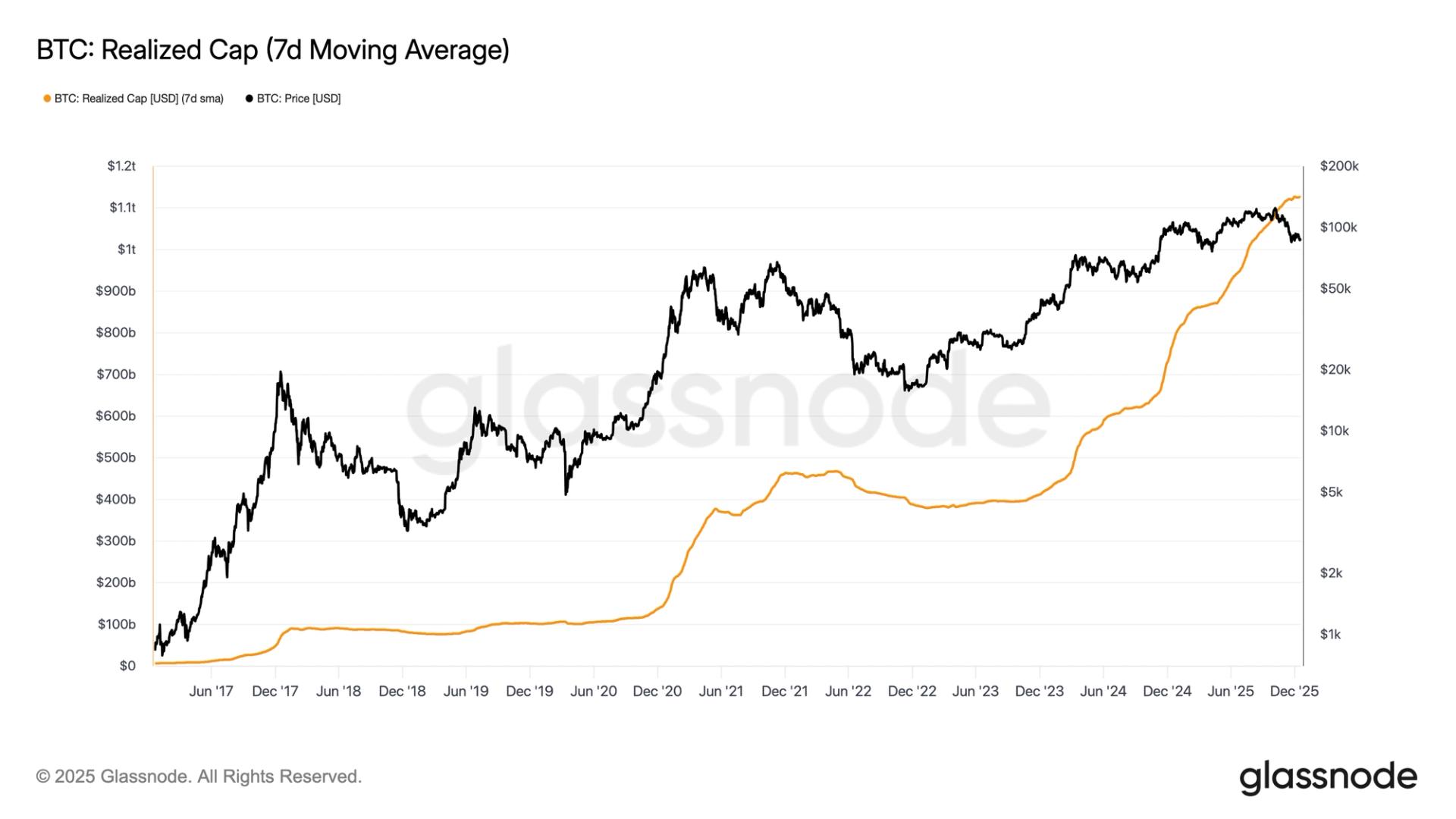

MicroStrategy's Bitcoin (BTC) holdings person turned profitable for the archetypal clip since July this twelvemonth arsenic the BTC terms has breached done supra $30,000.

MicroStrategy up $132M successful insubstantial profits

As of Oct. 23, MicroStrategy held 158,245 BTC worthy $4.847 billion, up astir $132 cardinal from the archetypal magnitude invested — astatine an mean complaint of 29,870 per BTC. In different words, the steadfast is present up astatine slightest $130 per coin.

