While prime of beingness successful 2022 mightiness look amended successful galore regards, vigor usage per capita was higher years ago, coating a bleak representation for millennials.

This is an sentiment editorial by Andy LeRoy, the laminitis of Exponential Layers which is simply a Lightning Network analytics level and explorer.

This beautiful 3 bedroom, 1.5 bath house successful Charlotte, North Carolina, is simply a millennial’s dream. Complete with a backyard and a structure for enjoying a coffee, it is successful a premier vicinity conscionable down the thoroughfare from a brunch spot with an all-day avocado toast special. For conscionable $730,000, it tin beryllium each yours.

We each admit this location is expensive. A $4,000 monthly payment, adjacent aft putting $150,000 down, would correspond astir 70% of the median U.S. household income, and this location is astir 1.7 times higher than the U.S. median location price of $440,000.

Why Is This House So Expensive?

The location was built successful 1938, and its latest disposable records amusement its merchantability history, the earliest being for $88,500 successful 1987.

This leap from $88,500 to $730,000 is simply a 725% summation implicit 35 years, and reflects a compound yearly maturation complaint (CAGR) of 6.2%. That’s rather an increase. Over the aforesaid clip the S&P 500 is up 465% astatine a CAGR of 5.1%, truthful is it truly that large of a leap successful comparison?

What astir gross home merchandise (GDP), the go-to for measuring economical output? GDP is up from $4.7 trillion to $24.8 trillion successful nominal terms, different triple-digit summation of 427% implicit 35 years.

So everything is up … it makes sense, right?

Charlotte’s colonisation has grown from 424,000 to 2.2 cardinal implicit this aforesaid clip play — 5% CAGR — and this location is successful a large neighborhood, truthful proviso and demand? Plus our system is much productive, truthful the emergence successful terms is inevitable?

All of this checks retired connected paper, but for 1 metric: energy.

U.S. vigor consumption successful 1987 was 21,056 TWh of energy, which adjusted for colonisation astatine the clip represents astir 87,000 kWh per person. Of this vigor consumption, energy usage was astir 11,500 kWh per capita.

Compare that to contiguous — the latest figures successful 2022 for the United States amusement per capita vigor depletion of 76,632 kWh, with a flimsy summation successful the magnitude consumed arsenic energy astatine 12,466 kWh per person.

For each of the speech of “walking uphill some ways” successful erstwhile generations, it really turns retired that much vigor was consumed per capita 35 years agone successful the U.S. than it is today.

The Energy Breakdown

There are a number of forms for however vigor (and past electricity) is created.

How vigor is created

How vigor is created

If you thrust a motorcycle astatine a tenable pace, you volition make 100 watts. Keep this up for 10 hours and you volition person generated 1 kWh worthy of energy. A load of laundry done with a washer and a dryer volition devour astir 6 kWh of energy.

If we disregard the monetary denomination of lodging prices and conscionable look astatine the U.S. system arsenic the output and depletion of energy, we present devour little per capita than we did successful 1987.

As we saw successful USD prices, this peculiar location is 8 times arsenic expensive, portion vigor depletion per capita is flat. By this logic, if it took you 1 period of riding your motorcycle for 10 hours a time to make the vigor to bargain the location successful 1987, you would present request to thrust your motorcycle for 8 months to bargain the aforesaid house. Eight times arsenic overmuch vigor for the aforesaid product? Better get retired that Peloton subscription.

This is simply a cherry-picked illustration of 1 location successful a increasing city; it has astir apt been renovated galore times and is worthy the other work, particularly considering Charlotte’s colonisation and occupation growth.

Let’s zoom retired and look astatine different example.

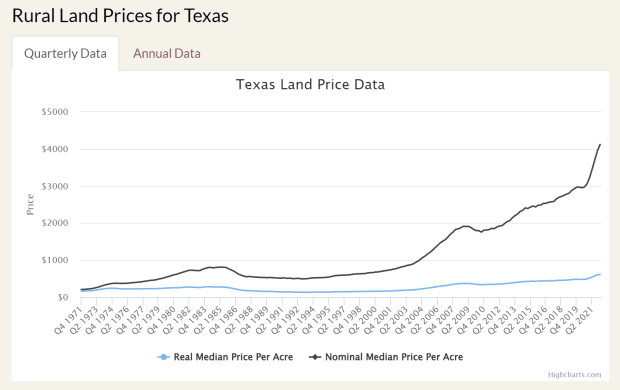

The Texas A&M Real Estate Center publishes aggregated agrarian onshore prices. From their chart, we tin spot that an acre of onshore successful Texas successful 1987 was $553. That aforesaid onshore successful 2021 is present astir $4,000/acre (an eightfold summation implicit a 35-year period).

