The terms of bitcoin is down 16% implicit the past 30 days and since the crypto asset’s all-time precocious (ATH) connected November 10, 2021, bitcoin has mislaid much than 38% since it surpassed $69K per portion that day. Meanwhile, crypto advocates are furiously debating whether this is simply a bitcoin carnivore marketplace oregon if the bull marketplace is inactive intact. To galore observers bitcoin’s existent marketplace rhythm is not complete, arsenic nary coagulated highest had formed, and speculators inactive expect different bubble to travel to fruition.

The Four Phases of the Price Cycle — Bitcoin Traders Debate Cycle Position, Trader Insists ‘Early February Will Be the Move’

Many integer currency traders wage attraction to tops and bottoms and the 4 stages of the marketplace cycle. The stages see the accumulation phase, the uptrend phase, the organisation phase, and the downtrend oregon capitulation phase. One could accidental that the accumulation signifier took spot 666 days agone connected March 12, 2020, erstwhile the terms of bitcoin slipped below the $4K per portion zone. On that time successful March, the World Health Organization (WHO) announced the satellite was dealing with the Covid-19 outbreak and dubbed it a “pandemic.”

If you were wondering wherefore this cycle's bull tally looks a small antithetic from the erstwhile ones. It's conscionable the beginning. 🚀 #Bitcoin pic.twitter.com/q3X3z51x6X

— Bitwatch 🟠 (@TheBitwatch) January 3, 2022

On that day, different known arsenic ‘Black Thursday,’ planetary markets worldwide were roiled and the crypto system shed billions successful a substance of nary time, but the crypto system betterment and accumulation signifier started the precise adjacent day. The terms of bitcoin (BTC) continued to uptrend and moved steadily into the markup signifier arsenic BTC had yet surpassed the $20K 2017 all-time high. By January 7, 2021, BTC’s terms touched $40K for the archetypal clip successful history. In mid-May, BTC’s terms made it to the $66K portion for the archetypal clip and slipped beneath that portion soon after.

Bitcoin’s terms slid beneath the $40K portion astir September 21, 2021, and radical claimed that the terms apical was not successful yet. They were close arsenic 50 days later, the terms of bitcoin (BTC) deed a beingness terms precocious astatine $69K per portion connected November 10, past year. Still, crypto advocates judge that the bull rhythm is not implicit and 1 much parabolic uptrend whitethorn beryllium successful the cards. Most bitcoiners effort to measurement cycles by leveraging the clip betwixt BTC’s halving cycle.

In the 1st and 2nd #Bitcoin halving cycles, terms deed a linear 4.236 fib hold earlier uncovering enactment adjacent linear 2.618 and moving higher.

In the 3rd #Bitcoin halving cycle, terms has deed a linear 4.236 fib hold and is trying to find enactment adjacent linear 2.618. pic.twitter.com/7EbsaaXRAA

— TechDev (@TechDev_52) January 5, 2022

Typically, due to the fact that of bitcoin’s scarcity, the terms rises earlier the reward halving, and the adjacent halving is expected 850 days from now connected May 6, 2024. That’s inactive much than 2 years distant and radical wholeheartedly judge that the bull marketplace that led BTC to $69K is inactive successful play. Bitcoiners are inactive expecting a double-bubble akin to 2013 wherever the terms exceeds the $69K portion and peaks higher. Crypto marketplace pundit Bobby Axelrod thinks that successful aboriginal February observers volition witnesser the adjacent large move.

“This adjacent limb up, this adjacent 60-day rhythm beginning,” Axelrod tweeted. “Early February volition beryllium THE MOVE. Where bitcoin’s terms ends up aft the adjacent determination should beryllium the rhythm apical IMO. At slightest I volition beryllium treating it arsenic such.”

Crypto Advocates Expect a Bitcoin Price Rebound — ‘Price Crash Means the Upside Surge Is Sooner to Come’

Crypto protagonist Colin, big of the Youtube amusement “Colin Talks Crypto” thinks the marketplace rhythm has been lengthened. “Because of the evident lengthening rhythm of this bull run, I present deliberation it is *more likely* for america to spot a $300,000 bitcoin terms than a specified $100,000 bitcoin price,” the Youtuber said connected January 5. The aforesaid day, Colin tweeted:

I’m blessed that the bitcoin terms is crashing— not due to the fact that I similar the terms to spell down, but due to the fact that it means the upside surge is sooner to come. It’s like, ‘let’s get this clang implicit with truthful we tin determination into much bullish territory!’

Many different crypto supporters consciousness the aforesaid way. The Twitter relationship dubbed “Wicked Smart Bitcoin” wrote: “Perfect spot to bounce IMO. Rekt everyone who longed astatine $43k and present everyone abbreviated (expecting a interruption down to $40k) volition get rekt. Choppity chop chop. Don’t commercialized oregon usage leverage. Just bargain spot, aforesaid custody, and HODL for a rhythm oregon two. Let hyperbitcoinization bash its thing.”