MicroStrategy Bitcoin holdings arsenic of Oct. 23. Source: BlockchainCenter.Net

MicroStrategy Bitcoin holdings arsenic of Oct. 23. Source: BlockchainCenter.NetMicroStrategy started buying Bitcoin successful 2020. The steadfast ramped up purchases successful 2023 arsenic BTC's terms recovered from utmost losses caused by the Federal Reserve's rate hike policy and high-profile crypto bankruptcies and implosions.

In September 2023, MicroStrategy acquired 5,444 BTC by raising an equivalent magnitude of capital, mirroring the attack that saw the steadfast buying astir 12,333 Bitcoin by raising funds earlier this year.

Michael Saylor, the co-founder and president of MicroStrategy, shared data showing Bitcoin's outperformance versus accepted assets since the institution adopted its cryptocurrency-buying strategy successful August 2020.

Bitcoin vs. S&P 500, Nasdaq, Gold, Silver, and Bond returns since August 2020. Source: Michael Saylor/X

Bitcoin vs. S&P 500, Nasdaq, Gold, Silver, and Bond returns since August 2020. Source: Michael Saylor/XWill Bitcoin terms emergence further into 2024?

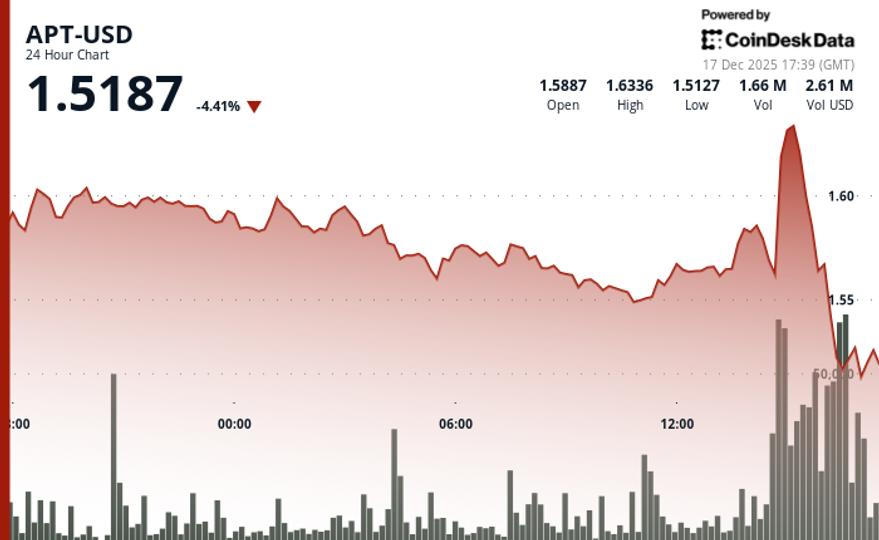

Since May 2022, Bitcoin has failed to found a wide bullish momentum aft crossing $30,000. This script whitethorn repetition successful the coming weeks. This, successful turn, risks pushing MicroStrategy's BTC concern beneath its mean buying terms erstwhile again.

BTC/USD regular terms chart. Source: TradingView

BTC/USD regular terms chart. Source: TradingViewMore downside cues travel from Bitcoin's daily relative spot index (RSI), present astatine its astir overbought levels since January 2023. As a regularisation of method analysis, an overbought RSI (above 70) could punctual BTC terms to driblet oregon consolidate sideways.

A correction script volition spot Bitcoin's terms caput toward its 50-day exponential moving mean (50-day EMA; the reddish wave) adjacent $27,720 successful November, down astir 10% from existent levels.

Conversely, maintaining and confirming $30,000 arsenic the caller enactment level volition unfastened the doorway toward the adjacent large absorption country astatine $32,000 — a level not seen since May 2022.

Related: How precocious tin Bitcoin terms spell by 2024?

From a cardinal perspective, a imaginable Bitcoin exchange-traded money (ETF) support successful the U.S. serves arsenic a beardown bullish backdrop, according to CryptoQuant. It notes that the support of a Bitcoin ETF tin boost the Bitcoin market's nett capitalization by $155 billion.

In turn, the terms of each Bitcoin would deed $50,000-73,000 successful 2024, which would surely go a boon for MicroStrategy, though the steadfast says it will enactment connected its BTC course adjacent if the Bitcoin ETF get the greenish light.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)