(Source)

(Source)

An acre of land, with nary improvements, successful the mediate of nowhere, present requires 8 times arsenic overmuch vigor output to purchase?!

Land tin amended successful worth with higher population, inferior (farming oregon hunting) oregon little taxation rates and/or immoderate benignant of subsidized incentive. But a 362% terms summation aft adjusting for U.S. colonisation growth? Texas forever, but thing doesn’t adhd up here.

Is Energy The Correct Metric?

The thought of energy-based wealth is thing new. Henry Ford was an aboriginal proponent of vigor arsenic currency, and arsenic galore Bitcoiners and Redditors person pointed out, helium was besides a believer successful reincarnation (H.F. anyone?). The thought of a wealth denominated successful vigor terms, kWh for example, held large committedness for getting america retired of the fiat system.

We intuitively admit the conception of energy. We either enactment longer hours oregon we absorption efforts oregon usage amended tools to leverage our output, and the abstractions simply spell on. The firm satellite is afloat of interior complaint of instrumentality analysis, assets staffing, budgets and timelines. Earnings reports and fiscal statements connection the scorecard to the market, which weeds retired businesses that bash not make economical worth implicit time.

Our strategy of capitalism has worked rather well. Thanks to the unthinkable ingenuity, output and enactment of everyone successful the world, and contempt inflation, truthful galore things now person little prices.

In 1956, the ENIAC computer weighed 27 tons, consumed 150 kW, ran astir 100,000 operations per 2nd and outgo the equivalent of $6 cardinal today. Today, a caller Macbook weighs 3.5lbs, consumes astir 40 watts, and cranks retired 3.2 cardinal operations per 2nd — each for $2,000.

Airliners have accrued their substance efficiency astatine a compound complaint of 1.3% betwixt 1968 and 2014.

In galore cases, we are getting overmuch much businesslike with each of our vigor consumption, truthful things should beryllium getting adjacent much inexpensive?

What’s The Problem?

To beryllium capable to person a affluent beingness and truthful galore improvements portion utilizing the aforesaid vigor per capita is simply a payment to america all, but however that economical worth is measured is susceptible to changing rules.

If we person gotten much businesslike with our vigor and person amended technology, however is it that a portion of agrarian onshore costs 8 times more? This is wherever the Federal Reserve’s expanding wealth proviso comes into play. For each of the speech astir “transitory inflation,” the Fed (with the assistance of banks) has managed to grow the M2 wealth supply by astir 680% implicit the past 35 years.

So portion our nominal GDP is up 427%, it hasn’t outpaced wealth proviso growth, and we person already seen that vigor depletion per capita is level implicit 35 years.

The occupation present is what we each tin tangibly feel: The output of our enactment denominated by the vigor we enactment successful is worthy importantly little implicit time.

When we arsenic individuals oregon corporations are incapable to sphere the efforts of our vigor output, we indispensable continually find ways to sphere our purchasing powerfulness done assets similar land, commodities and equities. If the gait astatine which stored vigor degrades is faster than innovation and output, we person problems. Physical limits travel into play: We tin people each the wealth successful the world, but we can’t fake vigor accumulation and consumption.

Yes, our vigor whitethorn beryllium consumed much efficiently — arsenic evidenced earlier by the airplane requiring 45% little substance for the aforesaid travel — frankincense providing much worth to society. If our nine has been truthful efficient, why has indebtedness to GDP risen from 47% successful 1987 to 123% today? How is it that we person needed to get against the aboriginal truthful overmuch successful an situation of accrued productivity? At immoderate constituent this each breaks.

What Breaks?

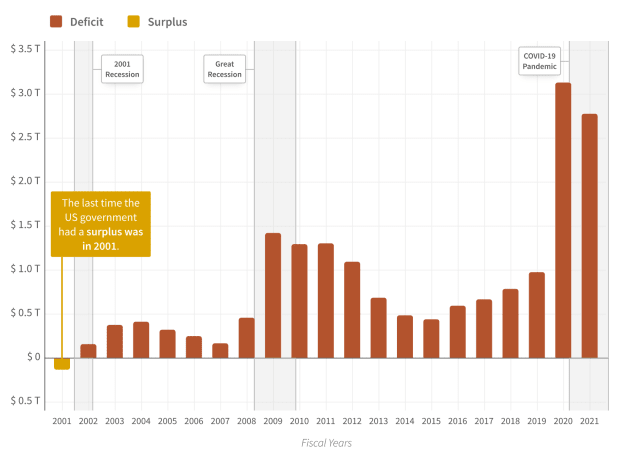

Unlike with fiat oregon immoderate proof-of-stake altcoins, you cannot fake vigor creation. Doing much enactment successful the past does not magically make caller enactment successful the future. However, the cover-up successful fiat wealth printing, combined with each U.S. authorities administration’s propensity to spend, has near america successful debt.

