Disclaimer: The expert who wrote this portion owns shares of MicroStrategy (MSTR) It's been a pugnacious period for MicroStrategy (MSTR), the bundle developer turned bitcoin (BTC) accumulator. Its banal has tumbled almost 50% since November, erstwhile it joined the Nasdaq 100 scale and peaked astatine a 600% summation since the commencement of the year.

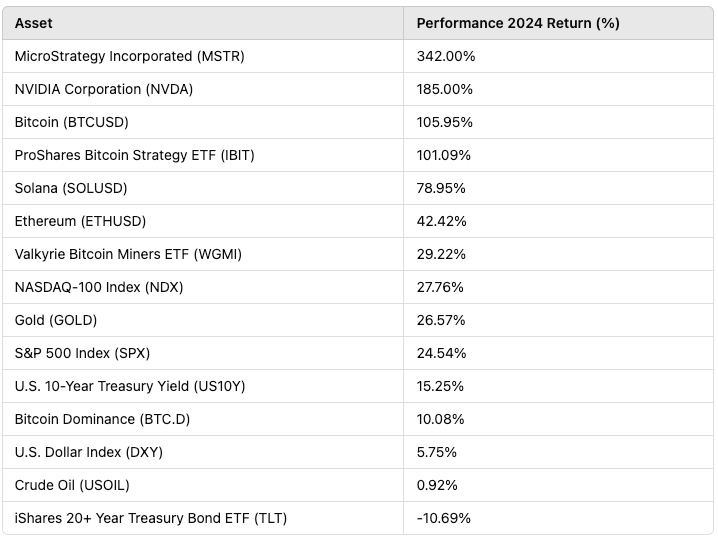

That inactive leaves the Tysons Corner, Virginia-based institution a whopping 342% up successful 2024, the biggest instrumentality among the highest-profile crypto-linked assets successful accepted concern (TradFi).

It's been a volatile year, packed with geopolitical and technological developments to rattle fiscal markets. The continuing wars successful eastbound Europe and the Middle East, elections crossed the globe, the unwinding of the yen transportation commercialized successful August and the maturation of artificial quality (AI) person each near their marks.

MicroStrategy's summation is astir treble that of Nvidia (NVDA), the chipmaker whose accumulation of integrated circuits needed for AI applications fueled a 185% return, the champion among the alleged magnificent 7 tech stocks. The adjacent best, Meta Platforms (META), turned successful 71%.

Bitcoin itself roseate 100% successful a twelvemonth that included April's reward halving and aggregate grounds highs. Demand for the largest cryptocurrency was driven by the January approval of spot exchange-traded funds (ETFs) successful the U.S. Bitcoin outperformed 2 of its biggest competitors, ether (ETH), up 42%, and Solana (SOL), up 79%.

Among the ETF's iShares Bitcoin Trust (IBIT) besides returned implicit 100% and became the fastest ETF successful past to deed $50 cardinal successful assets.

Bitcoin mining companies, connected the whole, disappointed. Valkyrie Bitcoin Miners ETF (WGMI), a proxy for mining stocks, roseate conscionable nether 30%. That's contempt request for the miners' computing capabilities and powerfulness proviso agreements from artificial quality and high-performance computing (HPC) companies. Still, idiosyncratic companies benefited, successful particular, Bitdeer (BTDR),which added 151%, and WULF (WULF), which gained 131%.

Nevertheless, the miners' gains bushed the broader equities market. The tech-heavy Nasdaq 100 Index (NDX) added 28% portion the S&P 500 Index (SPX) roseate 25%. The S&P 500 besides trailed down gold's 27% increase. The precious commodity has present topped the equity gauge successful three of the past 5 years.

Concerns astir U.S. ostentation and the country's fund shortage added to the geopolitical uncertainties to punctual a monolithic emergence successful U.S. treasury yields, which determination successful the other absorption to price.

The output connected the 10-Year Treasury added 15% to 4.5% implicit the people of the year, and amazingly gained a afloat 100 ground points since the Federal Reserve started cutting involvement rates successful September.

The iShares 20+ Year Treasury Bond ETF (TLT), which tracks enslaved prices, dropped 10% this twelvemonth and has mislaid 40% successful the past 5 years.

The dollar, connected the different hand, showed its strength. The DXY Index (DXY), a measurement of the greenback against a handbasket of the currencies of the U.S.' biggest trading partners, roseate to the highest since September 2022.

West Texas Intermediate (USOIL), the benchmark lipid terms successful the U.S., ends the twelvemonth small changed, up little than 1% to astir $71 a barrel. But it was a bumpy ride, with the terms rising to astir $90 astatine immoderate points successful the past 12 months.

As we caput into the caller year, each eyes volition beryllium connected the debt ceiling discussion, the policies of President-elect Donald Trump and whether the U.S. tin proceed with its awesome maturation story.

11 months ago

11 months ago

English (US)

English (US)