- Since MicroStrategy’s pivot to Bitcoin, the institution has managed to accumulate 130,000 Bitcoins, worthy conscionable implicit $3.406 Billion astatine existent rates.

- MicroStrategy’s Bitcoin acquisition was financed done aggregate debts and enslaved offerings.

- Bitcoin’s dip to $18,300 connected 13 October whitethorn person temporarily jeopardized the company’s fiscal health.

- MicroStrategy’s archetypal indebtedness repayment is owed successful 17 months, wherever Saylor volition beryllium required to wage $855 Million.

- According to a Fortune report, the company’s halfway bundle concern is generating precise small currency flow, and its Bitcoin involvement indebtedness payments whitethorn negatively impact its currency flow.

Bitcoin maximalist Michael Saylor tweeted earlier today, “Bitcoin is the heartbeat of Planet Earth.” Michael Saylor is precise fashionable successful the crypto assemblage and is often seen making the lawsuit for Bitcoin and spreading the connection astir its advantages. But the existent impervious of Saylor’s assurance successful the flagship crypto is disposable connected the equilibrium expanse of MicroStrategy, the bundle institution that helium co-founded.

According to a Forbes report, Michael Saylor whitethorn person risked the solvency of the bundle institution by taking a large gamble connected Bitcoin.

MicroStrategy’s pivot from bundle to Bitcoin

In August 2020, Saylor, past CEO of the firm, decided that an concern successful Bitcoin should beryllium made arsenic a hedge against inflation. He hasn’t looked backmost since.

With Michael Saylor astatine its helm, MicroStrategy acquired much than 129,000 Bitcoins. This acquisition was financed done 4 indebtedness deals worthy $2.4 billion, 3 bond offerings, 1 borderline loan, and a $1 cardinal equity offering.

Saylor announced that helium was stepping down from his relation arsenic CEO successful August. However, the Bitcoin accumulation didn’t stop. The company’s latest purchase of $6 cardinal worthy of Bitcoins brought the full holdings to 130,000 BTC astatine a existent worth of $3.406 Billion.

So what has happened since then? Well, connected 13 October, BTC plunged to $18,300, the lowest it had been successful astir 2 years. This is wherever things got somewhat uncomfortable for MicroStrategy. The company’s indebtedness obligations meant that Bitcoin’s terms has to enactment supra the $18,500 people (their mean BTC price), which would warrant the holdings against its $2.4 cardinal debt.

Bitcoin’s dip translated to a level $26 cardinal nonaccomplishment connected his investment. Additionally, specified a diminution successful BTC’s terms besides renders the company’s $1 cardinal banal merchantability useless.

MicroStrategy volition person to commencement repaying its indebtedness successful 17 months. Come December 2025, the steadfast volition person to repay $885 Million of the indebtedness and wage disconnected the full magnitude by aboriginal 2027.

Given that Saylor has boosted the firm’s Bitcoin holdings by employing important leverage, its fiscal wellness greatly depends connected the betterment of Bitcoin’s price.

The bull lawsuit for MicroStrategy

The company’s halfway bundle concern is failing to make capable currency flow. While the gross from this watercourse wasn’t awesome earlier the company’s Bitcoin purchases, the post-Bitcoin epoch has seen the company’s financials degrade adjacent more. The yearly involvement of $46 cardinal that Saylor’s steadfast has to wage for its debts does small to easiness the financials.

However, with a marketplace capitalization of $2.2 billion, the institution boasts an awesome ratio erstwhile compared to its humble annualized escaped currency flow.

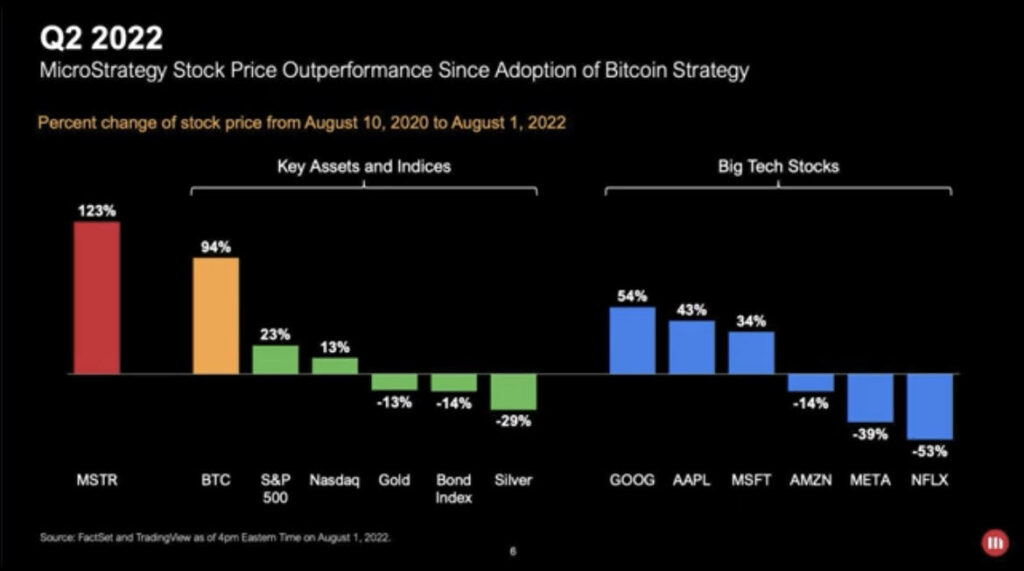

If we zoom retired and look astatine the MicroStrategy (MSTR) stock’s show since August 2020, an summation of much than 75% tin beryllium seen. When compared to the S&P 500 oregon adjacent gold, MSTR’s show is thing abbreviated of impressive.

The company’s Q3 net telephone is organized for 27 October. The information disclosed past volition supply further insights into its fiscal health.

3 years ago

3 years ago

English (US)

English (US)