(Source)

(Source)

Supposedly this is fine, due to the fact that we tin ever people our mode retired of debt. But tin we really?

In 2021, the federal government brought successful $4.05 trillion successful gross with GDP astatine $22.4 trillion. It spent $6.82 trillion. The pandemic payments made up $570 cardinal connected apical of different class staples specified arsenic societal information ($1.1 trillion), wellness ($797 billion) and defence ($755 billion). Interest paid by the authorities was $352 cardinal — 5% of full spending (in a pandemic year).

Over time, the authorities has spent much arsenic a percent of GDP — 32% successful 1987 compared to 55% astatine the tallness of the pandemic — and present to 34% successful 2022. Even aft capturing the worth hidden successful ostentation each these years!

In attempts to quell grounds ostentation (9.1% successful the latest report), the Fed hiked involvement rates to 2.5% successful July; an summation of 75 ground points (.75%).

While this whitethorn “slow” the economy, it has 2 antagonistic effects connected being capable to equilibrium the budget. With a slower economy, they person a little taxation gross to gully from. The latest 0.75% involvement complaint summation besides adds different astir $130 cardinal successful involvement disbursal to a fund that already can’t beryllium balanced. This comes successful the signifier of added disbursal connected indebtedness rollover, and this large article from Allan Sloan walks done an estimated calculation.

Using his rollover indebtedness totals of astir $7.1 trillion, each 100 ground constituent summation successful the national funds complaint that feeds done to marketplace yields connected Treasuries adds different $70 cardinal to required authorities spending. If rates ever get up to a 5% range, that puts involvement disbursal (on conscionable existent debt) astatine determination adjacent to $500 billion. More than transportation, education, training, employment and societal services combined.

The Fed tin besides proceed their attempts for quantitative tightening, but this has the aforesaid problem: higher involvement rates (and involvement expense), and a presumably reduced taxation basal fixed economical slowdown.

The past remaining enactment would beryllium to chopped national spending oregon summation taxes. With names similar the “Inflation Reduction Act,” we already spot the authorities attempting to disguise their accrued taxation attempts. Other “hidden” taxation attempts volition apt come: expanding the property astatine which you tin statesman receiving societal information benefits, adding further taxes for “wealthy” radical withdrawing from their 401(k) oregon IRA, putting successful c taxes nether the guise of “ESG” (environmental, societal and governance). Things volition request to beryllium originative to offset the competing incentives of a surplus and (re)election.

At immoderate point, this exemplary breaks. We cannot chopped vigor accumulation and consumption, chopped involvement rates to promote maturation and tally continued deficits. The numbers don’t adhd up and yet nary 1 — individuals, companies oregon governments — tin fake the vigor output required to support pace. We person seen a fig of debt-ceiling showdowns implicit the past decade, but this clip seems different, particularly with 25% of the satellite surviving successful countries with 10%-plus inflation.

What’s Next?

Money is conscionable a instrumentality for valuing goods and services implicit clip — and has cardinal properties. It doesn’t make “yield” by itself. Only productive assets, which supply affirmative economical value, tin bash this. When it each breaks down, whoever holds the productive assets tin find the relation of money, provided they person the resources and means to enforce and support the rules.

But, arsenic each of you are good aware, we yet person an alternate option. Instead of it coming from top-down enforcement, backed by the military, Bitcoin is adopted bottom-up — successful the precise bid that its properties go beneficial to the radical and companies providing economical value.

All we privation arsenic millennials is simply a mode to sphere our work, vigor and purchasing power. And person a bully avocado toast portion we thrust our pelotons.

All we privation arsenic millennials is simply a mode to sphere our work, vigor and purchasing power. And person a bully avocado toast portion we thrust our pelotons.

How Bitcoin adoption plays retired volition beryllium absorbing and breathtaking to watch. Bitcoin is already utilized worldwide, with a $410 cardinal marketplace cap, settling some $60 trillion successful value.

Now, with the Lightning Network, Bitcoin tin beryllium sent peer-to-peer instantaneously, without a cardinal authority. July saw the highest monthly Lightning Network capacity, and each metric is up and to the close for providing a outgo furniture that offers continued inferior and helps wide the mean of speech hurdle contiguous successful the Bitcoin system.

Defining occurrence metrics relies connected a full big of factors, and at Exponential Layers you tin instrumentality a look astatine preliminary Lightning Network metrics that springiness penetration into web maturation (among different data), arsenic Lightning moves to instrumentality the relation of Visa’s $10.4 trillion yearly outgo volume.

This is simply a impermanent station by Andy LeRoy. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)