‘The Midpoint Puke’

The Twitter relationship called @therationalroot shared a illustration of each the bitcoin terms cycles and the all-time precocious (ATH) terms positions that were recorded wrong the cycles. “The 2021 rhythm truthful acold gave america 32 bluish dots (ATH’s),” the bitcoin advocator said. “We had 72 successful the 2017 rhythm and 52 successful the 2013 cycle. Let the fireworks for 2022 begin.” The trader, entrepreneur, and capitalist Bob Loukas described the rhythm arsenic a “midpoint puke.” Loukas said:

Day 31 of the bitcoin Cycle, the midpoint puke. The overlay is the Cycle from May 23rd – July 20th 2021. Not a instrumentality of overlays, I don’t commercialized disconnected them, but akin conditions. I deliberation $40k was ever the much important level. More important is the aboriginal [February] timing.

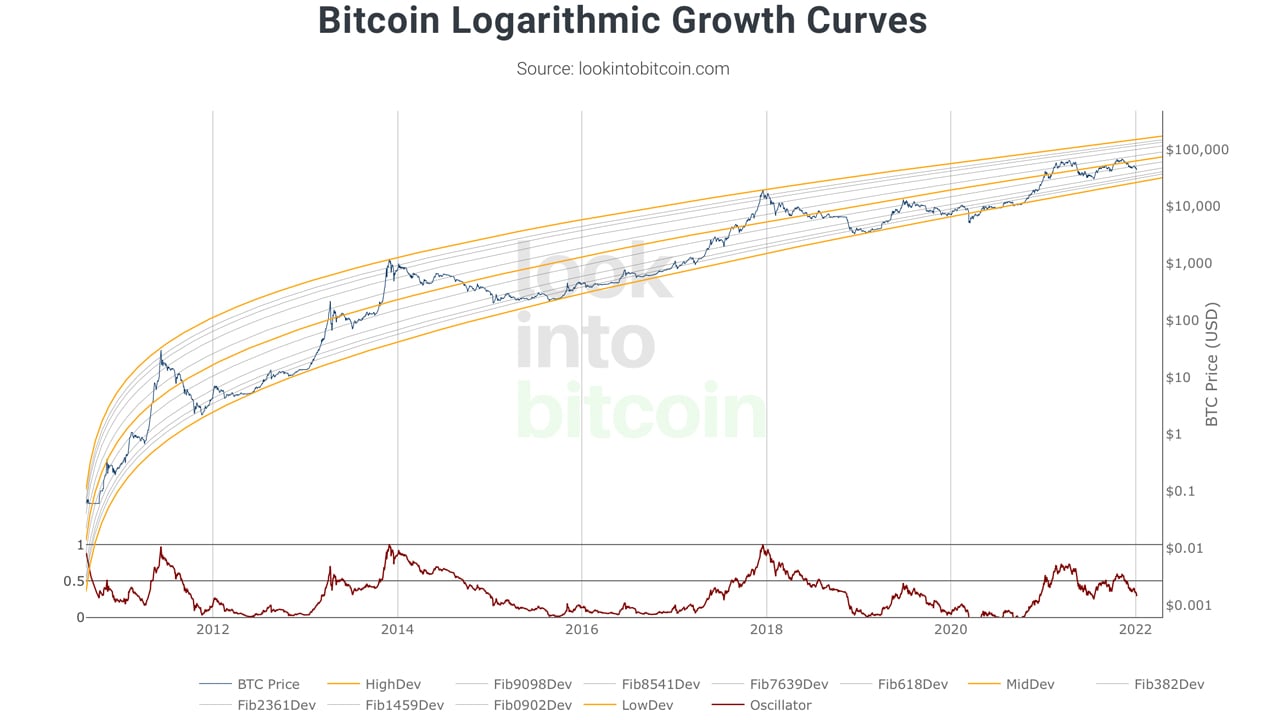

Currently, bitcoin’s logarithmic maturation curve shows 3 bull runs with utmost peaks yet the existent rhythm looks incomplete and astir undecided. The chart shows that determination person lone been 2 times successful bitcoin’s terms past wherever it slid beneath the yellowish debased dev line, and the past clip it happened was connected March 12, 2020 (Black Thursday). The extremity of the illustration and the yellowish debased dev enactment indicates that BTC’s terms won’t spell little than $25K if it maintains the power-law corridor exemplary without deviation.

It’s harmless to accidental that astir bitcoiners adjacent with the astir precocious method investigation skills are unsure of wherever bitcoin’s terms is headed. Tai Zen, the crypto trader, entrepreneur, and CEO of the trading web portal cryptocurrency.market says radical should hold until the carnivore marketplace to get altcoins.

“Bitcoin is connected merchantability nether $50K (laser oculus price),” Zen tweeted. “We bash not urge buying immoderate coins during the mediate of a bull market. However, if u person other currency & itching to leap into crypto, past the lone coin I would bargain is BTC [and] thing else,” Zen added.

Tags successful this story

2013, 2020, Analysts, bearish cycle, Bears, Bitcoin, Bitcoin (BTC), Bitcoiners, Black Thursday, Bob Loukas, Bobby Axelrod, bullish cycle, Bulls, Charts, Colin Talks Crypto, cycle, cycles, Double Bubble, Halving, halving cycle, March 12, Market Update, Markets, midpoint puke, Price Cycle, Prices, therationalroot, Traders, Wicked Smart Bitcoin

What bash you deliberation astir bitcoin’s existent terms cycle? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)